Florida Statutes 1983, Volume 3 - Florida State University College of ...

Florida Statutes 1983, Volume 3 - Florida State University College of ...

Florida Statutes 1983, Volume 3 - Florida State University College of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

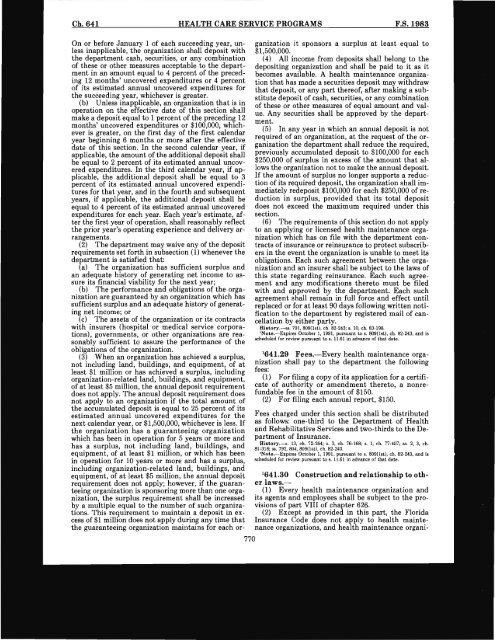

Ch.641 HEALTH CARE SERVICE PROGRAMS F.S.<strong>1983</strong><br />

On or before January 1 <strong>of</strong> each succeeding year, unless<br />

inapplicable, the organization shall deposit with<br />

the department cash, securities, or any combination<br />

<strong>of</strong> these or other measures acceptable to the department<br />

in an amount equal to 4 percent <strong>of</strong> the preceding<br />

12 months' uncovered expenditures or 4 percent<br />

<strong>of</strong> its estimated annual uncovered expenditures for<br />

the succeeding year, whichever is greater.<br />

(b) Unless inapplicable, an organization that is in<br />

operation on the effective date <strong>of</strong> this section shall<br />

make a deposit equal to 1 percent <strong>of</strong> the preceding 12<br />

months' uncovered expenditures or $100,000, whichever<br />

is greater, on the first day <strong>of</strong> the first calendar<br />

year beginning 6 months or more after the effective<br />

date <strong>of</strong> this section. In the second calendar year, if<br />

applicable, the amount <strong>of</strong> the additional deposit shall<br />

be equal to 2 percent <strong>of</strong> its estimated annual uncovered<br />

expenditures. In the third calendar year, if applicable,<br />

the additional deposit shall be equal to 3<br />

percent <strong>of</strong> its estimated annual uncovered expenditures<br />

for that year, and in the fourth and subsequent<br />

years, if applicable, the additional deposit shall be<br />

equal to 4 percent <strong>of</strong> its estimated annual uncovered<br />

expenditures for each year. Each year's estimate, after<br />

the first year <strong>of</strong> operation, shall reasonably reflect<br />

the prior year's operating experience and delivery arrangements.<br />

(2) The department may waive any <strong>of</strong> the deposit<br />

requirements set forth in subsection (1) whenever the<br />

department is satisfied that:<br />

(a) The organization has sufficient surplus and<br />

an adequate history <strong>of</strong> generating net income to assure<br />

its financial viability for the next year;<br />

(b) The performance and obligations <strong>of</strong> the organization<br />

are guaranteed by an organization which has<br />

sufficient surplus and an adequate history <strong>of</strong> generating<br />

net income; or<br />

(c) The assets <strong>of</strong> the organization or its contracts<br />

with insurers (hospital or medical service corporations),<br />

governments, or other organizations are reasonably<br />

sufficient to assure the performance <strong>of</strong> the<br />

obligations <strong>of</strong> the organization.<br />

(3) When an organization has achieved a surplus,<br />

not including land, buildings, and equipment, <strong>of</strong> at<br />

least $1 million or has achieved a surplus, including<br />

organization-related land, buildings, and equipment,<br />

<strong>of</strong> at least $5 million, the annual deposit requirement<br />

does not apply. The annual deposit requirement does<br />

not apply to an organization if the total amount <strong>of</strong><br />

the accumulated deposit is equal to 25 percent <strong>of</strong> its<br />

estimated annual uncovered expenditures for the<br />

next calendar year, or $1,500,000, whichever is less. If<br />

the organization has a guaranteeing organization<br />

which has been in operation for 5 years or more and<br />

has a surplus, not including land, buildings, and<br />

equipment, <strong>of</strong> at least $1 million, or which has been<br />

in operation for 10 years or more and has a surplus,<br />

including organization-related land, buildings, and<br />

equipment, <strong>of</strong> at least $5 million, the annual deposit<br />

requirement does not apply; however, if the guaranteeing<br />

organization is sponsoring more than one organization,<br />

the surplus requirement shall be increased<br />

by a multiple equal to the number <strong>of</strong> such organizations.<br />

This requirement to maintain a deposit in excess<br />

<strong>of</strong> $1 million does not apply during any time that<br />

the guaranteeing organization maintains for each or-<br />

770<br />

ganization it sponsors a surplus at least equal to<br />

$1,500,000.<br />

(4) All income from deposits shall belong to the<br />

depositing organization and shall be paid to it as it<br />

becomes available. A health maintenance organization<br />

that has made a securities deposit may withdraw<br />

that deposit, or any part there<strong>of</strong>, after making a substitute<br />

deposit <strong>of</strong> cash, securities, or any combination<br />

<strong>of</strong> these or other measures <strong>of</strong> equal amount and value.<br />

Any securities shall be approved by the department.<br />

(5) In any year in which an annual deposit is not<br />

required <strong>of</strong> an organization, at the request <strong>of</strong> the organization<br />

the department shall reduce the required,<br />

previously accumulated deposit to $100,000 for each<br />

$250,000 <strong>of</strong> surplus in excess <strong>of</strong> the amount that allows<br />

the organization not to make the annual deposit.<br />

If the amount <strong>of</strong> surplus no longer supports a reduction<br />

<strong>of</strong> its required deposit, the organization shall immediately<br />

redeposit $100,000 for each $250,000 <strong>of</strong> reduction<br />

in surplus, provided that its total deposit<br />

does not exceed the maximum required under this<br />

section.<br />

(6) The requirements <strong>of</strong> this section do not apply<br />

to an applying or licensed health maintenance organization<br />

which has on file with the department contracts<br />

<strong>of</strong> insurance or reinsurance to protect subscribers<br />

in the event the organization is unable to meet its<br />

obligations. Each such agreement between the organization<br />

and an insurer shall be subject to the laws <strong>of</strong><br />

this state regarding reinsurance. Each such agreement<br />

and any modifications thereto must be filed<br />

with and approved by the department. Each such<br />

agreement shall remain in full force and effect until<br />

replaced or for at least 90 days following written notification<br />

to the department by registered mail <strong>of</strong> cancellation<br />

by either party.<br />

History.-S8. 791, 809(18t), ch. 82-243; 8. 10, ch. 83-198.<br />

'Note.-Expires October 1, 1991, pursuant to s. 809(18t), ch. 82-243, and is<br />

scbeduled for review pursuant to s. 11.61 in advance <strong>of</strong> that date.<br />

1641.29 Fees.-Every health maintenance organization<br />

shall pay to the department the following<br />

fees:<br />

(1) For filing a copy <strong>of</strong> its application for a certificate<br />

<strong>of</strong> authority or amendment thereto, a nonrefundable<br />

fee in the amount <strong>of</strong> $150.<br />

(2) For filing each annual report, $150.<br />

Fees charged under this section shall be distributed<br />

as follows: one-third to the Department <strong>of</strong> Health<br />

and Rehabilitative Services and two-thirds to the Department<br />

<strong>of</strong> Insurance.<br />

History.-8. 13, ch. 72-264; 8. 3, cb. 76-168; s. 1, ch. 77-457; S8. 2, 3, cb.<br />

81-318; ... 792, 804, 809(18t), cb. 82-243.<br />

'Note.-Expires October 1, 1991, pursuant to s. 809(18t), cb. 82-243, and is<br />

scheduled for review pursuant to s. 11.61 in advance <strong>of</strong> that date.<br />

1641.30 Construction and relationship to other<br />

laws.-<br />

(1) Every health maintenance organization and<br />

its agents and employees shall be subject to the provisions<br />

<strong>of</strong> part VIII <strong>of</strong> chapter 626.<br />

(2) Except as provided in this part, the <strong>Florida</strong><br />

Insurance Code does not apply to health maintenance<br />

organizations, and health maintenance organi-