Florida Statutes 1983, Volume 3 - Florida State University College of ...

Florida Statutes 1983, Volume 3 - Florida State University College of ...

Florida Statutes 1983, Volume 3 - Florida State University College of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

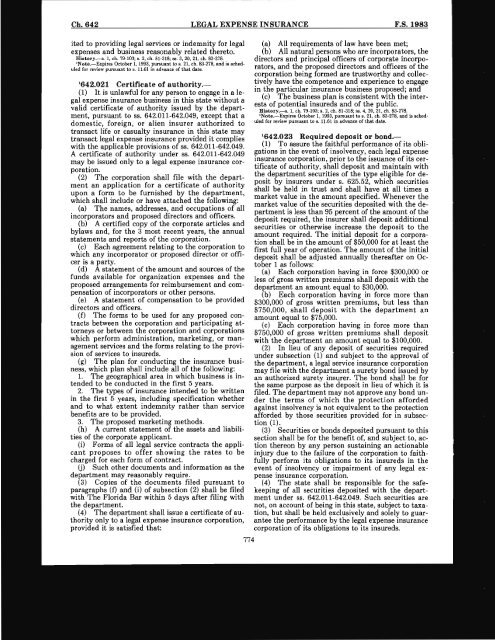

Ch.642 LEGAL EXPENSE INSURANCE F.S.<strong>1983</strong><br />

ited to providing legal services or indemnity for legal<br />

expenses and business reasonably related thereto.<br />

History.- s. 1, ch. 79-103; s. 2, ch. 81-318; 88. 3, 20, 21, ch. 83-278.<br />

'Note.-Expires October 1, 1993, pursuant to s. 21, ch. 83-278, and is scheduled<br />

for review pursuant to •. 11.61 in advance <strong>of</strong> that date.<br />

'642.021 Certificate <strong>of</strong> authority.-<br />

(1) It is unlawful for any person to engage in a legal<br />

expense insurance business in this state without a<br />

valid certificate <strong>of</strong> authority issued by the department,<br />

pursuant to ss. 642.011-642.049, except that a<br />

domestic, foreign, or alien insurer authorized to<br />

transact life or casualty insurance in this state may<br />

transact legal expense insurance provided it complies<br />

with the applicable provisions <strong>of</strong> ss. 642.011-642.049.<br />

A certificate <strong>of</strong> authority under ss. 642.011-642.049<br />

may be issued only to a legal expense insurance corporation.<br />

(2) The corporation shall file with the department<br />

an application for a certificate <strong>of</strong> authority<br />

upon a form to be furnished by the department,<br />

which shall include or have attached the following:<br />

(a) The names, addresses, and occupations <strong>of</strong> all<br />

incorporators and proposed directors and <strong>of</strong>ficers.<br />

(b) A certified copy <strong>of</strong> the corporate articles and<br />

bylaws and, for the 3 most recent years, the annual<br />

statements and reports <strong>of</strong> the corporation.<br />

(c) Each agreement relating to the corporation to<br />

which any incorporator or proposed director or <strong>of</strong>ficer<br />

is a party.<br />

(d) A statement <strong>of</strong> the amount and sources <strong>of</strong> the<br />

funds available for organization expenses and the<br />

proposed arrangements for reimbursement and compensation<br />

<strong>of</strong> incorporators or other persons.<br />

(e) A statement <strong>of</strong> compensation to be provided<br />

directors and <strong>of</strong>ficers.<br />

(f) The forms to be used for any proposed contracts<br />

between the corporation and participating attorneys<br />

or between the corporation and corporations<br />

which perform administration, marketing, or management<br />

services and the forms relating to the provision<br />

<strong>of</strong> services to insureds.<br />

(g) The plan for conducting the insurance business,<br />

which plan shall include all <strong>of</strong> the following:<br />

1. The geographical area in which business is intended<br />

to be conducted in the first 5 years.<br />

2. The types <strong>of</strong> insurance intended to be written<br />

in the first 5 years, including specification whether<br />

and to what extent indemnity rather than service<br />

benefits are to be provided.<br />

3. The proposed marketing methods.<br />

(h) A current statement <strong>of</strong> the assets and liabilities<br />

<strong>of</strong> the corporate applicant.<br />

(i) Forms <strong>of</strong> all legal service contracts the applicant<br />

proposes to <strong>of</strong>fer showing the rates to be<br />

charged for each form <strong>of</strong> contract.<br />

(j) Such other documents and information as the<br />

department may reasonably require.<br />

(3) Copies <strong>of</strong> the documents filed pursuant to<br />

paragraphs (f) and (i) <strong>of</strong> subsection (2) shall be filed<br />

with The <strong>Florida</strong> Bar within 5 days after filing with<br />

the department.<br />

(4) The department shall issue a certificate <strong>of</strong> authority<br />

only to a legal expense insurance corporation,<br />

provided it is satisfied that:<br />

774<br />

(a) All requirements <strong>of</strong> law have been met;<br />

(b) All natural persons who are incorporators, the<br />

directors and principal <strong>of</strong>ficers <strong>of</strong> corporate incorporators,<br />

and the proposed directors and <strong>of</strong>ficers <strong>of</strong> the<br />

corporation being formed are trustworthy and collectively<br />

have the competence and experience to engage<br />

in the particular insurance business proposed; and<br />

(c) The business plan is consistent with the interests<br />

<strong>of</strong> potential insureds and <strong>of</strong> the public.<br />

History.-s. 1, ch. 79-103; s. 2, ch. 81-318; 88. 4, 20, 21, ch. 83-278.<br />

'Note.-Expires October 1, 1993, pursuant to s. 21, ch. 83-278, and is scheduled<br />

for review pursuant to s. 11.61 in advance <strong>of</strong> that date.<br />

'642.023 Required deposit or bond.-<br />

(1) To assure the faithful performance <strong>of</strong> its obligations<br />

in the event <strong>of</strong> insolvency, each legal expense<br />

insurance corporation, prior to the issuance <strong>of</strong> its certificate<br />

<strong>of</strong> authority, shall deposit and maintain with<br />

the department securities <strong>of</strong> the type eligible for deposit<br />

by insurers under s. 625.52, which securities<br />

shall be held in trust and shall have at all times a<br />

market value in the amount specified. Whenever the<br />

market value <strong>of</strong> the securities deposited with the department<br />

is less than 95 percent <strong>of</strong> the amount <strong>of</strong> the<br />

deposit required, the insurer shall deposit additional<br />

securities or otherwise increase the deposit to the<br />

amount required. The initial deposit for a corporation<br />

shall be in the amount <strong>of</strong> $50,000 for at least the<br />

first full year <strong>of</strong> operation. The amount <strong>of</strong> the initial<br />

deposit shall be adjusted annually thereafter on October<br />

1 as follows:<br />

(a) Each corporation having in force $300,000 or<br />

less <strong>of</strong> gross written premiums shall deposit with the<br />

department an amount equal to $30,000.<br />

(b) Each corporation having in force more than<br />

$300,000 <strong>of</strong> gross written premiums, but less than<br />

$750,000, shall deposit with the department an<br />

amount equal to $75,000.<br />

(c) Each corporation having in force more than<br />

$750,000 <strong>of</strong> gross written premiums shall deposit<br />

with the department an amount equal to $100,000.<br />

(2) In lieu <strong>of</strong> any deposit <strong>of</strong> securities required<br />

under subsection (1) and subject to the approval <strong>of</strong><br />

the department, a legal service insurance corporation<br />

may file with the department a surety bond issued by<br />

an authorized surety insurer. The bond shall be for<br />

the same purpose as the deposit in lieu <strong>of</strong> which it is<br />

filed. The department may not approve any bond under<br />

the terms <strong>of</strong> which the protection afforded<br />

against insolvency is not equivalent to the protection<br />

afforded by those securities provided for in subsection<br />

(1).<br />

(3) Securities or bonds deposited pursuant to this<br />

section shall be for the benefit <strong>of</strong>, and subject to, action<br />

thereon by any person sustaining an actionable<br />

injury due to the failure <strong>of</strong> the corporation to faithfully<br />

perform its obligations to its insureds in the<br />

event <strong>of</strong> insolvency or impairment <strong>of</strong> any legal expense<br />

insurance corporation.<br />

(4) The state shall be responsible for the safekeeping<br />

<strong>of</strong> all securities deposited with the department<br />

under ss. 642.011-642.049. Such securities are<br />

not, on account <strong>of</strong> being in this state, subject to taxation,<br />

but shall be held exclusively and solely to guarantee<br />

the performance by the legal expense insurance<br />

corporation <strong>of</strong> its obligations to its insureds.