Florida Statutes 1983, Volume 3 - Florida State University College of ...

Florida Statutes 1983, Volume 3 - Florida State University College of ...

Florida Statutes 1983, Volume 3 - Florida State University College of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

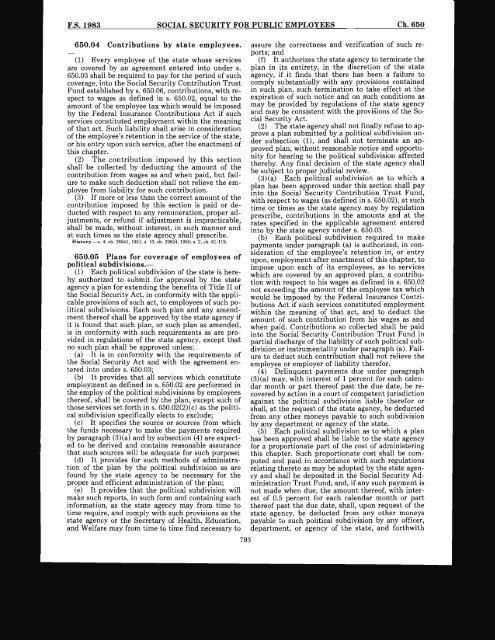

F.S.<strong>1983</strong> SOCIAL SECURITY FOR PUBLIC EMPLOYEES Ch.650<br />

650.04 Contributions by state employees.<br />

(1) Every employee <strong>of</strong> the state whose services<br />

are covered by an agreement entered into under s.<br />

650.03 shall be required to pay for the period <strong>of</strong> such<br />

coverage, into the Social Security Contribution Trust<br />

Fund established by s. 650.06, contributions, with respect<br />

to wages as defined in s. 650.02, equal to the<br />

amount <strong>of</strong> the employee tax which would be imposed<br />

by the Federal Insurance Contributions Act if such<br />

services constituted employment within the meaning<br />

<strong>of</strong> that act. Such liability shall arise in consideration<br />

<strong>of</strong> the employee's retention in the service <strong>of</strong> the state,<br />

or his entry upon such service, after the enactment <strong>of</strong><br />

this chapter.<br />

(2) The contribution imposed by this section<br />

shall be collected by deducting the amount <strong>of</strong> the<br />

contribution from wages as and when paid, but failure<br />

to make such deduction shall not relieve the em<br />

ployee from liability for such contribution.<br />

(3) If more or less than the correct amount <strong>of</strong> the<br />

contribution imposed by this section is paid or deducted<br />

with respect to any remuneration, proper adjustments,<br />

or refund if adjustment is impracticable,<br />

shall be made, without interest, in such manner and<br />

at such times as the state agency shall prescribe.<br />

Hi8tory.-s. 4, ch. 26841, 1951; s. 10, ch. 29824, 1955; s. 2, ch. 61-119.<br />

assure the correctness and verification <strong>of</strong> such reports;<br />

and<br />

(f) It authorizes the state agency to terminate the<br />

plan in its entirety, in the discretion <strong>of</strong> the state<br />

agency, if it finds that there has been a failure to<br />

comply substantially with any provisions contained<br />

in such plan, such termination to take effect at the<br />

expiration <strong>of</strong> such notice and on such conditions as<br />

may be provided by regulations <strong>of</strong> the state agency<br />

and may be consistent with the provisions <strong>of</strong> the Social<br />

Security Act.<br />

(2) The state agency shall not finally refuse to approve<br />

a plan submitted by a political subdivision under<br />

subsection (1), and shall not terminate an approved<br />

plan, without reasonable notice and opportunity<br />

for hearing to the political subdivision affected<br />

thereby. Any final decision <strong>of</strong> the state agency shall<br />

be subject to proper judicial review.<br />

(3)(a) Each political subdivision as to which a<br />

plan has been approved under this section shall pay<br />

into the Social Security Contribution Trust Fund,<br />

with respect to wages (as defined in s. 650.02), at such<br />

time or times as the state agency may by regulation<br />

prescribe, contributions in the amounts and at the<br />

rates specified in the applicable agreement entered<br />

into by the state agency under s. 650.03.<br />

(b) Each political subdivision required to make<br />

payments under paragraph (a) is authorized, in consideration<br />

<strong>of</strong> the employee's retention in, or entry<br />

650.05 Plans for coverage <strong>of</strong> employees <strong>of</strong><br />

political subdivisions.-<br />

(1) Each political subdivision <strong>of</strong> the state is hereby<br />

authorized to submit for approval by the state<br />

agency a plan for extending the benefits <strong>of</strong> Title II <strong>of</strong><br />

the Social Security Act, in conformity with the applicable<br />

provisions <strong>of</strong> such act, to employees <strong>of</strong> such political<br />

subdivisions. Each such plan and any amendment<br />

there<strong>of</strong> shall be approved by the state agency if<br />

it is found that such plan, or such plan as amended,<br />

is in conformity with such requirements as are provided<br />

in regulations <strong>of</strong> the state agency, except that<br />

upon, employment after enactment <strong>of</strong> this chapter, to<br />

impose upon each <strong>of</strong> its employees, as to services<br />

which are covered by an approved plan, a contribu<br />

tion with respect to his wages as defined in s. 650.02<br />

not exceeding the amount <strong>of</strong> the employee tax which<br />

would be imposed by the Federal Insurance Contri<br />

butions Act if such services constituted employment<br />

within the meaning <strong>of</strong> that act, and to deduct the<br />

amount <strong>of</strong> such contribution from his wages as and<br />

when paid. Contributions so collected shall be paid<br />

into the Social Security Contribution Trust Fund in<br />

partial discharge <strong>of</strong> the liability <strong>of</strong> such political subno<br />

such plan shall be approved unless:<br />

(a) It is in conformity with the requirements <strong>of</strong><br />

the Social Security Act and with the agreement endivision<br />

or instrumentality under paragraph (a). Failure<br />

to deduct such contribution shall not relieve the<br />

employee or employer <strong>of</strong> liability therefor.<br />

tered into under s. 650.03;<br />

(b) It provides that all services which constitute<br />

employment as defined in s. 650.02 are performed in<br />

the employ <strong>of</strong> the political subdivisions by employees<br />

there<strong>of</strong>, shall be covered by the plan, except such <strong>of</strong><br />

those services set forth in s. 650.02(2)(c) as the political<br />

subdivision specifically elects to exclude;<br />

(c) It specifies the source or sources from which<br />

the funds necessary to make the payments required<br />

by paragraph (3)(a) and by subsection (4) are expected<br />

to be derived and contains reasonable assurance<br />

that such sources will be adequate for such purpose;<br />

(d) It provides for such methods <strong>of</strong> administration<br />

<strong>of</strong> the plan by the political subdivision as are<br />

found by the state agency to be necessary for the<br />

proper and efficient administration <strong>of</strong> the plan;<br />

(e) It provides that the political subdivision will<br />

make such reports, in such form and containing such<br />

information, as the state agency may from time to<br />

time require, and comply with such provisions as the<br />

state agency or the Secretary <strong>of</strong> Health, Education,<br />

and Welfare may from time to time find necessary to<br />

(4) Delinquent payments due under paragraph<br />

(3)(a) may, with interest <strong>of</strong> 1 percent for each calen<br />

dar month or part there<strong>of</strong> past the due date, be re<br />

covered by action in a court <strong>of</strong> competent jurisdiction<br />

against the political subdivision liable therefor or<br />

shall, at the request <strong>of</strong> the state agency, be deducted<br />

from any other moneys payable to such subdivision<br />

by any department or agency <strong>of</strong> the state.<br />

(5) Each political subdivision as to which a plan<br />

has been approved shall be liable to the state agency<br />

for a proportionate part <strong>of</strong> the cost <strong>of</strong> administering<br />

this chapter. Such proportionate cost shall be computed<br />

and paid in accordance with such regulations<br />

relating thereto as may be adopted by the state agen<br />

cy and shall be deposited in the Social Security Ad<br />

ministration Trust Fund; and, if any such payment is<br />

not made when due, the amount there<strong>of</strong>, with inter<br />

est <strong>of</strong> 0.5 percent for each calendar month or part<br />

there<strong>of</strong> past the due date, shall, upon request <strong>of</strong> the<br />

state agency, be deducted from any other moneys<br />

payable to such political subdivision by any <strong>of</strong>ficer,<br />

department, or agency <strong>of</strong> the state, and forthwith<br />

793