Florida Statutes 1983, Volume 3 - Florida State University College of ...

Florida Statutes 1983, Volume 3 - Florida State University College of ...

Florida Statutes 1983, Volume 3 - Florida State University College of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

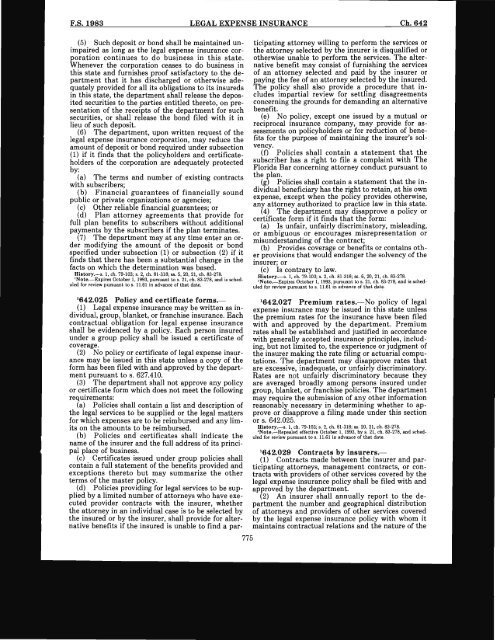

F.S.<strong>1983</strong> LEGAL EXPENSE INSURANCE Ch.642<br />

(5) Such deposit or bond shall be maintained unimpaired<br />

as long as the legal expense insurance corporation<br />

continues to do business in this state.<br />

Whenever the corporation ceases to do business in<br />

this state and furnishes pro<strong>of</strong> satisfactory to the department<br />

that it has discharged or otherwise adequately<br />

provided for all its obligations to its insureds<br />

in this state, the department shall release the deposited<br />

securities to the parties entitled thereto, on presentation<br />

<strong>of</strong> the receipts <strong>of</strong> the department for such<br />

securities, or shall release the bond filed with it in<br />

lieu <strong>of</strong> such deposit.<br />

(6) The department, upon written request <strong>of</strong> the<br />

legal expense insurance corporation, may reduce the<br />

amount <strong>of</strong> deposit or bond required under subsection<br />

(1) if it finds that the policyholders and certificateholders<br />

<strong>of</strong> the corporation are adequately protected<br />

by:<br />

(a) The terms and number <strong>of</strong> existing contracts<br />

with subscribers;<br />

(b) Financial guarantees <strong>of</strong> financially sound<br />

public or private organizations or agencies;<br />

(c) Other reliable financial guarantees; or<br />

(d) Plan attorney agreements that provide for<br />

full plan benefits to subscribers without additional<br />

payments by the subscribers if the plan terminates.<br />

(7) The department may at any time enter an order<br />

modifying the amount <strong>of</strong> the deposit or bond<br />

specified under subsection (1) or subsection (2) if it<br />

finds that there has been a substantial change in the<br />

facts on which the determination was based.<br />

History.-s. 1, ch. 79-103; s. 2, ch_ 81-318; 88. 5, 20, 21, ch_ 83-278_<br />

'Note.-Expires October 1, 1993, pursuant to s. 21, ch. 83-278, and is scheduled<br />

for review pursuant to s. 11.61 in advance <strong>of</strong> that date.<br />

1642.025 Policy and certificate forms.-<br />

(1) Legal expense insurance may be written as individual,<br />

group, blanket, or franchise insurance. Each<br />

contractual obligation for legal expense insurance<br />

shall be evidenced by a policy. Each person insured<br />

under a group policy shall be issued a certificate <strong>of</strong><br />

coverage.<br />

(2) No policy or certificate <strong>of</strong> legal expense insurance<br />

may be issued in this state unless a copy <strong>of</strong> the<br />

form has been filed with and approved by the department<br />

pursuant to s. 627.410.<br />

(3) The department shall not approve any policy<br />

or certificate form which does not meet the following<br />

requirements:<br />

(a) Policies shall contain a list and description <strong>of</strong><br />

the legal services to be supplied or the legal matters<br />

for which expenses are to be reimbursed and any limits<br />

on the amounts to be reimbursed.<br />

(b) Policies and certificates shall indicate the<br />

name <strong>of</strong> the insurer and the full address <strong>of</strong> its principal<br />

place <strong>of</strong> business.<br />

(c) Certificates issued under group policies shall<br />

contain a full statement <strong>of</strong> the benefits provided and<br />

exceptions thereto but may summarize the other<br />

terms <strong>of</strong> the master policy.<br />

(d) Policies providing for legal services to be supplied<br />

by a limited number <strong>of</strong> attorneys who have executed<br />

provider contracts with the insurer, whether<br />

the attorney in an individual case is to be selected by<br />

the insured or by the insurer, shall provide for alternative<br />

benefits if the insured is unable to find a par-<br />

775<br />

ticipating attorney willing to perform the services or<br />

the attorney selected by the insurer is disqualified or<br />

otherwise unable to perform the services. The alternative<br />

benefit may consist <strong>of</strong> furnishing the services<br />

<strong>of</strong> an attorney selected and paid by the insurer or<br />

paying the fee <strong>of</strong> an attorney selected by the insured.<br />

The policy shall also provide a procedure that includes<br />

impartial review for settling disagreements<br />

concerning the grounds for demanding an alternative<br />

benefit.<br />

(e) No policy, except one issued by a mutual or<br />

reciprocal insurance company, may provide for assessments<br />

on policyholders or for reduction <strong>of</strong> benefits<br />

for the purpose <strong>of</strong> maintaining the insurer's solvency.<br />

(f) Policies shall contain a statement that the<br />

subscriber has a right to file a complaint with The<br />

<strong>Florida</strong> Bar concerning attorney conduct pursuant to<br />

the plan.<br />

(g) Policies shall contain a statement that the individual<br />

beneficiary has the right to retain, at his own<br />

expense, except when the policy provides otherwise,<br />

any attorney authorized to practice law in this state.<br />

(4) The department may disapprove a policy or<br />

certificate form if it finds that the form:<br />

(a) Is unfair, unfairly discriminatory, misleading,<br />

or ambiguous or encourages misrepresentation or<br />

misunderstanding <strong>of</strong> the contract;<br />

(b) Provides coverage or benefits or contains other<br />

provisions that would endanger the solvency <strong>of</strong> the<br />

insurer; or<br />

(c) Is contrary to law.<br />

History.-s. 1, ch. 79-103; s. 2, ch. 81-318; 88. 6, 20, 21, ch. 83-278.<br />

'N ote.-Expires October 1, 1993, pursuant to s. 21, ch. 83-278, and is scheduled<br />

for review pursuant to s. 11.61 in advance <strong>of</strong> that date.<br />

1642.027 Premium rates.-No policy <strong>of</strong> legal<br />

expense insurance may be issued in this state unless<br />

the premium rates for the insurance have been filed<br />

with and approved by the department. Premium<br />

rates shall be established and justified in accordance<br />

with generally accepted insurance principles, including,<br />

but not limited to, the experience or judgment <strong>of</strong><br />

the insurer making the rate filing or actuarial computations.<br />

The department may disapprove rates that<br />

are excessive, inadequate, or unfairly discriminatory.<br />

Rates are not unfairly discriminatory because they<br />

are averaged broadly among persons insured under<br />

group, blanket, or franchise policies. The department<br />

may require the submission <strong>of</strong> any other information<br />

reasonably necessary in determining whether to approve<br />

or disapprove a filing made under this section<br />

or s. 642.025.<br />

History.-s. 1, ch. 79-103; s. 2, ch. 81-318; 88. 20, 21, ch. 83-278.<br />

'Note.-Repealed effective October 1, 1993, by s. 21, ch. 83-278, and scheduled<br />

for review pursuant to s. 11.61 in advance <strong>of</strong> that date.<br />

1642.029 Contracts by insurers.-<br />

(1) Contracts made between the insurer and participating<br />

attorneys, management contracts, or contracts<br />

with providers <strong>of</strong> other services covered by the<br />

legal expense insurance policy shall be filed with and<br />

approved by the department.<br />

(2) An insurer shall annually report to the department<br />

the number and geographical distribution<br />

<strong>of</strong> attorneys and providers <strong>of</strong> other services covered<br />

by the legal expense insurance policy with whom it<br />

maintains contractual relations and the nature <strong>of</strong> the