ACER Annual Report 2008-2009

ACER Annual Report 2008-2009

ACER Annual Report 2008-2009

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

58<br />

Australian Council for Educational Research Ltd and Controlled Entities ABN 19 004 398 145<br />

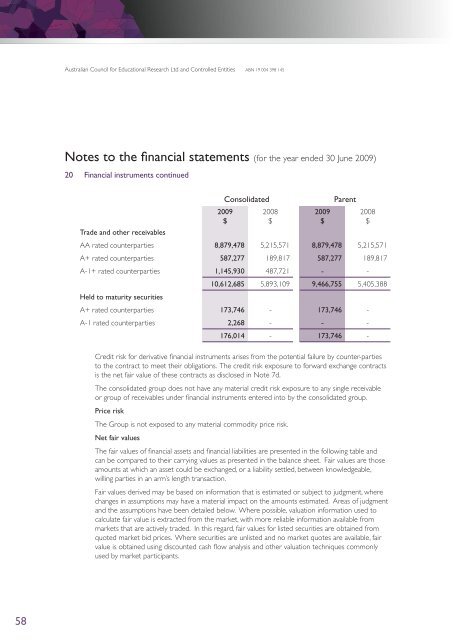

Notes to the financial statements (for the year ended 30 June <strong>2009</strong>)<br />

20 Financial instruments continued<br />

Consolidated Parent<br />

<strong>2009</strong><br />

$<br />

Trade and other receivables<br />

AA rated counterparties 8,879,478 5,215,571 8,879,478 5,215,571<br />

A+ rated counterparties 587,277 189,817 587,277 189,817<br />

A-1+ rated counterparties 1,145,930 487,721 - -<br />

Held to maturity securities<br />

10,612,685 5,893,109 9,466,755 5,405,388<br />

A+ rated counterparties 173,746 - 173,746 -<br />

A-1 rated counterparties 2,268 - - -<br />

176,014 - 173,746 -<br />

<strong>2008</strong><br />

$<br />

<strong>2009</strong><br />

$<br />

<strong>2008</strong><br />

$<br />

Credit risk for derivative financial instruments arises from the potential failure by counter-parties<br />

to the contract to meet their obligations. The credit risk exposure to forward exchange contracts<br />

is the net fair value of these contracts as disclosed in Note 7d.<br />

The consolidated group does not have any material credit risk exposure to any single receivable<br />

or group of receivables under financial instruments entered into by the consolidated group.<br />

Price risk<br />

The Group is not exposed to any material commodity price risk.<br />

Net fair values<br />

The fair values of financial assets and financial liabilities are presented in the following table and<br />

can be compared to their carrying values as presented in the balance sheet. Fair values are those<br />

amounts at which an asset could be exchanged, or a liability settled, between knowledgeable,<br />

willing parties in an arm’s length transaction.<br />

Fair values derived may be based on information that is estimated or subject to judgment, where<br />

changes in assumptions may have a material impact on the amounts estimated. Areas of judgment<br />

and the assumptions have been detailed below. Where possible, valuation information used to<br />

calculate fair value is extracted from the market, with more reliable information available from<br />

markets that are actively traded. In this regard, fair values for listed securities are obtained from<br />

quoted market bid prices. Where securities are unlisted and no market quotes are available, fair<br />

value is obtained using discounted cash flow analysis and other valuation techniques commonly<br />

used by market participants.