ACER Annual Report 2008-2009

ACER Annual Report 2008-2009

ACER Annual Report 2008-2009

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

60<br />

Australian Council for Educational Research Ltd and Controlled Entities ABN 19 004 398 145<br />

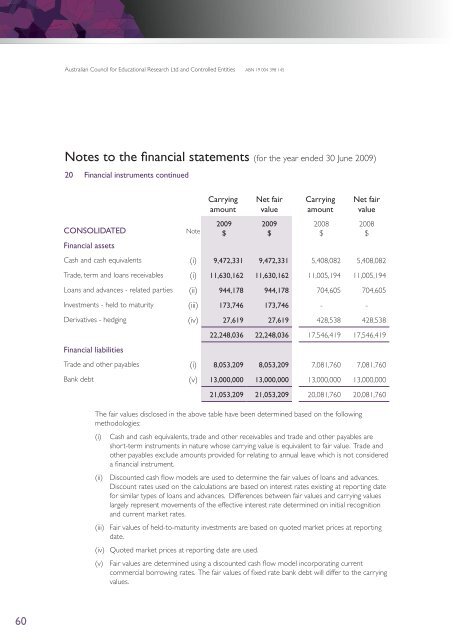

Notes to the financial statements (for the year ended 30 June <strong>2009</strong>)<br />

20 Financial instruments continued<br />

CONSOLIDATED Note<br />

Financial assets<br />

Carrying<br />

amount<br />

<strong>2009</strong><br />

$<br />

Net fair<br />

value<br />

<strong>2009</strong><br />

$<br />

Carrying<br />

amount<br />

<strong>2008</strong><br />

$<br />

Net fair<br />

value<br />

Cash and cash equivalents (i) 9,472,331 9,472,331 5,408,082 5,408,082<br />

Trade, term and loans receivables (i) 11,630,162 11,630,162 11,005,194 11,005,194<br />

Loans and advances - related parties (ii) 944,178 944,178 704,605 704,605<br />

Investments - held to maturity (iii) 173,746 173,746 - -<br />

Derivatives - hedging (iv) 27,619 27,619 428,538 428,538<br />

Financial liabilities<br />

<strong>2008</strong><br />

$<br />

22,248,036 22,248,036 17,546,419 17,546,419<br />

Trade and other payables (i) 8,053,209 8,053,209 7,081,760 7,081,760<br />

Bank debt (v) 13,000,000 13,000,000 13,000,000 13,000,000<br />

21,053,209 21,053,209 20,081,760 20,081,760<br />

The fair values disclosed in the above table have been determined based on the following<br />

methodologies:<br />

(i) Cash and cash equivalents, trade and other receivables and trade and other payables are<br />

short-term instruments in nature whose carrying value is equivalent to fair value. Trade and<br />

other payables exclude amounts provided for relating to annual leave which is not considered<br />

a financial instrument.<br />

(ii) Discounted cash flow models are used to determine the fair values of loans and advances.<br />

Discount rates used on the calculations are based on interest rates existing at reporting date<br />

for similar types of loans and advances. Differences between fair values and carrying values<br />

largely represent movements of the effective interest rate determined on initial recognition<br />

and current market rates.<br />

(iii) Fair values of held-to-maturity investments are based on quoted market prices at reporting<br />

date.<br />

(iv) Quoted market prices at reporting date are used.<br />

(v) Fair values are determined using a discounted cash flow model incorporating current<br />

commercial borrowing rates. The fair values of fixed rate bank debt will differ to the carrying<br />

values.