PINC POWERPICKS - Moneycontrol.com

PINC POWERPICKS - Moneycontrol.com

PINC POWERPICKS - Moneycontrol.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

RESEARCH<br />

RESEARCH<br />

<strong>PINC</strong> <strong>POWERPICKS</strong><br />

Ashok Leyland<br />

Ashoka Buildcon<br />

Bajaj Auto<br />

HSIL<br />

Infosys<br />

Jagran Prakashan<br />

Jyothy Laboratories<br />

Mahindra & Mahindra<br />

MRPL<br />

Nestle India<br />

NIIT Tech<br />

Phoenix Mills<br />

Power Grid Corporation<br />

Tecpro Systems

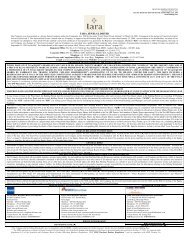

<strong>PINC</strong> <strong>POWERPICKS</strong><br />

Here’s the roster for the <strong>PINC</strong> PowerPicks:<br />

1<br />

Company Sector<br />

CMP<br />

(Rs)<br />

Re<strong>com</strong>.<br />

TP<br />

(Rs)<br />

Top-Shelf Selections<br />

Upside<br />

(%)<br />

FEBRUARY 2012<br />

Market Cap<br />

(Rs bn)<br />

RESEARCH<br />

RESEARCH<br />

P/E (x) EV/EBITDA (x) Earnings gr. (%) ROE (%) ROCE (%)<br />

FY12E FY13E FY12E FY13E (FY11-13E) FY12E FY12E<br />

Ashok Leyland Auto 28 ACCUMULATE 30 7 74 13.0 11.3 8.4 7.9 (0.1) 20.0 15.5<br />

Ashoka Buildcon Infrastructure 195 BUY 280 44 10 9.7 7.9 6.2 4.5 13.5 11.3 9.5<br />

Bajaj Auto Auto 1,732 BUY 1,850 7 501 15.9 14.1 11.1 9.5 16.7 55.5 69.0<br />

HSIL Diversified 153 BUY 230 50 10 9.3 6.8 5.3 4.2 32.1 15.1 12.6<br />

Infosys IT services 2,800 ACCUMULATE 2,975 6 1,600 18.9 16.9 12.4 10.6 17.6 24.9 29.7<br />

Jagran Prakashan Media 108 BUY 145 34 34 14.0 13.5 9.7 8.4 10.5 29.8 31.8<br />

Jyothy Laboratories FMCG 200 BUY 212 6 16 37.9 16.1 17.4 10.2 20.7 8.1 10.0<br />

Mahindra & Mahindra Auto 717 BUY 885 23 421 15.8 13.7 11.3 9.8 9.8 23.6 25.9<br />

MRPL Oil & Gas 72 BUY 88 21 127 26.8 10.1 20.3 6.5 3.4 7.1 7.9<br />

Nestle India FMCG 4,397 SELL 3,685 (16) 424 43.8 37.2 27.8 23.1 18.0 75.7 68.9<br />

NIIT Tech IT services 243 BUY 290 19 14 7.0 6.2 4.7 3.3 11.7 23.6 19.9<br />

Phoenix Mills Real Estate 213 BUY 265 24 31 18.4 18.0 16.1 13.7 42.6 9.6 6.8<br />

Power Grid Corp. Power Utilities 110 BUY 125 14 507 15.9 15.0 11.1 10.5 14.3 14.3 8.8<br />

Tecpro Systems Material Handling 193 BUY 375 95 10 6.2 5.2 4.8 4.5 17.7 21.4 23.1<br />

<strong>PINC</strong> <strong>POWERPICKS</strong> is a list of our high-conviction stock ideas, a choice of stocks from across sectors in our coverage universe.<br />

What moved in and what moved out:<br />

In our February issue of <strong>PINC</strong> Power Picks, we have introduced MRPL.<br />

We have excluded IRB Infrastructure in the February series as the stock has run up significantly since our last <strong>PINC</strong> Power Picks issue. Similarly, we are also<br />

excluding CESC as the stock has run up over the past two months and due to limited clarity on tariff revision owing to delay in issuance of tariff order.<br />

We have removed HCL Tech since our target price has been achieved and stock has given 18% absolute returns since we introduced the stock in our<br />

September 2011 issue. However, we still like the stock on the back of traction witnessed in its service lines and would be reviewing our valuations in the next<br />

issue.<br />

15th February 2012<br />

For rating objective and disclaimer, please refer to last page of the report<br />

<strong>PINC</strong> Research reports are also available on Reuters, Thomson Publishers and Bloomberg PINV

<strong>PINC</strong> <strong>POWERPICKS</strong><br />

ASHOK LEYLAND: ACCUMULATE, TP-Rs30 (7% upside)<br />

What’s the theme?<br />

FY12 has been a lackluster year for the <strong>com</strong>pany as it has underperformed the industry. In YTDFY12, as<br />

against the industry growth of 9.89%, Ashok Leyland volumes have been flat resulting in 240bps erosion in<br />

marketshare. We expect the <strong>com</strong>pany to claw back marketshare in Q4FY12 as demand sentiment in key<br />

markets of Southern India improves. We expect a volume growth of 7.4% in FY13 to 104k units with additional<br />

21k units for LCV 'Dost' dispatches.<br />

What will move the stock?<br />

1) Sales of the LCV Dost, produced in JV with Nissan, outside the state of Tamil Nadu are through Ashok<br />

Leyland. We expect the Dost to contribute 21k units in FY13. Additionally, two more products from the JV<br />

i.e. the van Stile and 6mt (GVW) goods carrier Partner would be launched over the <strong>com</strong>ing year. 2) We<br />

expect MHCV truck volume growth of 7% in FY13. After a decline in FY12 in bus segment, we expect<br />

volumes to pickup in FY13 with a moderate growth of 5% as demand from STUs revive. Further, a revival<br />

of purchases under the JNNURM scheme would boost volumes in the segment. 3) We expect profitability<br />

to have bottomed out in Q3FY12 (EBITDA margin of 7.3%) and expect the <strong>com</strong>pany to post margin of<br />

9.4% in FY13. The improvement in margins would be driven by the ramp up of volumes at Pantnagar<br />

facility and ramp up of LCV volumes.<br />

Where are we stacked versus consensus?<br />

Our earnings estimates for FY12 and FY13 are Rs2.1 and Rs2.4, respectively. Our FY13 earnings estimate<br />

is 10.3% lower than the consensus estimate of Rs2.6.We have a 'Accumulate' re<strong>com</strong>mendation on the<br />

stock with a target price of Rs30, which discounts FY13E earnings by 12.5x.<br />

What will challenge our target price?<br />

1) Increase in prices of raw materials such as steel and rubber affecting profitability; 2) Significant slowdown<br />

in industrial activity leading to a drop in freight rates and operator profitability.<br />

(Rs mn) FY10 FY11 FY12E YoY % FY13E YoY %<br />

Net Sales 72,447 111,177 128,206 15.3 146,292 14.1<br />

EBITDA 7,596 12,176 12,564 3.2 13,802 9.9<br />

EBITDA Marg. (%) 10.5 11.0 9.8 (120)bps 9.4 (40)bps<br />

Adj. Net Profit 4,237 6,313 5,508 (12.7) 6,303 14.4<br />

Dil. EPS (Rs) 1.6 2.4 2.1 (12.7) 2.4 14.4<br />

PER (x) 16.9 11.3 13.0 - 11.3 -<br />

ROE (%) 19.0 25.2 20.0 (520)bps 14.8 (520)bps<br />

ROCE (%) 13.7 18.4 15.5 (280)bps 15.2 (30)bps<br />

2<br />

Sector: Auto<br />

CMP: Rs28; Mcap: Rs74bn<br />

Bloomberg: AL IN; Reuters: ASOK.BO<br />

Units ('000s)<br />

Price performance<br />

34<br />

30<br />

26<br />

22<br />

Sales volume<br />

32<br />

24<br />

16<br />

8<br />

0<br />

Mar-10<br />

Jun-10<br />

MHCV Passenger MHCV Goods<br />

LCVs Vol. Gr (RHS)<br />

Sep-10<br />

Dec-10<br />

Mar-11<br />

Jun-11<br />

Sep-11<br />

RESEARCH<br />

RESEARCH<br />

AL BSE (Rebased) BSE AUTO (Rebased)<br />

18<br />

Feb-11 May -11 Aug-11 Nov -11 Feb-12<br />

Dec-11<br />

210<br />

150<br />

90<br />

30<br />

(30)<br />

(%)<br />

vineet.hetamasaria@pinc.co.in +91-22-6618 6388<br />

nikhil.deshpande@pinc.co.in +91-22-6618 6339<br />

tasmai.merchant@pinc.co.in +91-22-6618 6377

<strong>PINC</strong> <strong>POWERPICKS</strong><br />

ASHOKA BUILDCON: BUY, TP-Rs280 (44% upside)<br />

What’s the theme?<br />

We believe, Ashoka Buildcon (ABL), a well experienced BOT road player with 18 operational projects and 6<br />

projects of ~2500kms under construction, is likely to be<strong>com</strong>e a prominent player in road infra over the next 3<br />

years. However, due to unhealthy economic and market dynamics the stock is available at a sharp discount of<br />

P/BV 0.9x, which we believe does not reflect a long term average valuation for the <strong>com</strong>pany.<br />

What will move the stock?<br />

1) The P/E deal, which is likely post March 2011, wherein ABL will offload stake in a bouquet of 7-8 large<br />

BoT road assets. We believe ABL may offload approximately 20-25% stake for a value of Rs6-7bn.<br />

2) Going ahead, we expect ABL to substantially improve its EPC execution as OB has improved to Rs43.1bn<br />

(Rs54.1bn including Cuttack-Angul project). We estimate EPC revenue to grow by 11.4% in FY12E<br />

and then improve by 29.4% in FY13E.<br />

Where are we stacked versus consensus?<br />

Our FY12 and FY13 earnings estimates are Rs20.1 and Rs24.7, 7.2% and 11.8% lower than consensus<br />

estimates, respectively. We expect top-line growth of 16.5% and 31.7% to Rs15.2bn and Rs19.9bn in<br />

FY12E and FY13E vs. consensus forecasts of 28.9% and 25.3% to Rs16.8bn and Rs21bn, respectively.<br />

We value BOT (on a DCF basis) at FY12E and FY13E equity multiple of 1.7x and 1.1x, respectively. Our<br />

SOTP-based target price is Rs280, where BOT is valued at Rs196 and EPC at Rs84 (8x FY13E earnings).<br />

The stock offers an upside potential of 43% at our SOTP-based target price of Rs280 vs. consensus<br />

target of Rs273.<br />

What will challenge our target price?<br />

1) Lower IRR owing to further increase in interest rates; 2) Lower traffic growth; 3) Slowdown in execution<br />

of current orders; and 4) Adverse impact on tolling charges from any changes in the government policy.<br />

(Rs mn) FY10 FY11 FY12E YoY % FY13E YoY %<br />

Net Sales 7,956 13,020 15,168 16.5 19,980 31.7<br />

EBITDA 2,143 2,522 3,315 31.5 4,609 39.0<br />

EBITDA Marg. (%) 26.9 19.4 21.9 249 bps 23.1 5.6 bps<br />

Adj. Net Profits 804 1,008 1,060 5.1 1,299 22.5<br />

Dil. EPS (Rs) 17.6 19.2 20.1 5.1 24.7 22.5<br />

PER (x) 11.1 10.2 9.7 - 7.9 -<br />

ROE (%) 20.6 31.2 11.3 (1989)bps 12.3 100 bps<br />

ROCE (%) 12.5 17.2 9.5 (768)bps 9.3 (26)bps<br />

3<br />

Sector: Infrastructure<br />

CMP: Rs195; Mcap: Rs10bn<br />

Bloomberg: ASBL IN; Reuters: ABDL.BO<br />

Price performance<br />

340<br />

300<br />

260<br />

220<br />

SOTP<br />

ASBL BSE (Rebased)<br />

RESEARCH<br />

RESEARCH<br />

180<br />

Feb-11 May -11 Aug-11 Nov -11 Feb-12<br />

Particulars Rs/Share Percentage<br />

BOT Operational (SPV) 88 31.3%<br />

BOT Operational (Standalone) 31 11.0%<br />

BOT Under construction 78 27.7%<br />

Construction business 84 30.0%<br />

Total 280<br />

Upside (%) 43.5<br />

vinod.nair@pinc.co.in +91-22-6618 6379<br />

subramaniam.yadav@pinc.co.in +91-22-6618 6371

<strong>PINC</strong> <strong>POWERPICKS</strong><br />

BAJAJ AUTO: BUY, TP-Rs1,850 (7% upside)<br />

What’s the theme?<br />

The high-margin brands Pulsar and Discover, account for 70% of the Bajaj Auto's motorcycle sales thus<br />

validating its brand-centric strategy. The <strong>com</strong>pany showcased the brand new Pulsar 200NS which will be<br />

launched by Apr'12. Another executive segment motorcycle is expected to be launched by mid-2012. The<br />

<strong>com</strong>pany also launched the KTM Duke 200 at an attractive price of Rs117k in Jan'12. We expect the <strong>com</strong>pany<br />

to post a volume growth of 11.9% in FY13 and maintain 20% plus EBITDA margins.<br />

What will move the stock?<br />

1) Aided by new product launches and model refreshes, we expect Bajaj Auto to maintain market share with<br />

domestic volume growth of 12% in FY13. 2) The management expects to maintain a high growth in export<br />

markets largely through penetration into newer geographies. Exports contribute more than one third of the<br />

revenues for the <strong>com</strong>pany. 3) The <strong>com</strong>pany undertook a price hike of 3.5% in all export geographies to<br />

<strong>com</strong>pensate for the lower export benefit under the Duty drawback scheme. The rupee depreciation, increase<br />

in benefit rate under the Focused Market Scheme (FMS) and an additional 1% special incentive till FY12 are<br />

set to substantially boost export profitability. 4) BJAUT recently showcased the RE60 touted as an upgrade to<br />

the passenger three-wheeler. The product would first be launched in Sri Lanka wherein the current threewheeler<br />

finds acceptance in the personal segment too.<br />

Where are we stacked versus consensus?<br />

Our FY12 and FY13 earnings estimates are Rs109.2 and Rs123.1, respectively. We have a 'BUY'<br />

re<strong>com</strong>mendation on the stock with a target price of Rs1,850 discounting FY13E earnings at 15x. Our<br />

FY13 earnings estimate is 3.1% higher than the consensus estimate of Rs119.4.<br />

What will challenge our target price?<br />

1) Loss of market share and lack of pricing power due to increase in <strong>com</strong>petition would affect the <strong>com</strong>pany's<br />

ability to pass on cost inflation. 2) Slowdown in export markets is also a key risk to our volume estimate.<br />

(Rs mn) FY10 FY11 FY12E YoY % FY13E YoY %<br />

Net Sales 115,085 159,981 193,604 21.0 219,928 13.6<br />

EBITDA 25,752 33,836 40,835 20.7 46,048 12.8<br />

EBITDA Marg. (%) 21.6 20.4 20.2 (20)bps 20.2 (0)bps<br />

Adj. Net Profit 18,118 26,152 31,586 20.8 35,630 12.8<br />

Dil. EPS (Rs) 62.6 90.4 109.2 20.8 123.1 12.8<br />

PER (x) 27.7 19.2 15.9 - 14.1 -<br />

ROE (%) 78.5 66.7 55.5 (1120)bps 48.1 (740)bps<br />

ROCE (%) 65.4 73.4 69.0 (440)bps 61.5 (750)bps<br />

4<br />

Sector: Auto<br />

CMP: Rs1,732; Mcap: Rs501bn<br />

Bloomberg: BJAUT IN; Reuters: BAJA.BO<br />

Price performance<br />

1,800<br />

1,600<br />

1,400<br />

1,200<br />

Sales volume<br />

RESEARCH<br />

RESEARCH<br />

1,000<br />

Feb-11 May -11 Aug-11 Nov -11 Feb-12<br />

Units ('000s)<br />

1,200<br />

900<br />

600<br />

300<br />

0<br />

Mar-10<br />

BJAUT BSE BSE AUTO<br />

2-Wheelers 3-Wheelers Sales grow th (RHS)<br />

Jun-10<br />

Sep-10<br />

Dec-10<br />

Mar-11<br />

Jun-11<br />

Sep-11<br />

Dec-11<br />

100<br />

vineet.hetamasaria@pinc.co.in +91-22-6618 6388<br />

nikhil.deshpande@pinc.co.in +91-22-6618 6339<br />

tasmai.merchant@pinc.co.in +91-22-6618 6377<br />

75<br />

50<br />

25<br />

0<br />

(%)

<strong>PINC</strong> <strong>POWERPICKS</strong><br />

HSIL: BUY, TP-Rs230 (50% upside)<br />

What’s the theme?<br />

HSIL operates in 2 business segments, sanitary ware and container glass. Strong recall of the flagship<br />

brand Hindware enhances HSIL's leadership with 40% share in organised sanitary ware market and<br />

advantageous location of container glass plants helped achieve a 70% market share in south India.<br />

What will move the stock?<br />

� Growth in demand of the user industries of sanitary ware and glass will help engender a CAGR of 27%<br />

and 20% for sanitary ware and glass over FY11-FY13e.<br />

� Margin expansion of 100bps to 19.8% in FY13e over FY11 on increased realisation, reduced<br />

outsourcing and focus on value mix.<br />

� Improvement in FCF in FY12-FY13e through better operational efficiency.<br />

Where are we stacked versus consensus?<br />

Our earnings estimates (EPS) for FY12 and FY13 are Rs16.4 and Rs22.5, respectively. Our FY12 earnings<br />

estimate is 12% higher than the consensus estimate of Rs16.2. We have a 'BUY' re<strong>com</strong>mendation on the<br />

stock with a target price of Rs270, which discounts FY12e earnings by 13.5x.<br />

What will challenge our target price?<br />

� Fall in real estate demand<br />

� Rise in soda ash prices<br />

(Rs mn) FY10 FY11 FY12E YoY % FY13E YoY %<br />

Net Sales 8,042 10,785 13,391 24.2 16,583 23.8<br />

EBITDA 1,458 2,064 2,615 26.7 3,313 26.7<br />

EBITDA Marg. (%) 17.8 18.8 19.3 46 bps 19.8 48 bps<br />

Adj. Net Profits 436 782 1,086 38.9 1,486 36.9<br />

Dil. EPS (Rs) 7.9 12.9 16.4 27.3 22.5 37.0<br />

PER (x) 19.3 11.8 9.3 - 6.8 -<br />

ROE (%) 12.4 13.7 15.1 139 bps 17.9 277 bps<br />

ROCE (%) 9.1 10.5 12.6 208 bps 13.6 101 bps<br />

5<br />

Sector: Diversified<br />

CMP: Rs153; Mcap: Rs10bn<br />

Bloomberg: HSI IN; Reuters: HSNT.BO<br />

Price performance<br />

260<br />

215<br />

170<br />

125<br />

Revenue breakup<br />

100%<br />

75%<br />

50%<br />

25%<br />

0%<br />

HSIL Sensex Rebased<br />

RESEARCH<br />

RESEARCH<br />

80<br />

Feb-11 May -11 Aug-11 Nov -11 Feb-12<br />

Building Products Container Glass<br />

47.6% 49.8% 54.3% 52.3% 50.9% 49.5%<br />

52.4% 50.2% 45.7% 47.7% 49.1% 50.5%<br />

FY08 FY09 FY10 FY11 FY12E FY13E<br />

suman.memani@pinc.co.in +91-22-6618 6479<br />

abhishek.kumar@pinc.co.in +91-22-6618 6398

<strong>PINC</strong> <strong>POWERPICKS</strong><br />

INFOSYS: ACCUMULATE, TP-Rs2,975 (6% upside)<br />

What’s the theme?<br />

We re<strong>com</strong>mend staying with the leader during uncertain times. Infosys has a full-services portfolio with<br />

exposure to well-diversified verticals. The new management appears more aggressive on aspects such<br />

as inorganic growth and is looking for acquisitions in healthcare vertical and for increasing presence in<br />

Europe which seems to be opening up to outsourcing.<br />

What will move the stock?<br />

1) In anticipation of future demand, the <strong>com</strong>pany maintains an overall hiring guidance for FY12 at 45,000<br />

and for FY13 has already given 20,000 campus offers. 2) The <strong>com</strong>pany can exercise the utilisation lever<br />

to take care of demand spurt which would boost the operating margins. 3) Large deal wins in the recent<br />

past along with higher client mining gives revenue visibility over a longer term. 4) Salary increment will be<br />

lower going ahead and rupee depreciation is expected to support margins 5) Potential for utilisation of<br />

huge cash (~USD3.9bn) for acquisitions; the management indicated its interest in large-ticket acquisition<br />

to plug the gaps and drive growth; and 6) In case of recovery in the global economy, clients will stick to<br />

established and reliable brands such as Infosys with excellent execution skills.<br />

Where are we stacked versus consensus?<br />

Our revenue estimates for FY12 and FY13 lag the consensus by 0.7% and 1.6% respectively. For FY12,<br />

our EBITDA margin and EPS estimates are marginally higher than consensus by 98bps and 1.2%<br />

respectively. For FY13, while EBITDA margin estimate is marginally higher than consensus by 49bps, EPS<br />

estimate lag the consensus by 1.7%.<br />

What will challenge our target price?<br />

1) Prolonged delays in clients' decision making on project ramp-ups and new initiatives; 2) Appreciation of<br />

INR vs. USD and strengthening of USD against EUR; and 3) Higher attrition and wage increments.<br />

6<br />

(Rs mn) FY10 FY11 FY12E YoY % FY13E YoY %<br />

Net Sales 227,420 275,010 342,182 24.4 390,653 14.2<br />

EBITDA 78,520 89,640 111,242 24.1 124,545 12.0<br />

EBITDA Marg. (%) 34.5 32.6 32.5 (9)bps 31.9 (63)bps<br />

Adj. Net Profits 62,340 68,230 84,591 24.0 94,414 11.6<br />

Dil. EPS (Rs) 109.2 119.4 148.0 24.0 165.2 11.6<br />

PER (x) 25.7 23.4 18.9 - 16.9 -<br />

ROE (%) 25.9 25.0 24.9 (8)bps 22.7 (221)bps<br />

ROCE (%) 28.3 29.3 29.7 40 bps 27.0 (277)bps<br />

Sector: Information Technology<br />

CMP: Rs2,800; Mcap: Rs1,600bn<br />

Bloomberg: INFO IN; Reuters: INFY BO<br />

Price performance<br />

3,500<br />

3,150<br />

2,800<br />

2,450<br />

Strong employee addition<br />

20000<br />

16000<br />

12000<br />

8000<br />

4000<br />

0<br />

Q2FY10<br />

Q3FY10<br />

Q4FY10<br />

Q1FY11<br />

Q2FY11<br />

Q3FY11<br />

Q4FY11<br />

Q1FY12<br />

RESEARCH<br />

RESEARCH<br />

Infosy s BSE (Rebased) BSE IT (Rebased)<br />

2,100<br />

Feb-11 May -11 Aug-11 Nov -11 Feb-12<br />

Gross Addition Lateral Employ ees added<br />

Q2FY12<br />

Q3FY12<br />

6000<br />

4500<br />

3000<br />

1500<br />

rohit.anand@pinc.co.in +91-22-6618 6372<br />

niraj.garhyan@pinc.co.in +91-22-6618 6382<br />

0

<strong>PINC</strong> <strong>POWERPICKS</strong><br />

JAGRAN PRAKASHAN (JPL): BUY, TP-Rs145 (34% upside)<br />

What’s the theme?<br />

We like JPL for its leadership in the UP market (the largest print market in terms of readership and print ad<br />

value). We believe the <strong>com</strong>pany is well poised to benefit from steady growth in the print media sector,<br />

underpinned by: 1) its well-entrenched position in growing regions such as Bihar and Jharkhand; 2) phased<br />

and planned expansion into new media businesses; and 3) a wide portfolio (including Mid-day, I-next and<br />

Cityplus). JPL's well-balanced business model (more than 30% revenue from circulation and other media<br />

businesses), its growth strategy to further increase penetration in terms of circulation in its current market,<br />

and monetisation of its readership insulates it from slowdown in advertisements due to the current<br />

macroeconomic scenario.<br />

What will move the stock?<br />

1) Momentum in ad revenue, underpinned by government spends (UP election in Q4); 2) Broad-based growth<br />

across other new media businesses; 3) Attractive valuations-At CMP, the stock is trading at an attractive<br />

13.5xFY13E EPS.<br />

Where are we stacked versus consensus?<br />

Our FY13 revenue and EPS estimate of Rs8 is 3% and 6% below consensus estimates, respectively. We have<br />

a 'BUY' re<strong>com</strong>mendation on the stock with a target price of Rs145 (18xFY13E EPS).<br />

What will challenge our target price?<br />

1) Increase in imported newsprint prices; 2) Slowdown in the economy; and 3) Increased <strong>com</strong>petition in<br />

markets where JPL has presence.<br />

Consolidated (Rs mn) FY10 FY11 FY12E YoY % FY13E YoY %<br />

Net Sales 9,419 12,210 13,251 8.5 14,575 10.0<br />

EBITDA 2,821 3,568 3,885 8.9 4,120 6.0<br />

EBITDA Marg. (%) 29.9 29.2 29.3 10 bps 28.3 (105)bps<br />

Adj. Net Profits 1,759 2,080 2,440 17.3 2,539 4.0<br />

Dil. EPS (Rs) 5.8 6.6 7.7 17.4 8.0 4.0<br />

PER (x) 18.6 16.4 14.0 - 13.5 -<br />

ROE (%) 28.7 29.6 29.8 22 bps 27.5 (239)bps<br />

ROCE (%) 33.6 33.1 31.8 (132)bps 30.7 (112)bps<br />

7<br />

Sector: Media<br />

CMP: Rs108; Mcap: Rs34bn<br />

Bloomberg: JAGP IN: Reuters: JAGP BO<br />

Price performance<br />

140<br />

125<br />

110<br />

Financial performance<br />

(%)<br />

95<br />

42<br />

34<br />

26<br />

18<br />

10<br />

ROE ROCE<br />

RESEARCH<br />

RESEARCH<br />

Jagran Prakashan BSE (Rebased)<br />

80<br />

Feb-11 May -11 Aug-11 Nov -11 Feb-12<br />

FY07 FY08 FY09 FY10 FY11 FY12E FY13E<br />

namrata.sharma@pinc.co.in +91-22-6618 6412<br />

sakshee.chhabra@pinc.co.in +91-22-6618 6516

<strong>PINC</strong> <strong>POWERPICKS</strong><br />

MAHINDRA & MAHINDRA: BUY, TP-Rs885 (23% upside)<br />

What’s the theme?<br />

New launches and strong performance from its existing products has helped M&M retain its dominance in the<br />

utility vehicle (UV) and pick-up segments in addition to maintaining healthy margins despite surge in raw<br />

material costs increases. We expect an 18% growth in the automotive segment volumes in FY13. The farm<br />

equipment segment too is expected to grow 8.2% in FY13, given shortage of labour, rising rural in<strong>com</strong>e and<br />

increasing non-farm usage of tractors.<br />

What will move the stock?<br />

1) The passenger UV segment has grown 17.3% in 9MFY12 aided by the launch of lower end EX variant<br />

of the Scorpio and refreshed Bolero. 2) New offering XUV500 received overwhelming response since its<br />

launch in Sep'11 and the <strong>com</strong>pany has received a whooping 25k applications for the 7.2k units on offer in<br />

the second phase. The <strong>com</strong>pany has taken a price hike of up to Rs55k on the vehicle and production<br />

capacity has been ramped up from 2k to 3k per month. 3) M&M is expected to launch the mini SUV based<br />

on the Xylo in H1FY13 which would provide incremental volumes. 2) Pick-up and SCVs segment is expected<br />

to maintain its impressive performance with continued contribution <strong>com</strong>ing from Genio and Maxximo mini<br />

van. 3) M&M is working on turning around its recent acquisition of South Korean automaker Ssangyong.<br />

Two SUVs from the Ssangyong Motors' portfolio (Rexton and Korando) would be assembled at M&M's<br />

Chakan facility. 4) Tractor sales have remained soft in the past few months and volumes are expected to<br />

pick up from Apr'12 with the new season.<br />

Where are we stacked versus consensus?<br />

Our FY12 and FY13 earnings forecast are Rs45.4 and Rs52.2, respectively. Our FY13 earning estimate<br />

is 5.7% higher than the consensus estimate of Rs50.1. We value M&M at Rs885 using SOTP methodology,<br />

discounting the core earnings of standalone business at 13x FY13E.<br />

What will challenge our target price?<br />

1) Imposition of additional taxes on diesel powered vehicles or dual pricing for diesel would adversely<br />

impact demand for M&M's products; and 2) Global turbulence may delay turnaround at Ssangyong.<br />

(Rs mn) FY10 FY11 FY12E YoY % FY13E YoY %<br />

Net Sales 180,381 227,575 300,745 32.2 356,993 18.7<br />

EBITDA 29,758 34,581 38,165 10.4 42,535 11.5<br />

EBITDA Marg. (%) 16.0 14.7 12.4 (230)bps 11.7 (70)bps<br />

Adj. Net Profits 20,181 25,443 26,665 4.8 30,684 15.1<br />

Dil. EPS (Rs) 36.3 44.1 45.4 2.9 52.2 15.1<br />

PER (x) 19.7 16.2 15.8 - 13.7 -<br />

ROE (%) 30.9 28.1 23.6 (450)bps 22.8 (80)bps<br />

ROCE (%) 28.0 28.5 25.9 (260)bps 25.6 (30)bps<br />

9<br />

Sector: Auto<br />

CMP: Rs717; Mcap: Rs421bn<br />

Bloomberg: MM IN; Reuters: MAHM.BO<br />

Price performance<br />

900<br />

800<br />

700<br />

600<br />

RESEARCH<br />

RESEARCH<br />

MM BSE (Rebased) BSE Auto (Rebased)<br />

500<br />

Feb-11 May -11 Aug-11 Nov -11 Feb-12<br />

SOTP<br />

Valuation Per share Value<br />

Method (Rs) Multiple (Rs)<br />

M&M (Standalone) P/E 49.3 13 641<br />

M&M Veh. Mfg. (MVML) EV/EBITDA 8.5 4 34<br />

Tech Mahindra CMP 66.4 0.8 53<br />

Mahindra Holiday CMP 35.7 0.8 29<br />

M&M Financial Services CMP 68.5 0.8 55<br />

Mahindra Lifespace CMP 10.9 0.8 9<br />

M&M (Treasury Stocks) CMP 60.8 0.8 49<br />

Swaraj Engines CMP 3.1 0.8 2<br />

Mahindra Forgings CMP 4.5 0.8 4<br />

Mahindra Ugine Steel CMP 1.5 0.8 1<br />

Mahindra Composites CMP 1.1 0.8 1<br />

Mahindra Navistar P/BV 5.1 1.5 8<br />

SOTP Value (Rs) 885<br />

vineet.hetamasaria@pinc.co.in +91-22-6618 6388<br />

nikhil.deshpande@pinc.co.in +91-22-6618 6339<br />

tasmai.merchant@pinc.co.in +91-22-6618 6377

<strong>PINC</strong> <strong>POWERPICKS</strong><br />

MRPL: BUY, TP-Rs88 (21% upside)<br />

What’s the theme?<br />

Capacity addition of ~30% to 15.4mmpta along with enhancement in <strong>com</strong>plexity index from ~6 to ~9 should<br />

boost the future profitability. Progress has been expedited keeping in mind the target of <strong>com</strong>missioning<br />

before Mar'12 so as to get the full benefit of tax exemption. Capacity expansion along with polypropylene<br />

and SPM project should improve the GRM substantially.<br />

What will move the stock?<br />

1) Hangover on crude imports from Iran (~70% for MRPL) post recent sanctions by US is abated after<br />

inter government agreement under which 45% of payment will be done in INR<br />

2) Strong GRM supported by diesel cracks as MRPL has ~43% of HSD in their portfolio<br />

3) As of Mar'11, the <strong>com</strong>pany has Net Debt/ equity at around zero, which provides significant leverage to<br />

the <strong>com</strong>pany. Around 70% of the up<strong>com</strong>ing capex (~Rs160bn) will be funded through debt and even<br />

at peak debt levels, Net Debt/ Equity for MRPL should be below 1.0.<br />

Where are we stacked versus consensus?<br />

We expect that full impact of ongoing capex should materialise in FY14 with partial benefit <strong>com</strong>ing in<br />

FY13. As a result, our FY13 earnings estimate is ~3% lower while FY14 estimate is ~15% higher than<br />

consensus.<br />

What will challenge our target price?<br />

Delay in refinery-III <strong>com</strong>missioning beyond Mar'12, problem in crude sourcing from Iran (ME ~90%, Iran<br />

~70%), volatility in crude oil price/ international GRM/ USD-INR exchange rate in the current weak global<br />

environment may impact the earnings substantially.<br />

(Rs mn) FY10 FY11 FY12E YoY % FY13E YoY %<br />

Net Sales 319,452 389,567 513,116 31.7 561,257 9.4<br />

EBITDA 19,253 20,482 8,653 (57.8) 28,158 225.4<br />

EBITDA Marg. (%) 6.0 5.3 1.7 (357)bps 5.0 333 bps<br />

Adj. Net Profits 11,122 11,765 4,749 (59.6) 12,580 164.9<br />

Dil. EPS (Rs) 6.3 6.7 2.7 (59.6) 7.1 164.9<br />

PER (x) 11.4 10.8 26.8 - 10.1 -<br />

ROE (%) 21.5 19.4 7.1 (1230)bps 17.2 1005 bps<br />

ROCE (%) 23.7 22.5 7.9 (1456)bps 15.5 762 bps<br />

10<br />

Sector: Oil & Gas<br />

CMP: Rs72; Mcap: Rs127bn<br />

Bloomberg: MRPL IN; Reuters: MRPL.BO<br />

Price performance<br />

100<br />

85<br />

70<br />

55<br />

Substantial jump in GRM<br />

12<br />

8<br />

4<br />

0<br />

-4<br />

-8<br />

FY06<br />

FY07<br />

FY08<br />

MRPL BSE (Rebased)<br />

FY09<br />

FY10<br />

FY11<br />

FY12E<br />

FY13E<br />

RESEARCH<br />

RESEARCH<br />

40<br />

Feb-11 May -11 Aug-11 Nov -11 Feb-12<br />

GRM (USD/bl) Prem./ (Dis.) to Singapore<br />

Singapore GRM<br />

FY14E<br />

FY15E<br />

FY16E<br />

satish.mishra@pinc.co.in +91-22-6618 6488<br />

urvashi.biyani@pinc.co.in +91-22-6618 6334

<strong>PINC</strong> <strong>POWERPICKS</strong><br />

NESTLE INDIA: SELL, TP-Rs3,685 (16% downside)<br />

What’s the theme?<br />

Rising <strong>com</strong>petition in almost all the categories along with sharp price hike on all the key brands resulted into<br />

slower volume growth of 9% (lowest in the past 5 years) during 9MCY11 and the similar volume pressure was<br />

also witnessed in the Q4CY11 performance in which sales grew at slower pace of 17% (lowest in the last 7<br />

quarters). Nestle is in the capacity expansion mode which would force the <strong>com</strong>pany to focus more on the<br />

volume growth. Higher marketing efforts would be required for retaining leadership position which would exert<br />

pressure on profitability.<br />

What will move the stock?<br />

1) Noodles contribute ~35% of the total EBITDA and higher <strong>com</strong>petition would force Nestle to invest more<br />

on marketing efforts. As a result, we expect 70bps and 20bps decline in EBITDA margin in CY12E and<br />

CY13E respectively; 2) Nestle currently trades at 36x 12-month forward earnings which is ~33% premium<br />

over the FMCG sector P/E. Considering pressure on Nestle's EBITDA margin, reduction in the return<br />

ratios and improvement in performance of peers, we argue that Nestle's P/E premium should reduce.<br />

Where are we stacked versus consensus?<br />

Our estimates and target price are lower than the consensus, led by the expectation of pressure on<br />

EBITDA margin and argument of narrowing down of the Nestle's valuation premium. We assign P/E of 30x<br />

on the next 12-months earnings to derive a TP of Rs3,685.<br />

What will challenge our target price?<br />

1) We expect Nestle would focus on retaining the volume market share for Maggi noodles hence there will<br />

be volume driven growth going forward. This assumption would result in lower profitability for Nestle and<br />

any change in this proposition might change our estimates; 2) We expect ITC, GSK Consumer and HUL to<br />

be very aggressive in noodle segment, any delay in such efforts would again help Nestle to earn better<br />

profitability.<br />

11<br />

(Rs mn) CY09 CY10 CY11E YoY % CY12E YoY %<br />

Net Sales 51,395 62,609 75,336 20.3 93,176 23.7<br />

EBITDA 10,448 12,559 15,484 23.3 18,559 19.9<br />

EBITDA Marg. (%) 20.3 20.1 20.6 49bps 19.9 (64)bps<br />

Adj. Net Profits 6,575 8,188 9,673 18.1 11,403 17.9<br />

Dil. EPS (Rs) 68.2 84.9 100.3 18.1 118.3 17.9<br />

PER (x) 64.5 51.8 43.8 - 37.2 -<br />

ROE (%) 113.1 95.7 75.7 (2,003)bps 67.6 (812)bps<br />

ROCE (%) 179.7 146.8 68.9 (7,797)bps 66.1 (277)bps<br />

Sector: FMCG<br />

CMP: Rs4,397; Mcap: Rs424bn<br />

Bloomberg: NEST IN; Reuters: NEST.BO<br />

Price performance<br />

4,900<br />

4,300<br />

3,700<br />

3,100<br />

Domestic Volume Growth<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

15%<br />

19%<br />

13%<br />

18%<br />

RESEARCH<br />

RESEARCH<br />

Nestle BSE (Rebased) BSE FMCG (Rebased)<br />

2,500<br />

Feb-11 May -11 Aug-11 Nov -11 Feb-12<br />

10%<br />

9MCY07 9MCY08 9MCY09 9MCY10 9MCY11<br />

naveent@pinc.co.in +91-22-6618 6384

<strong>PINC</strong> <strong>POWERPICKS</strong><br />

NIIT TECH: BUY, TP-Rs290 (19% upside)<br />

What’s the theme?<br />

Sustained performance and aggressive deal wins reflected in strong order book would drive re-rating of<br />

the stock. NIIT Tech has large exposure to high-growth niche verticals such as travel and transportation.<br />

Moreover, it has a differentiated strategy with development of IPs in emerging technologies (such as cloud<br />

<strong>com</strong>puting) & verticals (such as insurance & healthcare).<br />

What will move the stock?<br />

1) Good performance in the BFSI and travel and transportation verticals, which contribute ~75% to revenue;<br />

2) Recent acquisition of Proyecta Sistemas and JV with Morris, will give further thrust to growth through<br />

access to untapped markets and presence in newer industries. 3) Large untapped opportunity in the<br />

APAC and Latin American markets; 4) Strong order book of USD245mn to be implemented over next 12<br />

months and continued high order bookings; 5) Ramp-ups of the major deals won in the recent quarters<br />

would substantiate growth 6) New service lines would boost non-linear growth and lead to improvement in<br />

realisations.<br />

Where are we stacked versus consensus?<br />

Our top-line estimate for FY12 is in-line with consensus while lag the consensus for FY13 by 3.5%. Our<br />

EBITDA margin estimates for FY12 are marginally lower than consensus by 21bps while higher than<br />

consensus for FY13 by 137bps. Our EPS estimates for FY12 & FY13 are higher than consensus by 0.4%<br />

and 1.8% respectively.<br />

What will challenge our target price?<br />

1) Prolonged macroeconomic uncertainty in Europe; 2) Sharp currency volatility; 3) Higher attrition and<br />

wage increments; and 4) Project delays and cancellation of government contracts.<br />

12<br />

(Rs mn) FY10 FY11 FY12E YoY % FY13E YoY %<br />

Net Sales 9,138 12,323 15,785 28.1 18,211 15.4<br />

EBITDA 1,889 2,363 2,719 15.0 3,484 28.1<br />

EBITDA Marg. (%) 20.7 19.2 17.2 (195)bps 19.1 191 bps<br />

Adj. Net Profits 1,265 1,823 2,032 11.5 2,319 14.1<br />

Dil. EPS (Rs) 21.5 30.9 34.2 10.5 38.6 13.0<br />

PER (x) 11.3 7.9 7.0 - 6.2 -<br />

ROE (%) 21.7 24.2 23.6 (65)bps 22.3 (127)bps<br />

ROCE (%) 19.1 20.4 19.9 (53)bps 21.7 176 bps<br />

Sector: Information Technology<br />

CMP: Rs243; Mcap: Rs14.3bn<br />

Bloomberg: NITEC IN; Reuters: NITT.BO<br />

Price performance<br />

250<br />

220<br />

190<br />

160<br />

Healthy order book<br />

(USD mn) 130<br />

RESEARCH<br />

RESEARCH<br />

Feb-11 May -11 Aug-11 Nov -11 Feb-12<br />

600<br />

450<br />

300<br />

150<br />

0<br />

NIIT Tech BSE (Rebased) BSE IT (Rebased)<br />

Order Book Ex ecutable ov er nex t 12 months Fresh Order Wins<br />

Q1 FY11<br />

Q2 FY11<br />

Q3 FY11<br />

Q4 FY11<br />

Q1 FY12<br />

Q2 FY12<br />

Q3 FY12<br />

rohit.anand@pinc.co.in +91-22-6618 6372<br />

niraj.garhyan@pinc.co.in +91-22-6618 6382

<strong>PINC</strong> <strong>POWERPICKS</strong><br />

PHOENIX MILLS: BUY, TP-Rs265 (24% upside)<br />

What’s the theme?<br />

PHNX's key project, High Street Phoenix (HSP), is now fully operational and is likely to generate rental<br />

in<strong>com</strong>e of ~Rs2-2.2bn in FY12E. In Q3FY12, three out of four market cities were operational and expect<br />

to deliver higher occupancy going forward. This will help strengthen the <strong>com</strong>pany's rental model. At present,<br />

PHNX's rental revenue (FY11- Rs1.8bn) <strong>com</strong>es from HSP and the launch of Pune, Chennai and Bengaluru<br />

Market Cities is likely to add ~Rs550mn of rental revenue to the topline in FY12E.<br />

What will move the stock?<br />

We see the following near-term stock triggers: (i) Kurla Market City project <strong>com</strong>menced operation in<br />

Q3FY12 and is ramping up, (ii) The first phase of Shangri-La Hotel to <strong>com</strong>mence in H1FY13, (iii) HSP<br />

Phase-IV (at present 0.25 msf) to provide a strong delta to the <strong>com</strong>pany's valuation if it manages to get<br />

hospitality FSI (5x), (iv) repositioning of its hospitality project under Phoenix hospitality (PHCPL) into retail/<br />

<strong>com</strong>mercial and residential projects is likely to help PHNX have a better cash flow visibility and reduce debt<br />

levels and (v) PHNX may further opt to increase its stake in Kurla, Bengaluru and Chennai market city<br />

projects 12-15 months down the line which will help improve stock valuations.<br />

Where are we stacked versus consensus?<br />

Our EPS estimates for FY12 and FY13 are Rs11.6 and Rs11.8 respectively. Our FY12 earnings estimate<br />

is 21% higher than consensus estimate of Rs8.4. We have a 'BUY' re<strong>com</strong>mendation on the stock with a<br />

target price of Rs265 after assigning 15% discount to FY12E gross NAV.<br />

What will challenge our target price?<br />

1) Slowdown in execution in Market City projects and extending free rental periods may hamper the holding<br />

<strong>com</strong>pany's profitability, 2) economic slowdown may affect revenue from Market City and HSP.<br />

(Rs mn) FY10 FY11 FY12E YoY % FY13E YoY %<br />

Net Sales 1,230 2,102 3,993 90.0 4,349 8.9<br />

EBITDA 775 1,406 2,447 74.1 2,872 17.4<br />

EBITDA Marg. (%) 63.0 66.9 61.3 (559)bps 66.0 474 bps<br />

Adj. Net Profits 620 842 1,675 98.9 1,713 2.3<br />

Dil. EPS (Rs) 4.3 5.8 11.6 98.9 11.8 2.3<br />

PER (x) 49.8 36.6 18.4 - 18.0 -<br />

ROE (%) 4.0 5.1 9.6 446 bps 9.0 (57)bps<br />

ROCE (%) 3.2 4.1 6.8 268 bps 6.4 (44)bps<br />

13<br />

Sector: Real Estate<br />

CMP: Rs213; Mcap: Rs31bn<br />

Bloomberg: PHNX IN; Reuters: PHOE.BO<br />

Price performance<br />

300<br />

250<br />

200<br />

150<br />

PHNX one year forward NAV<br />

RESEARCH<br />

RESEARCH<br />

PHNX Sensex Rebased BSE Realty<br />

100<br />

Feb-11 May -11 Aug-11 Nov -11 Feb-12<br />

Project NAV (Rs)<br />

High Street Phoenix 142<br />

Market City (Kurla, Bengaluru, Chennai, Pune) 87<br />

Other Residential 36<br />

BARE 10<br />

Investment in Treasure World Developers 18<br />

Investment in Galaxy Entertainment 0.2<br />

Investment in Phoenix construction 0.1<br />

Other investments 26<br />

Shangrila hotel 11<br />

HSP Phase IV 21<br />

Share Application Money 21<br />

Less: Net Debt 60<br />

NAV (Post 15% discount) 265<br />

suman.memani@pinc.co.in +91-22-6618 6479<br />

abhishek.kumar@pinc.co.in +91-22-6618 6398

<strong>PINC</strong> <strong>POWERPICKS</strong><br />

POWER GRID: BUY, TP-Rs125 (14% upside)<br />

What’s the theme?<br />

PGCIL remains confident of achieving not only its XIth Plan capex and capitalisation target but also achieving<br />

a large part of its XIIth Plan target too. Till January 2012, the <strong>com</strong>pany achieved 84% and 86% of its XIth<br />

Plan capex and capitalisation target respectively. PGCIL already has investment approvals for ~Rs700bn<br />

worth of projects and has placed orders for Rs560bn - all of which will <strong>com</strong>mission in the XIIth Plan. PGCIL<br />

targets to achieve a yearly capex and ordering run rate of Rs200bn and Rs180bn respectively. This<br />

should translate into 17% CAGR in regulated equity over FY11-15E. We believe the stock offers safe and<br />

steady returns as <strong>com</strong>pared to its private sector peers as it is insulated from risks like rising fuel cost,<br />

backing down and SEB defaults (as payments are secured through a tripartite agreement).<br />

What will move the stock?<br />

1) Conversion of its huge CWIP into regulatory assets will translate into increased earnings for the <strong>com</strong>pany,<br />

2) Increased capex run rate, translating into higher capitalisation and hence higher earnings, 3) Earnings<br />

visibility is further supported by healthy growth in tele<strong>com</strong> division and growing order book of consultancy<br />

division 4) Improving debtor days as distribution tariffs are revised.<br />

Where are we stacked versus consensus?<br />

Our FY12 & FY13 PAT estimates are in line with consensus. We value PGCIL on FCFE basis to arrive at<br />

a target price of Rs125 (terminal growth rate 3% and 13% Ke).<br />

What will challenge our target price?<br />

1) Delay in capitalisation of projects under construction & delayed payments by SEBs<br />

2) Lower incentives and STOA in<strong>com</strong>e will impact our earnings estimate<br />

3) Slowdown in its consultancy division<br />

4) High debtor days<br />

(Rs mn) FY10 FY11 FY12E YoY % FY13E YoY %<br />

Net Sales 72,182 84,009 96,126 14.4 111,282 15.8<br />

EBITDA 61,593 74,642 86,619 16.0 96,862 11.8<br />

EBITDA Marg. (%) 85.3 88.9 90.1 126 87.0 (307)<br />

Adj. Net Profits 21,308 25,800 31,942 23.8 33,696 5.5<br />

Dil. EPS (Rs) 5.1 5.6 6.9 23.8 7.3 5.5<br />

PER (x) 21.6 19.6 15.9 - 15.0 -<br />

RoE (%) 13.9 13.8 14.3 43 13.7 (52)<br />

ROCE (%) 8.4 8.8 8.8 (4) 8.6 (15)<br />

14<br />

(Rs bn)<br />

Sector: Power Utilities<br />

CMP: Rs110; Mcap: Rs507bn<br />

Bloomberg: PWGR IN; Reuters: PGRD.BO<br />

Price performance<br />

140<br />

120<br />

100<br />

80<br />

Steady growth in capitalisation<br />

Pow er Grid BSE (Rebased)<br />

RESEARCH<br />

RESEARCH<br />

60<br />

Feb-11 May -11 Aug-11 Nov -11 Feb-12<br />

280<br />

210<br />

140<br />

70<br />

0<br />

Capex Capitalisation Regulated Equity<br />

FY11 FY12E FY13E FY14E FY15E<br />

hitul.gutka@pinc.co.in +91-22-6618 6410<br />

vinod.nair@pinc.co.in +91-22-6618 6379<br />

madhura.joshi@pinc.co.in +91-22-6618 6395

<strong>PINC</strong> <strong>POWERPICKS</strong><br />

TECPRO SYSTEMS: BUY, TP-Rs375 (95% upside)<br />

What’s the theme?<br />

Most of the power BoP orders pertaining to the XIIth Five-Year Plan (including orders for coal and ash<br />

handling) are yet to be awarded. Tecpro appears to be best placed among peers to bag these orders,<br />

given its past experience. If interest rates stabilise in the near term, we expect incremental order inflows to<br />

<strong>com</strong>e from the cement, steel, minerals and mining sectors. A healthy (1.6x FY12E revenue) and safe (all<br />

orders have achieved financial closure) order book minimises the risk of any delay or cancellations.<br />

What will move the stock?<br />

� Increased pace of order inflow, expected in H2FY12, mainly from the power sector. We expect Tecpro<br />

to record 9% growth in order inflow in FY12.<br />

� Execution of the current order book in a timely and profitable manner. We expect Tecpro to achieve a<br />

29% CAGR in revenue and 20% CAGR in profit over FY11-13E.<br />

� Any decline in interest rates would enable the <strong>com</strong>pany to improve net profit margins.<br />

� Improvement in working capital would lead to higher cash flows.<br />

Where are we stacked versus consensus?<br />

We expect EPS of Rs31.4 and Rs37.6 in FY12 and FY13, respectively, almost in-line with consensus<br />

forecasts. We expect 9% growth in order inflow in FY12, whereas some analysts forecast de-growth of<br />

~30-35%. However, the management has guided for ~30% growth in order inflow in FY12. We maintain<br />

our BUY re<strong>com</strong>mendation on the stock with a target price of Rs375 (10x FY13E).<br />

What will challenge our target price?<br />

� Further rise in interest rates, which cannot be passed on to customers and hence, impact the bottom<br />

line.<br />

� Any delay in execution leading to further deterioration of working capital.<br />

� Less than estimated order inflows.<br />

15<br />

(Rs mn) FY10 FY11 FY12E YoY % FY13E YoY %<br />

Net Sales 14,628 19,736 26,594 34.7 32,889 23.7<br />

EBIDTA 1,982 3,010 3,736 24.1 4,456 19.3<br />

EBIDTA Marg. (%) 13.5 15.2 14.0 (115) bps 13.5 (50) bps<br />

Adj. Net Profit 1,096 1,363 1,565 14.9 1,887 20.5<br />

Dil. EPS (Rs) 24.8 27.0 31.0 14.9 37.4 20.5<br />

PER (x) 7.8 7.1 6.2 - 5.2 -<br />

ROE (%) 42.8 26.9 21.4 (550)bps 21.3 (10)bps<br />

ROCE (%) 37.1 26.9 23.1 (380)bps 22.9 (20)bps<br />

Sector: Material Handling<br />

CMP: Rs193; Mcap: Rs10bn<br />

Bloomberg: TPRO IN; Reuters: TPSL.BO<br />

Price performance<br />

500<br />

400<br />

300<br />

200<br />

Order inflow<br />

(Rs bn) 100<br />

60<br />

45<br />

30<br />

15<br />

0<br />

7.1<br />

Tecpro BSE (Rebased)<br />

9.7 9.9<br />

22.2<br />

43.5<br />

RESEARCH<br />

RESEARCH<br />

Oct-10 Jan-11 Apr-11 Sep-11 Feb-12<br />

47.5<br />

49.0<br />

FY07 FY08 FY09 FY10 FY11 FY12E FY13E<br />

ankit.b@pinc.co.in +91-22-6618 6551

RESEARCH<br />

RESEARCH<br />

EQUITY DESK<br />

T E A M<br />

Sadanand Raje Head - Institutional Sales sadanand.raje@pinc.co.in 91-22-6618 6366<br />

Technical Analyst<br />

RESEARCH<br />

Vineet Hetamasaria, CFA Head of Research, Auto, Cement vineet.hetamasaria@pinc.co.in 91-22-6618 6388<br />

Nikhil Deshpande Auto, Auto Ancillary, Cement nikhil.deshpande@pinc.co.in 91-22-6618 6339<br />

Tasmai Merchant Auto, Auto Ancillary, Cement tasmai.merchant@pinc.co.in 91-22-6618 6377<br />

Vinod Nair Construction, Power, Capital Goods vinod.nair@pinc.co.in 91-22-6618 6379<br />

Ankit Babel Capital Goods, Engineering ankit.b@pinc.co.in 91-22-6618 6551<br />

Hitul Gutka Power hitul.gutka@pinc.co.in 91-22-6618 6410<br />

Subramaniam Yadav Construction subramaniam.yadav@pinc.co.in 91-22-6618 6371<br />

Madhura Joshi Power madhura.joshi@pinc.co.in 91-22-6618 6395<br />

Satish Mishra Fertiliser, Oil & Gas satish.mishra@pinc.co.in 91-22-6618 6488<br />

Urvashi Biyani Fertiliser, Oil & Gas urvashi.biyani@pinc.co.in 91-22-6618 6334<br />

Naveen Trivedi FMCG naveent@pinc.co.in 91-22-6618 6384<br />

Rohit Kumar Anand IT Services rohit.anand@pinc.co.in 91-22-6618 6372<br />

Niraj Garhyan IT Services niraj.garhyan@pinc.co.in 91-22-6618 6382<br />

Namrata Sharma Media namrata.sharma@pinc.co.in 91-22-6618 6412<br />

Sakshee Chhabra Media sakshee.chhabra@pinc.co.in 91-22-6618 6516<br />

Bikash Bhalotia Metals, Mining bikash.bhalotia@pinc.co.in 91-22-6618 6387<br />

Harleen Babber Metals, Mining harleen.babber@pinc.co.in 91-22-6618 6389<br />

Dipti Vijaywargi Metals, Mining dipti.vijaywargi @pinc.co.in 91-22-6618 6393<br />

Sushant Dalmia, CFA Pharma sushant.dalmia@pinc.co.in 91-22-6618 6462<br />

Poonam Sanghavi Pharma poonam.sanghavi@pinc.co.in 91-22-6618 6709<br />

Suman Memani Real Estate, Mid caps suman.memani@pinc.co.in 91-22-6618 6479<br />

Abhishek Kumar Real Estate, Mid caps abhishek.kumar@pinc.co.in 91-22-6618 6398<br />

C Krishnamurthy Technical Analyst krishnamurthy.c@pinc.co.in 91-22-6618 6747<br />

SALES<br />

Rajeev Gupta Equities rajeev.gupta@pinc.co.in 91-22-6618 6486<br />

Ankur Varman Equities ankur.varman@pinc.co.in 91-22-6618 6380<br />

Himanshu Varia Equities himanshu.varia@pinc.co.in 91-22-6618 6342<br />

Shailesh Kadam Derivatives shaileshk@pinc.co.in 91-22-6618 6349<br />

Ganesh Gokhale Derivatives ganeshg@pinc.co.in 91-22-6618 6347<br />

DEALING<br />

Mehul Desai Head - Sales Trading mehul.desai@pinc.co.in 91-22-6618 6303<br />

Amar Margaje amar.margaje@pinc.co.in 91-22-6618 6327<br />

Ashok Savla ashok.savla@pinc.co.in 91-22-6618 6321<br />

Sajjid Lala sajjid.lala@pinc.co.in 91-22-6618 6337<br />

Raju Bhavsar rajub@pinc.co.in 91-22-6618 6322<br />

Hasmukh D. Prajapati hasmukhp@pinc.co.in 91-22-6618 6325<br />

Dhirenpuri D. Goswami dhirenpurig@pinc.co.in 91-22-6618 6345<br />

Arjun Prajapati arjun.prajapati@pinc.co.in 91-22-6618 6346<br />

DIRECTORS<br />

Gaurang Gandhi gaurangg@pinc.co.in 91-22-6618 6400<br />

Hemang Gandhi hemangg@pinc.co.in 91-22-6618 6400<br />

Ketan Gandhi ketang@pinc.co.in 91-22-6618 6400<br />

COMPLIANCE<br />

Rakesh Bhatia Head Compliance rakeshb@pinc.co.in 91-22-6618 6400

ight thinking<br />

Rating Objective<br />

Rating<br />

Infinity.<strong>com</strong><br />

Financial Securities Ltd<br />

SMALL WORLD, INFINITE OPPORTUNITIES<br />

Large Caps Mid Caps<br />

M.Cap > USD1bn M.Cap