E & G Industrial & Logistics Properties Stuttgart Region

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Demand<br />

In the reporting period, the greatest<br />

demand for industrial and logistics<br />

property came from the automotive<br />

sector (OEMs & suppliers) with a<br />

51.3% share (ca. 123,500 sqm). A major<br />

part of this figure can be accounted<br />

to the large-scale letting of newly<br />

built logistics space in Tamm with ca.<br />

38,000 square metres. <strong>Logistics</strong> service<br />

providers and freight forwarders<br />

ranked second with 19.9%, followed<br />

by the local industrial and manufacturing<br />

sector with 12% of the overall<br />

space take-up.<br />

Despite the high level of construction<br />

activity in the <strong>Stuttgart</strong> <strong>Region</strong>,<br />

the demand from industries, logistics<br />

and commerce has still not been met<br />

by a sufficient supply of large-scale,<br />

multi-functional hall space. One<br />

reason for this lies with the long development<br />

periods for logistics space.<br />

Re-developments on brownfield sites<br />

entering the market in 2017 had<br />

already been initiated several years<br />

before. In some cases, first talks between<br />

owners and developers took<br />

place five to seven years before construction.<br />

Often, environmental remediation<br />

and analyses, as well as changes<br />

in statutory requirements and<br />

reluctant approval processes have<br />

slowed down development dynamics.<br />

This means that projects on brownfield<br />

sites require some staying power<br />

on the developer´s side. Furthermore,<br />

the gap between demand and supply<br />

of suitable industrial and logistics<br />

space is most likely to continue in the<br />

coming years.<br />

At the same time, the letting rate of<br />

existing space went down by 31.5%<br />

from ca. 173,700 square metres in<br />

2016 to only 118,900 square metres<br />

in 2017. Also this figure shows the<br />

on-going trend for limited supply of<br />

industrial and logistics space in the<br />

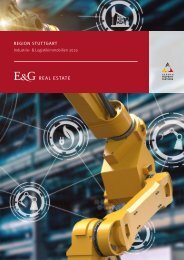

Tenants by rental area 2017<br />

Others Trade<br />

Services<br />

Commerce<br />

<strong>Industrial</strong><br />

Automotive/OEM<br />

Total<br />

240,600 m²<br />

<strong>Logistics</strong><br />

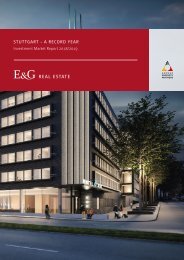

Tenants after conclusion of rental agreement 2017<br />

Trade<br />

Commerce<br />

<strong>Industrial</strong><br />

Others<br />

<strong>Logistics</strong><br />

Automotive/OEM<br />

Services<br />

The <strong>Stuttgart</strong> <strong>Region</strong>:*<br />

A 8 direction<br />

Karlsruhe<br />

A 81 direction<br />

Singen<br />

Weil der<br />

Stadt<br />

Herrenberg<br />

Vaihingen a. d. Enz<br />

Leonberg<br />

Sindelfingen<br />

Schwieberdingen<br />

Ditzingen<br />

Böblingen<br />

Bietigheim-<br />

Bissingen<br />

<strong>Stuttgart</strong><br />

A 81 direction<br />

Heilbronn<br />

County of Ludwigsburg<br />

Weilimdorf<br />

County of Böblingen<br />

Kornwestheim<br />

Leinfelden-<br />

Echterdingen<br />

Ludwigsburg<br />

Filderstadt<br />

Waiblingen<br />

Ostfildern<br />

Neckartenzlingen<br />

Esslingen<br />

Backnang<br />

County of Rems-Murr<br />

Winnenden<br />

Wendlingen<br />

County of Esslingen<br />

Nürtingen<br />

Schorndorf<br />

Murrhardt<br />

Kirchheim u. Teck<br />

Göppingen<br />

County of Göppingen<br />

Geislingen a. d. Steige<br />

Source: Research E & G Real Estate GmbH ©, Januar 2018<br />

<strong>Stuttgart</strong><br />

Berlin<br />

A 8 direction<br />

München<br />

industrial and logistics cluster *<br />

* logistics space < 50,000 sqm<br />

industrial space < 100.000 sqm<br />

10 I I 11