E & G Industrial & Logistics Properties Stuttgart Region

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Foreword.<br />

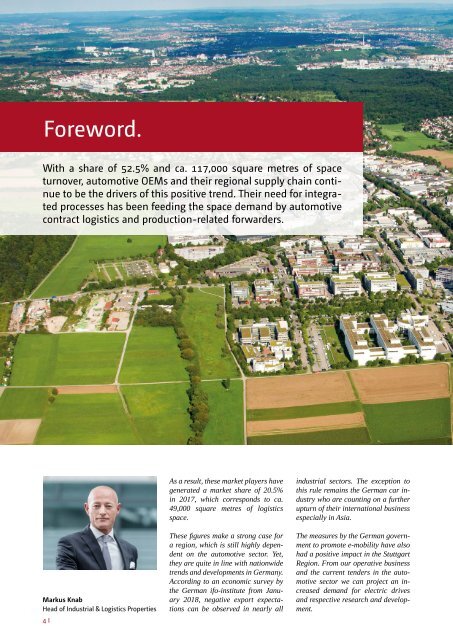

With a share of 52.5% and ca. 117,000 square metres of space<br />

turnover, automotive OEMs and their regional supply chain continue<br />

to be the drivers of this positive trend. Their need for integrated<br />

processes has been feeding the space demand by automotive<br />

contract logistics and production-related forwarders.<br />

Markus Knab<br />

Head of <strong>Industrial</strong> & <strong>Logistics</strong> <strong>Properties</strong><br />

As a result, these market players have<br />

generated a market share of 20.5%<br />

in 2017, which corresponds to ca.<br />

49,000 square metres of logistics<br />

space.<br />

These figures make a strong case for<br />

a region, which is still highly dependent<br />

on the automotive sector. Yet,<br />

they are quite in line with nationwide<br />

trends and developments in Germany.<br />

According to an economic survey by<br />

the German ifo-institute from January<br />

2018, negative export expectations<br />

can be observed in nearly all<br />

industrial sectors. The exception to<br />

this rule remains the German car industry<br />

who are counting on a further<br />

upturn of their international business<br />

especially in Asia.<br />

The measures by the German government<br />

to promote e-mobility have also<br />

had a positive impact in the <strong>Stuttgart</strong><br />

<strong>Region</strong>. From our operative business<br />

and the current tenders in the automotive<br />

sector we can project an increased<br />

demand for electric drives<br />

and respective research and development.<br />

Yet, this structural change is not going<br />

to happen disruptively, but rather<br />

step-by-step. As the transition to<br />

e-mobility will still require the combustion<br />

engine as bridging technology,<br />

both drive systems will run parallel<br />

minimum up to 2025.<br />

The current trend for outsourcing<br />

in the automotive sector as well as<br />

in other industries will be pushed<br />

to a high level. This means that the<br />

automotive suppliers and logistics<br />

servicers of the <strong>Stuttgart</strong> <strong>Region</strong> can<br />

count on a stable and sustainable environment<br />

for their business. Especially<br />

system logistics providers profit<br />

from the commissioning of complex<br />

works such as pre-assembly to external<br />

partners. While such assignments<br />

place high requirements on the respective<br />

logistics facilities, they are<br />

rewarded with longer contract durations<br />

of five to seven, and in some cases<br />

of up to ten years.<br />

At the same time, the space demand<br />

from the industrial sector has been<br />

significantly lower with a share of<br />

merely 11.5% and an overall take-up<br />

of 27,000 square metres of industrial<br />

hall space. This can only partly<br />

be explained by the aforementioned<br />

trend for outsourcing to logistics<br />

service providers. Furthermore, the<br />

industrial companies of the <strong>Stuttgart</strong><br />

<strong>Region</strong> continue to strongly focus on<br />

their core business in order to meet<br />

the challenges of industry 4.0 (automation<br />

and digitalization).<br />

For the investment market in light<br />

industrial and especially for logistics<br />

property, the described trends seem<br />

to create a positive environment. However,<br />

the scarcity of the sought-after<br />

asset class logistics property has lead<br />

to a further compression of yields.<br />

Currently, the gross initial yield for<br />

such products still lies at 5%. Yet, it<br />

can be assumed that this figure will<br />

come under further pressure over the<br />

course of the year.<br />

The high space volume in the last<br />

year can be accounted for by the fact<br />

that many development projects were<br />

implemented on so-called brownfield<br />

sites (plots with previous industrial<br />

use). In some cases, the preparatory<br />

measures (remediation, species conservation,<br />

planning approval, etc.)<br />

had taken years in order to make<br />

these sites available for industrial<br />

re-development. On the basis of our<br />

on-going market research, we do not<br />

expect this trend for brownfield developments<br />

to continue on a comparable<br />

level in 2018.<br />

Likewise, the insufficient designation<br />

and therefore a limited availability<br />

of suitable greenfield plots will have<br />

a negative impact on the industrial<br />

and logistics space take-up in 2018.<br />

This becomes evident from the letting<br />

volumes in existing space, which<br />

have already plummeted by 30% in<br />

2017. In face of the overall scarcity<br />

of industrial and logistics space, the<br />

companies in the <strong>Stuttgart</strong> <strong>Region</strong><br />

are forced to either work with their<br />

existing space, or to look elsewhere<br />

for suitable facilities. Therefore, the<br />

tight market environment could be a<br />

further reason for the low space take-up<br />

of industrial companies in the<br />

previous year.<br />

At this point, local authorities are<br />

called upon to designate suitable sites<br />

for industrial and logistics use in<br />

the immediate vicinity of the region´s<br />

OEMs and their tier 1 suppliers. The<br />

prevailing negative preconceptions<br />

about logistics settlement must be<br />

challenged, because the logistics sector<br />

plays a key role for the competitiveness<br />

of the automotive industry in<br />

the entire <strong>Stuttgart</strong> <strong>Region</strong>.<br />

Next to the provision of a compatible<br />

road and IT infrastructure, also<br />

the availability of suitable industrial<br />

and logistics space will remain a core<br />

challenge for the economic success of<br />

the <strong>Stuttgart</strong> <strong>Region</strong>.<br />

Yours<br />

4 I<br />

I 5