ExtraMileIssue11

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

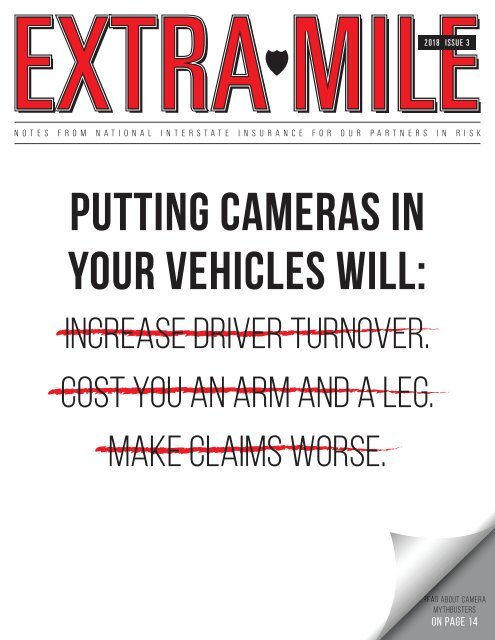

2018 ISSUE 3<br />

NOTES FROM NATIONAL INTERSTATE INSURANCE FOR OUR PARTNERS IN RISK<br />

Putting cameras in<br />

your vehicles will:<br />

INCREASE DRIVER TURNOVER.<br />

Cost you an arm and a leg.<br />

Make claims worse.<br />

Read about Camera<br />

Mythbusters<br />

on page 14

Contents2018 ISSUE 3<br />

LETTER FROM THE PRESIDENT AND CEO 3<br />

EXTRA MILER MIKE SILVESTRO 4<br />

EXECUTIVE SPOTLIGHT: SCOTT NOERR 6<br />

PRODUCT SPOTLIGHT: VENTURE, VOYAGER AND VELOCITY ALTERNATIVE RISK PROGRAMS 8<br />

A CROWNING ACHIEVEMENT 10<br />

BECOME A BETTER TRUCKING INSURANCE BUYER 12<br />

Letter from the President and CEO<br />

TONY MERCURIO<br />

CAMERA MYTH BUSTERS 14<br />

AERS: WHAT DO YOU THINK OF THEM? 18<br />

WHY VIDEO ALONE ISN’T ENOUGH: THE VALUE OF A MANAGED SERVICE 20<br />

SUMMER PARTY 23<br />

PREPARING FOR THE FUTURE: HIRING TOP TALENT 24<br />

INSURANCE BUILT AROUND FAITH – GOOD FAITH 26<br />

HOW TO REPORT A CLAIM 28<br />

Subscriptions:<br />

Extra Mile magazine is a free, quarterly publication offered by National Interstate Insurance Company in<br />

support of its customers. To subscribe, call 800-929-1500 or email amanda.genther@natl.com.<br />

Publisher:<br />

Established in 1989, National Interstate Insurance is one of the leading specialty property and casualty<br />

insurance companies in the country. Offering more than 30 different insurance products, including traditional<br />

insurance, innovative alternative risk transfer (ART) programs for commercial companies and insurance for<br />

specialty vehicle owners. Its customized solutions are made possible by its talented and dedicated team<br />

members. National Interstate employs over 700 employees in offices in Northeast Ohio, HI, and MO.<br />

© 2018 National Interstate Insurance Company<br />

natl.com/facebook<br />

natl.com/linkedin<br />

natl.com/twitter<br />

natl.com/youtube<br />

instagram.com/natl_hq<br />

Editorial Contributors:<br />

Amanda Genther<br />

Tom King<br />

Todd Koca<br />

Tony Mercurio<br />

Chris Mikolay<br />

Kate Mitchell<br />

Melissa Purcell<br />

Keith Rawson<br />

Sandra Ritley<br />

Josh Stoll<br />

Charlie Wendland<br />

Well over a decade ago, National Interstate became the first<br />

insurance company in the United States to offer a program for in-cab<br />

video cameras, or Automated Event Recorders (AERs). To-date, we’ve<br />

helped our customers install tens of thousands of cameras and have<br />

spent more than $15 million investing in these devices. While it’s<br />

hard to quantify the exact return on this investment, we believe now<br />

more than ever in the power of the camera to provide an irrefutable<br />

witness (particularly in today’s age of runaway verdicts), to help<br />

coach our drivers to better behaviors and to prevent accidents before<br />

they happen.<br />

In the early days of promoting the use of in-cab cameras, we were<br />

met with significant resistance. The early adopters were our bus<br />

and motorcoach customers who understood the power of having a<br />

video when passengers were aboard. While the trucking industry<br />

was much slower to embrace this technology, I believe we’ve<br />

reached a tipping point – it’s getting harder and harder to ignore the<br />

many benefits cameras provide – and easier to explode the myths<br />

surrounding them. For example, I recently attended an Advisory Board<br />

Meeting with one of our trucking group captives. During a session we<br />

call, “Iron Sharpens Iron”, where the members share best practices,<br />

the conversation turned to cameras. One of our more influential<br />

members stood up, turned to his peers and stated emphatically, “I<br />

am here to tell you it is a myth that you will lose drivers if you install<br />

cameras. It simply doesn’t happen, particularly if you do it right.<br />

Repeat after me: It is a myth that you will lose drivers if you install<br />

cameras.”<br />

That conversation led to this issue of the Extra Mile where we aim to<br />

dispel the biggest myths of utilizing AER technology. We hope, if you<br />

haven’t taken the leap into the AER world yet, that this issue helps<br />

you get comfortable installing them.<br />

Finally, if you’ve been following along over the past several issues of<br />

Extra Mile, you’ll know that by the time you receive this one, National<br />

Interstate will have cut the ribbon on our new world headquarters in<br />

Richfield, Ohio. Our goal with the new building is to not only make<br />

space for future growth, but also to provide a first-class venue to<br />

host our many meetings with customers, agents and prospects. It’s a<br />

beautiful space with an upgraded cafeteria for our team and room to<br />

grow to over 1,000 total employees on our three-building campus. Of<br />

course, we recognize the only way we’ll fill the space is by providing<br />

world-class customer service at a fair price, and by delivering the<br />

insurance experience built around you. If you’re in the area, please<br />

stop by. We’d love to show you around!<br />

As always, thank you for your partnership, and may each mile you<br />

drive be a safe one.<br />

Best,<br />

Tony Mercurio<br />

President & CEO<br />

3

MIKE<br />

SILVESTRO<br />

Manning an IT help desk can be challenging and cause a good deal<br />

of frustration when something unexpected happens. It can be even<br />

more difficult for the supervisor of a help desk. Managing a help desk<br />

requires keeping a close eye on tickets coming into the queue, current<br />

ticket load and wait time. These are all things that could trigger stress.<br />

It takes a stable person with a calm disposition to effectively manage<br />

the desk, and National Interstate has found that in Mike Silvestro.<br />

Mike joined our Infrastructure team in 2014 and stepped into the help<br />

desk role with an instant sense of purpose and urgency, leveraging his<br />

experience at a much larger company. His interpersonal communication<br />

skills made an immediate impact on our employees in an extremely<br />

short amount of time. Mike purposely became their first-impression<br />

of our IT organization. He has since been on a continuous mission to<br />

improve the department’s service credibility, while managing a team<br />

of five Help Desk Technicians.<br />

Tuesday to display new available equipment such as laptop models,<br />

peripherals and monitors.<br />

Additionally, he is a driving force with the company’s Ease of Doing<br />

Business (EODB) initiative in regards to employee mobility requests<br />

and updated conference room resources, such as plug and play<br />

screen projection. In a continued effort to maintain transparency, Mike<br />

provides an ongoing upgrade report to our workforce, identifying when<br />

an employee will be due for an equipment upgrade, and what device<br />

he or she will receive. Most of this effort was focused on the corporate<br />

migration from desktops to laptops, resulting in a 200% company-wide<br />

laptop deployment increase last year.<br />

Based on continuous customer feedback, Mike started to address<br />

the problem of aging technology in our shared conference rooms. His<br />

team drove the effort of introducing plug and play automation into<br />

several of our Richfield conference room spaces, thereby improving<br />

the experience of both internal and external customers.<br />

Just as information technology changes and innovates each day, a<br />

help desk must do the same to stay ahead of the curve. Mike played<br />

a large role in introducing several new help desk services, including<br />

our Tech Tuesday initiative. Tech Tuesday’s are designed to build and<br />

maintain customer relationships using more of a casual approach. The<br />

initiative provides comprehensive information to our employees during<br />

the lunch hour. This venue provided a direct line of communication to<br />

IT’s internal customers, giving them a sample view of upcoming IT<br />

products and services such as Salesforce, Remedy Force Ticketing,<br />

Okta, network security initiatives, Microsoft Office services and<br />

softphone functionality for remote users. Mike has also leveraged Tech<br />

MEET MIKE SILVESTRO<br />

WHAT IS YOUR FAVORITE<br />

THING TO DO OUTSIDE OF<br />

THE OFFICE?<br />

Spending time with family<br />

and friends.<br />

IF YOU HAD TO PICK A BOX OF CEREAL THAT REPRESENTS YOUR<br />

PERSONALITY, WHAT WOULD IT BE AND WHY?<br />

Lucky Charms, because I consider myself to be one of the luckiest people<br />

I know.<br />

WHAT WOULD YOU DO IF YOU WON THE LOTTERY?<br />

I would set my family and friends up nicely, and then escape to a very<br />

secluded island with some of my favorite people.<br />

WHAT IS THE BEST PART OF YOUR JOB?<br />

Finding solutions and helping others.<br />

Mike has instilled a simple vision of the proper customer experience<br />

within the help desk operations, gaining positive PR and branding<br />

through word-of-mouth, grass root efforts. His attitude and dedication<br />

to this effort created a positive shift in the overall image of the help desk<br />

team. Mike enjoys the ongoing challenge of identifying the business<br />

needs associated with each problem, inquiry or request involved. He<br />

treats every phone call, email, ticket or in-person discussion as if the<br />

person is his single priority customer.<br />

PEOPLE WOULD BE SURPRISED TO KNOW…<br />

That I used to love singing karaoke.<br />

WHAT WOULD YOU DO IF YOU WEREN’T WORKING IN IT?<br />

I would be an astronaut or NFL quarterback, but I love IT too much to do<br />

anything different.<br />

MY DAY CAN’T START UNTIL…<br />

I’m done hitting snooze several times.<br />

WHAT IS YOUR FAVORITE TV SHOW?<br />

Seinfeld.<br />

WHAT IS IT ABOUT TECHNOLOGY THAT MAKES YOU TICK?<br />

The constant evolution of everything from phones to computers<br />

to software.<br />

4<br />

5

Executive Spotlight<br />

S cot t<br />

Noerr<br />

Chief Information Officer<br />

In your own words, can you tell me what you do?<br />

I believe it’s my responsibility to help our company create a<br />

sustainable, competitive advantage in the marketplace by leveraging<br />

technology and innovation. Once we’ve created that shared vision,<br />

it’s my responsibility to motivate our teams to deliver on that set of<br />

common goals.<br />

What are the most important decisions you<br />

make as a leader?<br />

Without a doubt, the most important decision I make, as well as one<br />

that my leadership team makes, is around acquiring and developing<br />

top talent. As a company, we need to attract and retain people that<br />

are curious, intelligent and ambitious. They need to thrive on change<br />

and believe that they can change the world.<br />

You’ve made a significant amount of<br />

technological improvements since joining<br />

National Interstate in 2016. Is there a single<br />

improvement that you are most proud of<br />

implementing?<br />

I would say the biggest change that has been made is a cultural one.<br />

We are building a culture that believes we are capable of solving any<br />

problem or challenge put in front of us. The more wins we put under<br />

our belt, the more we believe and the more opportunities we want to<br />

act on.<br />

Can you name a person who has had a<br />

tremendous impact on your career? Why and<br />

how did this person impact your life?<br />

My parents definitely taught me the value of working hard from a<br />

young age. But it was Dave Roush who taught me to work smart.<br />

Dave was the founder and Chairman of the Board of Insurance.<br />

com and now serves as President of JDP Holdings. He shaped my<br />

thinking on sales and marketing, innovation and creating value<br />

through association of unrelated ideas or fields.<br />

What books and blogs are you currently<br />

reading?<br />

I just finished reading Sprint – How to Solve Big Problems and Test<br />

New Ideas in Just Five Days by Jake Knapp. In my department, we<br />

will try to implement concepts from this book in several projects we<br />

are executing on this year.<br />

What motivates you to get out of bed in the<br />

morning?<br />

I’m fortunate enough to work at a company I love that is filled with<br />

brilliant people who embrace entrepreneurship. Beginning with our<br />

President & CEO, Tony Mercurio, and his desire to always stretch<br />

ourselves to create and implement the best of something which has<br />

trickled down to the entire company. If you’re someone that wants to<br />

make a difference, it would be hard to find a better environment than<br />

National Interstate.<br />

What do you enjoy doing when you’re not<br />

working?<br />

Spending time with my family. I have three very active children and<br />

a wonderful wife. We spend a majority of our time running the kids<br />

from one sporting event to another, but when we’re not doing that,<br />

we enjoy spending time by a pool or at a beach relaxing.<br />

What have you been listening to in your car to<br />

and from work?<br />

I have a long commute to the office, so I listen to a lot of books on<br />

tape, TED Talks and Harvard Business Review stories. Here’s some<br />

of the more recent books I’ve listened to during my drive: Influence:<br />

The Psychology of Persuasion (Robert B. Cialdini), Pitch Anything:<br />

An Innovative Method for Presenting, Persuading and Winning the<br />

Deal (Oren Klaff) and How to Measure Anything: Finding the Value of<br />

Intangibles in Business (Douglas W. Hubbard).<br />

If you could mass market a t-shirt with a saying<br />

on the front of it, what would it say?<br />

Lead from the front – Innovate!<br />

Where will technology be in five years?<br />

If I could predict that, I’d probably be retired. The only thing I know<br />

is the pace of change is growing exponentially and those who can’t<br />

adapt quickly will be left behind.<br />

6<br />

7

PRODUCT SPOTLIGHT:<br />

VENTURE, VOYAGER AND VELOCITY<br />

ALTERNATIVE<br />

RISK PROGRAMS<br />

Like commercial trucking itself, the market for trucking insurance<br />

moves in cycles. It can be frustrating and pricing is often illogical,<br />

particularly for better run trucking companies. For nearly two<br />

decades, National Interstate has been committed to providing<br />

insurance solutions to the trucking industry, much of it in<br />

alternative risk programs. We recognized the opportunity to create<br />

a program for best-in-class trucking companies that would allow<br />

them to capitalize on their commitment to safety and outstanding<br />

loss performance, and in 2001, National Interstate launched<br />

the Voyager group rental captive program. Voyager immediately<br />

afforded mid-market fleets the opportunity to partner with their<br />

insurance company, take on a reasonable layer of risk ($100K) and<br />

see the benefit of controlling their cost of risk. Today, the Voyager<br />

program stands at 34 active members.<br />

As National Interstate grew the Voyager program through the<br />

early 2000’s, there was interest in the alternative risk concept<br />

from trucking companies who had a lower tolerance for risk.<br />

Recognizing this need, National Interstate launched the Venture<br />

captive program in 2003 to fill a void in our alternative risk<br />

portfolio for insureds seeking to retain the first $50K of risk.<br />

Venture now has 50 active members. Continuously seeking to<br />

offer an insurance experience built around our customers, in<br />

2006 the formation of Velocity rounded out our truck alternative<br />

risk portfolio. Feedback from select Voyager members indicated<br />

that they would be interested in taking on more risk with the<br />

opportunity for a potentially higher reward. The Velocity program<br />

formed, allowing its members to participate in the first $250K<br />

of risk and the opportunity to get back more than half of their<br />

premium. Though these are three distinct programs designed for<br />

fleets of various sizes, each offers its members an experience that<br />

is unique - the opportunity to work closely with National Interstate<br />

to shape and mold your insurance program.<br />

In total, our V programs have grown to become a network of more<br />

than 80 innovative companies. Our members have had more than<br />

$46M in premiums returned to them since 2001.<br />

As a leader in the Truck Alternative Risk space, National Interstate<br />

is always looking for companies who are willing to think differently<br />

about risk financing to set themselves apart from their peers.<br />

➼<br />

➼<br />

➼<br />

➼<br />

➼<br />

Have a commitment to developing and maintaining an<br />

ongoing culture of safety at all levels.<br />

Exhibit a history of best-in-class results evidenced by stable<br />

growth and sound financial statements.<br />

Are willing to commit to a long-term mindset. Participants<br />

must understand that a primary reason for the program is to<br />

minimize wild price fluctuations.<br />

Are willing to provide his or her time and expertise to<br />

continuously raise the bar through sharing of knowledge and<br />

best practices.<br />

Stand out from the crowd by exhibiting risk management<br />

practices beyond industry compliance.<br />

DO YOU HAVE WHAT IT TAKES?<br />

If you have what it takes or you’re an agent of an insured that<br />

has these qualities, call me today at 800-929-1500 x1316 to<br />

learn about an insurance solution that provides access to an<br />

exclusive group of best-in-class companies, stability in a volatile<br />

market, the opportunity for returned premium and investment<br />

income and more.<br />

JOSH STOLL<br />

Director, Truck Alternative Risk<br />

8<br />

9

O P E N<br />

a crowning<br />

achievement<br />

$<br />

Innovation can begin in the most<br />

unexpected places, including a<br />

high school National Dance Team<br />

Competition. During the January<br />

2017 Championships in Orlando,<br />

Florida, two dads, Todd Koca and<br />

Keith Rawson, had a conversation<br />

about their respective careers<br />

while waiting for their daughters’<br />

team to perform. Thirty minutes<br />

into the conversation, Todd knew<br />

he and Keith would eventually<br />

become business partners, and<br />

that business would ultimately<br />

become CROWNSOURCE.<br />

Just prior to this trip to Florida, Todd resigned from the company he<br />

founded in 2005 that had recently been purchased. While he loved the<br />

work, after 3 years Todd was getting the itch to build another business.<br />

He just didn’t know what that would be, until his conversation with<br />

Keith. Keith, the leader of contracting and procurement at YRC<br />

Worldwide, found himself in the same position; he loved his work, and<br />

did it well, saving YRC tens of millions of dollars on supply and service<br />

purchases, but was ready for a new challenge. Although both came<br />

from different industries, Todd and Keith had similar experiences.<br />

Todd was also in the business of saving his clients’ money, to<br />

the tune of over $400M through his health care supply custom<br />

contracting and technology business. Today’s transportation industry,<br />

like healthcare before it, is challenged by thin margins and hyperfragmentation.<br />

Individual organizations do not have the resources or<br />

size to create lower price points on supplies and services. Together,<br />

Todd and Keith knew their knowledge of healthcare purchasing and<br />

transportation procurement could revolutionize transportation through<br />

CROWNSOURCE, a new business designed to transform how the<br />

trucking, moving and storage and passenger transportation industries<br />

purchase supplies and services.<br />

Purchasing Network model increases negotiating<br />

power across the trucking, moving and storage<br />

and passenger transportation industries. The<br />

Purchasing Network membership community is<br />

designed for any size company – from small to<br />

large – to generate the purchasing power needed<br />

to deliver bigger savings that members can<br />

individually attain. Total supply cost savings are passed to members<br />

through CROWNCONNECT, a world-class eCommerce Marketplace and<br />

eProcurement system. CROWNCONNECT not only connects members<br />

to a comprehensive, industry-specific portfolio of deeply discounted<br />

national and regional contracted supplies and services, it delivers a<br />

centralized purchasing platform with purchasing controls to manage<br />

spend more effectively.<br />

CROWNSOURCE provides members depth and breadth of supplies and<br />

services, including office supplies, equipment, furniture and technology,<br />

breakroom supplies, shop supplies, janitorial and cleaning supplies,<br />

safety supplies, facility supplies and facility maintenance services.<br />

Additionally, due to rapid membership growth, CROWNSOURCE is<br />

moving into custom contracting of rolling stock supplies (tires, parts,<br />

fuel, oil, lubes and equipment). CROWNCONNECT will truly be the onestop<br />

shopping experience for members to reduce their total cost on the<br />

items they purchase every day.<br />

The CROWNSOURCE contracting philosophy goes beyond line-item<br />

savings. Contracting experts incorporate pricing, purchase process<br />

and supplier management into the CROWNCONNECT platform, giving<br />

members an easy and effective way to save.<br />

CROWNSOURCE’s sole mission is to improve members’ bottom line<br />

through effective and efficient total supply cost management; simply,<br />

to save members more money on everyday products and services.<br />

CROWNSOURCE is committed to the continuous improvement of<br />

purchasing processes through membership collaboration. Buying<br />

supplies should be easy. Saving money should be easy. Together with<br />

CROWNSOURCE, member companies can realize both without adding<br />

infrastructure, resources or costs.<br />

To learn more about CROWNSOURCE, visit www.crownsourceinc.com<br />

CROWNSOURCE’s mission is to transform how transportation<br />

companies purchase their supplies and services through their total<br />

supply cost management platform, CROWNCONNECT. With decades<br />

of contracting and procurement expertise, industry experience and<br />

supplier relationships, CROWNSOURCE is uniquely prepared to improve<br />

historically thin profit margins across the transportation industry. In<br />

the few short months since its launch, the company is experiencing<br />

rapid growth in membership.<br />

TODD KOCA<br />

President and Chief Executive Officer<br />

CROWNSOURCE delivers value to member companies through its<br />

Membership Purchasing Network and eCommerce Marketplace.<br />

Similar to what Todd experienced in healthcare, the CROWNSOURCE<br />

KEITH RAWSON<br />

Executive Vice President and Chief Operating Officer<br />

10<br />

11

TRUCKING<br />

Become a Better<br />

INSURANCE<br />

BUYER<br />

Your customers view your product as a commodity. Rogue<br />

competitors lurk, willing to offer your customers a cheaper shortterm<br />

deal. Rate increases are only achieved if market forces allow<br />

them, not whether you need them.<br />

Are we talking about the trucking industry or the insurance<br />

industry?<br />

I have often remarked that the trucking and insurance industries<br />

are remarkably similar, and understanding those similarities can<br />

help you become a better insurance buyer.<br />

Economics textbooks would consider the trucking and insurance<br />

industries to be near perfectly competitive markets. In a perfectly<br />

competitive market, producers can choose how much to produce<br />

but not the price at which they can sell their output. Time and<br />

again I hear trucking industry executives lament how if they could<br />

only find more drivers, they could fill more trucks tomorrow. But<br />

they also lament that market forces rarely allow them to get the<br />

rate they really need.<br />

The same is true of the insurance industry; in the insurance<br />

business, supply is determined by available capital, and despite<br />

recent catastrophic weather events, capital is still abundant. While<br />

prices have risen recently in some parts of the insurance industry,<br />

particularly in the excess market for auto liability limits above $1<br />

million, insurance industry executives lament how market forces<br />

will not allow them to set prices where they can achieve adequate<br />

underwriting profit. In fact, with the average commercial trucking<br />

insurer turning in a Combined Ratio (equivalent to the Operating<br />

Ratio in the trucking world) of 110 over the past few years, the<br />

insurance industry has been less profitable than the trucking<br />

industry and is projected to remain so for the foreseeable future.<br />

Still, the industries are symbiotic. Understanding their similarities<br />

will help you better manage your cost of risk:<br />

➼ Just as all trucking fleets are not the same, all insurance<br />

providers are not created equal. While we are told through<br />

frequent television ads that 15 minutes can save you 15% or<br />

more, the insurance needs of for-hire truckers are decidedly<br />

more complex than personal auto, and the products vary<br />

widely. Shrewd insurance buyers will investigate and<br />

understand how to properly value product features like basket<br />

deductibles, aggregate stop losses, varying risk retention<br />

levels, large deductibles and alternative risk options versus<br />

first dollar programs, and the impact of collateral. Educating<br />

yourself on these kinds of terms will allow you to understand<br />

the vast difference between buying insurance and financing<br />

risk. Working with a seasoned insurance broker who<br />

specializes in trucking can help you decipher what you’re<br />

buying, and that broker should encourage you to think about<br />

the smartest way to control the cost of risk intelligently over<br />

time, rather than viewing insurance as a commodity and<br />

going for the “cheapest” deal.<br />

➼ If a trucking fleet provides consistently poor service, they’re<br />

going to hear about it from the shipper. At some point,<br />

the shipper is going to determine that carrier isn’t worth<br />

the hassle, no matter how cheap their rates. Likewise, an<br />

insurance carrier with poor claims service isn’t worth the<br />

heartache. Worse, poor claims outcomes can haunt your fleet<br />

for years, driving up rates down the road. Find an insurance<br />

carrier with true expertise in handling large trucking claims<br />

and demand excellent communication throughout the claims<br />

handling process.<br />

➼ Just as you might do a favor for a loyal shipper, is your<br />

insurance carrier going to step up when it matters most? You<br />

want an insurance carrier that will be your best partner on<br />

your worst day. Get to know insurance company personnel,<br />

including its senior executives, and develop a long-term<br />

partnership. If you build strong relationships with the right<br />

people, it will pay off when you need to rely on them should<br />

the need arise.<br />

➼ Just as there are reefer, tanker or heavy-haul fleets, insurance<br />

carriers offer various classes of business, and the products<br />

they sell can be quite varied. Find an insurance carrier that<br />

specializes in and offers programs for your particular niche,<br />

and make sure they offer the full suite of insurance coverages<br />

you need.<br />

➼ Finally, just as you might invest in technologies to improve<br />

miles per gallon, your insurance carrier should offer tools and<br />

programs that help you mitigate risk so that you avoid claims<br />

to begin with. In other words, there are ways to improve the<br />

ROI of your insurance program, just as there are ways to<br />

maximize miles per gallon.<br />

In the huge, highly competitive trucking industry, there are wellmanaged<br />

fleets, and some that lag behind. Of course, the same<br />

is true for insurance companies, and in the long run, you should<br />

align with a reputable carrier that offers creative, flexible programs<br />

tailored to your risk financing needs.<br />

Astute trucking executives know that in the long run, there is a<br />

difference between price and value; who they’re insured with,<br />

and how they finance risk, can make a significant impact on their<br />

organization.<br />

CHRIS MIKOLAY<br />

VP, National Accounts and Truck Alternative Risk<br />

12<br />

13

MYTH<br />

01<br />

“Cameras Are Too Expensive”<br />

Pete Fioretti, President, Island Transportation<br />

CAMERA<br />

We asked three proficient users of Automated Event<br />

Records (AERs) to share their success stories and<br />

help us debunk the myths around installing a fleetwide<br />

camera program. Here are their stories.<br />

MYTH<br />

BUSTERS<br />

WHAT HE’S USING:<br />

Lytx DriveCam<br />

WHY HE USES DRIVECAM:<br />

There’s not a lot of work involved on our part in getting the videos to<br />

review with the driver. It’s worth every penny because Lytx analyzes<br />

our recordings and acts as a neutral, third party. Their analysis clearly<br />

points out situations where a driver needs to be coached. Therefore,<br />

when a driver gets called in to a meeting with management, we<br />

don’t hear complaints like, “I’m having a meeting with my manager<br />

because he doesn’t like me, or she’s picking on me.” There is a clear<br />

reason for the meeting to correct an unsafe driver behavior with<br />

video evidence to back it up.<br />

ARE CAMERAS WORTH THE MONEY?<br />

The process is worthwhile for sure. The cameras reinforce our<br />

safety culture because every driver is involved and goes through the<br />

process every single day.<br />

ARE YOU SAVING MONEY WHEN IT<br />

COMES TO CLAIMS?<br />

Yes, I definitely find that the cameras help when it comes to adjusting<br />

claims, absolutely. It also helps management to not just take the<br />

driver’s word for it. I’ve been in situations where the driver said, “He<br />

ran into me.” We would go through the entire claim process, and<br />

during a deposition, the driver changed his statement under oath on<br />

the stand. Meanwhile, that claim just tripled in cost for us.<br />

WHAT WAS YOUR RELUCTANCE TO<br />

A CAMERA PROGRAM, PRIOR TO<br />

ADOPTING ONE?<br />

My number one area of reluctance was that the video footage would<br />

prove my driver guilty. However, my company had two large losses,<br />

and I knew that I had to do something dramatic to change our culture<br />

and focus immediately. I became aware of the camera program<br />

through National Interstate and decided to install the cameras in my<br />

fleet. After implementing the program, the cameras helped us settle<br />

claims where we knew we were at fault much quicker, saving our<br />

company money. The faster we can settle a claim, the cheaper it is.<br />

HAVE YOU LOST ANY DRIVERS?<br />

No, less than 1% of my drivers had an issue with it, and that 1%<br />

tends to have an issue with everything. I talk to every new driver<br />

that Island Transportation hires, and not one has an issue with the<br />

cameras. There might be a driver that knows we have cameras,<br />

and he or she won’t apply here, which is okay because there’s a<br />

reason they don’t want to work with a camera – they’re doing<br />

something wrong.<br />

14<br />

15

MYTH<br />

02<br />

MYTH<br />

03<br />

“You will lose drivers if you<br />

install cameras”<br />

Don Carney, Owner, Brothers Auto Transport<br />

“Cameras Could Make a Claim Worse if<br />

the Driver is Doing Something Wrong”<br />

David Butcher, VP of Safety, GO Riteway Transportation Group<br />

WHAT HE’S USING:<br />

Rosco<br />

WHY HE USES ROSCO?<br />

I was first introduced to the concept when I joined the Venture<br />

captive program. Other members presented it to me as a safety<br />

factor that had proven success. When I first came into Venture, I<br />

was new to a captive and I had a lot to learn. One of the first things I<br />

learned was that I needed to get my RASS (Risk Assessment Scoring<br />

System) score in line, and cameras were shown to help improve this<br />

score. RASS is the Venture captive’s benchmarking scoring system.<br />

I was reluctant to utilize in-cab cameras because I feared I would<br />

lose drivers. However, something happened to me personally a few<br />

months before implementation that changed my opinion.<br />

I was visiting my mother in Buffalo, New York, and on the drive<br />

back I passed a semi-truck on the interstate. As I was passing it,<br />

the truck veered off into the left lane, pushing me into the median.<br />

Being a truck driver myself for a long time, I know that things can<br />

happen. But, as I passed his vehicle, I looked up and the driver<br />

was texting on his phone. I continued driving home, stopping for<br />

gas and coffee along the way. I caught up with that truck a second<br />

time in Pennsylvania, and as I passed him again, sure enough, he<br />

was texting. I made the decision that day to put cameras in all of<br />

my trucks because I did not want any of my drivers doing the same<br />

thing that he was doing. Since installing the cameras, it has been<br />

nothing but a positive experience.<br />

WHAT WAS YOUR RELUCTANCE TO<br />

A CAMERA PROGRAM, PRIOR TO<br />

ADOPTING ONE?<br />

I was afraid of the same thing that everyone else was – that the<br />

camera was there to be big brother and do nothing but spy on my<br />

drivers. I was afraid of losing drivers because they thought that with<br />

the cameras, their freedom was taken away. We did have some<br />

drivers threaten to leave, but no one left on their own accord. The<br />

use of cameras has been very valuable to our company.<br />

HAVE YOU LOST ANY DRIVERS?<br />

The only way I lost a driver after implementing them was after<br />

seeing someone do something he/she wasn’t supposed to be doing<br />

on the camera and terminated that person. We did not have anyone<br />

quit or leave the company as a result of the implementation. In fact,<br />

after I installed the first set of cameras, I had a driver get into an<br />

accident, but the camera footage vindicated him and showed that<br />

he was not at fault. After that, I had drivers asking me how quick<br />

they could get a camera in their truck.<br />

ARE CAMERAS WORTH THE MONEY?<br />

Absolutely. In my estimation, a rear-end accident costs in the<br />

neighborhood of $100,000. One accident that we were not at fault<br />

for paid for our cameras the first year.<br />

WHAT HE’S USING:<br />

Lytx plus two continuous-recording hard drive-based solutions in<br />

differing parts of his fleet.<br />

WHY HE USES LYTX?<br />

I liked the Lytx program because I can use it for driver behavior<br />

modification and typically, we can manage our drivers better with<br />

respect to weeding out those caught exhibiting poor behavior who<br />

do not want to change and correcting those that are correctable.<br />

Additionally, people don’t argue with video when they see<br />

themselves doing the things they should not be doing or performing<br />

in a less than safe manner. Also, with the Lytx program, all of our<br />

recordings are stored in the cloud instead of on a hard drive, which<br />

may become corrupted, may not work properly for a driver or are not<br />

replaced when they are removed from one vehicle to another.<br />

HOW HAVE YOU SEEN CLAIMS IMPACTED?<br />

We installed late in 2015 starting with our motorcoaches, then<br />

moved on to our black car division. We did the implementation<br />

incrementally and phased it in throughout 2016. The driver coaching<br />

is performed by operations managers and my safety team. Contrary<br />

to what some may fear, the cameras have had a net-positive impact.<br />

For example, by 2017 we were completely implemented across the<br />

fleet. In that same year, our claims dropped 38%.<br />

HOW DID YOU IMPLEMENT YOUR PROGRAM?<br />

We have quarterly driver safety meetings and used this platform to<br />

give our drivers a heads up that we were moving in that direction.<br />

We were pretty easy going the first 30 days, and no one had any<br />

issue with it. There were no drivers who were fired, and no one quit<br />

on their own accord.<br />

DID YOU HAVE RELUCTANCE TO THE<br />

CAMERA PROGRAM BEFORE IMPLEMENTING?<br />

I didn’t have any reluctance to it; I always believed in the use<br />

of cameras and driver coaching, and using cameras for claims<br />

mitigation. While the drivers were very resistant to it in the<br />

beginning, after about two to three months they relaxed because<br />

they found out that they’re being exonerated in accidents more than<br />

they are getting their wrist slapped.<br />

ARE YOU SAVING MONEY WHEN IT<br />

COMES TO CLAIMS?<br />

Absolutely. Because we changed our driver’s behaviors, our safety culture<br />

improved, resulting in less claims. Due to our effective use of the camera<br />

program, we saw an overall significant reduction in premiums.<br />

When an adjuster needs to know something, we have the footage to<br />

back up what we say. In cases where an accident was our fault, we’ve<br />

settled the claim quicker instead of dragging it out through litigation.<br />

DID YOU LOSE ANY DRIVERS?<br />

No, the drivers began to recognize the benefits of the program.<br />

16<br />

17

A NATIONAL<br />

INTERSTATE<br />

SURVEY<br />

Cameras:<br />

We are big fans of camera technology, and there’s a story we just love<br />

about a customer’s camera experience. This customer noticed that one<br />

of their drivers had a habit of not coming to a complete stop at a stop<br />

sign. When he was brought in for coaching, he said that he always<br />

came to a complete stop, so his manager showed him the camera<br />

footage. He was very surprised with what he saw. After coaching and<br />

monitoring his behavior, his manager saw a 180 degree change. Put<br />

one in the win column for cameras.<br />

We know the value of this technology, but we’re always interested<br />

to learn how our customers are using them, and what benefits they<br />

are noticing in their businesses. So, we conducted a broad survey of<br />

33 camera users over a measured period of time. Of those, 14 use<br />

a managed service program, while 19 utilize a self-monitor program.<br />

Here’s what they had to say:<br />

What do you<br />

think of them?<br />

“Our drivers are speaking<br />

with each other regarding<br />

the benefits of in-cab<br />

cameras.”<br />

Camera<br />

Advice<br />

“Our drivers become more<br />

aware of their behaviors<br />

when they see themselves<br />

on camera.”<br />

Top 3<br />

Reasons<br />

FOR A COMPANY<br />

THAT IS STILL<br />

HESITANT ABOUT<br />

ADOPTING AER<br />

TECHNOLOGY?<br />

76%<br />

HAVE SEEN<br />

THEIR DRIVERS’<br />

ATTITUDES<br />

CHANGE FOR THE<br />

POSITIVE AFTER<br />

INSTALLING<br />

CAMERAS.<br />

“At the time we<br />

installed them,<br />

we were the only<br />

carrier in our area<br />

with cameras.<br />

It totally set us<br />

apart from our<br />

competition.”<br />

97%<br />

BELIEVE CAMERAS<br />

PROVIDE A<br />

POSITIVE ROI<br />

TO INSTALL<br />

CAMERAS:<br />

1 Eyewitness to an accident/<br />

driver exoneration<br />

2 Increase company<br />

safety culture<br />

3 Coach/change driver behavior<br />

➼<br />

➼<br />

➼<br />

➼<br />

➼<br />

The money saved from one<br />

recorded accident can pay for<br />

the fleet-wide installation.<br />

Cameras with coaching<br />

can help reduce negative<br />

behaviors and increase<br />

positive behaviors.<br />

Cameras often help us on<br />

exonerating driver behavior<br />

and we can use the footage<br />

for accident investigation.<br />

If you care about safety or<br />

want to take it to the next<br />

level, you need to get over<br />

any fears about what drivers<br />

may think about cameras.<br />

If safety is your concern,<br />

there is no other option.<br />

18<br />

19

Why<br />

Isn’t<br />

Video Alone<br />

Adoption of video-based safety solutions is increasing rapidly across<br />

the industry, and for good reason. According to a recent AAA study,<br />

the use of video-based safety systems could prevent 63,000 crashes<br />

and 17,733 injuries annually. 1<br />

However, it’s not enough for fleets to simply install the hardware.<br />

Though a dash cam might capture a collision, this action alone<br />

doesn’t identify the contributing factors or prevent future collisions.<br />

Today’s most advanced video-based safety and analytics solutions<br />

are offered as a fully managed service, alleviating fleet managers<br />

from the tedious tasks of reviewing video footage and analyzing<br />

data, while offering a consistent and unbiased insight into risk. As<br />

a result, fleets maximize the value of their video safety investment<br />

and drivers benefit from a program they can trust.<br />

Get More from Your Data<br />

Choosing to implement a video-based safety program is a tremendous<br />

step toward creating a safer and more efficient fleet. However, few<br />

fleets have the internal resources to take on the cumbersome task of<br />

analyzing the massive amounts of data produced by these systems<br />

to decipher where the risk lies and what can be done to address it.<br />

Additionally, the process of collecting, analyzing and acting on data<br />

must be a standardized, repeatable process that drivers view as fair<br />

and consistent. Without these elements, fleets will forego the true<br />

value of a video-based program.<br />

Unbiased Analysis<br />

Another key benefit to choosing a managed service program is<br />

the unbiased analysis of the data. Using third-party experts rather<br />

than fleet managers ensures each driver and event is evaluated<br />

consistently, creating a fair playing field and avoiding issues<br />

that might stem from bias. With easy-to-use tools such as driver<br />

scorecards, fleet managers can ensure continued improvement<br />

among their drivers, ultimately increasing bottom-line results.<br />

Improvement Can’t Occur Without Measurement<br />

Drivers can have perfect driving records, but that doesn’t necessarily<br />

mean they are driving safely—they may just be lucky. Eventually,<br />

that luck will run out. Before it does, fleets should have an accurate<br />

understanding of their risk.<br />

A managed service affords a real-time stream of analyzed data that<br />

accurately measures a driver’s exposure to risk. This measurement<br />

is based on the triggering event, observed behaviors, risk exposure<br />

metrics based on predictive algorithms and correlations to prior<br />

collision data, thus painting a thorough picture. As a result,<br />

fleet managers can quickly identify which drivers are more likely<br />

to be involved in an incident and can allocate time for coaching<br />

appropriately. In addition to supporting coaching programs,<br />

accurately measuring drivers’ performance can serve as the<br />

foundation of recognition programs.<br />

The state-of-the art video-based safety program includes management<br />

reports and key performance indicators (KPIs) that optimize the<br />

program on an on-going basis, while underscoring areas of strength<br />

and opportunities to improve.<br />

More than the Bottom Line<br />

Expert, consistent and non-biased review is essential to every videobased<br />

program. Compared to taking on this task in-house, a managed<br />

service is clearly the more efficient and cost-effective approach for<br />

fleets. When investing in a video-based safety solution, fleets should<br />

look for a partner that can share best practices, modify the program<br />

to specific goals and priorities and support a growing company.<br />

Most fleets report that by preventing just one collision, a managed<br />

service program more than pays for itself. A managed service<br />

will deliver measurable results that will pay off financially and<br />

significantly improve safety.<br />

Did you know National Interstate offers a camera program for<br />

eligible customers? To find out more information, please contact<br />

your Business Development Specialist.<br />

About SmartDrive Systems<br />

SmartDrive Systems is an industry innovator, delivering driving<br />

performance solutions and transportation intelligence that<br />

transforms fleet safety and operational efficiency. Their video<br />

analysis, predictive analytics and personalized performance program<br />

improves driving skills, lowers costs and provides immediate ROI.<br />

Enough<br />

The Hidden Costs of Self Review<br />

Number of Vehicles 300<br />

Number of Video Events (per vehicle/per month) 20<br />

Review Time in Minutes (per video) 5<br />

Total Time (hours/month) 500<br />

Fully Burden Labor (per hour) $20<br />

Without Managed Services<br />

Additional Hidden Costs:<br />

➼ Initial and recurring recruting costs<br />

➼ Training<br />

➼ Develop & maintain safety review rules<br />

➼ Lost opportunity costs for lack of<br />

reporting, analysis and benchmarking<br />

Impact of this choice:<br />

➼ Limited ROI<br />

➼ Delayed action waiting days or weeks to<br />

get reviewed video<br />

➼ Driver acceptance of video<br />

➼ Inconsistency of view breeds lack<br />

of trust<br />

➼ Ineffective coaching<br />

2.9 Full-time equivalent | $33.33 per month/vehicle | $10,000 monthly<br />

Source:<br />

MELISSA PURCELL<br />

1 AAA. (2017, September 21). Truck Safety Technology Can Prevent 63,000 Crashes Each Year. Retrieved from https://newsroom.aaa.<br />

com/2017/09/truck-safety-technology-can-prevent-63000-crashes-year/<br />

Sr. VP Marketing & Customer Success, SmartDrive ®<br />

20<br />

21

PAYING TOO MUCH<br />

FOR SUPPLIES?<br />

INTRODUCING<br />

• Group Purchasing Network<br />

• eCommerce Marketplace<br />

Summer<br />

party<br />

Our annual Summer Party is pretty special around here, as it gives<br />

us a chance to show appreciation to our employees, spend time with<br />

family and friends and of course, kick off summer! Check out a few<br />

highlights from the event below.<br />

CROWNSOURCE creates buying power for the trucking,<br />

moving and storage, and passenger transportation industries.<br />

• CROWNSOURCE members gain access to CROWNCONNECT,<br />

a world-class eCommerce Marketplace designed to<br />

deliver total supply cost savings. This one-stop shopping<br />

experience with management control functions provides<br />

discounted prices with national suppliers and manufacturers<br />

of products and services specifically tailored for the<br />

transportation industry.<br />

• CROWNSOURCE members save on everyday, “floor<br />

to ceiling” non-rolling purchases – office supplies,<br />

equipment, furniture, and technology; breakroom<br />

supplies; shop supplies; janitorial and cleaning supplies;<br />

safety supplies; facility supplies; and facility maintenance<br />

services.<br />

• In addition to non-rolling supplies, we custom contract<br />

on rolling supplies, such as tires, fuel, oil, lubes, parts<br />

and equipment.<br />

NO ACTIVATION FEES<br />

NO TECHNOLOGY FEES<br />

NO MEMBERSHIP FEES<br />

SAVE MONEY<br />

IMMEDIATELY<br />

MAKE CROWNSOURCE THE<br />

TOP SOURCE FOR YOUR BOTTOM LINE.<br />

22<br />

For more information visit:<br />

www.crownsourceinc.com/learnmore<br />

23

Preparing for the Future<br />

Hiring Top Talent<br />

SANDRA RITLEY<br />

2018 Ignition Class<br />

Human Resources Supervisor<br />

The war for talent is a well-documented one, especially in recent<br />

years as companies are competing for the best talent now more than<br />

ever. Across all industries, a candidate-driven market is challenging<br />

recruiters. And, as baby boomers begin to retire, the gaps that exist<br />

in the workforce will continue to grow. The insurance industry is not<br />

immune to this challenge. By 2024, more than 29,000 insurance<br />

jobs will be available in Ohio alone, according to the Ohio Insurance<br />

Institute. National Interstate does not take these numbers lightly.<br />

Instead, we seek to be a part of the solution by offering robust<br />

internship and meaningful first-career opportunities through our<br />

graduate development program, Ignition.<br />

Summer Internship Program<br />

Our summer internship program has been a driver for student<br />

recruitment since 2012, and in that time, we have employed over<br />

80 college students. During the 10-week program, interns have the<br />

opportunity to work in a variety of departments including Claims, Data<br />

Analytics, Finance, Information Services, Product, Risk Management,<br />

Marketing and Underwriting. Targeted to college juniors and seniors,<br />

the hope is to tie the classroom to real-world experience. Our interns<br />

can expect a well-rounded opportunity to explore both insurance, as<br />

well as National Interstate.<br />

Over the course of the internship program, students gain exposure to<br />

company leaders, have opportunities for professional development,<br />

participate in social functions and gain a unique look at our business<br />

and ever-changing industry. Additionally, interns are required to<br />

participate in a group project and presentation on a business case<br />

at the conclusion of the program. Business case topics have included<br />

new product development, current market disruptors and integrating<br />

multigenerational communication.<br />

Most importantly, interns are reminded throughout the program<br />

that they are interviewing for a potential full-time job and have the<br />

opportunity to receive offers upon completion of their education.<br />

While we hope students have an educational experience and leave<br />

with more interest in exploring the insurance industry, we can’t deny<br />

the excitement we feel when a student wants to join the National<br />

Interstate family.<br />

Ignition Program<br />

In 2014, National Interstate launched the Ignition program, fed by some<br />

of our strongest intern graduates. This dynamic, four-week program helps<br />

prepare recent college graduates with more advanced insurance and<br />

company-specific knowledge and career development opportunities. Over<br />

the last four years, 53 new graduates have completed the Ignition program,<br />

and after the 2018 program, another eight will join the alum list.<br />

Overseeing the program curriculum is Jim Parks, VP and Chief<br />

Underwriting Officer, whose expertise and understanding of our<br />

underwriting practices lay a foundation for the participants. Michelle<br />

Wiltgen, AVP and National Marketing Manager, has served as the<br />

program mentor since inception. Michelle’s 27-year tenure, experience<br />

and passion provides a unique perspective.<br />

The Ignition curriculum is comprised of online learning through Kaplan<br />

Learning Systems and in-person business sessions, education sessions,<br />

professional development presentations and social activities. Our<br />

subject matter experts present foundational business material related<br />

to their business or product focus and lead education sessions to help<br />

drive concepts provided by Kaplan home. Professional development<br />

includes professional etiquette, communication and networking,<br />

to name a few. To encourage relationship building and networking,<br />

several social events occur throughout the program and include a corn<br />

hole mixer, escape room challenge, Akron RubberDucks game, Whirly<br />

Ball and a closing dinner.<br />

A program component that truly exhibits our commitment to our<br />

insureds is the customer collaboration experience. Ignition participants<br />

have the opportunity to visit a local customer to understand their<br />

business and put classroom learnings into real-world perspective. This<br />

eye opening experience provides not only a unique perspective, but<br />

also firsthand experience into what it means to form a customer –<br />

insurance carrier partnership.<br />

Each year, National Interstate evaluates our program successes and<br />

looks for areas of improvement. Feedback has been a powerful tool as<br />

we continue to strengthen both programs and understand the needs<br />

of the future. Every company measures success differently, and at<br />

National Interstate we focus on hiring meaningful talent who develop<br />

into future insurance leaders. In fact, we are proud that many of our<br />

Ignition participants reach their first promotion within eighteen months<br />

and most program graduates are on second or third promotions.<br />

National Interstate welcomes students and new graduates, as they<br />

are the future of our workforce. If you would like more information on<br />

our internship and Ignition programs, please contact Sandra Ritley at<br />

Sandra.Ritley@natl.com.<br />

24<br />

25

Insurance Built Around Faith<br />

GOOD FAITH<br />

matter whether you think George Michael or Limp Bizkit<br />

No said it best, we can all agree: “Got to have faith, gotta<br />

have faith.”<br />

It forms the basis of trust upon which all mutually beneficial<br />

relationships are built. The insurance context is no exception. In fact,<br />

good faith and fair dealing are the hallmarks of a strong business<br />

and insurance relationship.<br />

Even if you have heard George Michael’s 1987 original “Faith” or<br />

the 1997 Limp Bizkit cover, chances are you probably have not<br />

heard the Latin phrase uberrimae fidei (yoo-ber--may fi-dee). Literally<br />

translated, it means “most abundant faith” or “utmost good faith.”<br />

Black’s Law Dictionary (10th Ed. 2014).<br />

The doctrine of utmost good faith in commercial transactions has<br />

been recognized since antiquity, including endorsement by the<br />

Greeks and Romans. Arnaldo Biscardi, “On Aequitas and Epieikeia,”<br />

Aequitas and Equity: Equity in Civil Law and Mixed Jurisdictions, ed.<br />

Alfredo Mordechai Rabello (Jerusalem: Hamaccabi Press, 1997), 2.<br />

In more modern times, the doctrine first appeared in the insurance<br />

context in England, where the Chief Justice of the King’s Bench,<br />

Lord Mansfield, held that neither the insured nor the insurer may<br />

exploit the other by failing to disclose relevant facts to draw the<br />

other into a bargain. Carter v. Boehm, 97 E.R. 1162, 1164 (1766).<br />

The purpose of the doctrine, as explained by Lord Mansfield, is to<br />

encourage good faith and prevent fraud. Id.<br />

The doctrine navigated the Atlantic Ocean and found support in the<br />

U.S. Supreme Court in the 1828 case of McLanahan v. Universal Ins.<br />

Co., 26 U.S. 170, at 185, which the Supreme Court reinforced 100<br />

years later in Stipcich v. Metropolitan Life Ins. Co., 277 U.S. 311,<br />

316 (1928). In both cases, the Supreme Court cited approvingly of<br />

the doctrine of utmost good faith in insurance contracts, holding<br />

that the principles governing insurance are those of an enlightened<br />

moral policy. Since then, courts throughout the U.S. have affirmed<br />

the doctrine. Shipley v. Arkansas Blue Cross & Blue Shield, 333 F.3d<br />

898, 903 (8th Cir. 2003) (citations omitted).<br />

Some states have modified the duty of utmost good faith to demand<br />

proof of fraudulent intent and misrepresentation of a material<br />

fact before an insurer may assert rights against an insured. Other<br />

states require a material misrepresentation but disregard the<br />

insured’s intent in failing to disclose a material fact. However, the<br />

consequence is often the same: the insurer may rescind the policy<br />

and avoid payment of claims when the insured’s failure to provide<br />

material information had an impact on the nature of the risk.<br />

The foundation of the underwriting process requires an insured<br />

to provide a prospective insurer all facts relevant to the proposed<br />

risk. In commercial transportation property and casualty insurance,<br />

this often requires accurate details of an insured’s assets, revenue<br />

sources, employee count, the number and location of the insured’s<br />

offices, branches, or terminals, miles and routes driven by an<br />

insured’s fleet, management experience and prior claims history,<br />

among other information. When an insured suppresses information<br />

that would have disclosed a different kind of risk than the one<br />

submitted through concealed facts, the insurer may argue that<br />

the insured fraudulently induced it to issue an insurance policy,<br />

affording the insurer the right to void the policy. A leading insurance<br />

treatise asserts that because each party to the insurance contract<br />

is at the mercy of the other, a breach of the special duty of utmost<br />

good faith warrants punishment and deterrence. Couch on Ins. §<br />

198:12 (3d ed. 2001).<br />

Because the consequences of an insured’s failure to abide by the<br />

duty of good faith can be extreme, it is important for applicants<br />

to understand the duty of good faith. Insureds should work closely<br />

with their insurance broker and the underwriter to seek clarification<br />

when a question arises concerning the extent of the disclosures<br />

required or information requested by the underwriter. An open<br />

dialogue and clarification of questions helps avoid situations where<br />

facts are uncovered at the time of loss indicating an insured omitted<br />

important information during the underwriting process.<br />

When parties to an insurance contract are well meaning and<br />

demonstrate good faith by recognizing the special relationship and<br />

obligations owed to one another, the insured obtains the benefits<br />

of the coverage it seeks to protect its assets, reputation and more.<br />

Without good faith, an insured may be exposed to an uninsured, and<br />

unexpected, loss.<br />

The next time you complete an insurance application, it might do<br />

some good to pull out that old cassette tape or CD, turn up the<br />

volume, and play your favorite version of “Faith.” I can just hear<br />

Fred Durst’s earsplitting voice in risk managers’ and brokers’ offices<br />

across the country.<br />

THOMAS J. KING<br />

Corporate Attorney<br />

26<br />

27

How to REPORT A CLAIM<br />

As specialists in commercial transportation insurance, National<br />

Interstate claim professionals aggressively adjust hundreds of millions<br />

of dollars in claims each year. On every claim, for every customer, we<br />

work tirelessly to achieve fair, equitable and cost-effective resolutions.<br />

How to REPORT A CLAIM<br />

800-929-0870 24/7<br />

Reminder:<br />

Catastrophic claims must be<br />

reported immediately and by phone.<br />

newclaims@natl.com<br />

From a minor fender-bender to a catastrophic loss, our experts will<br />

provide a superior level of service. Our teams are organized by specialty<br />

and severity to ensure that your claim is handled by a professional who<br />

understands your industry, no matter the complexity. We understand<br />

claims can be stressful, and our goal is to make the process as smooth<br />

as possible.<br />

We are here when you need us, 24/7, 365 days a year.<br />

FOUR STEPS TO A STRESS-FREE CLAIM EXPERIENCE<br />

1. Report the claim immediately!<br />

2. Gather as much information as possible before our claims<br />

professional contacts you.<br />

3. Communicate anything and everything relevant to the claim to<br />

our claims professional.<br />

4. Relax. We’ll take it from here.<br />

330-659-8909