Intuit QuickBooks Payroll Paycheck Calculator - PosTechie for QuickBooks

In case you want to get more detailed information on QuickBooks Payroll calculators you can contact QuickBooks Payroll calculator Support.

In case you want to get more detailed information on QuickBooks Payroll calculators you can contact QuickBooks Payroll calculator Support.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>QuickBooks</strong> <strong>Payroll</strong> <strong>Paycheck</strong> <strong>Calculator</strong> -<br />

<strong>PosTechie</strong><br />

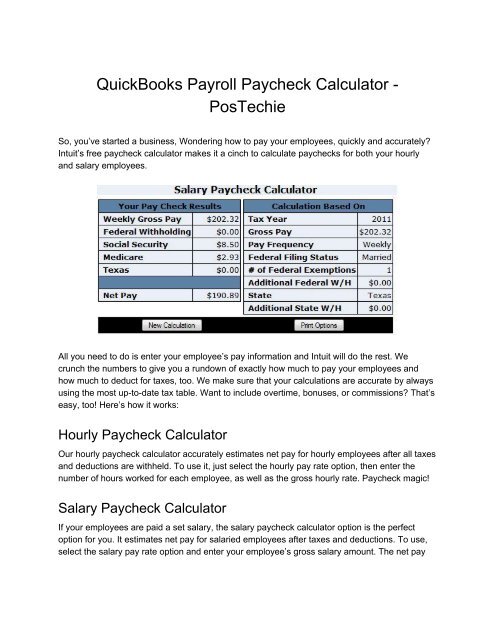

So, you’ve started a business, Wondering how to pay your employees, quickly and accurately?<br />

<strong>Intuit</strong>’s free paycheck calculator makes it a cinch to calculate paychecks <strong>for</strong> both your hourly<br />

and salary employees.<br />

All you need to do is enter your employee’s pay in<strong>for</strong>mation and <strong>Intuit</strong> will do the rest. We<br />

crunch the numbers to give you a rundown of exactly how much to pay your employees and<br />

how much to deduct <strong>for</strong> taxes, too. We make sure that your calculations are accurate by always<br />

using the most up-to-date tax table. Want to include overtime, bonuses, or commissions? That’s<br />

easy, too! Here’s how it works:<br />

Hourly <strong>Paycheck</strong> <strong>Calculator</strong><br />

Our hourly paycheck calculator accurately estimates net pay <strong>for</strong> hourly employees after all taxes<br />

and deductions are withheld. To use it, just select the hourly pay rate option, then enter the<br />

number of hours worked <strong>for</strong> each employee, as well as the gross hourly rate. <strong>Paycheck</strong> magic!<br />

Salary <strong>Paycheck</strong> <strong>Calculator</strong><br />

If your employees are paid a set salary, the salary paycheck calculator option is the perfect<br />

option <strong>for</strong> you. It estimates net pay <strong>for</strong> salaried employees after taxes and deductions. To use,<br />

select the salary pay rate option and enter your employee’s gross salary amount. The net pay

will be automatically calculated and you’ll be all set.<br />

<strong>Intuit</strong> takes the guesswork out of payroll taxes; you can ditch the complicated calculations and<br />

spend more time working on your business.<br />

How to Calculate <strong>QuickBooks</strong> <strong>Payroll</strong><br />

In case you are running your own business it is recommended to use <strong>QuickBooks</strong> payroll<br />

calculators to ensure the consistency and accuracy of payroll services. You can use <strong>Intuit</strong><br />

Online <strong>Payroll</strong> paycheck calculators that will help to see the probable changes in the salaries or<br />

hourly pay rates <strong>for</strong> a single time. No matter if you do not own a business still you can use the<br />

payroll calculator to see the impact of the changes on your paycheck.<br />

Types of <strong>Payroll</strong> <strong>Calculator</strong>s Are:<br />

▩ Salary <strong>Paycheck</strong> <strong>Calculator</strong><br />

▩ Hourly <strong>Paycheck</strong> <strong>Calculator</strong><br />

▩ Net-to-Gross <strong>Paycheck</strong> <strong>Calculator</strong><br />

Why Need QB <strong>Payroll</strong> <strong>Calculator</strong>s<br />

<strong>Payroll</strong> calculators are designed with a purpose to accurately calculate your net pay and your<br />

gross pay.<br />

▩ Salary <strong>Paycheck</strong> <strong>Calculator</strong><br />

You have to enter a gross pay amount and the Salary <strong>Paycheck</strong> <strong>Calculator</strong> automatically<br />

estimates the net pay after taxes and deductions are withheld.<br />

▩ Hourly <strong>Paycheck</strong> <strong>Calculator</strong><br />

Here you need to provide the gross hourly rate and the number of hours worked and the Hourly<br />

<strong>Paycheck</strong> <strong>Calculator</strong> automatically estimates net pay after taxes and deductions are withheld.<br />

▩ Net-to-Gross <strong>Paycheck</strong> <strong>Calculator</strong><br />

You have to provide the net pay amount and the Net-to-Gross <strong>Paycheck</strong> <strong>Calculator</strong><br />

automatically estimates gross wages be<strong>for</strong>e taxes and deductions are withheld.<br />

<strong>QuickBooks</strong> <strong>Payroll</strong> <strong>Calculator</strong> is a free calculator designed by <strong>Intuit</strong>. It helps you to calculate<br />

paychecks <strong>for</strong> hourly or salary employees with quality output. It is a very simple process. You<br />

just have to enter the pay in<strong>for</strong>mation of your employees and the calculator will automatically<br />

process and show the total amount to be paid and amount that is to be deducted <strong>for</strong> taxes. The<br />

software ensures that the calculations are accurate with the latest tax tables. The calculator<br />

eases when overtime, bonuses, or commissions are included.

Technical Help Support <strong>for</strong> <strong>Intuit</strong> <strong>QuickBooks</strong> <strong>Payroll</strong><br />

<strong>Calculator</strong><br />

In case you want to get more detailed in<strong>for</strong>mation on <strong>QuickBooks</strong> <strong>Payroll</strong> calculators you can<br />

contact <strong>QuickBooks</strong> <strong>Payroll</strong> calculator Support. The <strong>QuickBooks</strong> support team is prompt and<br />

responsive in handling <strong>QuickBooks</strong> queries and doubts.<br />

You can also prefer to call to QB<strong>Payroll</strong> help that is a reliable <strong>QuickBooks</strong> Consulting agency.<br />

The in house team is proficient and competent in according <strong>QuickBooks</strong> POS support in a very<br />

short time. They assure complete support and provide quick and accurate in<strong>for</strong>mation on<br />

<strong>QuickBooks</strong> <strong>Payroll</strong> calculator.