Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

20 — Vanguard, MONDAY, APRIL 29, 2019<br />

FINANCIAL VANGUARD<br />

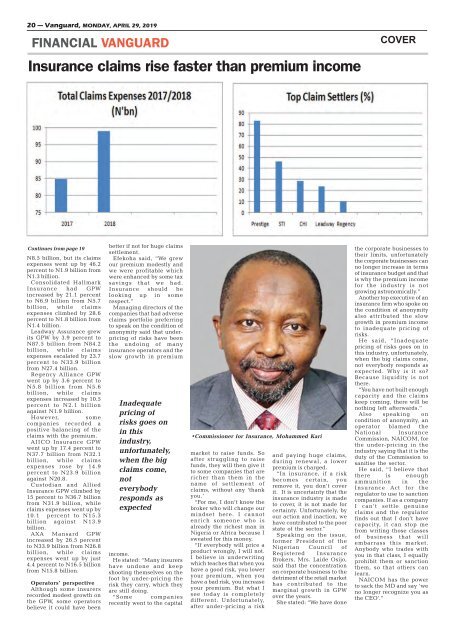

Insurance claims rise f<strong>as</strong>ter than premium income<br />

COVER<br />

Continues from page 19<br />

N8.5 billion, but its claims<br />

expenses went up by 46.2<br />

percent to N1.9 billion from<br />

N1.3 billion.<br />

Consolidated Hallmark<br />

Insurance had GPW<br />

incre<strong>as</strong>ed by 21.1 percent<br />

to N6.9 billion from N5.7<br />

billion, while claims<br />

expenses climbed by 28.6<br />

percent to N1.8 billion from<br />

N1.4 billion.<br />

Leadway Assurance grew<br />

its GPW by 3.9 percent to<br />

N87.5 billion from N84.2<br />

billion, while claims<br />

expenses escalated by 23.7<br />

percent to N33.9 billion<br />

from N27.4 billion.<br />

Regency Alliance GPW<br />

went up by 3.6 percent to<br />

N5.8 billion from N5.6<br />

billion, while claims<br />

expenses incre<strong>as</strong>ed by 10.5<br />

percent to N2.1 billion<br />

against N1.9 billion.<br />

However, some<br />

companies recorded a<br />

positive balancing of the<br />

claims with the premium.<br />

AIICO Insurance GPW<br />

went up by 17.4 percent to<br />

N37.7 billion from N32.1<br />

billion, while claims<br />

expenses rose by 14.9<br />

percent to N23.9 billion<br />

against N20.8.<br />

Custodian and Allied<br />

Insurance GPW climbed by<br />

15 percent to N36.7 billion<br />

from N31.9 billion, while<br />

claims expenses went up by<br />

10.1 percent to N15.3<br />

billion against N13.9<br />

billion.<br />

AXA Mansard GPW<br />

incre<strong>as</strong>ed by 26.5 percent<br />

to N33.9 billion from N26.8<br />

billion, while claims<br />

expenses went up by just<br />

4.4 percent to N16.5 billion<br />

from N15.8 billion.<br />

Operators’ perspective<br />

Although some insurers<br />

recorded modest growth on<br />

the GPW, some operators<br />

believe it could have been<br />

better if not for huge claims<br />

settlement.<br />

Efekoha said, “We grew<br />

our premium modestly and<br />

we were profitable which<br />

were enhanced by some tax<br />

savings that we had.<br />

Insurance should be<br />

looking up in some<br />

respect.”<br />

Managing directors of the<br />

companies that had adverse<br />

claims portfolio preferring<br />

to speak on the condition of<br />

anonymity said that underpricing<br />

of risks have been<br />

the undoing of many<br />

insurance operators and the<br />

slow growth in premium<br />

Inadequate<br />

pricing of<br />

risks goes on<br />

in this<br />

industry,<br />

unfortunately,<br />

when the big<br />

claims come,<br />

not<br />

everybody<br />

responds <strong>as</strong><br />

expected<br />

income.<br />

He stated: “Many insurers<br />

have undone and keep<br />

shooting themselves on the<br />

foot by under-pricing the<br />

risk they carry, which they<br />

are still doing.<br />

“Some companies<br />

recently went to the capital<br />

•Commissioner for Insurance, Mohammed Kari<br />

market to raise funds. So<br />

after struggling to raise<br />

funds, they will then give it<br />

to some companies that are<br />

richer than them in the<br />

name of settlement of<br />

claims, without any ‘thank<br />

you.’<br />

“For me, I don’t know the<br />

broker who will change our<br />

mindset here. I cannot<br />

enrich someone who is<br />

already the richest man in<br />

Nigeria or Africa because I<br />

sweated for this money.<br />

“If everybody will price a<br />

product wrongly, I will not.<br />

I believe in underwriting<br />

which teaches that when you<br />

have a good risk, you lower<br />

your premium, when you<br />

have a bad risk, you incre<strong>as</strong>e<br />

your premium. But what I<br />

see today is completely<br />

different. Unfortunately,<br />

after under-pricing a risk<br />

and paying huge claims,<br />

during renewal, a lower<br />

premium is charged.<br />

“In insurance, if a risk<br />

becomes certain, you<br />

remove it, you don’t cover<br />

it. It is uncertainty that the<br />

insurance industry is made<br />

to cover, it is not made for<br />

certainty. Unfortunately, by<br />

our action and inaction, we<br />

have contributed to the poor<br />

state of the sector.”<br />

Speaking on the issue,<br />

former President of the<br />

Nigerian Council of<br />

Registered Insurance<br />

Brokers, Mrs. Laide Osijo,<br />

said that the concentration<br />

on corporate business to the<br />

detriment of the retail market<br />

h<strong>as</strong> contributed to the<br />

marginal growth in GPW<br />

over the years.<br />

She stated: “We have done<br />

the corporate businesses to<br />

their limits, unfortunately<br />

the corporate businesses can<br />

no longer incre<strong>as</strong>e in terms<br />

of insurance budget and that<br />

is why the premium income<br />

for the industry is not<br />

growing <strong>as</strong>tronomically.”<br />

Another top executive of an<br />

insurance firm who spoke on<br />

the condition of anonymity<br />

also attributed the slow<br />

growth in premium income<br />

to inadequate pricing of<br />

risks.<br />

He said, “Inadequate<br />

pricing of risks goes on in<br />

this industry, unfortunately,<br />

when the big claims come,<br />

not everybody responds <strong>as</strong><br />

expected. Why is it so?<br />

Because liquidity is not<br />

there.<br />

“You have not built enough<br />

capacity and the claims<br />

keep coming, there will be<br />

nothing left afterwards.”<br />

Also speaking on<br />

condition of anonymity, an<br />

operator blamed the<br />

National Insurance<br />

Commission, NAICOM, for<br />

the under-pricing in the<br />

industry saying that it is the<br />

duty of the Commission to<br />

sanitise the sector.<br />

He said, “I believe that<br />

there is enough<br />

ammunition in the<br />

Insurance Act for the<br />

regulator to use to sanction<br />

companies. If <strong>as</strong> a company<br />

I can’t settle genuine<br />

claims and the regulator<br />

finds out that I don’t have<br />

capacity, it can stop me<br />

from writing those cl<strong>as</strong>ses<br />

of business that will<br />

embarr<strong>as</strong>s this market.<br />

Anybody who trades with<br />

you in that cl<strong>as</strong>s, I equally<br />

prohibit them or sanction<br />

them, so that others can<br />

learn.<br />

NAICOM h<strong>as</strong> the <strong>power</strong><br />

to sack the MD and say ‘we<br />

no longer recognize you <strong>as</strong><br />

the CEO’.”