Wills, Trusts & Estates

Wills, Trusts & Estates

Wills, Trusts & Estates

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

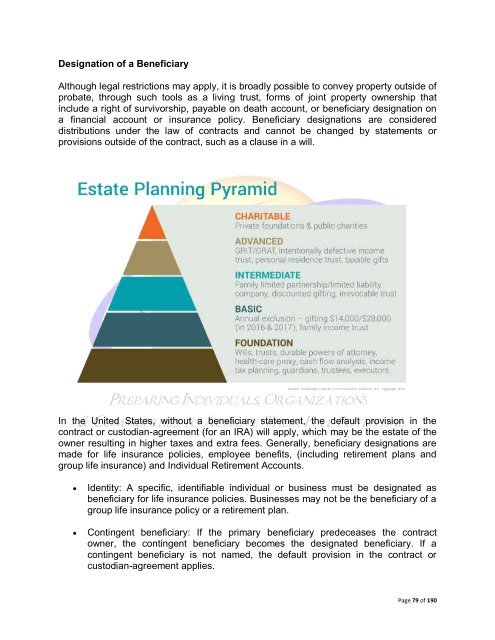

Designation of a Beneficiary<br />

Although legal restrictions may apply, it is broadly possible to convey property outside of<br />

probate, through such tools as a living trust, forms of joint property ownership that<br />

include a right of survivorship, payable on death account, or beneficiary designation on<br />

a financial account or insurance policy. Beneficiary designations are considered<br />

distributions under the law of contracts and cannot be changed by statements or<br />

provisions outside of the contract, such as a clause in a will.<br />

In the United States, without a beneficiary statement, the default provision in the<br />

contract or custodian-agreement (for an IRA) will apply, which may be the estate of the<br />

owner resulting in higher taxes and extra fees. Generally, beneficiary designations are<br />

made for life insurance policies, employee benefits, (including retirement plans and<br />

group life insurance) and Individual Retirement Accounts.<br />

<br />

<br />

Identity: A specific, identifiable individual or business must be designated as<br />

beneficiary for life insurance policies. Businesses may not be the beneficiary of a<br />

group life insurance policy or a retirement plan.<br />

Contingent beneficiary: If the primary beneficiary predeceases the contract<br />

owner, the contingent beneficiary becomes the designated beneficiary. If a<br />

contingent beneficiary is not named, the default provision in the contract or<br />

custodian-agreement applies.<br />

Page 79 of 190