You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Vanguard, MONDAY, JUNE 17, 2019 —21<br />

FINANCIAL VANGUARD<br />

Decline in stop rates on FGN bond to<br />

persist as DMO offer N100bn<br />

Continues from page 19<br />

market this week.<br />

Last week, cost of<br />

funds rose in response<br />

to outflow for funding<br />

of foreign exchange<br />

wholesale auctions and<br />

foreign exchange<br />

swaps by the Central<br />

Bank of Nigeria as well<br />

as rollover of N17.61<br />

billion worth of treasury<br />

bills (TBs) that<br />

matured during the<br />

week. The outflows<br />

suppressed the impact<br />

of inflow of N89 billion<br />

from matured<br />

secondary market<br />

(Open Market<br />

Operation, OMO) TBs,<br />

prompting average<br />

short term interest rate<br />

to rise by 346 bpts.<br />

Data from FMDQ<br />

showed that interest<br />

rate on Collateralised<br />

(Open Buy Back, OBB)<br />

rose by 342 bpts to 8.71<br />

percent last week from<br />

5.29 percent the<br />

previous week.<br />

Similarly, interest rate<br />

on Overnight lending<br />

rose by 350 bpts to 9.21<br />

percent last week from<br />

5.71 percent the<br />

previous week.<br />

Analysts at Lagos<br />

based Vetiva Capital<br />

Management Company<br />

projected that the apex<br />

bank might sell OMO<br />

bills today leading to<br />

further rise in cost of<br />

funds. "With the current<br />

level of system<br />

liquidity, we foresee an<br />

OMO auction in<br />

Monday's session,<br />

leading to a negative<br />

close in the secondary<br />

market at the start of<br />

the week", they said.<br />

External reserves<br />

record first weekly<br />

decline in three<br />

months<br />

The nation's external<br />

reserves last week<br />

record the first weekly<br />

decline in three<br />

months.<br />

Buoyed by increased<br />

foreign exchange<br />

earnings courtesy high<br />

crude oil price and<br />

influx of dollars from<br />

foreign portfolio<br />

investors, the nation's<br />

reserves have been on<br />

the upward trend since<br />

February 28th, 2019,<br />

when it stood at $41.296<br />

billion. This trend was<br />

however halted on<br />

June 10 when the<br />

reserves peaked at<br />

$45.175 billion.<br />

Last week, the<br />

reserves recorded its<br />

first weekly decline of<br />

$76 million as it fell to<br />

$45.087 billion on<br />

Thursday June 20th,<br />

2019 from $45.163<br />

billion on Thursday<br />

June 13th, previous<br />

week.<br />

Meanwhile the naira<br />

appreciated marginally<br />

by 2 kobo at the<br />

Investors and Exporters<br />

(I&E) window last<br />

week. Data from FMDQ<br />

showed that the<br />

indicative exchange<br />

rate for the window<br />

dropped marginally to<br />

N360.49 per dollar last<br />

week from N360.51 per<br />

dollar the previous<br />

week. On its part, the<br />

CBN sustained its<br />

weekly injection of $210<br />

million to support<br />

activities in the<br />

interbank foreign<br />

exchange market.<br />

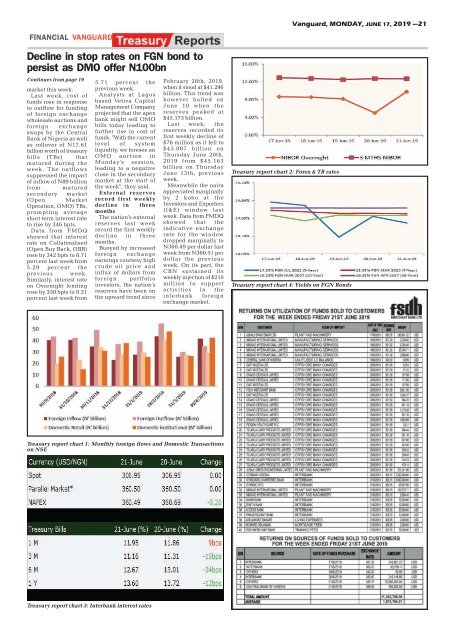

Treasury report chart 2: Forex & TB rates<br />

Treasury report chart 4: Yields on FGN Bonds<br />

Treasury report chart 1: Monthly foreign flows and Domestic Transactions<br />

on NSE<br />

Treasury report chart 3: Interbank interest rates