Insurance Journal (2nd Quarter 2019)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Guest Contribution<br />

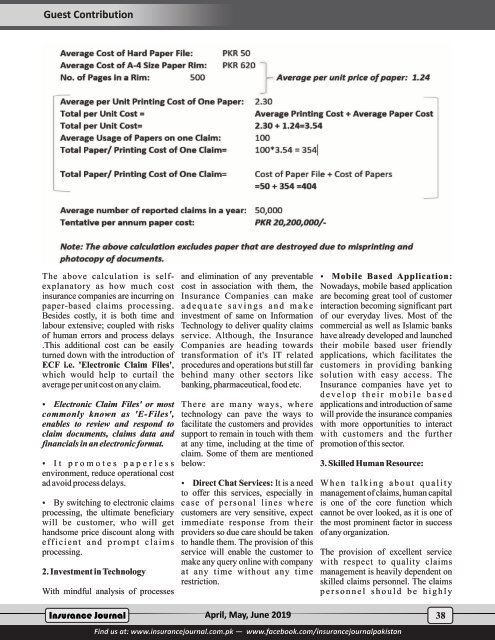

The above calculation is selfexplanatory<br />

as how much cost<br />

insurance companies are incurring on<br />

paper-based claims processing.<br />

Besides costly, it is both time and<br />

labour extensive; coupled with risks<br />

of human errors and process delays<br />

.This additional cost can be easily<br />

turned down with the introduction of<br />

ECF i.e. 'Electronic Claim Files',<br />

which would help to curtail the<br />

average per unit cost on any claim.<br />

Ÿ Electronic Claim Files' or most<br />

commonly known as 'E-Files',<br />

enables to review and respond to<br />

claim documents, claims data and<br />

financials in an electronic format.<br />

Ÿ I t p r o m o t e s p a p e r l e s s<br />

environment, reduce operational cost<br />

ad avoid process delays.<br />

Ÿ By switching to electronic claims<br />

processing, the ultimate beneficiary<br />

will be customer, who will get<br />

handsome price discount along with<br />

e ff i c i e n t a n d p r o m p t c l a i m s<br />

processing.<br />

2. Investment in Technology<br />

With mindful analysis of processes<br />

and elimination of any preventable<br />

cost in association with them, the<br />

<strong>Insurance</strong> Companies can make<br />

a d e q u a t e s a v i n g s a n d m a k e<br />

investment of same on Information<br />

Technology to deliver quality claims<br />

service. Although, the <strong>Insurance</strong><br />

Companies are heading towards<br />

transformation of it's IT related<br />

procedures and operations but still far<br />

behind many other sectors like<br />

banking, pharmaceutical, food etc.<br />

There are many ways, where<br />

technology can pave the ways to<br />

facilitate the customers and provides<br />

support to remain in touch with them<br />

at any time, including at the time of<br />

claim. Some of them are mentioned<br />

below:<br />

Ÿ Direct Chat Services: It is a need<br />

to offer this services, especially in<br />

case of personal lines where<br />

customers are very sensitive, expect<br />

immediate response from their<br />

providers so due care should be taken<br />

to handle them. The provision of this<br />

service will enable the customer to<br />

make any query online with company<br />

at any time without any time<br />

restriction.<br />

Ÿ Mobile Based Application:<br />

Nowadays, mobile based application<br />

are becoming great tool of customer<br />

interaction becoming significant part<br />

of our everyday lives. Most of the<br />

commercial as well as Islamic banks<br />

have already developed and launched<br />

their mobile based user friendly<br />

applications, which facilitates the<br />

customers in providing banking<br />

solution with easy access. The<br />

<strong>Insurance</strong> companies have yet to<br />

d e v e l o p t h e i r m o b i l e b a s e d<br />

applications and introduction of same<br />

will provide the insurance companies<br />

with more opportunities to interact<br />

with customers and the further<br />

promotion of this sector.<br />

3. Skilled Human Resource:<br />

W h e n t a l k i n g a b o u t q u a l i t y<br />

management of claims, human capital<br />

is one of the core function which<br />

cannot be over looked, as it is one of<br />

the most prominent factor in success<br />

of any organization.<br />

The provision of excellent service<br />

with respect to quality claims<br />

management is heavily dependent on<br />

skilled claims personnel. The claims<br />

p e r s o n n e l s h o u l d b e h i g h l y<br />

<strong>Insurance</strong> <strong>Journal</strong> April, May, June <strong>2019</strong><br />

38<br />

Find us at: www.insurancejournal.com.pk — www.facebook.com/insurancejournalpakistan