Global Roundup - RBC Wealth Management

Global Roundup - RBC Wealth Management

Global Roundup - RBC Wealth Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

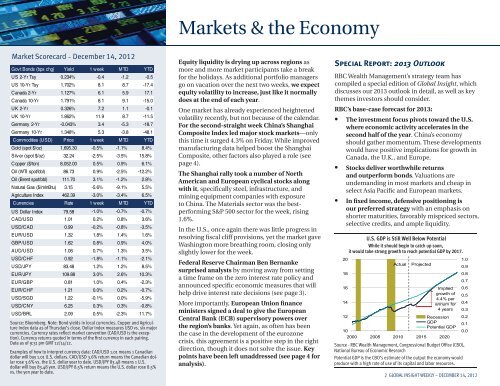

Market Scorecard – December 14, 2012<br />

Govt Bonds (bps chg) Yield 1 week MTD YTD<br />

US 2-Yr Tsy 0.234% -0.4 -1.2 -0.5<br />

US 10-Yr Tsy 1.702% 8.1 8.7 -17.4<br />

Canada 2-Yr 1.127% 6.1 5.9 17.1<br />

Canada 10-Yr 1.791% 8.1 9.1 -15.0<br />

UK 2-Yr 0.326% 7.2 1.1 -0.1<br />

UK 10-Yr 1.862% 11.9 8.7 -11.5<br />

Germany 2-Yr -0.043% 3.4 -5.3 -18.7<br />

Germany 10-Yr 1.348% 5.3 -3.8 -48.1<br />

Commodities (USD) Price 1 week MTD YTD<br />

Gold (spot $/oz) 1,695.30 -0.5% -1.1% 8.4%<br />

Silver (spot $/oz) 32.24 -2.5% -3.5% 15.8%<br />

Copper ($/ton) 8,052.00 0.5% 0.9% 6.1%<br />

Oil (WTI spot/bbl) 86.73 0.9% -2.5% -12.2%<br />

Oil (Brent spot/bbl) 111.70 3.1% -1.2% 2.8%<br />

Natural Gas ($/mlnBtu) 3.15 -5.6% -9.1% 5.5%<br />

Agriculture Index 462.39 -3.0% -3.4% 6.5%<br />

Currencies Rate 1 week MTD YTD<br />

US Dollar Index 79.58 -1.0% -0.7% -0.7%<br />

CAD/USD 1.01 0.2% 0.8% 3.6%<br />

USD/CAD 0.99 -0.2% -0.8% -3.5%<br />

EUR/USD 1.32 1.8% 1.4% 1.6%<br />

GBP/USD 1.62 0.8% 0.9% 4.0%<br />

AUD/USD 1.06 0.7% 1.3% 3.5%<br />

USD/CHF 0.92 -1.8% -1.1% -2.1%<br />

USD/JPY 83.48 1.2% 1.2% 8.5%<br />

EUR/JPY 109.88 3.0% 2.6% 10.3%<br />

EUR/GBP 0.81 1.0% 0.4% -2.3%<br />

EUR/CHF 1.21 0.0% 0.2% -0.7%<br />

USD/SGD 1.22 -0.1% 0.0% -5.9%<br />

USD/CNY 6.25 0.3% 0.3% -0.8%<br />

USD/BRL 2.09 0.5% -2.3% 11.7%<br />

Source: Bloomberg. Note: Bond yields in local currencies. Copper and Agriculture<br />

Index data as of Thursday’s close. Dollar Index measures USD vs. six major<br />

currencies. Currency rates refl ect market convention (CAD/USD is the exception).<br />

Currency returns quoted in terms of the fi rst currency in each pairing.<br />

Data as of 9:31 pm GMT 12/14/12.<br />

Examples of how to interpret currency data: CAD/USD 1.01 means 1 Canadian<br />

dollar will buy 1.01 U.S. dollars. CAD/USD 3.6% return means the Canadian dollar<br />

rose 3.6% vs. the U.S. dollar year to date. USD/JPY 83.48 means 1 U.S.<br />

dollar will buy 83.48 yen. USD/JPY 8.5% return means the U.S. dollar rose 8.5%<br />

vs. the yen year to date.<br />

Markets & the Economy<br />

Equity liquidity is drying up across regions as<br />

more and more market participants take a break<br />

for the holidays. As additional portfolio managers<br />

go on vacation over the next two weeks, we expect<br />

equity volatility to increase, just like it normally<br />

does at the end of each year.<br />

One market has already experienced heightened<br />

volatility recently, but not because of the calendar.<br />

For the second-straight week China’s Shanghai<br />

Composite Index led major stock markets—only<br />

this time it surged 4.3% on Friday. While improved<br />

manufacturing data helped boost the Shanghai<br />

Composite, other factors also played a role (see<br />

page 4).<br />

The Shanghai rally took a number of North<br />

American and European cyclical stocks along<br />

with it, specifi cally steel, infrastructure, and<br />

mining equipment companies with exposure<br />

to China. The Materials sector was the bestperforming<br />

S&P 500 sector for the week, rising<br />

1.6%.<br />

In the U.S., once again there was little progress in<br />

resolving fi scal cliff provisions, yet the market gave<br />

Washington more breathing room, closing only<br />

slightly lower for the week.<br />

Federal Reserve Chairman Ben Bernanke<br />

surprised analysts by moving away from setting<br />

a time frame on the zero interest rate policy and<br />

announced specifi c economic measures that will<br />

help drive interest rate decisions (see page 3).<br />

More importantly, European Union fi nance<br />

ministers signed a deal to give the European<br />

Central Bank (ECB) supervisory powers over<br />

the region’s banks. Yet again, as often has been<br />

the case in the development of the eurozone<br />

crisis, this agreement is a positive step in the right<br />

direction, though it does not solve the issue. Key<br />

points have been left unaddressed (see page 4 for<br />

analysis).<br />

Special Report: 2013 Outlook<br />

<strong>RBC</strong> <strong>Wealth</strong> <strong>Management</strong>’s strategy team has<br />

compiled a special edition of <strong>Global</strong> Insight, which<br />

discusses our 2013 outlook in detail, as well as key<br />

themes investors should consider.<br />

<strong>RBC</strong>’s base-case forecast for 2013:<br />

The investment focus pivots toward the U.S.<br />

where economic activity accelerates in the<br />

second half of the year. China’s economy<br />

should gather momentum. These developments<br />

would have positive implications for growth in<br />

Canada, the U.K., and Europe.<br />

Stocks deliver worthwhile returns<br />

and outperform bonds. Valuations are<br />

undemanding in most markets and cheap in<br />

select Asia Pacifi c and European markets.<br />

In fi xed income, defensive positioning is<br />

our preferred strategy with an emphasis on<br />

shorter maturities, favorably mispriced sectors,<br />

selective credits, and ample liquidity.<br />

20<br />

18<br />

16<br />

14<br />

U.S. GDP is Still Well Below Potential<br />

While it should begin to catch up soon,<br />

it would take strong growth to reach potential GDP by 2017.<br />

Actual Projected<br />

Implied<br />

growth of<br />

4.4% per<br />

annum for<br />

4 years<br />

12<br />

Recession<br />

GDP<br />

10<br />

Potential GDP<br />

2000 2005 2010 2015 2020<br />

Source - <strong>RBC</strong> <strong>Wealth</strong> <strong>Management</strong>, Congressional Budget Offi ce (CBO),<br />

National Bureau of Economic Research<br />

Potential GDP is the CBO’s estimate of the output the economy would<br />

produce with a high rate of use of its capital and labor resources.<br />

1.0<br />

0.9<br />

0.8<br />

0.7<br />

0.6<br />

0.5<br />

0.4<br />

0.3<br />

0.2<br />

0.1<br />

0.0<br />

2 GLOBAL INSIGHT WEEKLY – DECEMBER 14, 2012