2010 Annual Report University of Alaska Foundation Promise

2010 Annual Report University of Alaska Foundation Promise

2010 Annual Report University of Alaska Foundation Promise

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Impacts Today & Tomorrow<br />

Education Tax Credit<br />

Undergoes Key Changes<br />

Corporate and foundation giving accounts for over 80 percent <strong>of</strong> the private funds received<br />

annually by the <strong>University</strong> <strong>of</strong> <strong>Alaska</strong>. The <strong>Alaska</strong> Legislature, recognizing the importance <strong>of</strong><br />

corporate donations, expanded the <strong>Alaska</strong> Higher Education Tax Credit. The revised law, in<br />

effect from January 1, 2011 to December 31, 2013, allows companies to take up to a $5 million tax<br />

credit for contributions in support <strong>of</strong> education.<br />

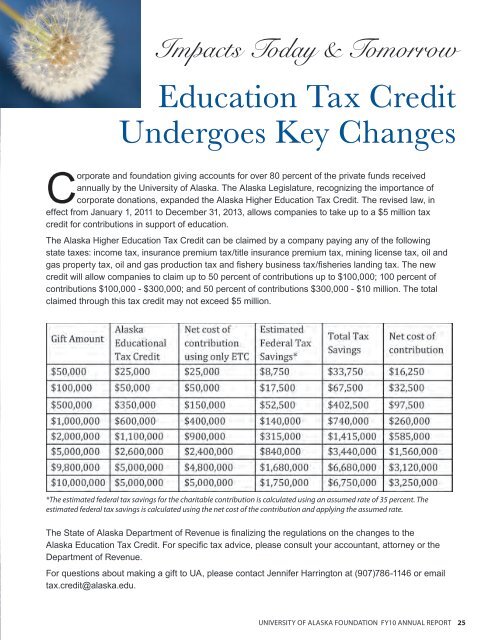

The <strong>Alaska</strong> Higher Education Tax Credit can be claimed by a company paying any <strong>of</strong> the following<br />

state taxes: income tax, insurance premium tax/title insurance premium tax, mining license tax, oil and<br />

gas property tax, oil and gas production tax and fishery business tax/fisheries landing tax. The new<br />

credit will allow companies to claim up to 50 percent <strong>of</strong> contributions up to $100,000; 100 percent <strong>of</strong><br />

contributions $100,000 - $300,000; and 50 percent <strong>of</strong> contributions $300,000 - $10 million. The total<br />

claimed through this tax credit may not exceed $5 million.<br />

*The estimated federal tax savings for the charitable contribution is calculated using an assumed rate <strong>of</strong> 35 percent. The<br />

estimated federal tax savings is calculated using the net cost <strong>of</strong> the contribution and applying the assumed rate.<br />

The State <strong>of</strong> <strong>Alaska</strong> Department <strong>of</strong> Revenue is finalizing the regulations on the changes to the<br />

<strong>Alaska</strong> Education Tax Credit. For specific tax advice, please consult your accountant, attorney or the<br />

Department <strong>of</strong> Revenue.<br />

For questions about making a gift to UA, please contact Jennifer Harrington at (907)786-1146 or email<br />

tax.credit@alaska.edu.<br />

UNIVERSITY OF ALASKA FOUNDATION FY10 ANNUAL REPORT 25