Stress testing in a SII environment

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

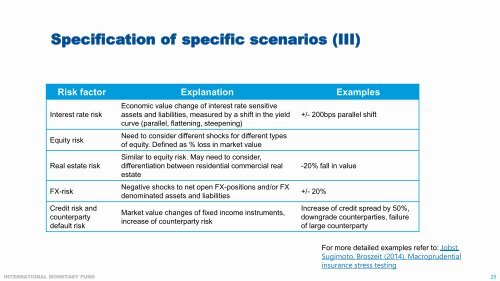

Specification of specific scenarios (III)<br />

Risk factor Explanation Examples<br />

Interest rate risk<br />

Equity risk<br />

Real estate risk<br />

FX-risk<br />

Credit risk and<br />

counterparty<br />

default risk<br />

Economic value change of <strong>in</strong>terest rate sensitive<br />

assets and liabilities, measured by a shift <strong>in</strong> the yield<br />

curve (parallel, flatten<strong>in</strong>g, steepen<strong>in</strong>g)<br />

Need to consider different shocks for different types<br />

of equity. Def<strong>in</strong>ed as % loss <strong>in</strong> market value<br />

Similar to equity risk. May need to consider,<br />

differentiation between residential commercial real<br />

estate<br />

Negative shocks to net open FX-positions and/or FX<br />

denom<strong>in</strong>ated assets and liabilities<br />

Market value changes of fixed <strong>in</strong>come <strong>in</strong>struments,<br />

<strong>in</strong>crease of counterparty risk<br />

+/- 200bps parallel shift<br />

-20% fall <strong>in</strong> value<br />

+/- 20%<br />

Increase of credit spread by 50%,<br />

downgrade counterparties, failure<br />

of large counterparty<br />

For more detailed examples refer to: Jobst,<br />

Sugimoto, Broszeit (2014), Macroprudential<br />

<strong>in</strong>surance stress <strong>test<strong>in</strong>g</strong><br />

INTERNATIONAL MONETARY FUND 25