fairfield atlas limited - Bombay Stock Exchange

fairfield atlas limited - Bombay Stock Exchange

fairfield atlas limited - Bombay Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

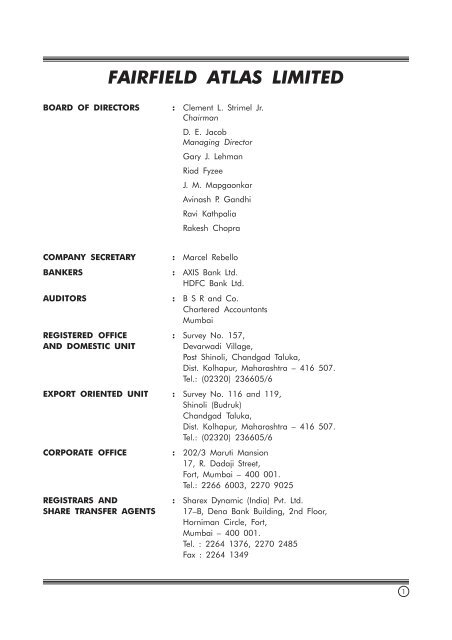

FAIRFIELD ATLAS LIMITED<br />

BOARD OF DIRECTORS : Clement L. Strimel Jr.<br />

Chairman<br />

D. E. Jacob<br />

Managing Director<br />

Gary J. Lehman<br />

Riad Fyzee<br />

J. M. Mapgaonkar<br />

Avinash P. Gandhi<br />

Ravi Kathpalia<br />

Rakesh Chopra<br />

COMPANY SECRETARY : Marcel Rebello<br />

BANKERS : AXIS Bank Ltd.<br />

HDFC Bank Ltd.<br />

AUDITORS : B S R and Co.<br />

Chartered Accountants<br />

Mumbai<br />

REGISTERED OFFICE : Survey No. 157,<br />

AND DOMESTIC UNIT Devarwadi Village,<br />

Post Shinoli, Chandgad Taluka,<br />

Dist. Kolhapur, Maharashtra – 416 507.<br />

Tel.: (02320) 236605/6<br />

EXPORT ORIENTED UNIT : Survey No. 116 and 119,<br />

Shinoli (Budruk)<br />

Chandgad Taluka,<br />

Dist. Kolhapur, Maharashtra – 416 507.<br />

Tel.: (02320) 236605/6<br />

CORPORATE OFFICE : 202/3 Maruti Mansion<br />

17, R. Dadaji Street,<br />

Fort, Mumbai – 400 001.<br />

Tel.: 2266 6003, 2270 9025<br />

REGISTRARS AND : Sharex Dynamic (India) Pvt. Ltd.<br />

SHARE TRANSFER AGENTS 17–B, Dena Bank Building, 2nd Floor,<br />

Horniman Circle, Fort,<br />

Mumbai – 400 001.<br />

Tel. : 2264 1376, 2270 2485<br />

Fax : 2264 1349<br />

1

FAIRFIELD ATLAS LIMITED<br />

2

NOTICE<br />

20th Annual Report 2009–2010<br />

NOTICE is hereby given that the Twentieth Annual General Meeting of shareholders of Fairfield Atlas Limited (the<br />

“Company”) will be held on Thursday 23rd September, 2010 at 3 P.M. at the Registered Office of the Company at Survey<br />

No 157, Devarwadi, Chandgad Taluka, Dist Kolhapur, Maharashtra 416507 to transact the following business :<br />

1. To receive, consider and adopt the Profit and Loss Account for the year ended 31st March, 2010, the Balance Sheet<br />

as at that date and the Reports of the Directors and the Auditors thereon.<br />

2. To appoint a Director in place of Mr. Riad Fyzee who retires by rotation and, being eligible, offers himself for re-<br />

election.<br />

3. To appoint a Director in place of Mr. J.M. Mapgaonkar who retires by rotation and being eligible, offers himself<br />

for re-election.<br />

4. To appoint B S R and Co., Chartered Accountants as Statutory Auditors of the Company to hold office from the<br />

NO NOTES NO TES TES: TES<br />

conclusion of this Annual General Meeting until the conclusion of the next Annual General Meeting and to fix their<br />

remuneration.<br />

a) A MEMBER ENTITLED TO ATTEND AND VOTE AT THE MEETING IS ENTITLED TO APPOINT A PROXY TO ATTEND<br />

AND VOTE INSTEAD OF HIMSELF AND A PROXY NEED NOT BE A MEMBER. PROXY FORMS MUST REACH THE<br />

COMPANY’S REGISTERED OFFICE NOT LESS THAN 48 HOURS BEFORE THE MEETING.<br />

b) The Register of Members and Share Transfer Books of the Company will be closed from Thursday 16th September,<br />

2010 to Thursday 23rd September, 2010 (both days inclusive).<br />

c) Members are requested to:<br />

i. Intimate to the Company’s Registrars and Share Transfer Agents change if any, in their registered address at an<br />

early date;<br />

ii. Quote Folio Numbers in all their correspondence.<br />

d) Members who hold shares in dematerialised form are requested to bring their Client ID and DP ID numbers for easy<br />

identification of attendance at the meeting.<br />

Place : Goa<br />

Dated : 11th May, 2010<br />

Registered office :<br />

Survey No. 157, Devarwadi Village,<br />

Post Shinoli, Chandgad Taluka,<br />

Dist. Kolhapur, Maharashtra – 416 507<br />

By Order of the Board of Directors<br />

Marcel Rebello<br />

Company Secretary<br />

3

FAIRFIELD ATLAS LIMITED<br />

DIRECTORS’ REPORT<br />

The Directors are pleased to present their 20th Annual Report together with the audited accounts of Fairfield Atlas Limited<br />

(the “Company”) for the year ended 31st March, 2010.<br />

i. i. Financial inancial Results Results<br />

Rs. in lakhs<br />

2009–2010 2008–2009<br />

Gross Income 9818.89 9818.89<br />

11624.45<br />

Profit before depreciation, Interest and tax 2003.19 2003.19<br />

987.58<br />

Interest and other finance charges 71.32 71.32<br />

134.50<br />

Depreciation and Amortisation 637.19 637.19<br />

721.89<br />

Prior Period Income - 28.57<br />

Exceptional item 341.95 341.95<br />

-<br />

Profit before Tax<br />

Provision for tax :<br />

1294.68 1294.68<br />

159.76<br />

Current tax 232.78 232.78<br />

28.96<br />

MAT Credit entitlement (447.03) (447.03)<br />

-<br />

Deferred Tax (credit) - (88.45)<br />

Profit after tax 1508.93 1508.93<br />

219.25<br />

Debit Balance in Profit & Loss Account<br />

Balance in Profit & Loss<br />

(533.76) (533.76)<br />

(753.00)<br />

Account Carried forward to Balance Sheet 975.17 975.17<br />

(533.76)<br />

ii. ii. ii. Dividend Dividend<br />

Dividend<br />

The Directors did not recommend dividend for the year ended 31st March, 2010.<br />

iii. iii. Performance<br />

erformance<br />

The global economic slowdown has impacted the revenues of the company particularly from its export business.<br />

However, various initiatives were undertaken by the company in its domestic business to mitigate the effects due to<br />

economic slowdown. The initiatives include extending its footprint to new customers particularly in the construction<br />

industry which present exciting opportunities for growth. The company has identified the opportunities for serving<br />

various markets through its diversified range of products. Sales turnover and other income decreased to Rs. 9818.69<br />

lakhs as compared to Rs.11624.45 lakhs for the previous financial year registering a marginal decrease of 15.53%.<br />

The company was entitled to a deferred sales tax benefit under the package scheme of incentives 1993 of the<br />

Government of Maharashtra. During the year the company has settled the entire liability at lower amount in<br />

pursuance of the option granted to it by the Sales Tax Act 1959. Apart from the above the company developed certain<br />

components for the parent company thereby earning development costs from these activities. All these factors<br />

contributed in maintaining the profitability trend of the company enabling it to wipe out its accumulated carried<br />

forward losses.<br />

iv iv. iv Directors Directors Responsibility Responsibility Statement Statement<br />

Statement<br />

Pursuant to the provisions of sub-section (2AA) of Section 217 of the Companies Act, 1956, the Board of Directors<br />

confirm:<br />

4<br />

(i) that in the preparation of the Annual Accounts, the applicable accounting standards had been followed alongwith<br />

proper explanation relating to material departures;<br />

(ii) that the Directors had selected such accounting policies and applied them consistently and made judgements and<br />

estimates that are reasonable and prudent so as to give a true and fair view of the state of affairs of the Company<br />

at the end of the financial year as on 31st March, 2010 and of the profit of the Company for that period;

20th Annual Report 2009–2010<br />

(iii) that the Directors had taken proper and sufficient care for the maintenance of adequate accounting records in<br />

accordance with the provisions of the Companies Act, 1956 for safeguarding the assets of the Company and<br />

for preventing and detecting fraud and other irregularities; and<br />

(iv) that the Director’s had prepared the annual accounts on a going concern basis.<br />

v. Corporate Corporate Governance<br />

Governance<br />

Governance<br />

Pursuant to Clause 49 of the Listing Agreement with the <strong>Stock</strong> <strong>Exchange</strong> a section titled “Corporate Governance” has<br />

been included in this Annual Report along with Management Discussion and Analysis report and Shareholder<br />

Information report. Certificate from a Practising Company Secretary regarding compliance of conditions of Corporate<br />

Governance is annexed to the report.<br />

vi. vi. Wage age Agreement<br />

Agreement<br />

The company has successfully concluded a wage agreement with the recognized Labour Union for a period of four<br />

years commencing from 1st July, 2009.<br />

vii. vii. Particulars articulars of of Employees<br />

Employees<br />

The Company does not have any employee of the category specified in Section 217 (2A) of the Companies Act, 1956,<br />

read with the Companies (Particulars of Employees) Rules, 1975.<br />

viii. viii. Conservation Conservation of of energy energy, energy , technology technology absorption absorption absorption and and foreign foreign exchange exchange earnings earnings and and outgo<br />

outgo<br />

The information required in terms of Section 217(1)(e) of the Companies Act, 1956 read with the Companies<br />

(Disclosure of Particulars in the Report of the Board of Directors) Rules, 1988, is given in the annexure forming part<br />

of this Report.<br />

ix. ix. Directors<br />

Directors<br />

It has been decided by Mr. Riad Fyzee, Mr. J.M. Mapgaonkar and Mr. Rakesh Chopra who were appointed Directors<br />

on the same day that is 25th September, 2007, that Mr. Riad Fyzee and Mr. J.M. Mapgaonkar will retire at this Annual<br />

General Meeting. Mr. Riad Fyzee and Mr. J.M. Mapgaonkar being eligible offer themselves for reappointment as<br />

Directors.<br />

None of the Directors of the Company is disqualified as on 31st March, 2010 for being appointed as Director as<br />

specified in Section 274(1)(g) of the Companies Act, 1956.<br />

x. x. x. CEO CEO and and CFO CFO Certification<br />

Certification<br />

The CEO and CFO have certified to the Board of Directors in respect of review of the financial statement and cash<br />

flow statement for the year in terms of the requirement of Clause 49(V) of the Listing Agreement.<br />

xi. xi. Auditors<br />

Auditors<br />

B S R and Co Chartered Accountants (KPMG), retire as Auditors at this Annual General Meeting and being eligible<br />

offer themselves for reappointment.<br />

xii xii Cost Cost Audit<br />

Audit<br />

Pursuant to the directions from the Department of Company Affairs for appointment of Cost Auditors, the Company<br />

has appointed M/s. M.P. Turakhia & Associates, Cost Accountants as the Cost Auditor for the financial year 2010-<br />

2011 subject to the approval of the Central Government.<br />

xiii. xiii. Auditors’ Auditors’ Auditors’ Report Report<br />

Report<br />

The notes on Accounts, referred to in the Auditors’ Report are self-explanatory.<br />

xiv xiv. xiv Acknowledgement<br />

Acknowledgement<br />

The Directors express their sincere thanks for the continued support and co-operation given by the Holding Company<br />

and Employees of the Company.<br />

Place : Goa<br />

Date : 11th May, 2010<br />

For and on behalf of the Board of Directors<br />

AVINASH VINASH P PP.<br />

P . GANDHI GANDHI<br />

D.E .E .E. .E . JA JA JACOB JA JA COB<br />

Director Managing Director<br />

5

FAIRFIELD ATLAS LIMITED<br />

ANNEXURE<br />

ANNEXURE<br />

ANNEXURE<br />

STATEMENT UNDER SECTION 217(1)(e) OF THE COMPANIES ACT 1956, READ WITH THE COMPANIES (DISCLOSURE<br />

OF PARTICULARS IN THE REPORT OF THE BOARD OF DIRECTORS), RULES 1988 AND FORMING PART OF THE<br />

DIRECTORS’ REPORT FOR THE YEAR ENDED 31ST MARCH 2010.<br />

A. CONSERV CONSERVATION CONSERV TION OF OF ENERG ENERGY ENERG<br />

6<br />

No measures for conservation of energy were taken during this financial year. However the company is making efforts<br />

on an ongoing basis to find measures for energy conservation in various areas and will implement the same if<br />

feasible.<br />

B. TECHNOL TECHNOLOG<br />

TECHNOL OG OGY OG Y ABSORPTION<br />

ABSORPTION<br />

ABSORPTION<br />

The company uses indigenous technology in the manufacture of gears for its domestic customers. Technical know how<br />

received from parent company has enabled improvement in export revenues of the Company<br />

C. C. FOREIGN FOREIGN EX EXCHANGE EX CHANGE EARNINGS EARNINGS AND AND AND OUTGO<br />

OUTGO<br />

The information on foreign exchange earnings and outgo is furnished in the Notes to the Accounts at Item No. 20.11.<br />

Place : Goa<br />

Date : 11th May, 2010<br />

For and on behalf of the Board of Directors<br />

AVINASH VINASH P PP.<br />

P . GANDHI GANDHI GANDHI<br />

D.E .E .E. .E . JA JACOB JA COB<br />

Director Managing Director

Management Discussion and Analysis<br />

(a) Industry Structure and Developments<br />

20th Annual Report 2009–2010<br />

The Company’s core business operations fall in the broad categories of agriculture, construction, automotive,<br />

energy, mining and more specifically the on-off highway power transmission sector. Indian Manufacturers of<br />

gears for these markets/industries can be classified on the basis of being an original equipment supplier or<br />

a replacement market supplier or a combination of both. Currently, leading manufacturers in these industries<br />

source their gear requirements through their captive in-house facilities, if any, or from suppliers approved by<br />

them. Fairfield Atlas Ltd., is one such approved and preferred supplier to OEM’s in the markets mentioned<br />

above. The demand for the company’s product is a derived demand and hence is dependent upon the growth<br />

rate of its OEM customers. The fiscal stimuli of the government and the budget proposals have lifted customer<br />

confidence and the domestic economy looks set to charter a fresh growth trajectory which augurs well for the<br />

company. Domestic sales in the past few months reflect the growing confidence of the customers. On the export<br />

front, the economies of the countries where the company products are supplied seem to manifest modest signs<br />

of recovery though not a sustained up-turn as yet.<br />

(b) Opportunities and Threats<br />

The domestic demand for the company’s products being an ancillary demand, the future of the company’s<br />

domestic business depends significantly on the growth of the infrastructure segment, as well as the agriculture<br />

market. Fiscal stimuli introduced by the Government has lifted customer confidence and the positive signs from<br />

the industry are encouraging. The company has seized this opportunity and responded through selective and<br />

strategic capacity and capability improvements and increases. With the construction industry in India seemingly<br />

on a long-term growth trajectory, the company has identified the opportunities for serving various markets<br />

through its diversified range of products. At present the company supplies to several of the major Indian and<br />

global OEM’s that participate in the manufacture of excavators, compactors, dumpers, tippers, etc…and<br />

envision to continue diversifying its customer-base and product offering in the coming years. The manufacturing<br />

capabilities in India, coupled with the additional offerings and engineering capabilities from the U.S. parent<br />

company position us well for the envisioned growth.<br />

(c) Segment-Wise Performance<br />

The company has determined it business segments as on-highway (select applications), agriculture, mining,<br />

energy and construction related transmission gears. There are no other primary reportable segments since<br />

100% of the company’s business is from transmission-type gears. As indicated above, the company will<br />

evaluate and establish strategic investment and growth to appropriate segments that will yield appropriate<br />

returns on investment.<br />

(d) Outlook<br />

The Indian economy appears to have shaken off the gloom and looks set to charter a fresh growth strategy<br />

as can be evidenced from the upward trend and stabilization in the domestic business of the company for the<br />

second half of the year under review. These signs give a positive outlook for the company’s domestic business.<br />

On the export front there are slight signs of revival though not yet a sustained upturn. To face the new scenario<br />

and defend its profitability the company has continued on the path towards lean manufacturing through active<br />

participation and leadership via the ACMA Cluster project. Building long term and deep relationships with our<br />

customers remains an ongoing focus to meet the challenges of a changing economy.<br />

(e) Internal Control System<br />

The company conducts its business based on ethical practices and in conformity with the laws and regulations<br />

7

FAIRFIELD ATLAS LIMITED<br />

8<br />

that govern its business. It has a well established frame work of internal control in operation with suitable<br />

monitoring procedures of various parameters supported by the ERP system mechanism. The Statutory Audit is<br />

supplemented by review of the financial and operating controls by the Internal Audit conducted by a reputed<br />

firm of Chartered Accountants. The Audit Committee of the Board of Directors actively reviews the adequacy<br />

and effectiveness of the internal control systems and suggests improvements. The company’s cost records are<br />

subject to Cost Audit as prescribed by the Government. Compliance with various laws and regulations pertaining<br />

to the company are also monitored by placing compliance reports at every Audit Committee meeting.<br />

(f) Human Resources / Industrial Relations<br />

Industrial relations at the Plant continue to be cordial. The company is striving to cultivate an organizational<br />

culture that is conducive to the welfare and safety of its employees. The company has recently concluded a<br />

four year wage settlement effective 1st July 2009 with the workers union. As a sequel salary structure of the<br />

non-bargainable staff has also been revised. The employees have played a key role in contributing to the<br />

growth and reputation of the company.<br />

The company has a strength of 479 permanent employees as on 31st March, 2010.<br />

(g) Risks and Concerns<br />

Since export revenues continue to be a significant contributor to the Company’s turnover a slackening of the<br />

export markets can have an impact on the overall profitability. Another matter of concern is the fluctuating rate<br />

of the dollar which can sometimes have a negative effect on the company’s export competitiveness, import bill<br />

and loan repayment commitments. The Company’s domestic business being tied to the automobiles and<br />

tractor business any slow down there due to low demand or vagaries of the monsoon could percolate and<br />

affect the company’s business. Rising of input costs could impair profitability of the company’s business<br />

whereas concerns of escalation in oil prices could crimp recovery of the economy as a whole.<br />

DISCUSSION ON FINANCIAL PERFORMANCE WITH RESPECT TO OPERATIONAL PERFORMANCE<br />

FINANCIAL INFORMATION<br />

FIXED ASSETS<br />

The company’s fixed asset gross block remained more or less at the same level as the previous year.<br />

INVENTORIES<br />

Inspite of the slow down in the export business, the company was able to maintain its inventory at more or less<br />

the same level as the previous year.<br />

SUNDRY DEBTORS<br />

Sundry debtors for the year ended 31st March, 2010 amounted to Rs.2716.03 lakhs being an increase of 63%<br />

over the previous year’s sundry debtors which amounted to Rs.1662.07 lakhs. The increase in debtors is due to<br />

granting of extended period of credit to overseas buyers as compared to previous year.<br />

RESULTS OF OPERATIONS<br />

Expenditure FY FY-2010 FY -2010 Rs. in lakhs<br />

FY-2009<br />

Cost of Goods Sold (COGS) 4580.04 4580.04<br />

6044.78<br />

Employee costs 1197.96 1197.96<br />

1061.84<br />

Manufacturing and other Expenses 2379.65 2379.65<br />

3575.79<br />

Finance Cost 71.32 71.32 71.32<br />

134.50<br />

Depreciation 637.19 637.19<br />

721.89

20th Annual Report 2009–2010<br />

Cost of Goods Sold: The company has reduced its COGS as compared to previous financial year due to change<br />

in product mix and additions of new products for existing and new customers.<br />

Employee Costs: The increase in employee costs is due to increased wages and salaries paid to the workmen and<br />

other employees consequent upon signing up of new wage agreement effective from 1st July, 2009.<br />

Manufacturing Costs: Manufacturing Costs and other expenses for the financial year has been reduced since the<br />

company had a foreign exchange gain during the financial year as compared to a foreign exchange loss of<br />

approximately Rupees 10 crores for the previous financial year. Additionally the company has also reduced all<br />

other expenses in line with its quantum of sales.<br />

Finance Cost: Interest cost has been reduced due to lowering of LIBOR rate applicable to the term loans and<br />

appreciation in the value of rupee vis-a-vis the US Dollar.<br />

Depreciation: Depreciation has reduced due to working of factory on two-shift basis for part of the financial year.<br />

Certain statements in the Management Discussion and Analysis describing the Company’s objectives, projections,<br />

estimates, expectations or predictions may be “forward – looking statements” within the meaning of applicable<br />

securities laws and regulations. Actual results could differ from those expressed or implied. Important factors that<br />

could make a difference to the Company’s operations include raw material availability and prices. Cyclical demand<br />

and pricing in the Company’s principal markets, changes in Government regulations, tax regimes, economic<br />

developments within India and the countries in which the Company conducts business and other incidental factors.<br />

9

FAIRFIELD ATLAS LIMITED<br />

Corporate Governance:<br />

1. Company’s philosophy on Corporate Governance:<br />

Name Category Attendance Particulars No. of No. of No. of<br />

Board Last AGM<br />

other<br />

Directorships<br />

Committee #<br />

Membership<br />

Chairmanship<br />

of Committee #<br />

Meeting held held<br />

Clement L. Strimel + Chairman 2 Yes - - -<br />

Non Executive Director<br />

Gary J. Lehman + Non Executive Director - Yes - - -<br />

Riad Fyzee Independent Director 3 Yes - 1 1<br />

Devanand E. Jacob Managing Director 4 Yes - 1 -<br />

J. M. Mapgaonkar Non Executive Director 3 Yes 1 1 -<br />

Avinash P. Gandhi Independent Director 4 Yes 11 4 2<br />

Ravi Kathpalia Independent Director 4 Yes 6 4 2<br />

Rakesh Chopra Independent Director 4 No 1 4 -<br />

10<br />

Fairfield Atlas Limited (“the Company”) is committed to adhere to the corporate governance code as prescribed by<br />

the <strong>Stock</strong> <strong>Exchange</strong> and has accordingly implemented various aspects of the code for the year ended 31st March,<br />

2010.<br />

2. Board of Directors :<br />

The names and categories of Directors are given below. The Chairman being non-executive and “related” to the<br />

promoters vide Amendment/Explanation dated 11th November, 2008 to the Listing Agreement the number of<br />

Independent Directors should be one half of the total strength. The Company complies with the same and at present<br />

all the Independent Directors are non-executive Directors. No Director of the Company is related to each other.<br />

3. Board Procedure :<br />

A detailed Agenda and papers for consideration at the Board/Committee Meetings are circulated to each Director<br />

in advance of Board and Committee Meetings. The Managing Director briefs the Board on the overall performance<br />

of the Company and clarifies queries raised by the Board Members on any item of the Agenda as well as presentations<br />

made by Senior Executives of the Company.<br />

4. Attendance of Directors at Meetings of Board and Members :<br />

During the year the Board met 4 times on 12th June, 2009, 29th July, 2009, 29th October, 2009, and 25th January,<br />

2010. The maximum time gap between any 2 meetings was not more than 4 calendar months.<br />

The following table gives details of Directors, attendance of Directors at the Board meetings and at the last Annual<br />

General Meeting, held on September 17, 2009, number of memberships held by Directors in the Board/Committee<br />

of various public companies. None of the Directors on the Board was a member of more than 10 Committees and<br />

Chairman of more than 5 Committees (as specified in Clause 49 of the Listing Agreement) across all the companies<br />

in which he is a Director:<br />

+ Nominee Director – Fairfield Manufacturing Co., Inc, U.S.A.<br />

# Committees considered are Audit Committee and Shareholders/Investors Grievance

5. Directors seeking reappointment:<br />

20th Annual Report 2009–2010<br />

At the ensuing Annual General Meeting Mr. Riad Fyzee, and Mr. J.M. Mapgaonkar retire by rotation and being eligible<br />

offer themselves for reappointment.<br />

Mr. Riad Fyzee 55, was the founder and Chief Promoter of the Company. He was the former Managing Director of<br />

the Company and has in-depth knowledge of the working of the Company. In view of his experience and association<br />

with the Company since inception, Mr. Fyzee continues on the Board of Directors in a Non-Executive Independent<br />

Director capacity. Mr. Fyzee is the Chairman of the Shareholders Grievance Committee. Mr. Fyzee presently holds<br />

about 0.16% of subscribed share capital of the company as on 31st March, 2010 and he is not related to any director<br />

of the company.<br />

Mr. J. M. Mapgaonkar 61, was formerly a Director nominated by Mahindra & Mahindra Ltd. Mr. Mapgaonkar liaises<br />

with the company in respect of the supplies to be made to Mahindra & Mahindra Ltd., and has contributed to the<br />

company’s sales efforts. Mr. Mapgaonkar has been the Director of the company since 1995. Mr. Mapgaonkar is a<br />

member of the Shareholders Grievance Committee of the Board. Mr. Mapgaonkar does not hold any shares in the<br />

company nor is he related to any director of the company.<br />

6. Code of Conduct<br />

The Board has laid down Code of Conduct for Directors and Senior Executives of the Company. All Board Members<br />

and Senior Management Personnel have affirmed compliance with the Code of Conduct. A declaration signed by Mr.<br />

D. E. Jacob, Managing Director is enclosed at the end of the report.<br />

7. <strong>Stock</strong> Options :<br />

No scheme for grant of stock options to Directors or employees.<br />

8. Committees of the Board:<br />

i. Audit Committee:<br />

The members of the Audit Committee are Mr. Avinash P. Gandhi, Mr. Ravi Kathpalia and Mr. Rakesh Chopra.<br />

Mr. Avinash P. Gandhi is the Chairman of the Committee. The Company Secretary acts as Secretary to the<br />

Committee. The terms of reference of the Audit Committee covers the matters enumerated in Clause 49 of the<br />

Listing Agreement.<br />

The Audit Committee held 4 meetings during the year on 12th June, 2009, 29th July, 2009, 29th October, 2009<br />

and 25th January, 2010 and reviewed with the Statutory Auditors the financial statement for the year ended 31st<br />

March 2009 and Unaudited Financial statements for the quarters ended 30th June, 2009, 30th September, 2009<br />

and 31st December, 2009.<br />

The attendance at the meetings was as under:<br />

Committee Members Meetings Attended<br />

Mr. Avinash P. Gandhi, Chairman 4<br />

Mr. Ravi Kathpalia, Member 4<br />

Mr. Rakesh Chopra, Member 4<br />

ii. Shareholders/Investors Grievance Committee:<br />

The present Committee consists of Mr. D. E. Jacob, Mr. Riad Fyzee and Mr. J. M. Mapgaonkar. Mr. Riad Fyzee<br />

is the Chairman of the Committee. The Committee looks into redressing of shareholders complaints like transfer<br />

of shares, non-receipt of Balance Sheet, dividend etc. The work of the Registrar and Transfer Agent is overseen<br />

11

FAIRFIELD ATLAS LIMITED<br />

12<br />

by the Committee. Mr. Marcel Rebello, Company Secretary is the Compliance Officer. No complaints were<br />

received from the shareholders during the year. The Committee had 4 meetings till date.<br />

The attendance at these meetings was as under:<br />

Names and<br />

Designation<br />

Committee Members Meetings Attended<br />

Mr. Riad Fyzee, Chairman 3<br />

Mr. J. M. Mapgaonkar, Member 3<br />

Mr. D. E. Jacob, Member 4<br />

iii. Remuneration Committee:<br />

The Remuneration Committee comprises of Mr. Ravi Kathpalia, Mr. Avinash P. Gandhi and Mr. Rakesh Chopra.<br />

Mr. Kathpalia is the Chairman of the Committee. The Committee recommends to the Board the remuneration<br />

package of the Managing/Whole Time Director and other Directors considering the performance of the company,<br />

current trends in the industry, experience of Directors, past performance and other relevant factors.<br />

Salary House<br />

Rent Allowance<br />

Special<br />

Allowance<br />

(Rs.)<br />

Remuneration paid during 2009–2010<br />

Commission<br />

(Performance<br />

Linked)<br />

(Rs.)<br />

Company’s<br />

contribution to<br />

Provident and<br />

Pension Fund<br />

(Rs.)<br />

Perquisites<br />

Mr. D. E. Jacob 1,394,000/- - 115,200 - 1,509,200<br />

Managing Director<br />

Mr. Riad Fyzee * - - - - 1,00,000<br />

Non-Executive/<br />

Independent Director<br />

Rakesh Chopra - - - - 1,00,000<br />

Non-Executive/<br />

Independent Director<br />

Avinash Gandhi - - - - 1,00,000<br />

Non-Executive/<br />

Independent Director<br />

Ravi Kathpalia - - - - 1,00,000<br />

Non-Executive/<br />

Independent Director<br />

J. M.-Mapgaonkar - - - - 50,000<br />

Non Executive<br />

Director<br />

(Rs.)<br />

Total<br />

(Rs.)<br />

Service Contract,<br />

notice period,<br />

severance fees<br />

The appointment is for a period<br />

of 2 years with effect from 24th<br />

October, 2008 till 23rd October<br />

2010 subject to termination by<br />

three months notice in writing on<br />

either side or payment of<br />

remuneration for three months in<br />

lieu of notice. If Agreement<br />

terminated without cause<br />

company to pay compensation<br />

subject to provisions of section<br />

318 of the Companies Act 1956<br />

calculated in accordance with<br />

Section 318(4) of the Companies<br />

Act 1956.<br />

Sitting fees for attending Board<br />

and Committee Meetings<br />

Sitting fees for attending Board<br />

and Committee Meetings<br />

Sitting fees for attending Board<br />

and Committee Meetings<br />

Sitting fees for attending Board<br />

and Committee Meetings<br />

Sitting fees for attending Board<br />

and Committee Meetings<br />

* Mr. Riad Fyzee holds 45230 equity shares of Rs.10/- each and Mr. D. E. Jacob holds 2 equity shares of Rs.10/- each in<br />

the company. None of the other Directors holds any shares in the company.<br />

Above Non Executive Directors are only entitled to sitting fees of Rs.15,000/- per Board Meeting attended and<br />

Rs.10,000/- per Committee Meeting attended.<br />

None of the other Non Executive Directors has been paid any remuneration including sitting fees during the year.

GENERAL INFORMATION FOR SHAREHOLDERS :<br />

Annual General Meeting:<br />

20th Annual Report 2009–2010<br />

The Twentieth Annual General Meeting of the Company will be held on Thursday 23rd September 2010, at 3 p.m.<br />

at the Registered Office situated at Survey No. : 157, Devarwadi Village, Chandgad Taluka, Dist. Kolhapur,<br />

Maharashtra - 416 507.<br />

Financial Calendar of the Company:<br />

The financial year covers the period 1st April to 31st March.<br />

Financial Reporting for<br />

Quarter ending June 30, 2010 Mid August 2010<br />

Half Year ending September 30, 2010 Mid November 2010<br />

Quarter ending December 31, 2010 Mid February 2011<br />

Year ending March 31, 2011 End May 2011<br />

Note: The above dates are indicative.<br />

Dates of Book Closure:<br />

16th September, 2010 to 23rd September, 2010 (both days inclusive)<br />

Dividend payment date:<br />

Not Applicable<br />

Listing of securities:<br />

The Company’s securities are listed only on the <strong>Stock</strong> <strong>Exchange</strong>, Mumbai. The Depositories for the Company’s<br />

shares are National Securities Depository Ltd., and Central Depository Services (India) Ltd. The listing fees of<br />

the <strong>Exchange</strong> and custodial fees of Depositories for the year 2010-2011 have been paid.<br />

1. Scrip Code: <strong>Stock</strong> <strong>Exchange</strong> Mumbai: 520145<br />

2. As per SEBI notification, the Company’s shares are being compulsorily traded in the Demat form. Demat<br />

identification number in NSDL and CDSL is ISIN INE 922C01013.<br />

Shareholders complaints redressal email ID<br />

As required by Clause 47(f) of the Listing Agreement the Company has designated a new email ID<br />

falredressalsmailbox@rediffmail.com for the purpose of attending to shareholders complaints.<br />

Registrar and Transfer Agents :<br />

Sharex Dynamic (India) Pvt. Ltd.<br />

a) 17-B, Dena Bank Bldg., Horniman Circle, Fort, Mumbai 400 001. Tel: 22702485, 22641376. Fax:<br />

22641349.<br />

b) Unit-1, Luthra Industrial Premises, Andheri Kurla Road, Safed Pool, Andheri (East), Mumbai 400 072. Tel:<br />

28515606, 28515646 Fax: 28512885<br />

13

FAIRFIELD ATLAS LIMITED<br />

Shareholding Pattern as on March 31, 2010:<br />

Foreign Promoters 22924796 83.91<br />

FI / Bank / FII / Mutual/ Venture Funds 2316668 8.48<br />

Bodies Corporate 233948 0.86<br />

NRI/OCBs Foreign Companies 20635 0.07<br />

Public 1824493 6.68<br />

Total Equity Capital 27320540 100.00<br />

Market Price Data:<br />

High/low during each month of the last financial year:<br />

14<br />

Category<br />

Number of Equity shares<br />

of Rs.10/– each<br />

% to Subscribed<br />

Capital<br />

High Rs. Low Rs.<br />

April 2009 27.30 15.05<br />

May 2009 33.40 18.00<br />

June 2009 37.00 24.55<br />

July 2009 37.95 21.30<br />

August 2009 41.70 30.50<br />

September 2009 39.05 32.00<br />

October 2009 35.00 29.75<br />

November 2009 37.65 27.50<br />

December 2009 41.70 33.00<br />

January 2010 48.20 36.00<br />

February 2010 41.75 34.80<br />

March 2010 43.00 35.10

Distribution of shareholding as on March 31, 2010:<br />

20th Annual Report 2009–2010<br />

Share of No. of % of No. of % of<br />

Nominal Value Rs. Holders Holders Shares Shareholding<br />

Upto 100 2917 60.19 260271 0.95<br />

101 to 200 602 12.42 114282 0.42<br />

201 to 500 740 15.27 286770 1.05<br />

501 to 1000 289 5.96 245831 0.90<br />

1001 to 5000 244 5.04 542113 1.98<br />

5001 to 10000 34 0.70 256525 0.94<br />

10001 to 100000 18 0.37 379584 1.39<br />

100001 to above 2 0.05 25235164 92.37<br />

Total 4846 100.00 27320540 100.00<br />

Dematerialization of shares and liquidity:<br />

98.74% of the total equity comprising 26977425 equity shares of Rs. 10 each is held in a dematerialized form with<br />

National Securities Depository Ltd. and Central Depository Services (India) Ltd. as on March 31, 2010.<br />

Share Transfer System :<br />

Trading in equity shares of the Company is permitted only in dematerialized form. Share transfers in physical form<br />

received by the Registrar and Share Transfer Agents are registered and share certificate(s) returned within a period of 30<br />

days from the date of receipt of the documents provided all documents are valid and complete in all respects. A committee<br />

consisting of a Non Executive Director and Company Secretary approves such transfer of shares.<br />

Plant Location:<br />

i) The Company’s Domestic Tariff Area Unit is located at Survey No. : 157, Devarwadi Village, Chandgad Taluka,<br />

Dist. Kolhapur, Maharashtra – 416 507.<br />

ii) The Company’s Export Oriented Unit is located at Survey No. 116 and 119, Shinoli (Budruk), Chandgad Taluka,<br />

Dist. Kolhapur, Maharashtra- 416 507.<br />

Address for Correspondence :<br />

Correspondence can be addressed to the registered/corporate office of the company or the offices of share transfer agents<br />

for the attention of the Company Secretary. Shareholders would have to correspond with respective Depository Participants<br />

for shares held in demat mode.<br />

Other Disclosures :<br />

1. Details of Annual / Extra-ordinary General Meetings:<br />

Annual General Meetings held during last three years:<br />

Year Date Time<br />

2007 September 25, 2007 3 PM<br />

2008 September 10, 2008 3 PM<br />

2009 September 17, 2009 3 PM<br />

No Extra-ordinary General Meetings held during last three years<br />

All Annual General Meetings were held at the registered office. No postal ballots were required to be used at these<br />

meetings. The Company will use postal ballots when required under the provisions of the Companies Act, 1956.<br />

15

FAIRFIELD ATLAS LIMITED<br />

The following Special Resolutions were passed at the previous three Annual General Meetings:<br />

16<br />

Special Resolutions passed<br />

1. Modification of the Employment Agreement dated 5th August, 2005<br />

entered into between the Company and Mr. A.K. Kaul, Whole Time<br />

Director upon terms and conditions set out in the Supplemental<br />

Agreement dated 24th January, 2008 entered into between the<br />

company and Mr. A.K. Kaul, Whole Time Director”.<br />

2. Appointment of Mr. Lalit K. Chaudhary as Managing Director and<br />

CEO for a period of 5 years commencing from 1st January, 2008<br />

upon terms and conditions set out in the Agreement dated 7th February,<br />

2008 entered into between Mr. Lalit K. Chaudhary and the Company.<br />

No Special Resolutions were passed at the Annual General Meeting held for the Financial Year 2006-2007.<br />

2. Related Party Transactions Disclosures:<br />

During the year under review, besides the transactions reported elsewhere in the Annual Report, there were no other<br />

related party transactions with the promoters, directors, management and subsidiaries or relatives etc. that had a<br />

potential conflict with the interest of the Company at large.<br />

Transactions with related parties are disclosed in Note No. 20.15 of Schedule 20 to the Accounts in the Annual Report.<br />

3. Details of non-compliance:<br />

There was no non-compliance by the Company on any matter related to capital market during the last three years.<br />

4. Means of communication:<br />

The Quarterly, Half yearly and Yearly results are published in Free Press Journal, Mumbai and Navshakti (Marathi),<br />

Mumbai. These are not sent individually to shareholders.<br />

5. Management Discussion and Analysis<br />

The Management Discussion and Analysis has been included in the Directors’ Report and forms part of this Annual<br />

Report.<br />

Declaration by the Managing Director pursuant to Clause 49 of the Listing Agreement<br />

To,<br />

Financial Year Date of Meeting<br />

2007-2008 10.09.2008<br />

2008-2009 17.09.2009<br />

The Members of Fairfield Atlas Limited<br />

1. Appointment of Mr. D. E. Jacob as Managing Director of the Company<br />

for a period of 2 (two) years commencing from 24th October 2008<br />

and ending 23rd October, 2010 upon terms and conditions set out<br />

in the Agreement dated 5th December, 2008 entered into between<br />

Mr. D.E. Jacob and the Company.<br />

I, Mr. Devanand E. Jacob, Managing Director of Fairfield Atlas Limited declare that all the members of the Board<br />

of Directors and Senior Executives of the Company have affirmed compliance with the Code of Conduct for the financial<br />

year 2009-2010.<br />

Place : Goa<br />

Date : 11th May, 2010<br />

D. E. JACOB<br />

Managing Director

20th Annual Report 2009–2010<br />

Auditors’ Certificate regarding compliance with the conditions of Corporate Governance<br />

TO THE MEMBERS OF FAIRFIELD ATLAS LIMITED<br />

I have examined the compliance of the conditions of Corporate Governance procedures implemented by Fairfield Atlas<br />

Limited, for the year ended on March 31, 2010, as stipulated in Clause 49 of the Listing Agreement of the said Company<br />

with the <strong>Stock</strong> <strong>Exchange</strong> in India.<br />

The Compliance of the conditions of Corporate Governance is the responsibility of the Management. My examination has<br />

been <strong>limited</strong> to a review of the procedures and implementations thereof, adopted by the Company for ensuring compliance<br />

with the conditions of Corporate Governance. It is neither an audit nor an expression of opinion of the financial statements<br />

of the Company.<br />

In my opinion and to the best of my information and according to the explanations given to me, and the representations<br />

made by the Directors and Management, I certify that the Company has complied with the conditions of Corporate<br />

Governance as stipulated in Clause 49 of the above mentioned Listing Agreement.<br />

As required by the Guidance Note issued by the Institute of Chartered Accountants of India I have to state that based<br />

on the report given by the Registrars of the Company to the Investors’ Grievance Committee, as on March 31, 2010 there<br />

were no valid investor grievance matters against the Company remaining unattended/pending for more than 30 days.<br />

I further state that such compliance is neither an assurance as to the future viability of the Company nor the efficiency<br />

or effectiveness with which the Management has conducted the affairs of the Company.<br />

Place : Mumbai<br />

Date : May 11, 2010<br />

CS MAHESH SONI<br />

Practising Company Secretary<br />

FCS : 3706 COP : 2324<br />

17

FAIRFIELD ATLAS LIMITED<br />

We have audited the attached balance sheet of Fairfield Atlas Limited (‘the Company’), as at 31 March 2010 and the<br />

related profit and loss account and the cash flow statement for the year ended on that date, annexed thereto. These<br />

financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion<br />

on these financial statements based on our audit.<br />

We conducted our audit in accordance with auditing standards generally accepted in India. Those Standards require that<br />

we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material<br />

misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the<br />

financial statements. An audit also includes assessing the accounting principles used and significant estimates made by<br />

management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a<br />

reasonable basis for our opinion.<br />

1. As required by the Companies (Auditor’s Report) Order, 2003 (‘the Order’) issued by the Central Government of<br />

India in terms of sub-section (4A) of Section 227 of the Companies Act, 1956, (‘the Act’) we enclose in the Annexure<br />

a statement on the matters specified in paragraphs 4 and 5 of the said Order.<br />

2. Further to our comments in the Annexure referred to above, we report that:<br />

18<br />

(i) we have obtained all the information and explanations, which to the best of our knowledge and belief were<br />

necessary for the purposes of our audit;<br />

(ii) in our opinion proper books of account as required by law have been kept by the Company so far as appears<br />

from our examination of those books;<br />

(iii) the balance sheet, profit and loss account and cash flow statement dealt with by this report are in agreement<br />

with the books of account;<br />

(iv) in our opinion, the balance sheet, profit and loss account and cash flow statement dealt with by this report<br />

comply with the accounting standards referred to in sub-section (3C) of Section 211 of the Act;<br />

(v) on the basis of written representations received from the directors as on 31 March 2010 and taken on record<br />

by the Board of Directors, we report that none of the directors is disqualified as on 31 March 2010 from being<br />

appointed as a director in terms of clause (g) of sub-section (1) of Section 274 of the Act; and<br />

(vi) in our opinion, and to the best of our information and according to the explanations given to us, the said<br />

accounts give the information required by the Act in the manner so required and give a true and fair view in<br />

conformity with the accounting principles generally accepted in India:<br />

a. in the case of the balance sheet, of the state of affairs of the Company as at 31 March 2010;<br />

b. in the case of the profit and loss account, of the profit of the Company for the year ended on that date;<br />

and<br />

c. in the case of the cash flow statement, of the cash flows for the year ended on that date.<br />

For or or<br />

Chartered Accountants<br />

Firm’s Registration No.: 128510W<br />

Place : Mumbai<br />

Bhavesh Bhavesh Dhupelia<br />

Dhupelia<br />

Partner<br />

Date : 11th May, 2010 Membership No: 042070

20th Annual Report 2009–2010<br />

With reference to the Annexure referred to in paragraph 1 of the Auditors’ Report to the members of Fairfield Atlas Limited<br />

(‘the Company’) on the financial statements for the year ended 31 March 2010, we report that:<br />

(i) (a) The Company has maintained proper records showing full particulars, including quantitative details and situation<br />

of fixed assets.<br />

(b) The Company has a regular programme of physical verification of its fixed assets by which all fixed assets are<br />

verified in a phased manner over a period of three years. In our opinion, this periodicity of physical verification<br />

is reasonable having regard to the size of the Company and the nature of its assets. No material discrepancies<br />

were noticed on such verification.<br />

(c) Fixed assets disposed off during the year were not substantial, and therefore, do not affect the going concern<br />

assumption.<br />

(ii) (a) The inventory, except goods-in-transit and stocks lying with third parties, has been physically verified by the<br />

management during the year. In our opinion, the frequency of such verification is reasonable. For stocks lying<br />

with third parties at the year-end, written confirmations have been obtained.<br />

(b) The procedures for the physical verification of inventories followed by the management are reasonable and<br />

adequate in relation to the size of the Company and the nature of its business.<br />

(c) On the basis of our examination of the inventory records, in our opinion, except for pending updation of<br />

inventory records of work in progress, the Company is maintaining proper records of inventory. Closing balance<br />

of work in progress has been valued based on physical verification at year end. Accordingly, the closing balance<br />

of work in progress as per books can not be ascertained. The discrepancies noticed on physical verification of<br />

inventory (except for work in progress) as compared to book records were not material.<br />

(iii) The Company has neither granted nor taken any loans, secured or unsecured, to or from companies, firms or other<br />

parties covered in the register maintained under Section 301 of the Companies Act, 1956 (‘the Act’).<br />

(iv) In our opinion and according to the information and explanations given to us, and having regard to the explanation<br />

that purchases of certain items of inventories and fixed assets are for the Company’s specialised requirements and<br />

similarly certain goods sold and services rendered are for the specialised requirements of the buyers and suitable<br />

alternative sources are not available to obtain comparable quotations, there is an adequate internal control system<br />

commensurate with the size of the Company and the nature of its business with regard to purchase of inventories<br />

and fixed assets and with regard to the sale of goods and services. In our opinion and according to the information<br />

and explanations given to us, except for pending updation of inventory records of work in progress, there is no<br />

continuing failure to correct major weaknesses in internal control system.<br />

(v) In our opinion, and according to the information and explanations given to us, there are no contracts and arrangements<br />

the particulars of which need to be entered into the register maintained under Section 301 of the Act.<br />

(vi) The Company has not accepted any deposits from the public.<br />

(vii) In our opinion, the Company has an internal audit system commensurate with the size and nature of its business.<br />

(viii) We have broadly reviewed the books of account maintained by the Company pursuant to the rules prescribed by<br />

the Central Government for maintenance of cost records under section 209(1)(d) of the Act, in respect of products<br />

and are of the opinion that prima facie, the prescribed accounts and records have been made and maintained<br />

19

FAIRFIELD ATLAS LIMITED<br />

20<br />

except for pending updation of inventory records of work in progress. However, we have not made a detailed<br />

examination of the records.<br />

(ix) (a) According to the information and explanations given to us and on the basis of our examination of the records<br />

of the Company, amounts deducted/accrued in the books of account in respect of undisputed statutory dues<br />

including Provident Fund, Professional tax, Income-tax, Wealth tax, Sales-tax, Service tax, Customs duty, Excise<br />

duty, Cess and other material statutory dues have been generally regularly deposited during the year by the<br />

Company with the appropriate authorities. As explained to us, the Company did not have any dues on account<br />

of Investor Education and Protection Fund and Employee’s State Insurance.<br />

There were no dues on account of cess under Section 441A of the Act, since the date from which the aforesaid<br />

section comes into force has not yet been notified by the Central Government.<br />

According to the information and explanations given to us, no undisputed amounts payable in respect of<br />

Provident Fund, Professional tax, Income tax, Sales tax, Service tax, Customs duty, Excise duty, Cess and other<br />

material statutory dues were in arrears as at 31 March 2010 for a period of more than six months from the<br />

date they became payable.<br />

(b) According to the information and explanations given to us, there are no dues of Income tax, Wealth tax,<br />

Customs duty and Excise duty which have not been deposited with the appropriate authorities on account of<br />

any dispute.<br />

According to the information and explanations given to us, the following dues of Sales tax and Service tax have<br />

not been deposited by the Company on account of disputes:<br />

Central Excise Act, 1944 Service Tax 2,479,821 April 2003 to Custom, Excise and<br />

June 2005 Service Tax Appellate<br />

Tribunal<br />

<strong>Bombay</strong> Sales Tax Act, Outstanding 1,523,773 1998-1999 Appellate Tribunal<br />

1959 relevant forms Sales Tax<br />

<strong>Bombay</strong> Sales Tax Act, Outstanding 2,386,772 1999-2000 Appellate Tribunal<br />

1959 relevant forms Sales Tax<br />

(x) The Company did not have any accumulated losses at the end of the financial year, and has not incurred cash losses<br />

in the financial year and in the immediately preceding financial year.<br />

(xi) In our opinion and according to the information and explanations given to us, the Company has not defaulted in<br />

repayment of dues to its bankers. The Company did not have any outstanding dues to any financial institution and<br />

debenture holders during the year.<br />

(xii) The Company has not granted any loans and advances on the basis of security by way of pledge of shares,<br />

debentures and other securities.<br />

(xiii) In our opinion and according to the information and explanations given to us, the Company is not a chit fund or<br />

a nidhi/ mutual benefit fund/ society.<br />

(xiv) According to the information and explanations given to us, the Company is not dealing or trading in shares,<br />

securities, debentures and other investments.

20th Annual Report 2009–2010<br />

(xv) According to the information and explanations given to us, the Company has not given any guarantee for loans<br />

taken by others from banks or financial institutions.<br />

(xvi) In our opinion and according to the information and explanations given to us, the term loans taken by the Company<br />

have been applied for the purpose for which they were raised.<br />

(xvii) According to the information and explanations given to us and on an overall examination of the balance sheet of<br />

the Company, we are of the opinion that the funds raised on short-term basis have not been used for long-term<br />

investment.<br />

(xviii)The Company has not made any preferential allotment of shares to companies/firms/parties covered in the register<br />

maintained under Section 301 of the Act.<br />

(xix) The Company did not have any outstanding debentures during the year.<br />

(xx) The Company has not raised any money by public issues during the year.<br />

(xxi) According to the information and explanations given to us, no fraud on or by the Company has been noticed or<br />

reported during the course of our audit.<br />

For or or<br />

Chartered Accountants<br />

Firm’s Registration No.: 128510W<br />

Place : Mumbai<br />

Bhavesh Bhavesh Bhavesh Dhupelia<br />

Dhupelia<br />

Partner<br />

Date : 11th May, 2010 Membership No: 042070<br />

21

FAIRFIELD ATLAS LIMITED<br />

BALANCE SHEET AS AT MARCH 31, 2010<br />

(Currency : Indian Rupees) As at As at<br />

Schedules March 31 2010 March 31 2009<br />

22<br />

Rupees Rupees<br />

SOURCES OF FUNDS<br />

Shareholders’ funds:<br />

Share capital 3 273,205,400 273,205,400<br />

Reserves and surplus 4 103,017,588 5,500,000<br />

376,222,988 278,705,400<br />

Loan funds:<br />

Secured loans 5 503,473,586 526,674,342<br />

Unsecured loans 6 - 57,997,516<br />

TOTAL 879,696,574 863,377,258<br />

APPLICATION OF FUNDS<br />

Fixed assets :<br />

Gross block 7 1,222,050,857 1,218,576,822<br />

Less: Accumulated depreciation and amortisation 747,916,703 691,561,495<br />

Net block 474,134,154 527,015,327<br />

Add: Capital work-in-progress (including capital advances) 11,575,425 4,209,467<br />

485,709,579 531,224,794<br />

Current assets, loans and advances :<br />

Inventories 8 240,216,049 241,718,869<br />

Sundry debtors 9 271,602,589 166,206,708<br />

Cash and bank balances 10 73,005,907 113,499,269<br />

Other current assets 11 3,509,342 476,527<br />

Loans and advances 12 66,465,120 53,671,732<br />

654,799,007 575,573,105<br />

Less : Current liabilities and provisions: 13<br />

Current liabilities 236,013,825 272,128,271<br />

Provisions 24,798,187 24,668,151<br />

260,812,012 296,796,422<br />

Net current assets 393,986,995 278,776,683<br />

Profit and loss account - 53,375,781<br />

TOTAL 879,696,574 863,377,258<br />

Significant accounting policies 2<br />

Notes to the accounts 20<br />

The Schedules referred to above form an integral part of this balance sheet.<br />

As per our report attached<br />

For B S R and Co For and on behalf of the Board of Directors<br />

Chartered Accountants<br />

Firm’s Registration No.: 128510W<br />

Bhavesh Dhupelia Avinash Gandhi D. E. Jacob<br />

Partner Director Managing Director<br />

Membership No.: 042070<br />

Vikram Nagar Marcel Rebello<br />

Chief Financial Officer Company Secretary<br />

Place : Mumbai Place : Goa<br />

Date : 11th May 2010 Date : 11th May 2010

PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED MARCH 31, 2010<br />

20th Annual Report 2009–2010<br />

(Currency : Indian Rupees) Schedules 2009–2010 2008–2009<br />

INCOME<br />

Rupees Rupees<br />

Sales and related services 14 892,574,614 1,126,558,882<br />

Other income 15 89,314,771 35,886,474<br />

981,889,385 1,162,445,356<br />

EXPENDITURE<br />

Cost of goods sold 16 458,003,835 604,478,048<br />

Employee costs 17 119,796,251 106,184,106<br />

Manufacturing and other expenses 18 237,964,978 353,025,633<br />

Finance cost 19 7,131,827 13,449,631<br />

Depreciation and amortisation 7 63,719,497 72,188,750<br />

Significant accounting policies 2<br />

Notes to the accounts 20<br />

The Schedules referred to above form an integral part of this Profit and Loss Account.<br />

As per our report attached<br />

For B S R and Co For and on behalf of the Board of Directors<br />

Chartered Accountants<br />

Firm’s Registration No.: 128510W<br />

Bhavesh Dhupelia Avinash Gandhi D. E. Jacob<br />

Partner Director Managing Director<br />

Membership No.: 042070<br />

Vikram Nagar Marcel Rebello<br />

Chief Financial Officer Company Secretary<br />

Place : Mumbai Place : Goa<br />

Date : 11th May 2010 Date : 11th May 2010<br />

886,616,388 1,149,326,168<br />

Profit before taxation, exceptional items and<br />

prior period items 95,272,997 13,119,188<br />

Prior period income, net 20.20 - 2,857,510<br />

Exceptional item 20.19 34,195,164 -<br />

Profit before taxation 129,468,161 15,976,698<br />

Provision for taxation<br />

- Current tax 23,277,792 2,000,000<br />

- MAT credit entitlement (44,703,000) -<br />

- Deferred tax (credit) - (8,845,178)<br />

Fringe benefits tax - 896,905<br />

Profit after taxation 150,893,369 21,924,971<br />

Debit balance in profit and loss account brought forward (53,375,781) (75,300,752)<br />

Balance in profit and loss account carried forward 97,517,588 (53,375,781)<br />

Earnings per equity share of Rs. 10 each<br />

Basic and diluted earnings per share 20.13 5.52 0.80<br />

23

FAIRFIELD ATLAS LIMITED<br />

Cash Flow Statement for the Year Ended March 31, 2010<br />

(Currency : Indian Rupees) 2009–2010 2008–2009<br />

Rupees Rupees<br />

24<br />

Profit before taxation<br />

Adjustments for:<br />

15,976,698<br />

Depreciation and amortisation 72,188,750<br />

Finance cost 13,449,631<br />

Interest on deposits (Gross) (2,076,870)<br />

Increase/ (decrease) in provision for gratuity 2,145,963<br />

Increase / (decrease )in provision for leave encashment (1,482,169)<br />

Unrealised foreign exchange (gain)/ loss 94,660,093<br />

Provision for doubtful advances/debts no longer required written-back (1,266,610)<br />

(Profit)/loss on sale of fixed assets (net) 1,442,835<br />

Liabilities/ provisions no longer required written - back (8,248,138)<br />

Gain on sales tax deferral loan repayment -<br />

Operating profit before working capital changes 186,790,183<br />

(Increase) / decrease in working capital<br />

Inventories (35,500,318)<br />

Trade and other receivables 87,018,008<br />

Trade payables (52,893,625)<br />

(1,375,935)<br />

CASH (USED IN) / GENERATED FROM OPERATIONS 185,414,248<br />

Direct taxes paid (10,455,025)<br />

174,959,223<br />

Purchase of fixed assets (104,339,243)<br />

Sale of fixed assets 1,156,424<br />

Interest received 3,322,936<br />

(99,859,883)<br />

Proceeds from borrowings -<br />

Repayment of borrowings (28,416)<br />

Interest expense (18,581,688)<br />

(18,610,104)<br />

Net (decrease) / increase in cash or cash equivalents (A+B+C) (40,493,362) 56,489,236

Cash Flow Statement for the Year Ended March 31, 2010<br />

20th Annual Report 2009–2010<br />

(Currency : Indian Rupees) 2009–2010 2008–2009<br />

Rupees Rupees<br />

1. The above Cash Flow Statement has been prepared under the “Indirect Method” as set out in the<br />

Accounting Standard - 3 on Cash Flow Statements.<br />

2. Previous year’s figures have been regrouped/ rearranged wherever necessary.<br />

The Schedules referred to above form an integral part of this Cash Flow Statement<br />

As per our report attached<br />

For B S R and Co<br />

Chartered Accountants<br />

Firm’s Registration No.: 128510W<br />

For and on behalf of the Board of Directors<br />

Bhavesh Dhupelia<br />

Partner<br />

Membership No.: 042070<br />

Avinash Gandhi<br />

Director<br />

D. E. Jacob<br />

Managing Director<br />

Vikram Nagar<br />

Chief Financial Officer<br />

Marcel Rebello<br />

Company Secretary<br />

Place : Mumbai Place : Goa<br />

Date : 11th May 2010 Date : 11th May 2010<br />

57,010,033<br />

113,499,269<br />

56,489,236<br />

Cash on hand<br />

Balances with scheduled banks<br />

244,306<br />

- In current accounts 97,234,963<br />

- In fixed deposit accounts 16,020,000<br />

113,499,269<br />

25

FAIRFIELD ATLAS LIMITED<br />

SCHEDULES TO THE FINANCIAL STATEMENTS<br />

for the year ended 31st March 2010 (Currency : Indian Rupees)<br />

1 BACKGROUND<br />

Fairfield Atlas Limited ('the Company'), a subsidiary of T-H Licensing Inc., USA, (‘the holding company’),<br />

a wholly owned subsidiary of Fairfield Manufacturing Company Inc, USA was incorporated on<br />

1 February 1990. The ultimate holding company is OC Oerlikon A.G. Pfaffikon. The Company is<br />

primarily engaged in manufacturing and selling of automotive transmission gears and gear boxes.<br />

2 SIGNIFICANT ACCOUNTING POLICIES<br />

2.1 Basis of preparation of financial statements<br />

The financial statements are prepared under the historical cost convention, on the accrual basis of<br />

accounting in accordance with the accounting principles generally accepted in India (‘Indian GAAP’)<br />

and comply with the companies (accounting standards) rules, 2006 issued by the Central Government,<br />

in consultation with National Advisory Committee on accounting standards (‘NACAS’) and relevant<br />

provisions of Companies Act, 1956 (‘the Act’) to the extent applicable.<br />

2.2 Use of estimates<br />

The preparation of the financial statements in conformity with Indian GAAP requires management to<br />

make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure<br />

of contingent liabilities as of the date of financial statements. Actual results may differ from those<br />

estimates. Any revision to accounting estimates is recognised prospectively in current and future periods.<br />

2.3 Revenue recognition<br />

Revenue from sale of transmission gears and gear boxes is recognized on transfer of all significant risks<br />

and rewards of ownership to the buyer. Related services are recognised once the services are rendered.<br />

Sales are recorded net of trade discounts, rebates, sales tax, excise duty and sales return.<br />

Interest income is recognized using the time proportion method based at the underlying interest rates.<br />

2.4 Fixed assets and depreciation<br />

Fixed assets are stated at cost of acquisition or construction, less accumulated depreciation, amortisation<br />

and impairment loss, if any. Cost includes inward freight, duties, taxes and incidental expenses relating<br />

to acquisition and installation of the asset.<br />

Depreciation on fixed assets has been provided using straight line value method in the manner and<br />

at the rates prescribed by Schedule XIV of the Companies Act, 1956, except for material handling<br />

equipments which have been depreciated on straight line method over a period of three years and<br />

technical know how fees is amortized over a period of eighteen months from the date of technology<br />

being put to use.<br />

Depreciation is charged on pro-rata basis for assets purchased / disposed off during the period.<br />

Individual assets costing less than Rs. 5,000 are depreciated fully in the year of purchase.<br />

Impairment of fixed assets<br />

The Company assesses at each balance sheet date whether there is any indication that an asset may<br />

be impaired. If any such indication exists, the Company estimates the recoverable amount of the asset.<br />

The recoverable amount is the greater of the net selling price and value in use. In assessing value in<br />

use, the estimated future cash flows are discounted to their present value based on an appropriate<br />

discount factor. If such recoverable amount of asset or the recoverable amount of the cash generating<br />

unit to which the asset belongs is less than its carrying amount, the carrying amount is reduced to its<br />

recoverable amount. The reduction is treated as an impairment loss and is recognised in the profit and<br />

loss account. If at the balance sheet date there is an indication that a previously assessed impairment<br />

loss no longer exists, the recoverable amount is reassessed and the asset is reflected at the recoverable<br />

amount subject to a maximum of depreciated historical cost.<br />

26

SCHEDULES TO THE FINANCIAL STATEMENTS (Contd.)<br />

for the year ended 31st March 2010 (Currency : Indian Rupees)<br />

20th Annual Report 2009–2010<br />

2.5 Borrowing costs<br />

Borrowing costs directly attributable to the acquisition/construction of a qualifying asset are apportioned<br />

to the cost of the fixed assets upto the date on which the asset is put to use/commissioned.<br />

2.6 Inventory<br />

Inventories are valued at the lower of cost and net realisable value. Cost includes raw material cost,<br />

conversion costs and all expenses incurred to bring the inventory to its present location and condition.<br />

Cost is determined on first in first out basis for raw materials, work-in-progress, finished goods and<br />

stores and spare parts.<br />

2.7 Taxation<br />

Income tax expense comprises current income tax, fringe benefit tax (i.e. amount of tax for the year<br />

determined in accordance with the income tax law) and deferred tax charge or credit (reflecting the<br />

tax effects of timing differences between accounting income and taxable income for the year). The<br />

deferred tax charge or credit and the corresponding deferred tax liabilities or assets are recognized<br />

using the tax rates that have been enacted or substantively enacted by the balance sheet date. Deferred<br />

tax assets are recognized only to the extent there is reasonable certainty that the assets can be realized<br />

in future.<br />

However, where there is unabsorbed depreciation or carried forward loss under taxation laws, deferred<br />

tax assets are recognized only if there is a virtual certainty of realization of such assets. Deferred tax<br />

assets are reviewed at each balance sheet date and written down or written up to reflect the amount<br />

that is reasonably/ virtually certain (as the case may be) to be realized.<br />

Provision for Fringe Benefit Tax (FBT) is made on the basis of applicable FBT on the taxable value of<br />

specified expenses of the company as prescribed under the Income-tax Act, 1961.<br />

In accordance with the guidance note issued by the Institute of Chartered Accountants of India (‘ICAI’)<br />

on accounting for credit available in respect of Minimum Alternate Tax (MAT) under the Income-tax Act,<br />

1961, the Company recognises MAT credit as an asset only when and to the extent there is convincing<br />

evidence for reasonable certainity that the Company will be liable to pay normal income tax during<br />

the specified period.<br />

2.8 Leases<br />

Operating lease<br />

Lease rentals in respect of assets acquired under operating lease are charged off to the profit and loss<br />

account on straight line basis over the period of lease.<br />

Finance lease<br />

Assets acquired under finance leases are recognized at the lower of the fair value of the leased assets<br />

at inception and the sum of the present value of minimum lease payments.<br />

2.9 Foreign currency transactions<br />

Transactions in foreign currency are recorded at the exchange rate prevailing on the date of the<br />

transaction. Foreign currencies denominated monetary assets and liabilities at the balance sheet date<br />

are translated at the exchange rate prevailing on the date of the balance sheet. <strong>Exchange</strong> rate<br />

differences resulting from foreign exchange transactions settled during the period, including period-end<br />

translation of assets and liabilities are recognised in the profit and loss account<br />

In respect of transactions covered by forward exchange contracts, discounts/premiums on forward<br />

exchange contracts are amortised over the period of the contract. <strong>Exchange</strong> differences arising due to<br />

change in exchange rates on forward exchange contracts are recognized in the profit and loss account.<br />

2.10 Employee benefits<br />

(a) Short term employment benefits<br />

All employee benefits payable wholly within twelve months of rendering the service are classified<br />

27

FAIRFIELD ATLAS LIMITED<br />

SCHEDULES TO THE FINANCIAL STATEMENTS (Contd.)<br />

for the year ended 31st March 2010 (Currency : Indian Rupees)<br />

as short-term employee benefits. Benefits such as salaries, wages, and short term compensated<br />

absences, etc. and the expected cost of ex-gratia are recognized in the period in which the<br />

employee renders the related service.<br />

(b) Post employment benefits<br />

Defined contribution plan:<br />

The Company contributes to the statutory provident fund, administered by the government, at the<br />

prescribed rates and has no further obligation beyond making its contribution. Provident fund<br />

dues are recognized when the liability to contribute to the provident fund arises under the<br />

Employees’ Provident Fund Act, 1952 and charged to revenue.<br />

Defined benefit plan:<br />

The Company’s gratuity benefit scheme is a defined benefit plan funded with Life Insurance<br />

Corporation of India (‘LIC’) defined benefit plan (unfunded upto previous year ). The Company’s<br />

obligation in respect of the gratuity benefit scheme is determined by an independent actuary by<br />

estimating the amount of future benefit that employees have earned in return for their service<br />

in the current and prior periods, that benefit is discounted to determine its present value.<br />

The present value of the obligation under such defined benefit plan is determined based on<br />

actuarial valuation using the projected unit credit method, which recognizes each period of<br />

service as giving rise to additional unit of employee benefit entitlement and measures each unit<br />

separately to build up the final obligation.<br />

The obligation is measured at the present value of the estimated future cash flows. The discount<br />

rates used for determining the present value of the obligation under defined benefit plan, are<br />

based on the relevant market yields on Government securities as at the balance sheet date.<br />

(c) Long term employment benefits :<br />

The Company’s net obligation in respect of long-term employment benefits, other than gratuity,<br />

is the amount of future benefit that employees have earned in return for their service in the<br />

current and prior periods. The obligation is based on actuarial valuation using the projected unit<br />

credit method and is discounted to its present value. The discount rates used for determining the<br />

present value of the obligation under defined benefit plan, are based on the relevant market<br />

yields on Government securities as at the balance sheet date.<br />

Actuarial gains and losses are recognized immediately in the profit and loss account.<br />

2.11 Earnings per share<br />

The basic earnings per share is computed by dividing the net profit attributable to the equity shareholders<br />

for the period by the weighted average number of equity shares outstanding during the reporting<br />

period. The Company does not have any dilutive potential equity shares during the reporting period.<br />

2.12 Provisions and contingencies<br />

The Company creates a provision where there is present obligation as a result of a past event that<br />

probably requires an outflow of resources and a reliable estimate can be made of the amount of the<br />

obligation. A disclosure for a contingent liability is made when there is a possible or a present<br />

obligation that may, but probably will not require an outflow of resources. When there is a possible<br />

obligation in respect of which the likelihood of outflow of resources is remote, no provision or disclosure<br />

is made. Loss contingencies arising from claims, assessment, fines, penalties etc are recorded when it<br />

is probable that a liability has been incurred and the amount can be reasonably estimated.<br />

Provisions are reviewed at each balance sheet date and adjusted to reflect the current best estimate.<br />

If it is no longer probable that an outflow of resources would be required to settle the obligation, the<br />

provision is reversed.<br />

28

SCHEDULES TO THE FINANCIAL STATEMENTS (Contd.)<br />

as at 31st March 2010 (Currency : Indian Rupees)<br />

20th Annual Report 2009–2010<br />

As at As at<br />