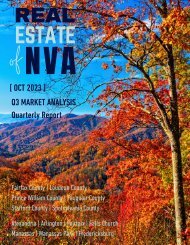

2020-12 -- Real Estate of Northern Virginia Market Report - December 2020 Real Estate Trends - Michele Hudnall

2020 - End of the Year Clearance Sale!! This is a monthly report of the Northern Virginia Real Estate market regarding current market conditions with the blog, report and video conversation. The numbers come from the MLS (Bright), opinions are my own. This represents the market up to 5 Bedrooms keeping the numbers sub $1.5M and out of the luxury, custom market.

2020 - End of the Year Clearance Sale!!

This is a monthly report of the Northern Virginia Real Estate market regarding current market conditions with the blog, report and video conversation.

The numbers come from the MLS (Bright), opinions are my own. This represents the market up to 5 Bedrooms keeping the numbers sub $1.5M and out of the luxury, custom market.

- TAGS

- fauquier-county-real-estate

- prince-william-real-estate

- loudoun-county-real-estate

- fairfax-county-real-estate

- arlington-real-estate

- alexandria-real-estate

- fairfax-real-estate

- falls-church-real-estate

- manassas-real-estate

- best-northern-virginia-realtor

- your-northern-virginia-realtor

- northern-virginia-home-trends

- northern-virginia-home-prices

- real-estate-of-nva

- nva-real-estate-trends

- nova-real-estate-trends

- northern-virginia-real-estate

- michele-hudnall

- realestateofnva

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

DECEMBER <strong>2020</strong> MARKET REPORT<br />

Fairfax – Loudoun – Prince William – Fauquier Counties<br />

Alexandria – Arlington - Fairfax – Falls Church<br />

Manassas – Manassas Park Cities<br />

Subscribe to the <strong>Report</strong> – Click Here!<br />

Overview<br />

The <strong>Real</strong> <strong>Estate</strong> <strong>of</strong> <strong>Northern</strong> <strong>Virginia</strong> <strong>Report</strong> is a monthly, comprehensive residential real estate update for the<br />

<strong>Northern</strong> <strong>Virginia</strong> (NVA) region. The report is the only one <strong>of</strong> its kind for residential real estate (detached,<br />

condominiums, townhouses) in the sub $1.5M market. The report is not a re-posting <strong>of</strong> a National or Regional<br />

subscribed service reports, thus the difference <strong>of</strong> both wide and deep, focused local data and actionable advice.<br />

The report is based on sales, pending, active and inventory data from the local listing service, Bright, compiled and<br />

presented with my opinion and advice as the author, knowledge as a <strong>Real</strong>tor and lifetime resident <strong>of</strong> this region. As<br />

a 30+ year consultative market strategist and product / solution owner out <strong>of</strong> the Technology S<strong>of</strong>tware <strong>Market</strong>, it is<br />

my goal to present data to educate, inform and provide actionable advice to assist sellers and buyers with their real<br />

estate decisions in the NVA region – my home and my love!<br />

This report has grown and been refined through and is aligned with the 10 jurisdictions <strong>of</strong> the <strong>Northern</strong> <strong>Virginia</strong><br />

Economic Development Alliance including the cities <strong>of</strong>: Arlington, Alexandria, Fairfax Falls Church, Manassas,<br />

Manassas Park and the counties <strong>of</strong> Fairfax, Fauquier, Loudoun, and Prince William.<br />

Join the conversation and tune-in on Facebook, YouTube and the <strong>Real</strong> <strong>Estate</strong> <strong>of</strong> NVA Blog for the monthly video and<br />

updates as the report is produced and broken down weekly until the next monthly publication. I am here for you if<br />

you are in or out <strong>of</strong> the region and have questions regarding the NVA Residential <strong>Real</strong> <strong>Estate</strong> <strong>Market</strong>.

OVERVIEW OF THE NORTHERN VIRGINIA MARKET .............................................................................. 1<br />

|| NORTHERN VIRGINIA OVERVIEW ........................................................................................................... 1<br />

MARKET DEMAND ...................................................................................................................................................................................... 3<br />

MARKET SUPPLY ........................................................................................................................................................................................ 4<br />

MARKET AND NEGOTIABILITY ................................................................................................................................................................ 5<br />

YoY AND YoY YTD STRUCTURE TYPE COMPARISON ......................................................................................................................... 6<br />

NORTHERN VIRGINIA SUMMARY ........................................................................................................................................................... 7<br />

CURRENT MARKET SUPPLY – MARKET SHIFT INDICATOR ......................................................................................................... 8<br />

NEW SUPPLY – THE FUEL FOR THE MARKET ............................................................................................................................. 9<br />

PAST DEMAND – PREVIOUS 45-60 DAYS PENDINGS ............................................................................................................... 10<br />

CURRENT MARKET DEMAND................................................................................................................................................... 11<br />

MARKET SUPPLY – INVENTORY TREND ................................................................................................................................... <strong>12</strong><br />

SELLER – BALANCED – BUYER MARKET ? ................................................................................................................................ 13<br />

MARKET VALUE – PRICE APPRECIATION ................................................................................................................................. 14<br />

MARKETABILITY DRIVERS – CONDITION AND PRICE ............................................................................................................... 15<br />

MARKET NEGOTIABILITY – BIDDING WARS ?.......................................................................................................................... 16<br />

EXTERNAL DRIVERS ................................................................................................................................................................. 17<br />

THE CITIES OF THE NORTHERN VIRGINIA MARKET ........................................................................... 19<br />

|| ALEXANDRIA CITY OVERVIEW .............................................................................................................. 21<br />

MARKET DEMAND .................................................................................................................................................................................... 23<br />

MARKET AND NEGOTIABILITY .............................................................................................................................................................. 23<br />

MARKET SUPPLY ...................................................................................................................................................................................... 24<br />

MARKET ANALYSIS BY STRUCTURE TYPE ........................................................................................................................................ 25<br />

|| ARLINGTON CITY OVERVIEW ................................................................................................................ 29<br />

MARKET DEMAND ..................................................................................................................................................................................... 31<br />

MARKET AND NEGOTIABILITY ............................................................................................................................................................... 31<br />

MARKET SUPPLY ...................................................................................................................................................................................... 32<br />

MARKET ANALYSIS BY STRUCTURE TYPE ........................................................................................................................................ 33

|| FAIRFAX CITY OVERVIEW ...................................................................................................................... 37<br />

MARKET DEMAND .................................................................................................................................................................................... 39<br />

MARKET AND NEGOTIABILITY .............................................................................................................................................................. 39<br />

MARKET SUPPLY ...................................................................................................................................................................................... 40<br />

MARKET ANALYSIS BY STRUCTURE TYPE ......................................................................................................................................... 41<br />

|| FALLS CHURCH CITY OVERVIEW ........................................................................................................ 45<br />

MARKET DEMAND .................................................................................................................................................................................... 47<br />

MARKET AND NEGOTIABILITY .............................................................................................................................................................. 47<br />

MARKET SUPPLY ...................................................................................................................................................................................... 48<br />

MARKET ANALYSIS BY STRUCTURE TYPE ........................................................................................................................................ 49<br />

|| MANASSAS CITY OVERVIEW ................................................................................................................ 53<br />

MARKET DEMAND .................................................................................................................................................................................... 55<br />

MARKET AND NEGOTIABILITY .............................................................................................................................................................. 55<br />

MARKET SUPPLY ...................................................................................................................................................................................... 56<br />

MARKET ANALYSIS BY STRUCTURE TYPE ........................................................................................................................................ 57<br />

|| MANASSAS PARK CITY OVERVIEW ..................................................................................................... 61<br />

MARKET DEMAND .................................................................................................................................................................................... 63<br />

MARKET AND NEGOTIABILITY .............................................................................................................................................................. 63<br />

MARKET SUPPLY ...................................................................................................................................................................................... 64<br />

MARKET ANALYSIS BY STRUCTURE TYPE ........................................................................................................................................ 65<br />

THE COUNTIES OF THE NORTHERN VIRGINIA MARKET ................................................................... 69<br />

|| FAIRFAX COUNTY OVERVIEW ................................................................................................................ 71<br />

MARKET DEMAND .................................................................................................................................................................................... 73<br />

MARKET AND NEGOTIABILITY .............................................................................................................................................................. 73<br />

MARKET SUPPLY ...................................................................................................................................................................................... 74<br />

MARKET ANALYSIS BY STRUCTURE TYPE ........................................................................................................................................ 75<br />

|| LOUDOUN COUNTY OVERVIEW ............................................................................................................. 81<br />

MARKET DEMAND .................................................................................................................................................................................... 83<br />

MARKET AND NEGOTIABILITY .............................................................................................................................................................. 83<br />

MARKET SUPPLY ...................................................................................................................................................................................... 84<br />

MARKET ANALYSIS BY STRUCTURE TYPE ........................................................................................................................................ 85

|| PRINCE WILLIAM COUNTY OVERVIEW ............................................................................................... 91<br />

MARKET DEMAND .................................................................................................................................................................................... 93<br />

MARKET AND NEGOTIABILITY .............................................................................................................................................................. 93<br />

MARKET SUPPLY ...................................................................................................................................................................................... 94<br />

MARKET ANALYSIS BY STRUCTURE TYPE ........................................................................................................................................ 95<br />

|| FAUQUIER COUNTY OVERVIEW .......................................................................................................... 101<br />

MARKET DEMAND .................................................................................................................................................................................. 103<br />

MARKET AND NEGOTIABILITY ............................................................................................................................................................ 103<br />

MARKET SUPPLY .................................................................................................................................................................................... 104<br />

MARKET ANALYSIS BY STRUCTURE TYPE ...................................................................................................................................... 105

OVERVIEW OF THE<br />

NORTHERN VIRGINIA MARKET

|| NORTHERN VIRGINIA OVERVIEW<br />

SUPPLY<br />

ACTIVE LISTINGS<br />

FUEL TO SUPPLY<br />

NEW LISTINGS<br />

CURRENT DEMAND<br />

PENDING LISTINGS<br />

PAST DEMAND<br />

CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

-18% -22% -16% 46% 17% 43% 86% 28%<br />

5,452<br />

2,286 2,077 3,433<br />

VALUE<br />

MEDIAN SALES PRICE<br />

MARKETING<br />

DAYS ON MARKET<br />

NEGOTIABILITY<br />

SALE TO ORIG LIST PRICE<br />

MARKET PACE<br />

AVG MONTHS OF INV<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

13% -5% -35% -35% 1% 1% 18% 32%<br />

$490,014<br />

22 99.70%<br />

1.00<br />

- 1 -

|| NORTHERN VIRGINIA OVERVIEW NOVEMBER <strong>2020</strong><br />

NORTHERN VIRGINIA<br />

Year Over Year<br />

DECEMBER<br />

Number<br />

<strong>of</strong> Sales<br />

YoY Chg<br />

Sales<br />

AVG DOM<br />

YoY Chg<br />

DOM<br />

AVG Sale<br />

to Orig<br />

List Ratio<br />

YoY Chg<br />

Price<br />

Ratio<br />

AVG Close<br />

Price<br />

YoY Chg<br />

Close<br />

Price<br />

2019 2,592 29 98.30% $ 522,871<br />

<strong>2020</strong> 3,326 28.32% 19 -35.32% 99.58% 1.29% $ 551,969 5.57%<br />

Alexandria City, VA 214 24.42% 22 9.27% 98.49% 0.30% $ 570,782 0.14%<br />

Arlington, VA 242 28.04% 28 10.16% 97.82% -0.65% $ 651,622 5.70%<br />

Fairfax City, VA 28 -15.15% 19 -49.60% 99.69% 2.11% $ 575,275 4.83%<br />

Fairfax, VA 1,303 24.81% 18 -34.87% 99.47% 1.31% $ 594,042 4.45%<br />

Falls Church City, VA 9 <strong>12</strong>.50% 31 2.48% 97.85% -0.19% $ 563,789 -25.00%<br />

Fauquier, VA <strong>12</strong>1 55.13% 45 -21.03% 97.51% 2.04% $ 493,847 4.99%<br />

Loudoun, VA 610 31.75% 17 -45.52% 100.26% 1.27% $ 575,651 6.47%<br />

Manassas City, VA 69 15.00% 18 -23.42% 100.41% 1.93% $ 350,630 0.09%<br />

Manassas Park City, VA 24 100.00% 11 -73.50% 98.58% 2.75% $ 348,971 14.61%<br />

Prince William, VA 706 32.46% 13 -56.19% 100.80% 2.46% $ 449,461 13.46%<br />

NORTHERN VIRGINIA<br />

YTD AVGs with<br />

Change % YoY<br />

DECEMBER<br />

Number<br />

<strong>of</strong> Sales<br />

YTD YoY<br />

Chg Sales<br />

AVG DOM<br />

The traditional measure <strong>of</strong> looking at change on a Year-Over-Year basis to see how the year is going and how it compares to<br />

the same month <strong>of</strong> the previous year is not comparing apples to apples currently. Even with the disruption this year, this has<br />

been a fair measure until September.<br />

The market is still very active over previous years when the market tends to seasonally cool. Now that folks are working and<br />

learning from home, the market continues to be very active creating what I would call “hype news” regarding percentages <strong>of</strong><br />

change in volume and price, however, price represents current conditions.<br />

I have added a YoY YTD measure <strong>of</strong> change to compare the current year to the previous year that you will only find in this report.<br />

The YoY YTD measure is a comparison <strong>of</strong> January to the current month <strong>of</strong> the previous year to January to the current month <strong>of</strong><br />

the current year to check the year as a whole against the previous year given the shifting, seasonal market.<br />

- 2 -<br />

YTD YoY<br />

Chg DOM<br />

AVG Sale<br />

to Orig<br />

List Ratio<br />

YTD YoY<br />

Chg Price<br />

Ratio<br />

AVG Close<br />

Price<br />

YTD YoY<br />

Chg Close<br />

Price<br />

2019 36,734 25 89.11% $ 516,871<br />

<strong>2020</strong> 39,449 7.39% 18 -25.13% 99.68% 11.86% $ 551,094 6.62%<br />

Alexandria City, VA 2,466 6.16% 16 -8.76% 99.22% -0.16% $ 581,656 5.61%<br />

Arlington, VA 2,444 -2.47% 17 -17.32% 98.97% -0.53% $ 668,413 6.61%<br />

Fairfax City, VA 356 -4.56% 24 -24.71% 100.17% 2.03% $ 577,562 4.51%<br />

Fairfax, VA 16,224 6.62% 18 -23.36% 99.81% 11.66% $ 592,839 6.79%<br />

Falls Church City, VA 158 -8.67% 14 -50.65% 100.33% 1.17% $ 735,495 -9.54%<br />

Fauquier, VA 1,341 14.13% 42 -7.68% 97.67% 1.81% $ 470,713 9.73%<br />

Loudoun, VA 7,470 <strong>12</strong>.15% 18 -25.70% 99.79% 34.14% $ 567,000 6.23%<br />

Manassas City, VA 692 6.63% 17 -33.96% 99.95% 1.57% $ 353,323 7.93%<br />

Manassas Park City, VA 256 -1.16% 19 -20.77% 99.82% 3.80% $ 343,777 5.11%<br />

Prince William, VA 8,042 8.71% 17 -37.70% 100.03% 1.52% $ 439,304 8.84%

NOVEMBER <strong>2020</strong> NORTHERN VIRGINIA OVERVIEW ||<br />

CURRENT DEMAND<br />

PENDING LISTINGS<br />

MARKET DEMAND<br />

PAST DEMAND<br />

CLOSED LISTINGS<br />

VALUE<br />

MEDIAN SALES PRICE<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

17% 43% 86% 28% 13% -5%<br />

2,077 3,433<br />

$490,014<br />

- 3 -

|| NORTHERN VIRGINIA OVERVIEW NOVEMBER <strong>2020</strong><br />

SUPPLY<br />

ACTIVE LISTINGS<br />

MARKET SUPPLY<br />

FUEL TO SUPPLY<br />

NEW LISTINGS<br />

CURRENT DEMAND<br />

PENDING LISTINGS<br />

PAST DEMAND<br />

CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

-18% -22% -16% 46% 17% 43% 86% 28%<br />

5,452<br />

2,286 2,077 3,433<br />

- 4 -

NOVEMBER <strong>2020</strong> NORTHERN VIRGINIA OVERVIEW ||<br />

MARKETING<br />

DAYS ON MARKET<br />

MARKET AND NEGOTIABILITY<br />

NEGOTIABILITY<br />

SALE TO ORIG LIST PRICE<br />

MARKET PACE<br />

AVG MONTHS OF INV<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

-35% -35% 1% 1% 18% 32%<br />

22 99.70%<br />

1.00<br />

CONDOMINIUM<br />

TOWNHOUSE<br />

DETACHED<br />

% <strong>of</strong> SALES WITH<br />

% <strong>of</strong> SALES WITH<br />

% <strong>of</strong> SALES WITH<br />

AVG CONCESSION<br />

AVG CONCESSION<br />

AVG CONCESSION<br />

CONCESSIONS<br />

CONCESSIONS<br />

CONCESSIONS<br />

$5,049 37%<br />

$5,479<br />

32.85%<br />

$7,028 28.75%<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

8% 9% -1% -5% -13% -15% -34.36% -40% -13% -13% -45% -44%<br />

- 5 -

|| NORTHERN VIRGINIA OVERVIEW NOVEMBER <strong>2020</strong><br />

YoY AND YoY YTD STRUCTURE TYPE COMPARISON<br />

NORTHERN<br />

VIRGINIA<br />

DECEMBER<br />

YEAR OVER YEAR<br />

CHANGE %<br />

Number<br />

<strong>of</strong> Sales<br />

AVG DOM<br />

Avg<br />

Price/SqFt<br />

Avg Sale<br />

to Orig<br />

List Price<br />

Ratio<br />

Avg Close<br />

Price<br />

YoY<br />

SALES<br />

YoY DOM<br />

YoY $ /<br />

SQFT<br />

YoY $<br />

RATIO<br />

YoY<br />

CLOSE<br />

2019 2,592 29 $ 295.77 98.30% $ 522,871<br />

<strong>2020</strong> 3,326 19 $ 330.31 99.58% $ 551,969 28.32% -35.32% 11.68% 1.29% 5.57%<br />

VALUE PAST DEMAND SUPPLY<br />

MEDIAN SALES PRICE CLOSED LISTINGS ACTIVE LISTINGS<br />

SUPPLY<br />

NEW LISTINGS<br />

MARKETING<br />

DAYS ON MARKET<br />

NEGOTIABILITY<br />

SALE TO ORIG LIST PRICE<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

5% 1% 68% 38% 59% 71% -11% 86% -24% -15% 0% 1%<br />

$284,550 585 1,574<br />

479 28<br />

99%<br />

YoY YTD<br />

$282,759 6,299<br />

19,016<br />

8,599 22<br />

2.66% -0.11%<br />

23.18%<br />

22.56%<br />

-19.22%<br />

99.25%<br />

0.55%<br />

VALUE<br />

PAST DEMAND<br />

SUPPLY<br />

MEDIAN SALES PRICE CLOSED LISTINGS ACTIVE LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

-3% 2% 86% 22% -38% -43% -24% 37% -56% -57% 11% 2%<br />

$641,465<br />

1,563 2,298<br />

SUPPLY<br />

NEW LISTINGS<br />

MARKETING<br />

DAYS ON MARKET<br />

979 17<br />

NEGOTIABILITY<br />

SALE TO ORIG LIST PRICE<br />

100%<br />

YoY YTD<br />

$667,685<br />

7.93%<br />

19,398<br />

5.87%<br />

51,4<strong>12</strong><br />

22,186<br />

23<br />

99.32%<br />

-27.91% -4.64%<br />

-31.51%<br />

0.18%<br />

VALUE PAST DEMAND SUPPLY<br />

MEDIAN SALES PRICE CLOSED LISTINGS ACTIVE LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

13% 3% 88% 29% -19% -21% -9% 38% -49% -34% 1% 0%<br />

$499,875<br />

1,243 1,555<br />

SUPPLY<br />

NEW LISTINGS<br />

8<strong>12</strong><br />

MARKETING<br />

DAYS ON MARKET<br />

15<br />

NEGOTIABILITY<br />

SALE TO ORIG LIST PRICE<br />

100%<br />

YoY YTD<br />

$474,934<br />

2.17%<br />

13,968<br />

7.93%<br />

29,428<br />

-<strong>12</strong>.43%<br />

15,908<br />

6.03%<br />

17<br />

-27.06%<br />

99.31%<br />

-0.40%<br />

NORTHERN<br />

VIRGINIA<br />

DECEMBER<br />

YTD AVGs<br />

YoY CHG %<br />

Number<br />

<strong>of</strong> Sales<br />

AVG DOM<br />

Avg<br />

Price/SqFt<br />

Avg Sale<br />

to Orig<br />

List Price<br />

Ratio<br />

Avg Close<br />

Price<br />

YoY<br />

SALES<br />

YoY DOM<br />

YoY $ /<br />

SQFT<br />

YoY $<br />

RATIO<br />

YoY<br />

CLOSE<br />

2019 36,734 25 $ 385.59 89.11% $ 516,871<br />

<strong>2020</strong> 39,449 18 $ 328.46 99.68% $ 551,094 7.39% -25.13% -14.81% 11.86% 6.62%<br />

- 6 -

NOVEMBER <strong>2020</strong> NORTHERN VIRGINIA OVERVIEW ||<br />

NORTHERN VIRGINIA SUMMARY<br />

DEMAND – SUPPLY – MARKET – VALUE<br />

MoM – YTD – YoY CHANGE<br />

NORTHERN VIRGINIA<br />

Avg Median Sales Price 2019/<strong>12</strong> <strong>2020</strong>/01 <strong>2020</strong>/11 <strong>2020</strong>/<strong>12</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA $ 553,000 $ 453,000 $ 540,000 $ 537,500 -0.46% 18.65% -2.80%<br />

Arlington, VA $ 579,000 $ 530,000 $ 602,500 $ 615,000 2.07% 16.04% 6.22%<br />

Fairfax City, VA $ 548,750 $ 480,994 $ 562,500 $ 570,000 1.33% 18.50% 3.87%<br />

Fairfax, VA $ 540,000 $ 515,000 $ 560,000 $ 552,685 -1.31% 7.32% 2.35%<br />

Falls Church City, VA $ 889,500 $ 475,000 $ 771,500 $ 525,000 -31.95% 10.53% -40.98%<br />

Fauquier, VA $ 450,000 $ 375,000 $ 469,900 $ 449,950 -4.25% 19.99% -0.01%<br />

Loudoun, VA $ 525,000 $ 497,284 $ 560,000 $ 540,000 -3.57% 8.59% 2.86%<br />

Manassas City, VA $ 369,500 $ 317,500 $ 3<strong>12</strong>,000 $ 345,000 10.58% 8.66% -6.63%<br />

Manassas Park City, VA $ 315,000 $ 317,500 $ 359,900 $ 345,000 -4.14% 8.66% 9.52%<br />

Prince William, VA $ 380,000 $ 365,000 $ 411,000 $ 420,000 2.19% 15.07% 10.53%<br />

Active Listings 2019/<strong>12</strong> <strong>2020</strong>/01 <strong>2020</strong>/11 <strong>2020</strong>/<strong>12</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 291 316 656 489 -25.46% 54.75% 68.04%<br />

Arlington, VA 324 3<strong>12</strong> 883 646 -26.84% 107.05% 99.38%<br />

Fairfax City, VA 101 89 81 51 -37.04% -42.70% -49.50%<br />

Fairfax, VA 2739 2600 3329 2197 -34.00% -15.50% -19.79%<br />

Falls Church City, VA 14 16 24 19 -20.83% 18.75% 35.71%<br />

Fauquier, VA 450 416 325 210 -35.38% -49.52% -53.33%<br />

Loudoun, VA 1387 1315 1313 838 -36.18% -36.27% -39.58%<br />

Manassas City, VA 119 <strong>12</strong>1 <strong>12</strong>1 69 -42.98% -42.98% -42.02%<br />

Manassas Park City, VA 61 52 40 26 -35.00% -50.00% -57.38%<br />

Prince William, VA 1524 1402 1420 907 -36.13% -35.31% -40.49%<br />

New Listings 2019/<strong>12</strong> <strong>2020</strong>/01 <strong>2020</strong>/11 <strong>2020</strong>/<strong>12</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 83 181 224 175 -21.88% -3.31% 110.84%<br />

Arlington, VA 98 177 277 180 -35.02% 1.69% 83.67%<br />

Fairfax City, VA 21 23 30 19 -36.67% -17.39% -9.52%<br />

Fairfax, VA 597 1089 <strong>12</strong>08 876 -27.48% -19.56% 46.73%<br />

Falls Church City, VA 6 7 9 9 0.00% 28.57% 50.00%<br />

Fauquier, VA 64 108 96 55 -42.71% -49.07% -14.06%<br />

Loudoun, VA 318 540 492 426 -13.41% -21.11% 33.96%<br />

Manassas City, VA 28 46 54 40 -25.93% -13.04% 42.86%<br />

Manassas Park City, VA 20 14 17 15 -11.76% 7.14% -25.00%<br />

Prince William, VA 336 536 621 491 -20.93% -8.40% 46.13%<br />

Sold Listings 2019/<strong>12</strong> <strong>2020</strong>/01 <strong>2020</strong>/11 <strong>2020</strong>/<strong>12</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 179 <strong>12</strong>3 217 232 6.91% 88.62% 29.61%<br />

Arlington, VA 190 138 208 256 23.08% 85.51% 34.74%<br />

Fairfax City, VA 34 14 32 31 -3.13% <strong>12</strong>1.43% -8.82%<br />

Fairfax, VA 1092 765 1369 1330 -2.85% 73.86% 21.79%<br />

Falls Church City, VA 10 4 10 9 -10.00% <strong>12</strong>5.00% -10.00%<br />

Fauquier, VA 79 65 107 <strong>12</strong>6 17.76% 93.85% 59.49%<br />

Loudoun, VA 484 310 647 625 -3.40% 101.61% 29.13%<br />

Manassas City, VA 60 28 57 73 28.07% 160.71% 21.67%<br />

Manassas Park City, VA <strong>12</strong> 16 21 24 14.29% 50.00% 100.00%<br />

Prince William, VA 551 387 692 727 5.06% 87.86% 31.94%<br />

Pending Listings 2019/<strong>12</strong> <strong>2020</strong>/01 <strong>2020</strong>/11 <strong>2020</strong>/<strong>12</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 107 130 138 162 17.39% 24.62% 51.40%<br />

Arlington, VA 97 113 171 149 -<strong>12</strong>.87% 31.86% 53.61%<br />

Fairfax City, VA 13 18 19 23 21.05% 27.78% 76.92%<br />

Fairfax, VA 592 713 1025 838 -18.24% 17.53% 41.55%<br />

Falls Church City, VA 3 2 6 9 50.00% 350.00% 200.00%<br />

Fauquier, VA 55 60 98 59 -39.80% -1.67% 7.27%<br />

Loudoun, VA 233 309 477 348 -27.04% <strong>12</strong>.62% 49.36%<br />

Manassas City, VA 26 34 47 32 -31.91% -5.88% 23.08%<br />

Manassas Park City, VA 16 14 14 17 21.43% 21.43% 6.25%<br />

Prince William, VA 311 377 563 440 -21.85% 16.71% 41.48%<br />

EOM Inv 2019/<strong>12</strong> <strong>2020</strong>/01 <strong>2020</strong>/11 <strong>2020</strong>/<strong>12</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 94 111 404 3<strong>12</strong> -22.77% 181.08% 231.91%<br />

Arlington, VA 91 94 588 4<strong>12</strong> -29.93% 338.30% 352.75%<br />

Fairfax City, VA 22 19 45 33 -26.67% 73.68% 50.00%<br />

Fairfax, VA 787 799 1750 <strong>12</strong>31 -29.66% 54.07% 56.42%<br />

Falls Church City, VA 4 8 13 10 -23.08% 25.00% 150.00%<br />

Fauquier, VA <strong>12</strong>9 <strong>12</strong>5 177 132 -25.42% 5.60% 2.33%<br />

Loudoun, VA 323 354 582 408 -29.90% 15.25% 26.32%<br />

Manassas City, VA 38 36 59 39 -33.90% 8.33% 2.63%<br />

Manassas Park City, VA 20 19 19 13 -31.58% -31.58% -35.00%<br />

Prince William, VA 450 449 598 433 -27.59% -3.56% -3.78%<br />

Avg Months <strong>of</strong> Inventory 2019/<strong>12</strong> <strong>2020</strong>/01 <strong>2020</strong>/11 <strong>2020</strong>/<strong>12</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 0.60 0.60 1.50 1.40 -6.67% 133.33% 133.33%<br />

Arlington, VA 0.50 0.50 2.40 2.00 -16.67% 300.00% 300.00%<br />

Fairfax City, VA 0.80 0.60 1.20 1.00 -16.67% 66.67% 25.00%<br />

Fairfax, VA 0.70 0.70 1.10 0.90 -18.18% 28.57% 28.57%<br />

Falls Church City, VA 0.40 0.80 0.80 1.00 25.00% 25.00% 150.00%<br />

Fauquier, VA 1.50 1.60 1.20 1.20 0.00% -25.00% -20.00%<br />

Loudoun, VA 0.70 0.70 0.80 0.60 -25.00% -14.29% -14.29%<br />

Manassas City, VA 0.70 0.60 0.80 0.70 -<strong>12</strong>.50% 16.67% 0.00%<br />

Manassas Park City, VA 0.80 1.60 0.80 0.60 -25.00% -62.50% -25.00%<br />

Prince William, VA 0.90 0.80 0.70 0.60 -14.29% -25.00% -33.33%<br />

Avg DOM 2019/<strong>12</strong> <strong>2020</strong>/01 <strong>2020</strong>/11 <strong>2020</strong>/<strong>12</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 20 31 19 22 15.79% -29.03% 10.00%<br />

Arlington, VA 25 30 19 28 47.37% -6.67% <strong>12</strong>.00%<br />

Fairfax City, VA 38 18 17 18 5.88% 0.00% -52.63%<br />

Fairfax, VA 29 33 17 18 5.88% -45.45% -37.93%<br />

Falls Church City, VA 44 25 13 31 138.46% 24.00% -29.55%<br />

Fauquier, VA 58 66 22 44 100.00% -33.33% -24.14%<br />

Loudoun, VA 30 35 13 17 30.77% -51.43% -43.33%<br />

Manassas City, VA 24 34 <strong>12</strong> 18 50.00% -47.06% -25.00%<br />

Manassas Park City, VA 42 28 8 11 37.50% -60.71% -73.81%<br />

Prince William, VA 29 39 11 13 18.18% -66.67% -55.17%<br />

Avg Sale to Orig Price Ratio 2019/<strong>12</strong> <strong>2020</strong>/01 <strong>2020</strong>/11 <strong>2020</strong>/<strong>12</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 100.00% 100.00% 100.00% 99.30% -0.70% -0.70% -0.70%<br />

Arlington, VA 100.00% 100.00% 100.00% 98.90% -1.10% -1.10% -1.10%<br />

Fairfax City, VA 99.40% 99.10% 99.20% 100.00% 0.81% 0.91% 0.60%<br />

Fairfax, VA 99.30% 99.30% 100.00% 100.00% 0.00% 0.70% 0.70%<br />

Falls Church City, VA 98.40% 96.70% 99.20% 97.80% -1.41% 1.14% -0.61%<br />

Fauquier, VA 97.40% 97.80% 100.00% 100.00% 0.00% 2.25% 2.67%<br />

Loudoun, VA 100.00% 99.30% 100.00% 100.00% 0.00% 0.70% 0.00%<br />

Manassas City, VA 99.30% 98.30% 100.00% 100.00% 0.00% 1.73% 0.70%<br />

Manassas Park City, VA 97.30% 100.00% 101.90% 100.70% -1.18% 0.70% 3.49%<br />

Prince William, VA 99.60% 99.00% 101.00% 100.30% -0.69% 1.31% 0.70%<br />

- 7 -

|| NORTHERN VIRGINIA OVERVIEW NOVEMBER <strong>2020</strong><br />

CURRENT MARKET SUPPLY – MARKET SHIFT INDICATOR<br />

Active Listings 2019/<strong>12</strong> <strong>2020</strong>/01 <strong>2020</strong>/11 <strong>2020</strong>/<strong>12</strong>MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 291 316 656 489 -25.46% 54.75% 68.04%<br />

Arlington, VA 324 3<strong>12</strong> 883 646 -26.84% 107.05% 99.38%<br />

Fairfax City, VA 101 89 81 51 -37.04% -42.70% -49.50%<br />

Fairfax, VA 2739 2600 3329 2197 -34.00% -15.50% -19.79%<br />

Falls Church City, VA 14 16 24 19 -20.83% 18.75% 35.71%<br />

Fauquier, VA 450 416 325 210 -35.38% -49.52% -53.33%<br />

Loudoun, VA 1387 1315 1313 838 -36.18% -36.27% -39.58%<br />

Manassas City, VA 119 <strong>12</strong>1 <strong>12</strong>1 69 -42.98% -42.98% -42.02%<br />

Manassas Park City, VA 61 52 40 26 -35.00% -50.00% -57.38%<br />

Prince William, VA 1524 1402 1420 907 -36.13% -35.31% -40.49%<br />

ACTIVE LISTINGS:<br />

This is the indicator that will predict shift from the Seller’s <strong>Market</strong> to a Balanced or Buyer’s <strong>Market</strong>.<br />

The cities <strong>of</strong> Alexandria, Arlington and Falls Church are the only Cities/Counties that are up YTD as well as YoY. These Sellers<br />

are benefiting from the market, while these markets start to cool driven by rising condominiums on the market in all three<br />

cities.<br />

The greatest YoY rise are the two cities with cooling prices and the two counties with the lowest change are the two with the<br />

greatest increase in price.<br />

Is the Amazon Effect cooling with the pandemic and thoughtful sellers migrating out <strong>of</strong> the city?<br />

- 8 -

NOVEMBER <strong>2020</strong> NORTHERN VIRGINIA OVERVIEW ||<br />

NEW SUPPLY – THE FUEL FOR THE MARKET<br />

New Listings 2019/<strong>12</strong> <strong>2020</strong>/01 <strong>2020</strong>/11 <strong>2020</strong>/<strong>12</strong>MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 83 181 224 175 -21.88% -3.31% 110.84%<br />

Arlington, VA 98 177 277 180 -35.02% 1.69% 83.67%<br />

Fairfax City, VA 21 23 30 19 -36.67% -17.39% -9.52%<br />

Fairfax, VA 597 1089 <strong>12</strong>08 876 -27.48% -19.56% 46.73%<br />

Falls Church City, VA 6 7 9 9 0.00% 28.57% 50.00%<br />

Fauquier, VA 64 108 96 55 -42.71% -49.07% -14.06%<br />

Loudoun, VA 318 540 492 426 -13.41% -21.11% 33.96%<br />

Manassas City, VA 28 46 54 40 -25.93% -13.04% 42.86%<br />

Manassas Park City, VA 20 14 17 15 -11.76% 7.14% -25.00%<br />

Prince William, VA 336 536 621 491 -20.93% -8.40% 46.13%<br />

NEW LISTINGS:<br />

This is the fuel to the current market as these New Listings are sold as fast as they come to market without improving the<br />

inventory situation.<br />

The interesting point to note from this chart is the upward trend <strong>of</strong> new listings that began in May after the pandemic dip during<br />

March/April and continues currently. This is the time <strong>of</strong> year when the market begins to cool from the spring / summer market,<br />

however, this chart proves the shift <strong>of</strong> the spring / summer market to late summer and fall. The boundaries <strong>of</strong> school years are<br />

not impacting the market this season with folks working and learning from home.<br />

While new listings are rising in the urban cities YoY, the current month indicates declines and flattening in new listings. New<br />

listings are the current market and without them, inventory becomes more constrained. Buyer demand remains high during this<br />

holiday season with ever more constrained inventory.<br />

Are the cities migrating to the outer counties and fueling the growth in Fauquier, Loudoun and Prince William?<br />

- 9 -

|| NORTHERN VIRGINIA OVERVIEW NOVEMBER <strong>2020</strong><br />

PAST DEMAND – PREVIOUS 45-60 DAYS PENDINGS<br />

Sold Listings 2019/<strong>12</strong> <strong>2020</strong>/01 <strong>2020</strong>/11 <strong>2020</strong>/<strong>12</strong>MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 179 <strong>12</strong>3 217 232 6.91% 88.62% 29.61%<br />

Arlington, VA 190 138 208 256 23.08% 85.51% 34.74%<br />

Fairfax City, VA 34 14 32 31 -3.13% <strong>12</strong>1.43% -8.82%<br />

Fairfax, VA 1092 765 1369 1330 -2.85% 73.86% 21.79%<br />

Falls Church City, VA 10 4 10 9 -10.00% <strong>12</strong>5.00% -10.00%<br />

Fauquier, VA 79 65 107 <strong>12</strong>6 17.76% 93.85% 59.49%<br />

Loudoun, VA 484 310 647 625 -3.40% 101.61% 29.13%<br />

Manassas City, VA 60 28 57 73 28.07% 160.71% 21.67%<br />

Manassas Park City, VA <strong>12</strong> 16 21 24 14.29% 50.00% 100.00%<br />

Prince William, VA 551 387 692 727 5.06% 87.86% 31.94%<br />

SOLD LISTINGS:<br />

This indicator is the lagging indicator to New Listings. Like New Listings, Sold Listings continue to rise into the Fall Season and<br />

is thus much higher regarding Year over Year change percentages.<br />

Sold Listings continued to rise gobbling up Active Listings with New and Pending Listings declining. I call this the end <strong>of</strong> year<br />

clean out the Listings Closet sale.<br />

- 10 -

NOVEMBER <strong>2020</strong> NORTHERN VIRGINIA OVERVIEW ||<br />

CURRENT MARKET DEMAND<br />

Pending Listings 2019/<strong>12</strong> <strong>2020</strong>/01 <strong>2020</strong>/11 <strong>2020</strong>/<strong>12</strong>MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 107 130 138 162 17.39% 24.62% 51.40%<br />

Arlington, VA 97 113 171 149 -<strong>12</strong>.87% 31.86% 53.61%<br />

Fairfax City, VA 13 18 19 23 21.05% 27.78% 76.92%<br />

Fairfax, VA 592 713 1025 838 -18.24% 17.53% 41.55%<br />

Falls Church City, VA 3 2 6 9 50.00% 350.00% 200.00%<br />

Fauquier, VA 55 60 98 59 -39.80% -1.67% 7.27%<br />

Loudoun, VA 233 309 477 348 -27.04% <strong>12</strong>.62% 49.36%<br />

Manassas City, VA 26 34 47 32 -31.91% -5.88% 23.08%<br />

Manassas Park City, VA 16 14 14 17 21.43% 21.43% 6.25%<br />

Prince William, VA 311 377 563 440 -21.85% 16.71% 41.48%<br />

PENDING LISTINGS:<br />

This is the Current Demand indicator and it continues to decline along with New Listings. The Year over Year Change is higher<br />

than previous years but is illustrating a downward trend. The Holiday season slowed the market as sellers chose to enjoy the<br />

holidays instead <strong>of</strong> coming to market.<br />

The interesting change for this year is the percentage <strong>of</strong> change in the more rural Counties <strong>of</strong> Fauquier, Loudoun, Prince<br />

William and Manassas as Current Demand.<br />

Pending sales are driven by New Listings and are currently throttled with declining New Listings!<br />

- 11 -

|| NORTHERN VIRGINIA OVERVIEW NOVEMBER <strong>2020</strong><br />

MARKET SUPPLY – INVENTORY TREND<br />

EOM Inv 2019/<strong>12</strong> <strong>2020</strong>/01 <strong>2020</strong>/11 <strong>2020</strong>/<strong>12</strong>MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 94 111 404 3<strong>12</strong> -22.77% 181.08% 231.91%<br />

Arlington, VA 91 94 588 4<strong>12</strong> -29.93% 338.30% 352.75%<br />

Fairfax City, VA 22 19 45 33 -26.67% 73.68% 50.00%<br />

Fairfax, VA 787 799 1750 <strong>12</strong>31 -29.66% 54.07% 56.42%<br />

Falls Church City, VA 4 8 13 10 -23.08% 25.00% 150.00%<br />

Fauquier, VA <strong>12</strong>9 <strong>12</strong>5 177 132 -25.42% 5.60% 2.33%<br />

Loudoun, VA 323 354 582 408 -29.90% 15.25% 26.32%<br />

Manassas City, VA 38 36 59 39 -33.90% 8.33% 2.63%<br />

Manassas Park City, VA 20 19 19 13 -31.58% -31.58% -35.00%<br />

Prince William, VA 450 449 598 433 -27.59% -3.56% -3.78%<br />

END OF MONTH INVENTORY:<br />

New Listings are absolutely the “Fuel” that drives the current market and feeds current Demand requirements. Inventory was<br />

starting to rise, however, holiday season took the air out <strong>of</strong> the market. Demand contined with an End <strong>of</strong> Year, Empty the Closet<br />

Sale with New Listings declining.<br />

The region has been in a downward errosion <strong>of</strong> inventory for the past 5 years with slight improvement in <strong>2020</strong> but not enough<br />

to come close to balancing the market and the momentum was lost during Holiday Season. It does illustrate that even during<br />

the Holiday Season Demand continued.<br />

Momentum was lost in lieu <strong>of</strong> a much needed Holiday Season!<br />

- <strong>12</strong> -

NOVEMBER <strong>2020</strong> NORTHERN VIRGINIA OVERVIEW ||<br />

SELLER – BALANCED – BUYER MARKET ?<br />

BUYERS<br />

MARKET<br />

BALANCED<br />

MARKET<br />

SELLERS<br />

MARKET<br />

Avg Months <strong>of</strong> Inventory 2019/<strong>12</strong> <strong>2020</strong>/01 <strong>2020</strong>/11 <strong>2020</strong>/<strong>12</strong>MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 0.60 0.60 1.50 1.40 -6.67% 133.33% 133.33%<br />

Arlington, VA 0.50 0.50 2.40 2.00 -16.67% 300.00% 300.00%<br />

Fairfax City, VA 0.80 0.60 1.20 1.00 -16.67% 66.67% 25.00%<br />

Fairfax, VA 0.70 0.70 1.10 0.90 -18.18% 28.57% 28.57%<br />

Falls Church City, VA 0.40 0.80 0.80 1.00 25.00% 25.00% 150.00%<br />

Fauquier, VA 1.50 1.60 1.20 1.20 0.00% -25.00% -20.00%<br />

Loudoun, VA 0.70 0.70 0.80 0.60 -25.00% -14.29% -14.29%<br />

Manassas City, VA 0.70 0.60 0.80 0.70 -<strong>12</strong>.50% 16.67% 0.00%<br />

Manassas Park City, VA 0.80 1.60 0.80 0.60 -25.00% -62.50% -25.00%<br />

Prince William, VA 0.90 0.80 0.70 0.60 -14.29% -25.00% -33.33%<br />

MONTHS OF INVENTORY:<br />

This metric is also called Absorption Rate meaning the number <strong>of</strong> months it would take to sell everything that is on the market.<br />

Across the region we see only about a Month <strong>of</strong> Inventory and 2 Months in Arlington and still leaves all <strong>of</strong> the region in a 5 year<br />

Sellers <strong>Market</strong>.<br />

A Sellers <strong>Market</strong> is considerd 0 to 4 Months – Balanced <strong>Market</strong> is 4 to 6 Months – Buyers <strong>Market</strong> is 6+ Months. The NVA region<br />

has not seen a balanced market in greater than 5 years. The Active Listings metric is the one to watch. As Active Listings begin<br />

to rise and thus End <strong>of</strong> Month Inventory, only then will we see the Absorption Rate rise and shift the market.<br />

Current growth in Inventory is driven by those Condominium cities with the Holiday Season stealing the Growth<br />

momentum. <strong>Northern</strong> <strong>Virginia</strong> is more Inventory constrained than the National numbers, illustrates strong Demand<br />

and is a long way from reaching a balanced market!<br />

- 13 -

|| NORTHERN VIRGINIA OVERVIEW NOVEMBER <strong>2020</strong><br />

MARKET VALUE – PRICE APPRECIATION<br />

Avg Median Sales Price 2019/<strong>12</strong> <strong>2020</strong>/01 <strong>2020</strong>/11 <strong>2020</strong>/<strong>12</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA $ 553,000 $ 453,000 $ 540,000 $ 537,500 -0.46% 18.65% -2.80%<br />

Arlington, VA $ 579,000 $ 530,000 $ 602,500 $ 615,000 2.07% 16.04% 6.22%<br />

Fairfax City, VA $ 548,750 $ 480,994 $ 562,500 $ 570,000 1.33% 18.50% 3.87%<br />

Fairfax, VA $ 540,000 $ 515,000 $ 560,000 $ 552,685 -1.31% 7.32% 2.35%<br />

Falls Church City, VA $ 889,500 $ 475,000 $ 771,500 $ 525,000 -31.95% 10.53% -40.98%<br />

Fauquier, VA $ 450,000 $ 375,000 $ 469,900 $ 449,950 -4.25% 19.99% -0.01%<br />

Loudoun, VA $ 525,000 $ 497,284 $ 560,000 $ 540,000 -3.57% 8.59% 2.86%<br />

Manassas City, VA $ 369,500 $ 317,500 $ 3<strong>12</strong>,000 $ 345,000 10.58% 8.66% -6.63%<br />

Manassas Park City, VA $ 315,000 $ 317,500 $ 359,900 $ 345,000 -4.14% 8.66% 9.52%<br />

Prince William, VA $ 380,000 $ 365,000 $ 411,000 $ 420,000 2.19% 15.07% 10.53%<br />

AVERAGE MEDIAN SALES PRICE:<br />

As Inventory declines, Median Sales Prices continue to rise with a little s<strong>of</strong>tening during the <strong>December</strong> Holiday season. Falls<br />

Church appears to be the most erradic but it represents lower volume, however, it is clear there is a slow and steady rise<br />

without significant change. This trend will continue until the inventory situation improves. The only balance to this rise will be<br />

when Supply improves to meet Demand.<br />

Prices s<strong>of</strong>tened during the <strong>December</strong> holiday season with declining New Listings throttling New Pending Listings<br />

and Sold Listings erroding Active Inventory.<br />

- 14 -

NOVEMBER <strong>2020</strong> NORTHERN VIRGINIA OVERVIEW ||<br />

MARKETABILITY DRIVERS – CONDITION AND PRICE<br />

Avg DOM 2019/<strong>12</strong> <strong>2020</strong>/01 <strong>2020</strong>/11 <strong>2020</strong>/<strong>12</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 20 31 19 22 15.79% -29.03% 10.00%<br />

Arlington, VA 25 30 19 28 47.37% -6.67% <strong>12</strong>.00%<br />

Fairfax City, VA 38 18 17 18 5.88% 0.00% -52.63%<br />

Fairfax, VA 29 33 17 18 5.88% -45.45% -37.93%<br />

Falls Church City, VA 44 25 13 31 138.46% 24.00% -29.55%<br />

Fauquier, VA 58 66 22 44 100.00% -33.33% -24.14%<br />

Loudoun, VA 30 35 13 17 30.77% -51.43% -43.33%<br />

Manassas City, VA 24 34 <strong>12</strong> 18 50.00% -47.06% -25.00%<br />

Manassas Park City, VA 42 28 8 11 37.50% -60.71% -73.81%<br />

Prince William, VA 29 39 11 13 18.18% -66.67% -55.17%<br />

AVERAGE DAYS ON MARKET:<br />

The time to market a property has also been on a steady decline for greater than 5 years. Properties that do not sell within the<br />

first 20 days or less are either not in a condition that presents well and / or the price is not set to match the market. Just<br />

because it is a Sellers <strong>Market</strong> does not mean that Buyers are being wreckless with their <strong>of</strong>fers also indicating we are not<br />

setting up for a crash like that <strong>of</strong> 2008-2009.<br />

The decline <strong>of</strong> Days On <strong>Market</strong> also indicates strong Coming Soon campaigns with <strong>of</strong>fers coming as soon as a property goes<br />

Active on the market. These are savvy buyers with pr<strong>of</strong>essional representation to drive a strategy to win. Chasing the market by<br />

waiting for properties to hit the market and syndicate across advertising platorms is chasing strategy. Buyers <strong>of</strong>ten wonder<br />

how a property sells in 4 or less days. It is because it was presented as a Coming Soon for up to a month garnering interest and<br />

preparation from those buyers well represented, committed to buying and being ready to write the <strong>of</strong>fer at the time the<br />

property goes active and / or prior to it going active sight unseen.<br />

Days on <strong>Market</strong> is also rising with the s<strong>of</strong>tening Prices with Sold Listings eroding aging Active Listings with the<br />

decline in New Listings.<br />

- 15 -

|| NORTHERN VIRGINIA OVERVIEW NOVEMBER <strong>2020</strong><br />

MARKET NEGOTIABILITY – BIDDING WARS ?<br />

Avg Sale to Orig Price Ratio 2019/<strong>12</strong> <strong>2020</strong>/01 <strong>2020</strong>/11 <strong>2020</strong>/<strong>12</strong> MoM CHGYTD CHG YoY CHG<br />

Alexandria City, VA 100.00% 100.00% 100.00% 99.30% -0.70% -0.70% -0.70%<br />

Arlington, VA 100.00% 100.00% 100.00% 98.90% -1.10% -1.10% -1.10%<br />

Fairfax City, VA 99.40% 99.10% 99.20% 100.00% 0.81% 0.91% 0.60%<br />

Fairfax, VA 99.30% 99.30% 100.00% 100.00% 0.00% 0.70% 0.70%<br />

Falls Church City, VA 98.40% 96.70% 99.20% 97.80% -1.41% 1.14% -0.61%<br />

Fauquier, VA 97.40% 97.80% 100.00% 100.00% 0.00% 2.25% 2.67%<br />

Loudoun, VA 100.00% 99.30% 100.00% 100.00% 0.00% 0.70% 0.00%<br />

Manassas City, VA 99.30% 98.30% 100.00% 100.00% 0.00% 1.73% 0.70%<br />

Manassas Park City, VA 97.30% 100.00% 101.90% 100.70% -1.18% 0.70% 3.49%<br />

Prince William, VA 99.60% 99.00% 101.00% 100.30% -0.69% 1.31% 0.70%<br />

AVERAGE SALES PRICES TO ORIGINAL LIST PRICE RATIO:<br />

This metric describes the Negotiability <strong>of</strong> properties. When a buyer asks about making an <strong>of</strong>fer below list price, I present this<br />

metric and trend line. It has been more than 5 years since a buyer can negotiate a properties price down. Properties are coming<br />

to market well priced keeping a steady 100% Ratio for the region.<br />

This metric also indicates that there are not “bidding” wars per se. Yes, there are multiple contracts on properties but price is<br />

not the deciding factor. The seller is looking for <strong>of</strong>fers with the least amount <strong>of</strong> risk as well as the best value and this metric<br />

indicates reasonable pricing and closing prices.<br />

- 16 -

NOVEMBER <strong>2020</strong> NORTHERN VIRGINIA OVERVIEW ||<br />

EXTERNAL DRIVERS<br />

BUYER DEMAND STRENGTH FUELED BY<br />

RECORD SETTING INTEREST RATES AND MORTGAGE ORIGINATIONS<br />

Mortgage Originations<br />

at a 14 Year High<br />

- 17 -

|| NORTHERN VIRGINIA OVERVIEW NOVEMBER <strong>2020</strong><br />

BUYER STRENGTH – INTEREST RATES, MORTGAGE ORIGINATION AND DOWN PAYMENTS<br />

The external drivers indicating demand are the mortgage interest rates and the mortgage applications. Interest rates continue<br />

decline and are now predicted to stay low over the next 4 years. Mortgage Originations are up 26% annually, while Refi<br />

Originations are up <strong>12</strong>4% annually. The interesting metric is that Refi’s represent 74.8% <strong>of</strong> the Originations.<br />

Homes at the lower end are rising fast with cash investors creating a challenging environment for first-time buyers. I believe<br />

the story is the large portion <strong>of</strong> Refi Originations indicating investment into current homes instead <strong>of</strong> selling. The Refi indicates<br />

a decision to reamain in place and thus will not be a reprieve to the current inventory constrained situation.<br />

GROWTH IN BUYER COMMUNITY AND REQUIREMENTS<br />

In a recent article on Mortgage News Daily, a survey was cited that almost 50% <strong>of</strong> all Americans are considering a move.<br />

Motivation to consider the move is COVID-19 as they want to leave the cities and require more space.<br />

They are considering the following:<br />

27% are considering their current area<br />

<strong>12</strong>% are considering a nearby city<br />

8% are planning a relocation to another state<br />

Outcomes they expect to achieve are:<br />

44% expect to reduce expenses<br />

27% are seeking larger space<br />

27% are seeking different features in a home<br />

<strong>12</strong>% want to change their location<br />

The desire to make a move are fueled by the COVID virus putting<br />

additional pressure on inventory demands along with their<br />

current home equity and historically low interest rates. The<br />

following chart is from the article citing desired features in<br />

homes currently.<br />

LARGEST BUYER COMMUNITY, FIRST TIME BUYERS - FIRST TIME BUYER CHARACTERISTICS<br />

The market is a pure Demand versus Supply market favoring the Sellers currently and over the past 5 years. Even though the<br />

market favors the Seller, it is important for Sellers to understand who their buyer is, their characteristics, requirements and<br />

purchasing preferences.<br />

Millennials are the largest buying force in the market<br />

First-time buyers driving demand based on size and price<br />

accordingly<br />

Millennials are ready to grow their family<br />

Millennials grew up leveraging technology and are using it at a<br />

high level – photos, videos, and property presentation matter<br />

regardless <strong>of</strong> it being a Sellers’ <strong>Market</strong><br />

Millennials seek move-in ready – not interested in inheriting<br />

projects, again regardless <strong>of</strong> it being a Sellers’ <strong>Market</strong><br />

COVID has accelerated the decision to purchase<br />

Remote working has added to the savings account<br />

Serious Buyers expect competition, are creating a strategy,<br />

preparing via online viewing and Coming Soon campaigns with<br />

their pr<strong>of</strong>essional agent along with added savings<br />

- 18 -

THE CITIES OF THE<br />

NORTHERN VIRGINIA MARKET

|| ALEXANDRIA CITY OVERVIEW<br />

SUPPLY<br />

ACTIVE LISTINGS<br />

FUEL TO SUPPLY<br />

NEW LISTINGS<br />

CURRENT DEMAND<br />

PENDING LISTINGS<br />

PAST DEMAND<br />

CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

55% 68% -3% 111% 25% 51% 89% 30%<br />

489<br />

175 162 232<br />

VALUE<br />

MEDIAN SALES PRICE<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

19% -3% -29% 10% -1% -1% 133% 133%<br />

$537,500<br />

MARKETING<br />

DAYS ON MARKET<br />

22 99.30%<br />

- 21 -<br />

NEGOTIABILITY<br />

SALE TO ORIG LIST PRICE<br />

MARKET PACE<br />

AVG MONTHS OF INV<br />

1.40

|| ALEXANDRIA CITY OVERVIEW NOVEMBER <strong>2020</strong><br />

YoY AND YoY YTD COMPARISON TO PREVIOUS YEAR<br />

ALEXANDRIA CITY<br />

DECEMBER<br />

YoY CHANGE %<br />

Condominium<br />

Detached<br />

Townhouse<br />

Number<br />

<strong>of</strong> Sales<br />

YoY<br />

SALES<br />

AVG<br />

DOM<br />

YoY<br />

DOM<br />

Avg<br />

Price/SqFt<br />

YoY $ /<br />

SQFT<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

YoY $<br />

RATIO<br />

Avg Close<br />

Price<br />

YoY<br />

CLOSE<br />

2019 172 20 $ 424.38 98.19% $ 570,001<br />

<strong>2020</strong> 214 24.42% 22 9.27% $ 423.28 -0.26% 98.49% 0.30% $ 570,782 0.14%<br />

2019 1,057 18 $ 323.89<br />

99.11% $ 323,256<br />

<strong>2020</strong> 1,108 4.82% 17 -3.02% $ 382.65 18.14% 98.48% -0.64% $ 340,674 5.39%<br />

2019 382 18 $ 485.82<br />

98.77% $ 861,659<br />

<strong>2020</strong> 377 -1.31% 18 -4.40% $ 516.45 6.31% 99.01% 0.24% $ 930,674 8.01%<br />

2019 884 18 $ 1,293.76<br />

99.87% $ 688,386<br />

<strong>2020</strong> 981 10.97% 15 -16.93% $ 476.24 -63.19% 99.73% -0.14% $ 719,708 4.55%<br />

ALEXANDRIA CITY<br />

DECEMBER<br />

YTD AVGs<br />

YoY CHG %<br />

Condominium<br />

Detached<br />

Townhouse<br />

Number<br />

<strong>of</strong> Sales<br />

YoY<br />

SALES<br />

AVG<br />

DOM<br />

YoY<br />

DOM<br />

Avg<br />

Price/SqFt<br />

YoY $ /<br />

SQFT<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

YoY $<br />

RATIO<br />

Avg Close<br />

Price<br />

YoY<br />

CLOSE<br />

2019 2,323 18 $ 719.47 99.38% $ 550,740<br />

<strong>2020</strong> 2,466 6.16% 16 -8.76% $ 440.61 -38.76% 99.22% -0.16% $ 581,656 5.61%<br />

2019 1,057 18 $ 323.89<br />

99.11% $ 323,256<br />

<strong>2020</strong> 1,108 4.82% 17 -3.02% $ 382.65 18.14% 98.48% -0.64% $ 340,674 5.39%<br />

2019 382 18 $ 485.82<br />

98.77% $ 861,659<br />

<strong>2020</strong> 377 -1.31% 18 -4.40% $ 516.45 6.31% 99.01% 0.24% $ 930,674 8.01%<br />

2019 884 18 $ 1,293.76<br />

99.87% $ 688,386<br />

<strong>2020</strong> 981 10.97% 15 -16.93% $ 476.24 -63.19% 99.73% -0.14% $ 719,708 4.55%<br />

- 22 -

NOVEMBER <strong>2020</strong> ALEXANDRIA CITY OVERVIEW ||<br />

CURRENT DEMAND<br />

PENDING LISTINGS<br />

MARKET DEMAND<br />

PAST DEMAND<br />

CLOSED LISTINGS<br />

VALUE<br />

MEDIAN SALES PRICE<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

25% 51% 89% 30% 19% -3%<br />

162 232<br />

$537,500<br />

MARKETING<br />

DAYS ON MARKET<br />

MARKET AND NEGOTIABILITY<br />

NEGOTIABILITY<br />

SALE TO ORIG LIST PRICE<br />

MARKET PACE<br />

AVG MONTHS OF INV<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

-29% 10% -1% -1% 133% 133%<br />

22 99.30%<br />

1.40<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$5,051 29%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

-33% -14% -18% -15%<br />

- 23 -

|| ALEXANDRIA CITY OVERVIEW NOVEMBER <strong>2020</strong><br />

SUPPLY<br />

ACTIVE LISTINGS<br />

MARKET SUPPLY<br />

FUEL TO SUPPLY<br />

NEW LISTINGS<br />

CURRENT DEMAND<br />

PENDING LISTINGS<br />

PAST DEMAND<br />

CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

55% 68% -3% 111% 25% 51% 89% 30%<br />

489<br />

175 162 232<br />

- 24 -

NOVEMBER <strong>2020</strong> ALEXANDRIA CITY OVERVIEW ||<br />

MARKET ANALYSIS BY STRUCTURE TYPE<br />

Avg<br />

Days on<br />

ALEXANDRIA CITY<br />

Avg Sale to<br />

Orig List<br />

Condominium<br />

Number<br />

<strong>of</strong> Sales<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Price Ratio<br />

TOTALS / AVGS 99 28 $ 342.32 $ 331,324 $ 337,696 98%<br />

BEDS<br />

92 28 $ 346.93 $ 317,925 $ 323,821 98%<br />

7 26 $ 281.70 $ 507,429 $ 520,057 98%<br />

DOM<br />

% <strong>of</strong> SALES<br />

61 11%<br />

AVG CONCESSION<br />

% OF SALES WITH<br />

A CONCESSION<br />

$4,166 36%<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

-<strong>12</strong>% 0% 10% 4%<br />

- 25 -

|| ALEXANDRIA CITY OVERVIEW NOVEMBER <strong>2020</strong><br />

Avg<br />

Days on<br />

Avg Sale to<br />

Orig List<br />

Detached<br />

Number<br />

<strong>of</strong> Sales<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Price Ratio<br />

TOTALS / AVGS 26 14 $ 5<strong>12</strong>.46 $ 917,2<strong>12</strong> $ 930,892 99%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

4 – 5<br />

ALEXANDRIA CITY<br />

4 <strong>12</strong> $ 671.57 $ 766,250 $ 785,000 98%<br />

10 13 $ 510.72 $ 873,050 $ 887,880 98%<br />

<strong>12</strong> 16 $ 460.87 $ 1,004,333 $ 1,015,367 99%<br />

DOM<br />

% <strong>of</strong> SALES<br />

61 2%<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$8,429 17%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

-25% -11% -70% -62%<br />

- 26 -

NOVEMBER <strong>2020</strong> ALEXANDRIA CITY OVERVIEW ||<br />

Avg<br />

Avg Sale to<br />

Number<br />

Avg Price Avg Close Avg Orig<br />

Days on<br />

Orig List<br />

<strong>of</strong> Sales<br />

/ SQFT Price List Price<br />

Townhouse<br />

Mkt<br />

Price Ratio<br />

TOTALS / AVGS 77 19 $ 488.65 $ 733,971 $ 747,446 98%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

4 – 5<br />

ALEXANDRIA CITY<br />

25 18 $ 545.16 $ 583,280 $ 593,9<strong>12</strong> 98%<br />

44 20 $ 484.00 $ 789,109 $ 804,093 98%<br />

8 17 $ 337.65 $ 901,625 $ 915,675 98%<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$5,885 23%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

-33% 5% -18% -15%<br />

DOM<br />

% <strong>of</strong> SALES<br />

61 3%<br />

- 27 -

|| ALEXANDRIA CITY OVERVIEW NOVEMBER <strong>2020</strong><br />

- 28 -

|| ARLINGTON CITY OVERVIEW<br />

SUPPLY<br />

ACTIVE LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

107% 99% 2% 84% 32% 54% 86% 35%<br />

646<br />

FUEL TO SUPPLY<br />

NEW LISTINGS<br />

CURRENT DEMAND<br />

PENDING LISTINGS<br />

PAST DEMAND<br />

CLOSED LISTINGS<br />

180 149 256<br />

VALUE<br />

MEDIAN SALES PRICE<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

16% 6% -7% <strong>12</strong>% -1% -1% 300% 300%<br />

$615,000<br />

MARKETING<br />

DAYS ON MARKET<br />

- 29 -<br />

NEGOTIABILITY<br />

SALE TO ORIG LIST PRICE<br />

28 98.90%<br />

MARKET PACE<br />

AVG MONTHS OF INV<br />

2.00

|| ARLINGTON CITY OVERVIEW NOVEMBER <strong>2020</strong><br />

YoY AND YoY YTD COMPARISON TO PREVIOUS YEAR<br />

ARLINGTON CITY<br />

DECEMBER<br />

YoY CHANGE %<br />

Condominium<br />

Detached<br />

Townhouse<br />

Number<br />

<strong>of</strong> Sales<br />

YoY<br />

SALES<br />

AVG<br />

DOM<br />

YoY<br />

DOM<br />

Avg<br />

Price/SqFt<br />

YoY $ /<br />

SQFT<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

YoY $<br />

RATIO<br />

Avg Close<br />

Price<br />

YoY<br />

CLOSE<br />

2019 189 25 $ 455.56 98.45% $ 616,491<br />

<strong>2020</strong> 242 28.04% 28 10.16% $ 487.33 6.98% 97.82% -0.65% $ 651,622 5.70%<br />

2019 1,266 22 $ 451.22<br />

99.45% $ 423,024<br />

<strong>2020</strong> 1,151 -9.08% 19 -13.03% $ 469.68 4.09% 99.01% -0.45% $ 445,415 5.29%<br />

2019 825 23 $ 514.11<br />

99.02% $ 929,365<br />

<strong>2020</strong> 795 -3.64% 17 -24.10% $ 559.85 8.90% 99.90% 0.89% $ 971,468 4.53%<br />

2019 415 13 $ 467.13<br />

100.97% $ 647,982<br />

<strong>2020</strong> 498 20.00% 13 -4.40% $ 496.29 6.24% 96.93% -4.00% $ 700,026 8.03%<br />

ARLINGTON CITY<br />

DECEMBER<br />

YTD AVGs<br />

YoY CHG %<br />

Condominium<br />

Detached<br />

Townhouse<br />

Number<br />

<strong>of</strong> Sales<br />

YoY<br />

SALES<br />

AVG<br />

DOM<br />

YoY<br />

DOM<br />

Avg<br />

Price/SqFt<br />

YoY $ /<br />

SQFT<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

YoY $<br />

RATIO<br />

Avg Close<br />

Price<br />

YoY<br />

CLOSE<br />

2019 2,506 21 $ 474.58 99.49% $ 626,970<br />

<strong>2020</strong> 2,444 -2.47% 17 -17.32% $ 504.45 6.29% 98.97% -0.53% $ 668,413 6.61%<br />

2019 1,266 22 $ 451.22<br />

99.45% $ 423,024<br />

<strong>2020</strong> 1,151 -9.08% 19 -13.03% $ 469.68 4.09% 99.01% -0.45% $ 445,415 5.29%<br />

2019 825 23 $ 514.11<br />

99.02% $ 929,365<br />

<strong>2020</strong> 795 -3.64% 17 -24.10% $ 559.85 8.90% 99.90% 0.89% $ 971,468 4.53%<br />

2019 415 13 $ 467.13<br />

100.97% $ 647,982<br />

<strong>2020</strong> 498 20.00% 13 -4.40% $ 496.29 6.24% 96.93% -4.00% $ 700,026 8.03%<br />

- 30 -

NOVEMBER <strong>2020</strong> ARLINGTON CITY OVERVIEW ||<br />

CURRENT DEMAND<br />

PENDING LISTINGS<br />

MARKET DEMAND<br />

PAST DEMAND<br />

CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

32% 54% 86% 35% 16% 6%<br />

149 256<br />

VALUE<br />

MEDIAN SALES PRICE<br />

$615,000<br />

MARKETING<br />

DAYS ON MARKET<br />

MARKET AND NEGOTIABILITY<br />

NEGOTIABILITY<br />

SALE TO ORIG LIST PRICE<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

-7% <strong>12</strong>% -1% -1% 300% 300%<br />

28 98.90%<br />

MARKET PACE<br />

AVG MONTHS OF INV<br />

2.00<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$6,698 37%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

23% 5% 65% 45%<br />

- 31 -

|| ARLINGTON CITY OVERVIEW NOVEMBER <strong>2020</strong><br />

SUPPLY<br />

ACTIVE LISTINGS<br />

MARKET SUPPLY<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

107% 99% 2% 84% 32% 54% 86% 35%<br />

646<br />

FUEL TO SUPPLY<br />

NEW LISTINGS<br />

CURRENT DEMAND<br />

PENDING LISTINGS<br />

PAST DEMAND<br />

CLOSED LISTINGS<br />

180 149 256<br />

- 32 -

NOVEMBER <strong>2020</strong> ARLINGTON CITY OVERVIEW ||<br />

MARKET ANALYSIS BY STRUCTURE TYPE<br />

Avg<br />

Days on<br />

ARLINGTON CITY<br />

Avg Sale to<br />

Orig List<br />

Condominium<br />

Number<br />

<strong>of</strong> Sales<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Price Ratio<br />

TOTALS / AVGS 105 37 $ 466.79 $ 439,250 $ 453,228 97%<br />

BEDS<br />

101 37 $ 471.95 $ 437,795 $ 451,757 97%<br />

4 32 $ 336.50 $ 476,000 $ 490,375 97%<br />

DOM<br />

% <strong>of</strong> SALES<br />

61 19%<br />

AVG CONCESSION<br />

% OF SALES WITH<br />

A CONCESSION<br />

$6,482 38%<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

48% -3% 91% 97%<br />

- 33 -

|| ARLINGTON CITY OVERVIEW NOVEMBER <strong>2020</strong><br />

Avg<br />

Days on<br />

Avg Sale to<br />

Orig List<br />

Detached<br />

Number<br />

<strong>of</strong> Sales<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Price Ratio<br />

TOTALS / AVGS 71 18 $ 532.<strong>12</strong> $ 922,808 $ 943,267 98%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

4 – 5<br />

ARLINGTON CITY<br />

5 6 $ 725.21 $ 916,200 $ 934,000 98%<br />

28 14 $ 565.58 $ 837,<strong>12</strong>1 $ 836,421 100%<br />

38 22 $ 482.05 $ 986,816 $ 1,023,215 96%<br />

DOM<br />

% <strong>of</strong> SALES<br />

61 8%<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$9,013 32%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

5% 33% 30% 22%<br />

- 34 -

NOVEMBER <strong>2020</strong> ARLINGTON CITY OVERVIEW ||<br />

Avg<br />

Avg Sale to<br />

Number<br />

Avg Price Avg Close Avg Orig<br />

Days on<br />

Orig List<br />

<strong>of</strong> Sales<br />

/ SQFT Price List Price<br />

Townhouse<br />

Mkt<br />

Price Ratio<br />

TOTALS / AVGS 53 26 $ 470.56 $ 695,260 $ 704,276 99%<br />

BEDS<br />

< 2<br />

3 4 – 5<br />

3 4 – 5<br />

4 – 5<br />

ARLINGTON CITY<br />

28 24 $ 516.04 $ 523,600 $ 532,178 98%<br />

14 14 $ 458.70 $ 874,679 $ 883,<strong>12</strong>5 99%<br />

11 46 $ 369.88 $ 903,864 $ 914,717 99%<br />

DOM<br />

% <strong>of</strong> SALES<br />

61 8%<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$4,855 41%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

19% -13% 63% -4%<br />

- 35 -

|| ARLINGTON CITY OVERVIEW NOVEMBER <strong>2020</strong><br />

- 36 -

|| FAIRFAX CITY OVERVIEW<br />

SUPPLY<br />

ACTIVE LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

-43% -50% -17% -10% 28% 77% <strong>12</strong>1% -9%<br />

51<br />

FUEL TO SUPPLY<br />

NEW LISTINGS<br />

CURRENT DEMAND<br />

PENDING LISTINGS<br />

PAST DEMAND<br />

CLOSED LISTINGS<br />

19 23 31<br />

VALUE<br />

MEDIAN SALES PRICE<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

19% 4% 0% -53% 1% 1% 67% 25%<br />

$570,000<br />

MARKETING<br />

DAYS ON MARKET<br />

- 37 -<br />

NEGOTIABILITY<br />

SALE TO ORIG LIST PRICE<br />

18 100.00%<br />

MARKET PACE<br />

AVG MONTHS OF INV<br />

1.00

|| FAIRFAX CITY OVERVIEW NOVEMBER <strong>2020</strong><br />

YoY AND YoY YTD COMPARISON TO PREVIOUS YEAR<br />

FAIRFAX CITY<br />

DECEMBER<br />

YoY CHANGE %<br />

Condominium<br />

Detached<br />

Townhouse<br />

Number<br />

<strong>of</strong> Sales<br />

YoY<br />

SALES<br />

AVG<br />

DOM<br />

YoY<br />

DOM<br />

Avg<br />

Price/SqFt<br />

YoY $ /<br />

SQFT<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

YoY $<br />

RATIO<br />

Avg Close<br />

Price<br />

YoY<br />

CLOSE<br />

2019 33 38 $ 308.46 97.63% $ 548,752<br />

<strong>2020</strong> 28 -15.15% 19 -49.60% $ 340.45 10.37% 99.69% 2.11% $ 575,275 4.83%<br />

2019 60 33 $ 262.23<br />

96.69% $ 287,216<br />

<strong>2020</strong> 70 16.67% 19 -41.71% $ 279.67 6.65% 98.36% 1.73% $ 287,042 -0.06%<br />

2019 224 32 $ 347.55<br />

98.10% $ 610,416<br />

<strong>2020</strong> 206 -8.04% 25 -20.96% $ 362.20 4.22% 100.71% 2.65% $ 661,415 8.35%<br />

2019 89 32 $ 283.74<br />

98.87% $ 586,261<br />

<strong>2020</strong> 80 -10.11% 26 -19.43% $ 286.59 1.00% 99.46% 0.60% $ 615,847 5.05%<br />

FAIRFAX CITY<br />

DECEMBER<br />

YTD AVGs<br />

YoY CHG %<br />

Condominium<br />

Detached<br />

Townhouse<br />

Number<br />

<strong>of</strong> Sales<br />

YoY<br />

SALES<br />

AVG<br />

DOM<br />

YoY<br />

DOM<br />

Avg<br />

Price/SqFt<br />

YoY $ /<br />

SQFT<br />

Avg Sale to<br />

Orig List<br />

Price Ratio<br />

YoY $<br />

RATIO<br />

Avg Close<br />

Price<br />

YoY<br />

CLOSE<br />

2019 373 32 $ 318.70 98.18% $ 552,663<br />

<strong>2020</strong> 356 -4.56% 24 -24.71% $ 328.98 3.23% 100.17% 2.03% $ 577,562 4.51%<br />

2019 60 33 $ 262.23<br />

96.69% $ 287,216<br />

<strong>2020</strong> 70 16.67% 19 -41.71% $ 279.67 6.65% 98.36% 1.73% $ 287,042 -0.06%<br />

2019 224 32 $ 347.55<br />

98.10% $ 610,416<br />

<strong>2020</strong> 206 -8.04% 25 -20.96% $ 362.20 4.22% 100.71% 2.65% $ 661,415 8.35%<br />

2019 89 32 $ 283.74<br />

98.87% $ 586,261<br />

<strong>2020</strong> 80 -10.11% 26 -19.43% $ 286.59 1.00% 99.46% 0.60% $ 615,847 5.05%<br />

- 38 -

NOVEMBER <strong>2020</strong> FAIRFAX CITY OVERVIEW ||<br />

CURRENT DEMAND<br />

PENDING LISTINGS<br />

MARKET DEMAND<br />

PAST DEMAND<br />

CLOSED LISTINGS<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

28% 77% <strong>12</strong>1% -9% 19% 4%<br />

23 31<br />

VALUE<br />

MEDIAN SALES PRICE<br />

$570,000<br />

MARKET AND NEGOTIABILITY<br />

MARKETING<br />

DAYS ON MARKET<br />

NEGOTIABILITY<br />

SALE TO ORIG LIST PRICE<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

0% -53% 1% 1% 67% 25%<br />

18 100.00%<br />

MARKET PACE<br />

AVG MONTHS OF INV<br />

1.00<br />

AVG CONCESSION<br />

% <strong>of</strong> SALES WITH<br />

CONCESSIONS<br />

$8,843 25%<br />

CHG YTD CHG YoY<br />

CHG YTD CHG YoY<br />

104% 70% 17% -37%<br />

- 39 -

|| FAIRFAX CITY OVERVIEW NOVEMBER <strong>2020</strong><br />

SUPPLY<br />

ACTIVE LISTINGS<br />

MARKET SUPPLY<br />

CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY CHG YTD CHG YoY<br />

-43% -50% -17% -10% 28% 77% <strong>12</strong>1% -9%<br />

51<br />

FUEL TO SUPPLY<br />

NEW LISTINGS<br />

CURRENT DEMAND<br />

PENDING LISTINGS<br />

PAST DEMAND<br />

CLOSED LISTINGS<br />

19 23 31<br />

- 40 -

NOVEMBER <strong>2020</strong> FAIRFAX CITY OVERVIEW ||<br />

MARKET ANALYSIS BY STRUCTURE TYPE<br />

Avg<br />

Days on<br />

FAIRFAX CITY<br />

Avg Sale to<br />

Orig List<br />

Condominium<br />

Number<br />

<strong>of</strong> Sales<br />

Mkt<br />

Avg Price<br />

/ SQFT<br />

Avg Close<br />

Price<br />

Avg Orig<br />

List Price<br />

Price Ratio<br />

TOTALS / AVGS 4 20 $ 230.32 $ 214,250 $ 229,500 93%<br />

BEDS<br />

4 20 $ 230.32 $ 214,250 $ 229,500 93%<br />

DOM<br />

% <strong>of</strong> SALES<br />

61 20%<br />

AVG CONCESSION<br />

% OF SALES WITH<br />

A CONCESSION<br />

$0 0%<br />

CHG YTD CHG YoY CHG YTD CHG YoY<br />

-100% -100% -100% -100%<br />

- 41 -

|| FAIRFAX CITY OVERVIEW NOVEMBER <strong>2020</strong><br />

Avg<br />