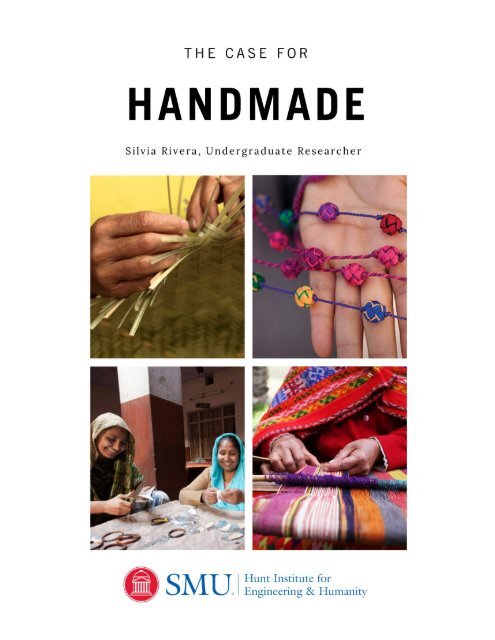

The Case for Handmade

Handicrafts or artisanal goods have a significant potential for social impact, both in terms of the income they generate and the cultural traditions they help preserve. This report explores the global artisan sector, its potential for impact and the challenges and opportunities for realizing this potential. From the definition of artisanal activity to its importance for poverty alleviation to the various challenges and opportunities faced by artisans, businesses and other sector stakeholders, this report concludes with a brief case study of the DFW market for artisanal goods, attempting to put to the test ideas set forth herein on the global artisan sector and the key opportunities that may point the way forward.

Handicrafts or artisanal goods have a significant potential for social impact, both in terms of

the income they generate and the cultural traditions they help preserve. This report explores

the global artisan sector, its potential for impact and the challenges and opportunities for

realizing this potential. From the definition of artisanal activity to its importance for poverty

alleviation to the various challenges and opportunities faced by artisans, businesses and other

sector stakeholders, this report concludes with a brief case study of the DFW market for

artisanal goods, attempting to put to the test ideas set forth herein on the global artisan sector

and the key opportunities that may point the way forward.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Silvia C. Rivera, Southern Methodist University, Undergraduate<br />

Eva Szalkai Csaky, PhD, MSF, Engaged Learning Mentor<br />

Hunter & Stephanie Hunt Institute <strong>for</strong> Engineering & Humanity in<br />

Lyle School of Engineering at<br />

Southern Methodist University<br />

Dallas, Texas<br />

2

Abstract<br />

Handicrafts or artisanal goods have a significant potential <strong>for</strong> social impact, both in terms of<br />

the income they generate and the cultural traditions they help preserve. This report explores<br />

the global artisan sector, its potential <strong>for</strong> impact and the challenges and opportunities <strong>for</strong><br />

realizing this potential. From the definition of artisanal activity to its importance <strong>for</strong> poverty<br />

alleviation to the various challenges and opportunities faced by artisans, businesses and other<br />

sector stakeholders, this report concludes with a brief case study of the DFW market <strong>for</strong><br />

artisanal goods, attempting to put to the test ideas set <strong>for</strong>th herein on the global artisan sector<br />

and the key opportunities that may point the way <strong>for</strong>ward.<br />

3

What are Handicrafts?<br />

<strong>The</strong> terms handicraft, handmade, and artisanal all refer to products made by skilled workers<br />

using minimal technology and equipment. According to the International Trade Center (ITC)<br />

these products include clothing and accessories, decorations, household items, gifts, toys, and<br />

stationary. 1 Given the continued lack of national and international trade recognition <strong>for</strong><br />

handicrafts, however, there is still no code <strong>for</strong> handicrafts in the World Trade Organization’s<br />

“Harmonized Commodity Description and Coding System” despite ef<strong>for</strong>ts by the ITC and<br />

UNESCO. A more detailed definition of handicrafts is necessary to illustrate the unique value of<br />

these products as distinguished from non-handmade goods. 2<br />

According to UNESCO, “the special nature of artisanal products derives from their distinctive<br />

features, which can be utilitarian, aesthetic, artistic, creative, culturally attached, decorative,<br />

functional, traditional, and religiously and socially symbolic and significant." 3 Another expert<br />

defines handicrafts as produced by a “type of activity in which economic, technical, productive,<br />

commercial, social, aesthetic and cultural elements of great complexity are involved.” 4 This<br />

expert goes on to distinguish them from serial, industrially produced goods noting:<br />

It is not about…maintaining the production of handicrafts at a technological<br />

backwardness that requires an unnecessary human ef<strong>for</strong>t. What happens is that,<br />

as with the sculptor who carefully handles his gouge <strong>for</strong> cutting just enough to<br />

achieve the <strong>for</strong>m he has imagined, or the painter who moves his brush gently to<br />

avoid the impression of hair left on the stand, handicrafts require a very close<br />

link between man and object. It is this link which gives special attributes to<br />

handicrafts, making them emotional, human. Sometimes this character is<br />

expressed through mistakes or imperfections as with the so called naïf painting<br />

or with carvings and objects that do not show the exquisiteness of academic art<br />

or the perfection of the industrial object, but which enjoy a grace and ingenuity<br />

that make them attractive.<br />

Simply put, handicrafts occupy a unique space between art and function, creativity and<br />

efficiency, humans and machines that distinguishes them from non-handmade goods. As a<br />

result, though not necessarily opposed by definition to the use of new tools, methods and<br />

equipment <strong>for</strong> production, there is an important reason why manufacturing has not entirely<br />

4

eplaced the handmade production of goods. A great source of value (market and other) <strong>for</strong><br />

handicrafts continues to rest on their remaining primarily handmade, and is one of the reasons<br />

why individuals from across the world have <strong>for</strong> generations continued to buy and make<br />

artisanal goods.<br />

Finally, as <strong>for</strong> the “culturally attached” and “cultural elements” mentioned in these and most<br />

definitions of handmade goods, handicrafts are also often—though not always— uniquely<br />

associated with the cultures in which they are produced, adding again to their value and<br />

distinguishing them from non-handmade goods. After hundreds of years of making certain<br />

crafts and the passing down of specific production designs and techniques, many artisanal<br />

products that can be purchased today are infused with the cultures of their artisans. <strong>The</strong>y<br />

represent an important source of cultural heritage <strong>for</strong> various nations and nationalities<br />

worldwide, and <strong>for</strong> this reason are both supported by UNESCO’s intangible cultural heritage<br />

ef<strong>for</strong>ts and continuously sought out by travelers and tourists around the world. 5<br />

Potential <strong>for</strong> Impact<br />

Still, in the words of Japanese poet Kobayashu Issa, “and yet, and yet…” the value of<br />

handmade reaches far beyond the value of the products themselves. <strong>The</strong> artisan sector is the<br />

second most important source of livelihood after agriculture <strong>for</strong> the global poor, meaning that<br />

artisanal products produce income <strong>for</strong> some of the poorest people in the world. Moreover, an<br />

overwhelming majority of artisans in the developing world are women, meaning that the jobs<br />

and income generated by artisanal products have the potential to empower women and the<br />

communities in which they live. Third, given the unique cultural component of many<br />

handmade goods and the often-traditional use of sustainably sourced raw materials,<br />

handicrafts also have the potential to preserve cultural heritage, empower ethnically<br />

marginalized communities, and promote sustainable methods of production.<br />

According to a market assessment conducted by USAID, the artisan sector is the second<br />

largest source of livelihood in the developing world. 6 For this reason alone, the sector has<br />

received considerable attention from USAID, the World Bank, the United Nations and various<br />

governments, nonprofits and other NGOs focused on international development and poverty<br />

alleviation. As an essential source of secondary income behind agriculture, handicrafts not only<br />

5

provide much needed work to people living in extreme poverty, but also serve as an important<br />

source of income diversification in times of droughts, floods and lean harvests—an important<br />

feature in the wake of rapidly changing climates. 7 Furthermore, development experts also<br />

point to the fact that handicrafts, as opposed to agriculture, are typically a less capitalintensive<br />

investment <strong>for</strong> both artisans and development organizations; relying less on<br />

technology, infrastructure and equipment and more on existing skills and available raw<br />

materials <strong>for</strong> production, in addition to not requiring ownership of land and allowing artisans to<br />

work from home.<br />

<strong>The</strong> fact that the majority of artisans are women has likewise not escaped the attention of<br />

development experts and those most committed to ending extreme global poverty. A number<br />

of well-known studies have pointed to the importance of investing in women <strong>for</strong> poverty<br />

alleviation, not only because they represent the majority of the world’s poor, but because they<br />

have also been found to reinvest up to 90% of their income earned back into their families, as<br />

opposed to 30-40% <strong>for</strong> men. 8 9 Ultimately these investments, primarily in the <strong>for</strong>m of income<br />

spent acquiring “food, healthcare, home improvement and schooling <strong>for</strong> themselves and their<br />

children,” find their way into entire communities, as these women’s families become healthier,<br />

safer and better educated. Continuing this virtuous circle, and counterbalancing the research<br />

demonstrating how much more difficult it is <strong>for</strong> women than men to find and keep decently<br />

paid work, is that thanks to social dynamics and the heavily communal nature of most<br />

artisanal work, women often recruit other women to work on handicrafts, as demonstrated by<br />

the prevalence of all-women artisan communities, associations, and cooperatives.<br />

Advocates of handicrafts as a method of poverty alleviation also point to some additional<br />

sources <strong>for</strong> social impact. As noted in the previous section, many handmade goods contain a<br />

key cultural component and <strong>for</strong>m an important part of the intangible cultural heritage of<br />

various nations. According to UNESCO, however, poverty, globalization and mass production,<br />

environmental and climatic pressures, shifting tastes, urban-rural migration and simply the fact<br />

that many craft traditions involve community “‘trade secrets” that disappear when younger<br />

members cannot be made interested, are all factors that contribute to the potential loss of<br />

cultural heritage in the <strong>for</strong>m of handicrafts. 10 As a result, investing in artisans—and not,<br />

UNESCO distinguishes, in preserving specific handicraft objects—is another way in which<br />

handicrafts can be used <strong>for</strong> social impact, particularly in the case of indigenous and ethnically<br />

marginalized communities whose intangible cultural heritage is thought to be especially at risk.<br />

6

What is more, these marginalized communities can also benefit greatly from the economic<br />

impact brought on by handicrafts in the <strong>for</strong>m of increased jobs and income.<br />

Lastly, though there is a need <strong>for</strong> more research into the potential environmental impact of<br />

sourcing from artisans at scale, some experts argue that investing in handicrafts has the<br />

added potential of promoting more sustainable methods of production. Artisans tend to rely<br />

heavily on the availability of raw materials <strong>for</strong> their crafts, and as noted by one expert, have<br />

been recognized <strong>for</strong> “their creative use of natural resources and concern <strong>for</strong> conservation and<br />

replenishment.” 11 This expert cites one particular case of an artisan from Santa Catarina de<br />

Ocotlán, Oaxaca in Mexico who, while teaching a class to other women artisans on traditional<br />

dry-cleaning, warned:<br />

I only recommend the use of these sensitive plant organisms (association of an<br />

alga and a fungus) after checking that there are plenty of them and also that<br />

people understand the importance of lichens in the <strong>for</strong>est. I must say that I use<br />

them there because they are of no use <strong>for</strong> these people, they even consider<br />

them a pest…once they saw the beautiful orange color that was obtained and<br />

that they do not have to use fixatives to get it, they liked very much the idea to<br />

use them <strong>for</strong> coloring. I emphasize to them very emphatically that they should<br />

not cut the lichens unless they are found in dead wood or in the wood to be<br />

burnt. I am confident that this will be so because the female artisans are<br />

sensitive and intelligent about things of life and nature.<br />

For those who have interacted with communities living in close proximity with nature and who<br />

depend greatly on its well-being, this Mexican artisan’s concern <strong>for</strong> the environment should<br />

come as little to no surprise. And yet it is also important to highlight the creativity and<br />

resourcefulness of artisans who in urban areas around the world continue to make creative<br />

use of available low-cost materials like trash and recycled goods, as noted by this study of<br />

12 13<br />

Latin American artisans and others in Southeast Asia and Africa.<br />

7

Global Market:<br />

Size and Key Players<br />

Handicraft’s potential <strong>for</strong> impact is significant, primarily as a method of poverty alleviation but<br />

also as a way of empowering women and other marginalized communities and promoting<br />

sustainable methods of production. Similarly, the global market <strong>for</strong> artisanal goods, valued at<br />

over $32 billion per year, is also significant—though not without its issues. Namely, the global<br />

market is still vastly understudied in terms of size and key players. It is there<strong>for</strong>e necessary to<br />

precede any discussion of the market’s greatest challenges and opportunities by attempting to<br />

draw out the global market <strong>for</strong> artisan goods with approximations of its size and key players.<br />

<strong>The</strong> UN Conference on Trade and Development (UNCTAD) has estimated the global market <strong>for</strong><br />

artisan goods to be worth over $32 billion per year. 14 According to UNCTAD, developing<br />

countries are responsible <strong>for</strong> approximately 65% of this trade, making it one industry in which<br />

they hold a leading market position. Also encouraging are UNCTAD figures on market growth<br />

rates, which show that developing country exports more than doubled between 2002 and<br />

2008, increasing from an estimated $9 billion to $21 billion. What is more, these measures<br />

proved 2008 to be a particular source of optimism <strong>for</strong> the artisan market, which was able to<br />

increase its export revenues “even as global demand plummeted and international trade<br />

contracted by 12 percent in the wake of the global economic crisis.” 15<br />

<strong>The</strong>se figures—especially the estimated size of the market—have been and continue to be<br />

widely used by a number of international development organizations and artisan non-profits,<br />

NGOs, and businesses. It is important to note, however, that it has now been a decade since<br />

many of these organizations have updated their estimates from the first international trade<br />

figures in 2008. Also important to note is a disclaimer by UNCTAD itself on these measures, in<br />

which it highlighted the difficulty of presenting first-hand figures on the handicrafts market<br />

due to the lack of an official code <strong>for</strong> classifying handicrafts and the largely in<strong>for</strong>mal nature of<br />

the sector. This is of course also largely true <strong>for</strong> national handicrafts estimates, where despite<br />

government and NGO ef<strong>for</strong>ts developing countries continue to struggle to collect accurate data<br />

on the sector.<br />

8

A 2007 UNESCO handicrafts study, <strong>for</strong> instance, calls attention to the significant size but also<br />

the need <strong>for</strong> better data on the global artisan sector. <strong>The</strong> study contains several positive<br />

market estimates <strong>for</strong> handicrafts in countries like Colombia, Tunisia, Morocco and Thailand,<br />

but a closer look demonstrates the need <strong>for</strong> more (and more accurate) data. <strong>The</strong> method used<br />

to size Thailand’s handicraft sector, <strong>for</strong> example, was to estimate the number of artisans<br />

employed (2 million in<strong>for</strong>mally and 1 million <strong>for</strong>mally) by extrapolating from a general<br />

employment survey. Meanwhile in Colombia, figures <strong>for</strong> the yearly income provided by<br />

handicrafts ($400 million) and yearly handicrafts exports ($40 million) were provided, while<br />

both Morocco and Tunisia used a percentage of GDP (19% and 3.8% respectively) to measure<br />

the production of handicrafts. While these measures ultimately succeed in demonstrating the<br />

importance of national handicraft sectors to developing countries and help make the case <strong>for</strong><br />

the importance of the global sector, there is a clear need <strong>for</strong> more frequent, detailed, and<br />

standardized market estimates.<br />

As mentioned by the UNCTAD in its flagship estimates, however, the act of measuring the<br />

global market <strong>for</strong> artisan goods becomes decidedly more difficult when attempting to replace<br />

rough estimates with accurate data from its often intricate and in<strong>for</strong>mal value chains. As a<br />

result, a number of studies have been carried out on artisan value chains by those aware of<br />

handicrafts’ economic value and potential <strong>for</strong> impact. Much like market estimates, these<br />

studies remain few and far between, but taken together help paint a more complete picture of<br />

the sector and its key players.<br />

In 2006, USAID conducted what remains one of the few publicly available global handicrafts<br />

market assessments. 16 1 <strong>The</strong> assessment focuses specifically on artisan home accessories and<br />

décor, but enriched with data from country-specific value chain studies that include<br />

in<strong>for</strong>mation on other artisanal goods like clothing and accessories, it allows <strong>for</strong> the<br />

identification of a handful of global sector key players. <strong>The</strong> following is an outline of these<br />

artisan sector key players using in<strong>for</strong>mation from the USAID assessment and country-specific<br />

value chain studies from Guatemala, 17 Senegal, 18 Madagascar, 19 India 20 and Namibia. 21 For<br />

1<br />

Technavio is a niche market research firm and has released the two most recent global handicrafts<br />

market assessments. In 2015 they published “Global Handicrafts Market 2015-2019” and have just<br />

recently followed this report with “Global Handicrafts Market 2018-2022.” Although neither report is<br />

publicly available, press clippings from the first Technavio report are. Some insights from these<br />

clippings will there<strong>for</strong>e be included in opportunities section of this report.<br />

9

more in<strong>for</strong>mation on the value chain studies used to identify and describe artisan key sector<br />

players, detailed value chain graphs can be found in the appendix.<br />

Input Suppliers are the farmers, ginners, spinners and other actors that supply the<br />

necessary raw materials to artisan producers. Most of these suppliers, with the exception of<br />

large-scale suppliers such as industrial spinners and textile treaters (dying, printing, etc.) in<br />

the case of cotton and textile inputs, <strong>for</strong> instance, are small-holder producers themselves. As a<br />

result, there is a great need <strong>for</strong> more research on market linkages between them and artisans,<br />

especially as these relate to the need <strong>for</strong> more accessible organic and international grade<br />

inputs <strong>for</strong> the international trade of artisan goods.<br />

Producers are the individual artisans and artisan producer organizations that create<br />

handicrafts. <strong>The</strong>y include weavers, carpenters, metal workers, bead workers, embroiderers,<br />

knitters, designers, and a number of other skilled and creative manual workers. <strong>The</strong> majority<br />

of artisans in developing countries are rural, home-based, and tend to work independently or<br />

in small groups, sometimes organizing themselves into producer organizations such as<br />

cooperatives and associations. In most cases, artisans must source and design their own<br />

crafts, and both can present a challenge to artisans who want to upgrade their products and<br />

operate above the subsistence level but lack the capital, capabilities, and market insights<br />

necessary to scale production. As a result, many artisans will organize themselves into<br />

producer organizations such as cooperatives and associations in order to enhance productivity<br />

and gain access to markets, as well as additional resources and services such as workshops,<br />

market in<strong>for</strong>mation, trainings, working capital, and social funds in the case of illnesses and<br />

emergencies. <strong>The</strong>re are several issues, however, associated with artisans and producer<br />

organizations, and the majority of handicrafts research focuses on these key players.<br />

Wholesalers are the intermediary buyers and sellers of handicrafts. <strong>The</strong>y include buying<br />

agents, artisan brokers, and exporters and importers, and they serve several important<br />

functions that help artisans gain access to local, regional, and international markets. For many<br />

rural and remote artisans unable to organize themselves into producer organizations,<br />

wholesalers such as buying agents and artisan brokers provide the only method of selling their<br />

crafts to markets. Oftentimes, these wholesalers also provide invaluable embedded services<br />

including communication, payments, quality control, shipping, packaging, procuring raw<br />

materials, and transmitting design in<strong>for</strong>mation <strong>for</strong> artisans, retailers, and end consumers.<br />

10

Retailers are the final link in the value chain connecting artisans to consumers. <strong>The</strong>se include<br />

mass retailers, department stores, internet retailers and independent retailers—a catch all<br />

term used by the USAID market assessment <strong>for</strong> small retailers, tourist shops, art galleries,<br />

museum stores, coffee shops, and others. Typically, end markets <strong>for</strong> handicrafts produced in<br />

developing countries can be divided into national exclusive, national popular, and international<br />

markets. Despite some countries’ success with handicrafts exports, the majority of artisanal<br />

goods sold are currently spread out through a large number of independent retailers servicing<br />

national popular and exclusive markets, highlighting the difficulty <strong>for</strong> artisans and artisan<br />

producer organizations to scale production to the levels necessary <strong>for</strong> retailers linked to global<br />

value chains—value chains which, according to UNCTAD, are now responsible <strong>for</strong> 80% of<br />

global trade. 22<br />

Governments are identified by several artisan market and value chain studies as key<br />

stakeholders in their national handicrafts industries. Though not directly involved in artisan<br />

value chains, many developing-country governments have taken an interest in realizing the<br />

economic value and impact potential associated with the promotion of artisans and their<br />

goods. As a result, ef<strong>for</strong>ts to support handicrafts have been initiated by governmental<br />

ministries responsible <strong>for</strong> areas such as national trade, tourism, SME development, and<br />

culture. <strong>The</strong>se ef<strong>for</strong>ts include helping artisans with questions of production capabilities,<br />

management techniques, licensing, environmental protection, international trade shows, and<br />

even organizing their own worldwide fairs to showcase artisanal products. It is important to<br />

note, however, that despite an apparent interest in supporting artisans, many studies still<br />

point to significant government shortfalls, such as confusion over ministry budgets and<br />

responsibilities, lack of transparency, lack of beneficial policies such as tax exceptions, lack of<br />

financial support, and many others.<br />

Enabling organizations encompass all other non-government stakeholders who lie outside<br />

of the artisan value chain but are deeply interested in realizing the social and economic<br />

potential of national and international handicrafts markets. <strong>The</strong>y include small and major<br />

international development organizations, charities, non-profits, impact investing funds,<br />

academia, and others, and they have led a number of important ef<strong>for</strong>ts to empower artisans<br />

and promote the handicrafts sector in developing countries. Among these ef<strong>for</strong>ts have been<br />

capacity building programs, research studies, artisan sponsorships to international trade shows<br />

and conferences, and many others. As noted by a study of Jordan’s handicrafts market,<br />

11

however, enablers in the artisan sector have often played such uniquely active roles in<br />

supporting artisans and their related value chains that they have effectively entered into these<br />

sectors themselves. According to the Jordan study, <strong>for</strong> instance, “some NGO’s…have played a<br />

major role in developing this sector in Jordan by initiating income-generating projects in rural<br />

areas…taking two roles, of which one is to help generate income and employment, and the<br />

second is to act as entrepreneurs.” 23<br />

Global Market:<br />

Issues and Barriers<br />

A brief look at the global market <strong>for</strong> artisan goods and the related value chains of artisans in<br />

developing countries already reveals some of the issues preventing the handicrafts sector from<br />

reaching its full potential. <strong>The</strong> focus of most handicrafts market studies, a fair amount of<br />

research exists detailing the barriers preventing artisans from reaching markets. <strong>The</strong>se<br />

studies, however, are largely case-by-case studies of specific countries, regions, and<br />

communities, and there is still a great need <strong>for</strong> systems-level research on the key issues<br />

impacting artisans and handicraft markets everywhere. Similar to the method used to identify<br />

key artisan stakeholders, the following is a distillation of the three key issues and barriers of<br />

the artisan sector—aggregation, in<strong>for</strong>mation, and finance—based on handicrafts studies from<br />

Guatemala, India, Mexico, Senegal, and Namibia as well as on findings from small-holder<br />

producer literature on agriculture. 2<br />

Aggregation is a term that has been used in recent literature on small-holder agriculture to<br />

identify one of the main challenges preventing small farmers from accessing global value<br />

chains. 24 Given the many parallels between small farmers and artisans in developing<br />

2<br />

<strong>The</strong>re are number of barriers preventing artisans from gaining access to markets, and this number<br />

absolutely exceeds three. In a recent study of the Indian handicrafts sector, however, one author<br />

poignantly notes “not much has changed since [1947] <strong>for</strong> the handicraft sector. Even today, the most<br />

important problem or the single most important reason behind most of the problems of the artisan<br />

community is reflected in the fact that the word artisan has no precise definition. This shows how<br />

underestimated this sector remains and how undermined is the potential of this sector in making any<br />

significant contribution to the economy.” In other words, there are typically a few key issues to which<br />

many others can ultimately be traced. <strong>The</strong> lack of <strong>for</strong>mal definitions and market estimates <strong>for</strong><br />

handicrafts identified earlier is one, and this report has attempted to identify only the key others.<br />

12

countries—and the fact that many of the same families whose primary source of income is<br />

agriculture also participate in the artisan sector—small-holder agriculture literature may hold<br />

some valuable macro-level insights currently missing in handicrafts research. An expert on<br />

small-holder farming and international development writes, <strong>for</strong> instance, that<br />

one of the key challenges policymakers, the development community, and<br />

agribusinesses face… is small-holders’ limited <strong>for</strong>mal organization (“producer<br />

organizations”) that aggregate their production and demand <strong>for</strong> goods and<br />

services in order to enable more effective market participation (“aggregation”).<br />

Only 5-10% of farmers globally are estimated to participate in <strong>for</strong>mal producer<br />

organizations. This is despite the fact that such organizations have been<br />

supported by both policymakers and the development field as a way of tackling<br />

poverty and addressing market failures.<br />

Much like those seeking to use producer organizations to empower small farmers and leverage<br />

agriculture <strong>for</strong> poverty alleviation, development experts in favor of handicrafts have long<br />

supported artisan producer organizations. Artisan cooperatives and associations have been the<br />

focus of many studies and promoted as a means of aggregating production and demand and<br />

providing artisans with much needed in<strong>for</strong>mation flows and embedded services. And yet, much<br />

like agriculture, handicrafts studies note repeated problems experienced by artisans organized<br />

into cooperatives that have prevented such aggregation from ultimately succeeding. As one<br />

Guatemalan study notes, “fraudulent, opportunistic and rent-seeking behavior” by cooperative<br />

leaders has often led to distrust and made horizontal cooperation difficult. 25<br />

Similarly, vertical cooperation and value chain participation as a means of aggregating demand<br />

and supply has also been supported by handicraft studies, although decidedly less so than<br />

horizontal cooperation and artisan cooperatives. As mentioned earlier, wholesalers often<br />

provide important embedded services such as quality control and shipping as well as market<br />

in<strong>for</strong>mation on buyer tastes and demand. Yet negative attitudes towards intermediaries<br />

abound, perhaps being even more prevalent than those towards cooperatives, in that artisans<br />

prefer more direct access to customers and often lack sufficient knowledge regarding the<br />

value chain actors above them, leading them to suspect intermediaries of inherently<br />

opportunistic behavior because of their higher position in the value chain. 26<br />

Markets rely on the flow of in<strong>for</strong>mation, and while there is no such thing as a perfect market,<br />

the artisan sector faces huge barriers in terms of access to in<strong>for</strong>mation. For one, access to<br />

13

accurate and timely data on consumer tastes, value chains, and various distribution channels<br />

is extremely difficult to obtain <strong>for</strong> many artisans. Nowadays, the best source of in<strong>for</strong>mation on<br />

rapidly changing consumer tastes is conveyed along efficient value chains led by global<br />

retailers with market research capabilities and access to a large number of consumers. Without<br />

access to this “insider” in<strong>for</strong>mation, artisans, artisan organizations and small independent<br />

retailers are limited in the markets they can target with their products, and must rely on less<br />

valuable “outsider” knowledge from what they can observe with limited internet access or from<br />

local tourist and domestic markets. What is more, without access to accurate in<strong>for</strong>mation on<br />

value chains and possible distribution channels, artisans are even more limited in their ability<br />

and willingness to enter into such “insider” in<strong>for</strong>mation relationships with wholesalers and<br />

retailers, further barring them from valuable in<strong>for</strong>mation.<br />

Relatedly, accurate in<strong>for</strong>mation on artisans and their production capabilities is also difficult to<br />

access <strong>for</strong> other actors in the market. When a buyer doesn’t know what to expect from<br />

artisans in terms of quality, design, production capacity, and delivery, they may perceive<br />

significant transaction costs—not to mention risks—that prevent them from entering into<br />

purchasing agreements. In another study of artisan cooperatives in Oaxaca, Mexico, <strong>for</strong><br />

instance, one author notes the competitive advantage that providing market actors with<br />

in<strong>for</strong>mation brought to one cooperative (Teotitlin) over another (Society):<br />

Society members do not lack skill or motivation, and the textiles produced in the<br />

village are virtually identical in quality and craftsmanship to weavings produced<br />

in Teotitlin. Yet skill and commitment to success don't necessarily allow Society<br />

members access to the export market network. <strong>The</strong> group's greatest failure<br />

continues to be its inability to break Teotitlin's control of the flow of in<strong>for</strong>mation<br />

between producers and <strong>for</strong>eign business interests and to convince potential<br />

buyers of the benefits of working in Santa Ana. 27<br />

In this example, it becomes clear that artisans’ ability to provide other actors in the market<br />

with in<strong>for</strong>mation on themselves can be just as important as the ability to obtain in<strong>for</strong>mation on<br />

the market. This is not only because providing this in<strong>for</strong>mation can lead to more and better<br />

purchasing agreements <strong>for</strong> artisans, but also because repeated purchasing agreements could<br />

lead to artisans’ eventual integration into more efficient value chains, thus improving their<br />

access to market in<strong>for</strong>mation. What is more, as noted in the previous section on the global<br />

market <strong>for</strong> artisan goods, access to in<strong>for</strong>mation on the market itself is a significant macro level<br />

14

concern <strong>for</strong> the sector and can create barriers <strong>for</strong> in<strong>for</strong>ming smart policy and driving<br />

investment.<br />

Finally, access to finance is one of the most widely cited barriers keeping artisans from<br />

markets. Although the production of handicrafts is not necessarily capital intensive, most<br />

artisans still need access to adequate working capital in order to produce labor-intensive crafts<br />

and continue production as they wait on payments (often late) from wholesalers and retailers. 3<br />

What is more, in order to make the upgrades necessary to scale, capital investments must still<br />

be made in terms of new tools and equipment, business management and training, third party<br />

design in<strong>for</strong>mation, sample production, and investments in international grade inputs. In the<br />

case of Guatemalan weavers, <strong>for</strong> instance:<br />

switching from the back-strap loom to the foot loom is the most significant<br />

process upgrading opportunity. However, the initial investment required to<br />

purchase the foot loom is so high that it is cost-prohibitive <strong>for</strong> most MSEs. <strong>The</strong><br />

only financial services that MSE weavers can access are small lines of credit from<br />

input suppliers or cash and in-kind advances of working capital from their buyers.<br />

In fact, while the firms that buy from MSEs may be willing to extend short-term<br />

working capital to their many suppliers, these buyers are not usually in a position<br />

to tie up large amounts of capital in numerous risky, long-term loans. 28<br />

Like a number of artisans in the developing world, and a large portion of MSEs in general,<br />

Guatemalan weavers are significantly restricted by the lack of credit and investment options<br />

<strong>for</strong> growing their businesses. Value chain finance <strong>for</strong> handicrafts as it stands is currently<br />

insufficient <strong>for</strong> artisans who seek to produce beyond the level of subsistence, and there is a<br />

great need <strong>for</strong> more research beyond current microfinancing schemes as to more creative,<br />

effective and sustainable ways to invest in artisans and realize the untapped economic and<br />

social potential of the sector.<br />

3<br />

This problem increases with participation in global value chains (GVCs). GVCs typically pay with<br />

considerable delay, as opposed to small local buyers or traders. It is there<strong>for</strong>e very difficult to<br />

participate in GVCs without access to finance. To make matters worse, without strong <strong>for</strong>mal contracts<br />

with a reputable counterparty (i.e. a GVC), it is very difficult to get access to finance.<br />

15

Global Market:<br />

Key Opportunities<br />

<strong>The</strong> challenges facing the global artisan market are significant. As a result, key stakeholders<br />

aware of the sector’s potential <strong>for</strong> impact and unrealized economic value have led a number of<br />

capacity building programs to empower artisans and help boost the sector. As noted by the<br />

Artisan Alliance, an initiative of the Aspen Institute and an international development partner<br />

of the U.S. Department of State, however, these ef<strong>for</strong>ts have largely been met with mixed<br />

results in that “building capacity across product development, market access, and business<br />

development requires a diverse and intricate set of skills and aptitudes. Like the artisan<br />

enterprises themselves, artisan support organizations are often small, work independently of<br />

each other, and are not well-funded or recognized.” 29<br />

Is there another way to enable both artisans to more easily access markets and the<br />

handiworks sector to realize its potential? What would be a solution that not only empowers<br />

individual artisans but also seeks to address the market failures that lead to their exclusion<br />

from global value chains?<br />

<strong>The</strong> Inclusive Economy Ecosystem (IEE) is a new theoretical framework <strong>for</strong> promoting<br />

inclusive economic development designed by two experts in international development and<br />

environmental sustainability. <strong>The</strong> model was created as a response to what the authors<br />

perceived as the immense potential of recent private, public, and non-profit solutions to solve<br />

some of the world’s most pressing social, economic and environmental challenges—including<br />

“market-based, climate-smart inclusive solutions, social entrepreneurship, and base-of-pyramid<br />

strategies”—and yet the failure of most of these solutions to achieve impact at scale. 30<br />

According to IEE authors, a new model <strong>for</strong> multi-stakeholder collaboration is necessary in<br />

order to achieve scalable and trans<strong>for</strong>mational impact. Through extensive research on recent<br />

models, solutions, and best practices, they have identified three key stakeholder groups—<br />

corporations, entrepreneurs, and enablers— with the potential to propel inclusive economic<br />

growth through holistic solutions designed across stakeholder groups. <strong>The</strong> IEE model,<br />

there<strong>for</strong>e, provides a way of re-thinking the artisan sector’s key stakeholders and their roles<br />

16

<strong>for</strong> achieving scalable impact and the inclusive market trans<strong>for</strong>mation needed <strong>for</strong> the sector. 4<br />

In an ef<strong>for</strong>t to highlight the greatest opportunities <strong>for</strong> handicrafts going <strong>for</strong>ward, the remaining<br />

section explores the most promising opportunities <strong>for</strong> entrepreneurs, corporations, and<br />

enablers to tackle the sector’s challenges while also leveraging broader changes taking place<br />

in global markets.<br />

Within the IEE model, entrepreneurs are the MSE artisans, artisan associations, wholesalers,<br />

and retailers who produce artisanal goods or buy directly from artisans. In recent years, a<br />

particular model of artisan entrepreneurship, the artisan social enterprise, has gained a lot of<br />

traction in global markets. Namely, these entrepreneurs have been able to capitalize on<br />

shifting consumer trends such as increases in “conscious consumerism,” online shopping, highend<br />

markets, and the demand <strong>for</strong> “cultural goods, uncommon souvenirs, and indigenous art”<br />

fueled by a rise in tourism. 31 32 <strong>The</strong>re has also been great diversity in the specific business<br />

models (including sourcing, product design and marketing strategies) employed by<br />

entrepreneurs in this space, which may hold promise to begin reinventing current relationships<br />

between artisans, cooperatives, wholesalers, and retailers.<br />

Realizing the importance of the knowledge being generated by these entrepreneurs’ innovative<br />

businesses models, the Artisan Alliance has made ef<strong>for</strong>ts to recruit artisan social enterprises to<br />

become Alliance member organizations. <strong>The</strong>y currently list over 100 of these entrepreneurs<br />

across 150 countries as members, though online search reveals the emergence of hundreds<br />

more of these over the past 15 years. 33 While it is necessary to note that entrepreneurs<br />

continue to struggle with the classic issues of the artisan sector—namely access to financing,<br />

aggregation, and access to market in<strong>for</strong>mation—their increasing success in competing with<br />

non-handmade retailers speaks to their improving ability to link artisans to markets. This is<br />

evidenced by recent ef<strong>for</strong>ts from retailers like Nordstrom and Niemen Marcus to partner with<br />

artisan entrepreneurs like Soko and Akola, as well as the ability of entrepreneurs like Akola to<br />

expand their models and begin scaling their businesses.<br />

Next, corporates can be thought of as the large retailers and corporate clients that have the<br />

ability to buy, market, and sell artisanal goods in large quantities to a wide base of consumers.<br />

Another defining attribute is an expansive, well-organized value chain that they control, and<br />

4<br />

For a graphic describing the original IEE model and the manner in which it was applied to the global<br />

artisan sector, please refer to the Appendix: Inclusive Economy Ecosystem Model.<br />

17

some examples include large retailers like Niemen Marcus as well as large corporate clients,<br />

like hotels, who exhibit demand <strong>for</strong> décor and gift shop items. As evidenced by recent<br />

partnerships with social enterprises, corporates are starting to realize the value of<br />

incorporating artisans into their value chains. By sourcing unique, quality goods from artisans,<br />

<strong>for</strong> example, corporates can increase the competitiveness of their products and invest in the<br />

reputational capital necessary to succeed in an age of conscious consumerism and corporate<br />

social responsibility (CSR).<br />

Despite some promising ef<strong>for</strong>ts on behalf of retailers like Nordstrom and Niemen Marcus,<br />

however, there still remains ample room <strong>for</strong> corporates to take more significant advantage of<br />

the opportunities presented by sourcing from artisans; ranging from fast-fashion retailers like<br />

Zara to luxury retailers like Gucci. Zara, <strong>for</strong> instance, currently sources from artisan workshops<br />

in Portugal <strong>for</strong> its labor-intensive embroidered items, while Gucci has continued the Italian<br />

luxury tradition of sourcing from master artisans in Italy. 34 35 Both have succeeded in<br />

incorporating small artisan producers into their massive supply chains and can leverage both<br />

this experience and their size to work towards expanding their models into other areas,<br />

particularly those where there is demand <strong>for</strong> the unique skills and production capabilities of<br />

artisans.<br />

Finally, enablers are the governments, NGOs, IGOs, nonprofits, impact-investing funds,<br />

academic institutions, and other non-value chain actors that are invested in the success of the<br />

artisan sector. According to the IEE model, enablers can also be described as the “sometimes<br />

hidden entities that introduce technologies, foster relationships, disseminate knowledge, and<br />

per<strong>for</strong>m other critical functions <strong>for</strong> collaboration.” 36 In this sense, while enablers have been<br />

able to do some important work in terms of capacity-building and artisan empowerment, a<br />

much more long-term focus is needed to remove the barriers preventing collaboration<br />

between entrepreneurs and corporates. A study of Madagascar’s artisan sector notes, <strong>for</strong><br />

instance:<br />

Handicraft-related programs sponsored by international development agencies<br />

have helped Malagasy artisan producers to improve the quality of their products<br />

and the efficiency of their business operations. At the same time, however, these<br />

programs have suffered from their short-term scope, poor coordination with<br />

other stakeholders, ineffective advertising, and focus on a small number of<br />

artisan producers. 37<br />

18

For many enabling organizations, this may simply mean the opportunity to reframe and<br />

refocus current ef<strong>for</strong>ts. Enablers have the opportunity, <strong>for</strong> instance, to focus more energy on<br />

continuing to develop a more <strong>for</strong>mal enabling environment <strong>for</strong> the artisan sector. <strong>The</strong>y can<br />

promote standardization of industry codes and definitions, establish quality control institutions<br />

and procedures, conduct better market estimates, discover sustainable mechanisms <strong>for</strong> closing<br />

finance gaps, and create regional databases of input suppliers, artisans, producer<br />

organizations and wholesalers. This process can take place alongside current ef<strong>for</strong>ts to provide<br />

artisans with general access to technology and education, as well as capacity-building in terms<br />

of production and management upgrades. Given the lack of recent impact-focused market<br />

assessments, they can also implement ef<strong>for</strong>ts to capture and disseminate knowledge being<br />

generated by corporate and social entrepreneurs in the artisan market.<br />

As set <strong>for</strong>th by the IEE model, however, a key <strong>for</strong> the success of the artisan sector going<br />

<strong>for</strong>ward must be holistic solutions based on multi-stakeholder collaboration. A notable example<br />

of this has been Kate Spade’s recent experiment with an internally-developed social enterprise<br />

model <strong>for</strong> sourcing from artisans. In a report notably titled, “A Social Enterprise Link in a<br />

Global Value Chain: Per<strong>for</strong>mance and Potential of a New Supplier Model,” researchers describe<br />

how Kate Spade was able to leverage its CSR department to establish a separate social<br />

enterprise allowing it to source efficiently from women artisans in Rwanda. 38 Though still in its<br />

early stages, the venture has already produced some impressive results <strong>for</strong> the women in<br />

Rwanda and positive (albeit premature) results <strong>for</strong> Kate Spade’s business. In this case, Kate<br />

Spade was able to apply some of the innovative strategies employed by artisan social<br />

enterprises but with fewer constraints on capital and market access. Critically, Kate Spade<br />

engaged with enablers in the <strong>for</strong>m of nonprofits <strong>for</strong> supporting functions in their social<br />

enterprise as well as academia to complete the study on their new sourcing model.<br />

Local Market:<br />

<strong>The</strong> <strong>Case</strong> of DFW<br />

<strong>The</strong> global artisan market represents a world of opportunity <strong>for</strong> those looking to create value<br />

and empower artisans. <strong>The</strong> Dallas Fort-Worth metroplex (DFW) is home to several such<br />

entrepreneurs who have succeeded in their mission to leverage the value and impact offered<br />

19

y handmade goods, each with a unique business model and approach to the opportunities<br />

and challenges presented by the market <strong>for</strong> artisan goods. <strong>The</strong> following is an overview of the<br />

results from interviews carried out with three different DFW entrepreneurs that work with<br />

refugee artisans and artisans from developing countries.<br />

This study was able to identify nine DFW businesses and organizations that work with artisans<br />

in developing countries and one organization that employs women refugees in Dallas. <strong>The</strong><br />

methodology <strong>for</strong> finding these entities was primarily online search and word of mouth, and the<br />

difficulty of this exercise demonstrated the disjointed nature of the local artisan sector. Of the<br />

ten businesses and organizations, three accepted an invitation to participate in this study,<br />

which consists of one online questionnaire and one in-person interview. 5<br />

In terms of demographics, the organizations interviewed consisted of two non-profits and one<br />

social enterprise. <strong>The</strong>y had been operating from 8 to 20 years, and had earned between<br />

$500,000 to over $1,000,000 in revenue the previous year. <strong>The</strong>y worked with between 16 to<br />

500 artisans from Latin America to Africa to Dallas, and all of the artisans they employed were<br />

women.<br />

As <strong>for</strong> organizational motivation, empowering artisans was ranked as extremely important to<br />

all organizations, while only one organization ranked celebrating arts and culture as a primary<br />

motivation. Artisanal work was a primary source of income <strong>for</strong> almost all of the artisans that<br />

these organizations worked with, and the organizations worked with women in both rural and<br />

urban areas. In terms of end-markets, most of the products that they sold were sold to<br />

customers in either DFW or the U.S., and these customers were described as both “affluent”<br />

and “average.” <strong>The</strong>y reported sales to final consumers, sales to retail outlets and storefronts,<br />

markets and events, and online sales were all ranked as important sales channels.<br />

Following the questionnaires, an interview was conducted with each entrepreneur regarding<br />

their experience in the handicrafts market, the services their organizations offer to artisans,<br />

and the greatest challenges and opportunities facing their organizations. Each business model<br />

was different, and they each had their own unique experiences in the market, but some<br />

common themes emerged in the answers.<br />

5<br />

For questionnaire and interview questions, please refer to the Appendix: DFW <strong>Case</strong> Study Questions<br />

20

For one, each began as a small-scale operation and demonstrated high levels of innovation<br />

and flexibility throughout their entrepreneurial journeys. Each entrepreneur had set out, <strong>for</strong><br />

instance, to empower just a few women living in poverty and in need of dignified work. One<br />

entrepreneur was inspired upon discovering the sewing talent of one of their clients and set<br />

out to help her sell handicrafts, later recruiting other artisans. Another had come across many<br />

instances of women with bead-working skills in their initial endeavors and later set out to<br />

recruit and train other women in this trade. Finally, another entrepreneur had interacted with<br />

artisans living in remote areas and was compelled to help them access the market. Only one<br />

entrepreneur had prior experience in the retail and fashion industry, but all three now run<br />

successful artisan businesses, helping to empower hundreds of artisans. All were agile<br />

organizations that learned and adapted as they grew and were highly in tune with both the<br />

needs and skills of their artisans and the demands of consumers in global markets. Because of<br />

these characteristics, they actively engaged in product marketing and development.<br />

Next, each had experience offering additional services to the women from whom they sourced.<br />

Financing was the most common service, and entrepreneurs were creative in their financial<br />

engagement with their artisan clients, going beyond just purchasing their crafts. Village<br />

savings loans, individual and community grants, and equipment buy-backs were offered to<br />

artisans. Entrepreneurs also offered business workshops and partnered with other non-profits<br />

to offer additional social services.<br />

As <strong>for</strong> the greatest challenges facing their organizations, a definite theme was clear. Despite<br />

the unique challenges presented by sourcing from artisans, including the need to provide<br />

additional services and pay fair prices <strong>for</strong> labor-intensive products, sourcing handmade was<br />

not viewed as a setback <strong>for</strong> entrepreneurs in the market. Instead, these unique challenges<br />

were met by entrepreneurs with drive and innovation, fueling both their determination and the<br />

unique value of their products. Rather, what seemed to concern entrepreneurs most was what<br />

concerns any business: supply chain efficiency, sales growth, capital, wholesale margins,<br />

inventory management, and marketing were all cited as challenges. Notably, only one<br />

organization was concerned with traditional artisan techniques disappearing, but all appeared<br />

optimistic about their future ability to source from artisans.<br />

Finally, a few common themes emerged regarding the entrepreneurs’ successes, and each saw<br />

various opportunities <strong>for</strong> continued growth. One important success shared by the three artisan<br />

entrepreneurs was their ability to partner with other organizations—including other artisan<br />

21

entrepreneurs, non-profits, and even a local university—<strong>for</strong> product development, social<br />

services, and data collection. In terms of future opportunities, the entrepreneurs saw the<br />

opportunity to enter new markets, develop their product lines, employ more artisans, and<br />

begin realizing efficiencies that could lead to lower price points. Most importantly, the<br />

entrepreneurs all saw continued opportunities to empower more women artisans, not only to<br />

succeed as creative and skilled workers, but also to continue their transition out of poverty and<br />

pursue their business aspirations.<br />

Conclusion<br />

<strong>The</strong> case <strong>for</strong> handmade is strong. Handicrafts occupy a unique space between art and<br />

function, between creativity and efficiency, and yet the value of handmade goes far beyond<br />

the value of the products themselves. As the second largest source of livelihood in the<br />

developing world, handicrafts have the potential to empower some of the world’s poorest<br />

people—the majority of them women—providing essential work and income, empowering<br />

women, and uplifting communities. In terms of market value, recent figures estimate the<br />

global market <strong>for</strong> artisan goods at $32 billion per year. While this does not mean that the<br />

sector lacks challenges—issues with aggregation, financing, and in<strong>for</strong>mation flows continue to<br />

create barriers between artisans and global markets—it implies that there is ample opportunity<br />

to capitalize on handicrafts’ significant economic and social potential <strong>for</strong> impact. Currently,<br />

there exists a fair amount of research on the challenges of connecting artisans to markets, and<br />

important work has been done in terms of capacity-building <strong>for</strong> artisan businesses, but much<br />

more research is needed in terms of opportunities to help the sector realize its potential.<br />

Namely, more research is needed into the recent ef<strong>for</strong>ts of corporates and artisan<br />

entrepreneurs to exploit market opportunities and empower artisans, as well as the potential<br />

link between artisan production and environmental sustainability.<br />

22

Appendix: Artisan Value Chains<br />

Figure 1: Global “Handicraft Market Channels”<br />

Figure 2: Madagascar “Importing Structure and Distribution Channels”<br />

23

Figure 3: “Guatemalan Textile Handicrafts Value Chain”<br />

Figure 4: Senegal “Value Chain <strong>for</strong> Artisan Textile Sub sector (Current)”<br />

24

Figure 5A: India “[Rural Cooperative] Retailing <strong>for</strong> Handicraft Cooperatives in Kerala”<br />

Figure 5B: India “[Rural Isolated] retailing <strong>for</strong> Handicraft Cooperatives in Kerala”<br />

25

26<br />

Figure 6: Namibia “Value Chain <strong>for</strong> Artisan Textile Sub sector

Appendix: Inclusive Economy Ecosystem Model<br />

Figure 1: Original Inclusive Economy Ecosystem Model<br />

Figure 2: Applied Inclusive Economy Ecosystem Model<br />

27

Appendix: DFW <strong>Case</strong> Study Questions<br />

Artisan Organization Questionnaire<br />

Artisanal products have significant potential <strong>for</strong> social impact, both in terms of the income they<br />

generate and the cultural traditions they help preserve. This survey is part of a broader<br />

research ef<strong>for</strong>t, of which the main objective is to better understand the global market <strong>for</strong><br />

artisanal products, the related value chain, and the market failures faced by artisans and the<br />

organizations they work with.<br />

As a reminder, you have a full right to privacy (see consent <strong>for</strong>m), and <strong>for</strong> each question there<br />

is the option to select “n/a” <strong>for</strong> in<strong>for</strong>mation that you do not know or wish not to disclose. Only<br />

the researchers involved in this study will see the in<strong>for</strong>mation. If the results of this study are<br />

published or otherwise presented to others, your name will not be used.<br />

This questionnaire should take no longer than 15 minutes; we appreciate your time.<br />

1. My artisan organization has been running <strong>for</strong> approximately ___ years<br />

2. My artisan organization can be best defined as a<br />

o Charity organization <br />

o Non-profit organization <br />

o For-profit business <br />

o Social enterprise <br />

o N/a <br />

3. Celebrating arts and culture is one of the main motivations of my artisan organization<br />

o Not at All <br />

o Very Little <br />

o Somewhat <br />

o To a Great Extent <br />

o N/a <br />

28

4. Empowering artisans is one of the main motivations of my artisan organization<br />

o Not at All <br />

o Very Little <br />

o Somewhat <br />

o To a Great Extent <br />

o N/a <br />

5. Artisanal work is the primary source of income <strong>for</strong> the artisans my organization works<br />

with <br />

o True<br />

o False<br />

o N/a <br />

6. Women make up approximately_______ of the artisans my organization works with<br />

o None <br />

o Less than half <br />

o Half <br />

o More than half <br />

o All <br />

o N/a <br />

7. My organization works with approximately ________ artisans<br />

8. <strong>The</strong> artisans my organization works with mainly work in _____ locations<br />

o Urban<br />

o Rural<br />

o N/a <br />

9. My organization mainly works with artisans in<br />

o One community <br />

o Few communities in the same geography <br />

o Many communities in multiple geographies N/a <br />

10. My organization’s products are mostly designed by<br />

o Artisans <br />

o Artisans, with the help of my organization <br />

o Artisans, with the help of a hired third party <br />

29

o A hired third party <br />

o My organization <br />

o N/a <br />

11. Most of my organization’s customers can be best described as<br />

o Affluent<br />

o Average<br />

o Thrifty<br />

o N/a<br />

12. Most of my organization’s customers can be best described as<br />

o Male<br />

o Female<br />

o N/a<br />

13. Most of my organization’s customers’ age can be best described as<br />

o Late teens <br />

o 20s and early 30s <br />

o late 30s and 40s <br />

o 50s and 60+ <br />

o N/a <br />

14. Most of my organization’s customers are based in <br />

o D/FW <br />

o Texas (excluding D/FW) <br />

o U.S. (excluding Texas) <br />

o Other/international <br />

o N/a <br />

15. Most of my organization’s artisan products are sold <br />

o Online <br />

o Storefront, owned <br />

o Storefront, shared <br />

o At markets and events <br />

o N/a<br />

16. . Most of my organization’s artisan products are sold <br />

o To other businesses <br />

30

o To individuals<br />

o N/a <br />

17. My organization employs approximately____ people (excluding artisans)<br />

18. My organization’s annual sales revenue is approximately<br />

o Under $100K <br />

o $100K- $500K <br />

o $500K - $1M <br />

o $1M+ <br />

o N/a <br />

19. My organization is aware of the existence of the following organizations<br />

o <strong>The</strong> Alliance <strong>for</strong> Artisan Enterprise <br />

o <strong>The</strong> International Folk Art Alliance <br />

o Ethical Fashion Initiative <br />

o Impact investing funds (any) <br />

o N/a <br />

Artisan Organization Interview<br />

Introductory Script:<br />

Artisanal products have significant potential <strong>for</strong> social impact, both in terms of the income they<br />

generate and the cultural traditions they help preserve. This survey is part of a broader<br />

research ef<strong>for</strong>t, of which the main objective is to better understand the global market <strong>for</strong><br />

artisanal products, the related value chain, and the market failures faced by artisans and the<br />

organizations they work with.<br />

Specifically, this interview seeks to gain a deeper understanding of the needs and experiences<br />

of DFW organizations that work with artisans in developing countries, and it will be used to<br />

identify the common barriers and opportunities faced by the DFW artisanal goods community<br />

in order to understand how to better empower and serve it.<br />

By participating in this interview, you are not only helping create a body of knowledge on a<br />

very important and understudied topic in international development and poverty alleviation,<br />

but are also contributing to a specific ef<strong>for</strong>t to empower DFW artisan organizations like yours<br />

and the artisans they serve.<br />

31

As a reminder, you have a full right to privacy (see consent <strong>for</strong>m), and <strong>for</strong> each question there<br />

is the option to select “n/a” <strong>for</strong> in<strong>for</strong>mation that you do not know or wish not to disclose. Only<br />

the researchers involved in this study will see the in<strong>for</strong>mation. If the results of this study are<br />

published or otherwise presented to others, your name will not be used.<br />

<strong>The</strong> entire interview should take no longer than one hour, and I really appreciate your time<br />

and participation.<br />

Q1: What is your organization’s “story”?<br />

Q2: What services has your organization offered to artisans so far?<br />

Q3: What have been the greatest successes of your organization?<br />

Q4: What have been the greatest challenges faced by your organization?<br />

Q5: What are your organization’s top three long-term aspirations?<br />

Q6: What are your organization’s top three concerns <strong>for</strong> the future?<br />

Q7: Tell me more about your artisans’ top three strengths/success(es).<br />

Q8: Tell me more about the top three challenges faced by your artisans.<br />

Q9: What, if any, has been your experience with each of the following types of events?<br />

1) networking event with other artisan organizations and potential investors/buyers<br />

2) artisan innovation workshop on strategies <strong>for</strong> leading an effective artisan business<br />

3) artisan market held at a university to promote and sell products<br />

32

Works Cited<br />

1<br />

Dunn, E., & Villeda, L. (2005). Weaving Micro and Small Enterprises into Global Value Chains.<br />

<strong>The</strong> <strong>Case</strong> of Guatemalan Textile Handicrafts. Microreport, 31, 35.<br />

2<br />

Harmonized Commodity Description and Coding Systems (HS) (Classifications, Commodity<br />

Codes, Commodity Description, HS, HS code search, WCO). (n.d.). Retrieved March 02, 2018,<br />

from https://unstats.un.org/unsd/tradekb/Knowledgebase/50018/Harmonized-Commodity-<br />

Description-and-Coding-Systems-HS<br />

3<br />

Richard, N. (2007). Handicrafts and employment generation <strong>for</strong> the poorest youth and<br />

women. United Nations Educational, Scientific and Cultural Organization UNESCO, Paris, 4.<br />

4<br />

Benítez Aranda, S. (1999). Latin American Handicrafts as a Factor <strong>for</strong> Economic, Social and<br />

Cultural Development: Handicrafts by the Light of the New Concepts of Culture and<br />

Development. Revista de Cultura y Desarollo, United Nations Educational, Scientific and<br />

Cultural Organization UNESCO, 6-8.<br />

5<br />

Intangible Cultural Heritage. (n.d.). UNESCO. Retrieved March 02, 2018, from<br />

https://ich.unesco.org/en/traditional-craftsmanship-00057<br />

6<br />

Barber, T., & Krivoshlykova, M. (2006). Global market assessment <strong>for</strong> handicrafts. United<br />

States Agency <strong>for</strong> International Development.<br />

7<br />

Richards, N. (2007).<br />

8<br />

Turning promises into action: Gender equality in the 2030 Agenda <strong>for</strong> Sustainable<br />

Development. (n.d.). Retrieved March 02, 2018, from http://www.unwomen.org/en/digital-<br />

library/publications/2018/2/gender-equality-in-the-2030-agenda-<strong>for</strong>-sustainable-development-<br />

2018<br />

9<br />

Yoo, T., & Cisco Systems Inc. (n.d.). Why women make the best tech investments. Retrieved<br />

March 02, 2018, from https://www.we<strong>for</strong>um.org/agenda/2014/01/women-technology-worldeconomy/<br />

10<br />

Intangible Cultural Heritage. (n.d.). UNESCO. Retrieved March 02, 2018, from<br />

https://ich.unesco.org/en/traditional-craftsmanship-00057<br />

11<br />

Benítez Aranda, S. (1999), 10.<br />

33

12<br />

Milgram, B. (2010). From trash to totes: Recycled production and cooperative economy<br />

practice in the Philippines. Human Organization, 69(1), 75-85.<br />

13<br />

Okot-Okumu, J. (2012). Solid waste management in African cities–East Africa. In Waste<br />

Management-An Integrated Vision. InTech.<br />

14<br />

UNCTAD, UNDP (2010). Special Unit <strong>for</strong> South-South Cooperation: Creative Economy Report<br />

2010-Creative Economy: A Feasible Development Option, 140.<br />

15<br />

UNCTAD, UNDP (2010), 126.<br />

16<br />

Barber, T., & Krivoshlykova, M. (2006).<br />

17<br />

Dunn, E., & Villeda, L. (2005).<br />

18<br />

USAID (2006). Artisan textile value chain Senegal: analysis and strategic framework <strong>for</strong> subsector<br />

growth initiatives. United States Agency <strong>for</strong> International Development, Aid to Artisans.<br />

19<br />

Ashamu, C. et al (2005). Made in Madagascar: Exporting Handicrafts to the US Market. Final<br />

Report.<br />

20<br />

Vadakepat, V. M. (2013). Rural retailing: Challenges to traditional handicrafts. Journal of<br />

Global Marketing, 26(5), 273-283.<br />

21<br />

MTI (2016). Growth Strategy <strong>for</strong> Namibia’s Handicraft Industry and Associated Value Chains.<br />

Ministry Of Industrialization, Trade And SME Development.<br />

22<br />

80% of trade takes place in ‘value chains’ linked to transnational corporations, UNCTAD<br />

report says. (2013, February 27). Retrieved April 02, 2018, from<br />

http://unctad.org/en/pages/PressRelease.aspx?OriginalVersionID=113<br />

23<br />

Mustafa, M. (2011). Potential of sustaining handicrafts as a tourism product in Jordan.<br />

International journal of business and social science, 2(2).<br />

24<br />

Csaky, E. (2014). Smallholder Global Value Chain Participation: <strong>The</strong> Role of Aggregation<br />

(Doctoral dissertation), 4.<br />

25<br />

Dunn, E., & Villeda, L. (2005), 28.<br />

26<br />

Dunn, E., & Villeda, L. (2005), 26.<br />

27<br />

Cohen, J. (1998). Craft production and the challenge of the global market: An artisans'<br />

cooperative in Oaxaca, Mexico. Human Organization, 57(1), 79.<br />

28<br />

Dunn, E., Sebstad, J., Batzdorff, L., & Parsons, H. (2006). Lessons learned on MSE<br />

upgrading in value chains. USAID, Washington, DC.<br />

34

29<br />

Alliance <strong>for</strong> Artisan Enterprise (2012). Bringing Artisan Enterprise to Scale. <strong>The</strong> Alliance <strong>for</strong><br />

Artisan Enterprise: <strong>The</strong> Aspen Institute.<br />

30<br />

Csaky, E., & Clark, A. (2018). <strong>The</strong> Inclusive Economy Ecosystem. Unpublished.<br />

31<br />

Barber, T., & Krivoshlykova, M. (2006), 7.<br />

32<br />

Global Handicrafts Market 2015-2019. (2015, December 02). PR Newswire, p. PR Newswire,<br />

Dec 2, 2015.<br />

33<br />

Current Members. (n.d.). Retrieved March 20, 2018, from<br />

http://www.artisanalliance.org/member-network/<br />

34<br />

Ghemawat, P., & Nueno, J.L. (2006). Zara: Fast Fashion. HBS No. 9-703-497. Boston, MA:<br />

Harvard Business School Publishing.<br />

35<br />

HBS (2001). Gucci Group N.V. (A). HBS No. 9-701-037. Boston, MA: Harvard Business<br />

School Publishing.<br />

36<br />

Csaky, E., & Clark, A. (2018).<br />

37<br />

Ashamu, C. et al (2005).<br />

38<br />

Soule, E., Tinsley, C., Rivoli, P (2017). A Social Enterprise Link in a Global Value Chain:<br />

Per<strong>for</strong>mance and Potential of a New Supplier Model. Georgetown University Women’s<br />

Leadership Institute, Georgetown University, Washington, DC.<br />

35