Child Tax Credit Grant Opportunity Call for Proposals

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Call</strong> <strong>for</strong> <strong>Proposals</strong><br />

The City of Philadelphia’s Office of Community Empowerment and <strong>Opportunity</strong> (CEO) with support from<br />

the Thomas Scattergood Behavioral Health Foundation (Scattergood) seeks proposals from Philadelphiabased<br />

community organizations to conduct outreach activities to maximize the number of Philadelphians<br />

that claim the newly expanded federal <strong>Child</strong> <strong>Tax</strong> <strong>Credit</strong>.<br />

The <strong>Child</strong> <strong>Tax</strong> <strong>Credit</strong> provides parents or guardians $3,000 <strong>for</strong> each child aged 5 and under, or $3,600 <strong>for</strong><br />

each child between the ages of 6 – 17, <strong>for</strong> the 2021 tax year. Payments are made by the IRS directly to<br />

families, many of whom began receiving a portion of the payments in monthly installments in July 2021,<br />

with the remaining balance to be paid to them by the IRS after they file their taxes in early 2022.<br />

An extra $3,000 - $3,600 per child could make an enormous difference <strong>for</strong> low-income families in<br />

Philadelphia in finding or keeping quality housing, ensuring good nutrition, paying <strong>for</strong> school supplies,<br />

medical care, transportation, clothing, and even saving <strong>for</strong> emergencies. But some Philadelphians are at<br />

risk of not receiving the <strong>Child</strong> <strong>Tax</strong> <strong>Credit</strong> (CTC) payments <strong>for</strong> which they are eligible because:<br />

• They did not file taxes in 2019 or 2020, and/or do not plan to file <strong>for</strong> 2021 because their<br />

incomes were too low or zero, there<strong>for</strong>e the IRS has not sent them automatic payments.<br />

• They don’t know about the CTC.<br />

• They lack access to the Internet and a computer needed to claim the CTC.<br />

• They need assistance from an expert to file taxes or navigate on-line portals <strong>for</strong> claiming the<br />

CTC.<br />

• They are mixed status immigration families that aren’t aware they may be eligible, don’t<br />

know how to get the proper identification to claim the CTC, and/or have concerns about filing<br />

in<strong>for</strong>mation with the IRS.<br />

• They have limited English proficiency and need interpretation and/or translation services to<br />

learn about the CTC and successfully claim it.<br />

• Someone else is claiming their child on their taxes and they don’t know how to change it.<br />

CEO is seeking to fund outreach activities in Philadelphia geared towards families that are at risk of not<br />

receiving the CTC to ensure they benefit from this poverty-fighting federal policy.<br />

We are seeking proposals from community organizations to help us achieve the following goals:<br />

Goal 1: Educate the community about the CTC and how to claim it.<br />

Goal 2: Connect individuals to trusted organizations that can help residents claim the CTC <strong>for</strong> free, such<br />

as the Campaign <strong>for</strong> Working Families.<br />

Goal 3: Help people access non-filer portals that help families claim the CTC (<strong>for</strong> as long as the IRS<br />

accepts submissions through the portals). This could include providing computer and Internet access,<br />

and/or a trained portal navigator to guide clients through the process of claiming the CTC.<br />

Activities we seek to fund can include, but are not limited to:<br />

• Distributing materials and/or making presentations at existing community events or meetings, or<br />

at new community events or meetings organized specifically <strong>for</strong> CTC outreach.<br />

• Recruiting people to come to a physical location (an office, a community space, etc.) to gain<br />

access to the Non-Filer portal at www.getCTC.org/philly and/or a trained portal navigator (<strong>for</strong> as<br />

long as the IRS accepts submissions through the portal).

• Partnering with community institutions like libraries, health care institutions, banks, or others <strong>for</strong><br />

outreach/assistance at their locations.<br />

• Outreach through grassroots methods such as canvassing, flyering, phone calling, texting, etc.<br />

• Assisting visitors to County Assistance Offices with access to the IRS portals at CAO kiosks, in<br />

coordination with the Pennsylvania Department of Human Services (DHS) as facilitated by CEO.<br />

• Gathering the stories of families that claimed the CTC in testimonials that may be delivered via<br />

video, photographs, audio, or in writing to be used to demonstrate the importance of making the<br />

CTC permanent and/or extending it <strong>for</strong> additional years (if combined with any of the activities<br />

above).<br />

• Or any other activities that will reach and assist Philadelphian families at risk of not receiving the<br />

CTC.<br />

Activities we will not consider funding include:<br />

• The purchase of advertising such as radio, print, billboards, or web-based ads.<br />

• <strong>Tax</strong> filing or preparation services, other than assistance with non-filer portal navigation.<br />

• Activities conducted outside of Philadelphia or targeted at families that do not live in Philadelphia.<br />

Who Should Apply<br />

Philadelphia-based community organizations with 501 (c)(3) status, or a fiscal sponsor, that already serve<br />

very low-income communities or groups that are at risk of not receiving the CTC are encouraged to<br />

apply.<br />

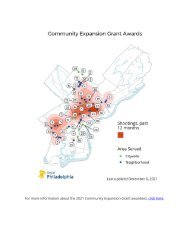

According to the U.S. Treasury, the following neighborhoods have the highest number of children in deep<br />

poverty whose parents or guardians are unlikely to already be receiving the CTC. Organizations that<br />

have a track recording serving these neighborhoods are also encouraged to apply: (In from highest to<br />

lowest) Port Richmond, Juniata/Frank<strong>for</strong>d/Feltonville, Hunting Park, Logan/Olney/Feltonville, University<br />

City, Frank<strong>for</strong>d/Mayfair, Lawndale/Castor Gardens, Fairhill/N. Phila, Germantown, Strawberry Mansion,<br />

West Phila/Walnut Hill, S.Phila/Whitman/Pennsport, Wynnefield, Brewerytown, Passyunk/Grad<br />

Hosp/Grays Ferry, West Oak Lane, Tacony, S.W. Phila/Elmwood, University<br />

City/Belmont/Parkside/Powelton Village, Holmesburg.<br />

We encourage applications from organizations whose staff, board, and/or volunteers include<br />

representation from the communities this project aims to reach.<br />

Timeline<br />

• <strong>Proposals</strong> Due: November 1, 2021<br />

• Funding Decisions Announced: December 1, 2021<br />

• Work Commences: January 3, 2022<br />

• Work Concludes: June 30, 2022<br />

• Reports Due: July 15, 2022<br />

Funding available<br />

We expect to fund 10 – 20 organizations <strong>for</strong> proposals of $5,000 to $20,000 each. <strong>Proposals</strong> <strong>for</strong> greater<br />

than $20,000 will be considered if they have the potential to make a significant impact in the number of<br />

Philadelphians reached. The total amount of funding available <strong>for</strong> all applicants combined is $192,000.<br />

Where to Apply<br />

The grant application process is being hosted by the Scattergood Foundation. Please visit their grant<br />

portal here.

For questions<br />

Please review the Frequently Asked Questions document posted first. If your question is not addressed,<br />

email beth.mcconnell@phila.gov with questions about this grant opportunity.