Relaunch Investment Suitability

Relaunch Investment Suitability

Relaunch Investment Suitability

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

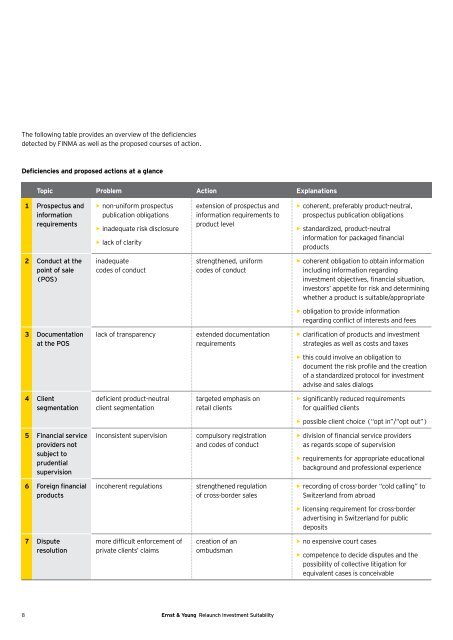

The following table provides an overview of the deficiencies<br />

detected by FINMA as well as the proposed courses of action.<br />

Deficiencies and proposed actions at a glance<br />

Topic Problem Action Explanations<br />

1 Prospectus and<br />

information<br />

requirements<br />

2 Conduct at the<br />

point of sale<br />

(POS)<br />

3 Documentation<br />

at the POS<br />

4 Client<br />

segmentation<br />

5 Financial service<br />

providers not<br />

subject to<br />

prudential<br />

supervision<br />

6 Foreign financial<br />

products<br />

7 Dispute<br />

resolution<br />

• non-uniform prospectus<br />

publication obligations<br />

• inadequate risk disclosure<br />

• lack of clarity<br />

inadequate<br />

codes of conduct<br />

extension of prospectus and<br />

information requirements to<br />

product level<br />

strengthened, uniform<br />

codes of conduct<br />

lack of transparency extended documentation<br />

requirements<br />

deficient product-neutral<br />

client segmentation<br />

targeted emphasis on<br />

retail clients<br />

inconsistent supervision compulsory registration<br />

and codes of conduct<br />

incoherent regulations strengthened regulation<br />

of cross-border sales<br />

more difficult enforcement of<br />

private clients’ claims<br />

creation of an<br />

ombudsman<br />

8 Ernst & Young <strong>Relaunch</strong> <strong>Investment</strong> <strong>Suitability</strong><br />

• coherent, preferably product-neutral,<br />

prospectus publication obligations<br />

• standardized, product-neutral<br />

information for packaged financial<br />

products<br />

• coherent obligation to obtain information<br />

including information regarding<br />

investment objectives, financial situation,<br />

investors’ appetite for risk and determining<br />

whether a product is suitable/appropriate<br />

• obligation to provide information<br />

regarding conflict of interests and fees<br />

• clarification of products and investment<br />

strategies as well as costs and taxes<br />

• this could involve an obligation to<br />

document the risk profile and the creation<br />

of a standardized protocol for investment<br />

advise and sales dialogs<br />

• significantly reduced requirements<br />

for qualified clients<br />

• possible client choice (“opt in”/“opt out”)<br />

• division of financial service providers<br />

as regards scope of supervision<br />

• requirements for appropriate educational<br />

background and professional experience<br />

• recording of cross-border “cold calling” to<br />

Switzerland from abroad<br />

• licensing requirement for cross-border<br />

advertising in Switzerland for public<br />

deposits<br />

• no expensive court cases<br />

• competence to decide disputes and the<br />

possibility of collective litigation for<br />

equivalent cases is conceivable