Online Marketing Strategy and Consumer Behavior - IHG Owners ...

Online Marketing Strategy and Consumer Behavior - IHG Owners ...

Online Marketing Strategy and Consumer Behavior - IHG Owners ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

This brings us back to the question of attribution<br />

models. Since we do not know what the traveler<br />

was doing on the OTA sites, <strong>and</strong> given the widespread<br />

visitation of many travel sites by the <strong>IHG</strong><br />

bookers, we are back to wondering which site(s),<br />

or other communication vehicles such as banner<br />

ads, email, or PPC ads, or off-line advertising (TV,<br />

radio, print ads), along with some combination<br />

of the seven to eight (or ten) websites that were<br />

visited, actually triggered the booking. This is a<br />

highly pertinent question that requires further<br />

study as the data from the CHR Billboard Effect<br />

study do not provide an answer.<br />

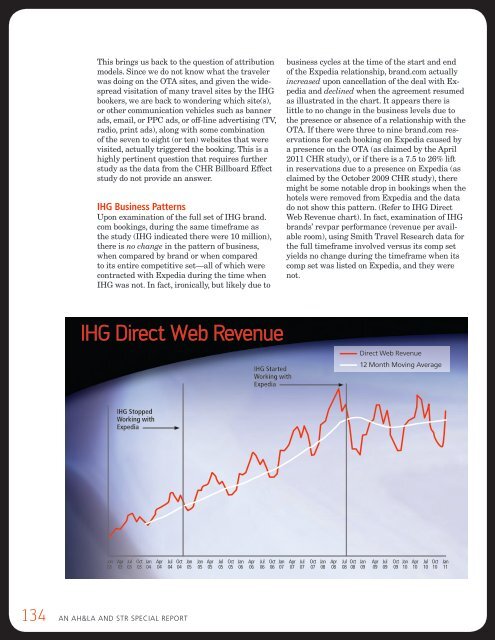

<strong>IHG</strong> Business Patterns<br />

Upon examination of the full set of <strong>IHG</strong> br<strong>and</strong>.<br />

com bookings, during the same timeframe as<br />

the study (<strong>IHG</strong> indicated there were 10 million),<br />

there is no change in the pattern of business,<br />

when compared by br<strong>and</strong> or when compared<br />

to its entire competitive set—all of which were<br />

contracted with Expedia during the time when<br />

<strong>IHG</strong> was not. In fact, ironically, but likely due to<br />

<strong>IHG</strong> Direct Web Revenue<br />

<strong>IHG</strong> Stopped<br />

Working with<br />

Expedia<br />

134 An Ah&lA And stR sPeciAl RePoRt<br />

<strong>IHG</strong> Started<br />

Working with<br />

Expedia<br />

business cycles at the time of the start <strong>and</strong> end<br />

of the Expedia relationship, br<strong>and</strong>.com actually<br />

increased upon cancellation of the deal with Expedia<br />

<strong>and</strong> declined when the agreement resumed<br />

as illustrated in the chart. It appears there is<br />

little to no change in the business levels due to<br />

the presence or absence of a relationship with the<br />

OTA. If there were three to nine br<strong>and</strong>.com reservations<br />

for each booking on Expedia caused by<br />

a presence on the OTA (as claimed by the April<br />

2011 CHR study), or if there is a 7.5 to 26% lift<br />

in reservations due to a presence on Expedia (as<br />

claimed by the October 2009 CHR study), there<br />

might be some notable drop in bookings when the<br />

hotels were removed from Expedia <strong>and</strong> the data<br />

do not show this pattern. (Refer to <strong>IHG</strong> Direct<br />

Web Revenue chart). In fact, examination of <strong>IHG</strong><br />

br<strong>and</strong>s’ revpar performance (revenue per available<br />

room), using Smith Travel Research data for<br />

the full timeframe involved versus its comp set<br />

yields no change during the timeframe when its<br />

comp set was listed on Expedia, <strong>and</strong> they were<br />

not.<br />

Direct Web Revenue<br />

12 Month Moving Average<br />

Jan Apr Jul Oct Jan Apr Jul Oct Jan Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan<br />

03 03 03 03 04 04 04 04 05 05 05 05 05 06 06 06 06 07 07 07 07 08 08 08 08 09 09 09 09 10 10 10 10 11