Mainfreight Annual Report 2022

Mainfreight Annual Report 2022

Mainfreight Annual Report 2022

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

90 91<br />

Notes to the FINANCIAL STATEMENTS<br />

Notes to the FINANCIAL STATEMENTS<br />

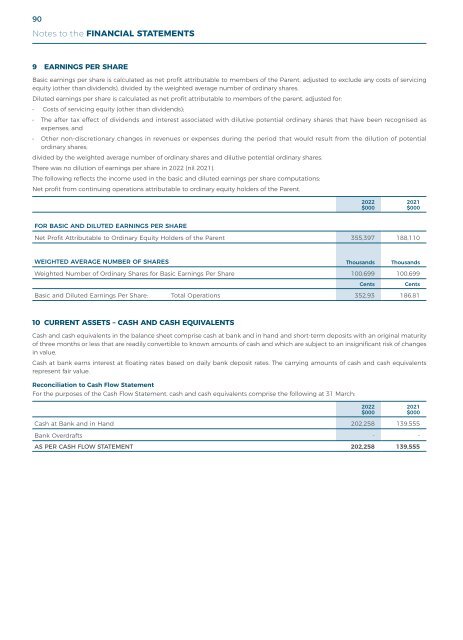

9 EARNINGS PER SHARE<br />

Basic earnings per share is calculated as net profit attributable to members of the Parent, adjusted to exclude any costs of servicing<br />

equity (other than dividends), divided by the weighted average number of ordinary shares.<br />

Diluted earnings per share is calculated as net profit attributable to members of the parent, adjusted for:<br />

• Costs of servicing equity (other than dividends);<br />

• The after tax effect of dividends and interest associated with dilutive potential ordinary shares that have been recognised as<br />

expenses; and<br />

• Other non-discretionary changes in revenues or expenses during the period that would result from the dilution of potential<br />

ordinary shares;<br />

divided by the weighted average number of ordinary shares and dilutive potential ordinary shares.<br />

There was no dilution of earnings per share in <strong>2022</strong> (nil 2021).<br />

The following reflects the income used in the basic and diluted earnings per share computations:<br />

Net profit from continuing operations attributable to ordinary equity holders of the Parent.<br />

11 CURRENT ASSETS – TRADE DEBTORS<br />

Trade debtors are non-interest bearing and are generally on 7–30 day terms. They are recognised initially at fair value and subsequently<br />

measured at amortised cost using the effective interest method, less an allowance for impairment. Trade debtors includes amounts<br />

for services performed but unbilled at balance date.<br />

Collectability of trade debtors is reviewed on an ongoing basis. Debts that are known to be uncollectible are written off when identified.<br />

The Group applies a simplified approach in calculating expected credit losses. Therefore, the Group does not track changes in credit<br />

risk, but instead recognises a loss allowance based on lifetime expected credit losses at each reporting date. This is based on historical<br />

credit loss experience, adjusted for forward-looking factors specific to the debtors and the economic environment. Trade debtors are<br />

written off as bad debts when all avenues of collection have been exhausted. Due to the short-term nature of these debtors, their<br />

carrying value is assumed to approximate fair value.<br />

Trade Debtors 810,333 493,862<br />

Allowance for Impairment Loss (4,765) (4,616)<br />

<strong>2022</strong><br />

$000<br />

2021<br />

$000<br />

<strong>2022</strong><br />

$000<br />

2021<br />

$000<br />

Movements in the allowance for impairment were as follows:<br />

805,568 489,246<br />

FOR BASIC AND DILUTED EARNINGS PER SHARE<br />

Net Profit Attributable to Ordinary Equity Holders of the Parent 355,397 188,110<br />

Balance at 1 April 4,616 4,798<br />

Charge for the Year 4,333 2,527<br />

Amounts Written Off (4,184) (2,709)<br />

WEIGHTED AVERAGE NUMBER OF SHARES Thousands Thousands<br />

BALANCE AT 31 MARCH 4,765 4,616<br />

Weighted Number of Ordinary Shares for Basic Earnings Per Share 100,699 100,699<br />

Cents<br />

Cents<br />

Basic and Diluted Earnings Per Share: Total Operations 352.93 186.81<br />

At 31 March, the ageing analysis of trade receivables is as follows:<br />

$000 Total<br />

0-30<br />

Days<br />

31-60<br />

Days<br />

61-90<br />

Days<br />

PDNI*<br />

61-90<br />

Days<br />

CI#<br />

+91<br />

Days<br />

PDNI*<br />

+91<br />

Days<br />

CI#<br />

10 CURRENT ASSETS – CASH AND CASH EQUIVALENTS<br />

Cash and cash equivalents in the balance sheet comprise cash at bank and in hand and short-term deposits with an original maturity<br />

of three months or less that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes<br />

in value.<br />

Cash at bank earns interest at floating rates based on daily bank deposit rates. The carrying amounts of cash and cash equivalents<br />

represent fair value.<br />

Reconciliation to Cash Flow Statement<br />

For the purposes of the Cash Flow Statement, cash and cash equivalents comprise the following at 31 March:<br />

<strong>2022</strong> 810,333 670,982 109,050 17,673 786 7,863 3,979<br />

2021 493,862 381,061 91,325 13,199 605 3,661 4,011<br />

* Past due not impaired (PDNI)<br />

# Considered Impaired (CI)<br />

Credit risk management policy is disclosed in note 3.<br />

The maximum exposure to credit risk is the fair value of receivables. Collateral is not held as security, nor is it the Group’s policy to<br />

transfer or factor receivables.<br />

<strong>2022</strong><br />

$000<br />

2021<br />

$000<br />

12 CURRENT ASSETS – OTHER RECEIVABLES<br />

Cash at Bank and in Hand 202,258 139,555<br />

Bank Overdrafts - -<br />

AS PER CASH FLOW STATEMENT 202,258 139,555<br />

Sundry Prepayments and Other Receivables 48,563 89,531<br />

CARRYING AMOUNT OF OTHER RECEIVABLES 48,563 89,531<br />

<strong>2022</strong><br />

$000<br />

2021<br />

$000