Green Economy Journal Issue 57

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

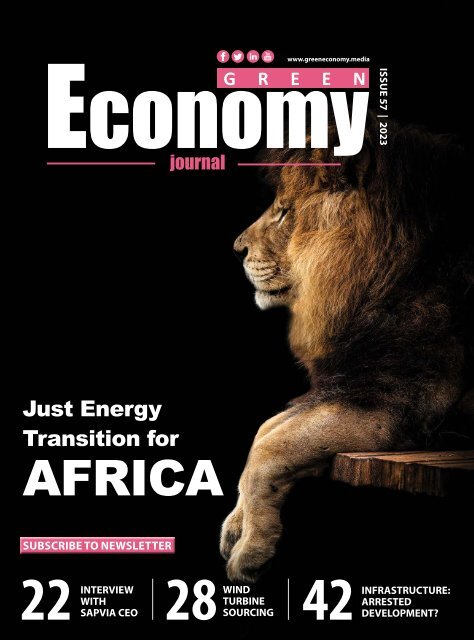

G R E E N<br />

<strong>Economy</strong><br />

journal<br />

ISSUE <strong>57</strong> | 2023<br />

Just Energy<br />

Transition for<br />

AFRICA<br />

22 SAPVIA<br />

INTERVIEW<br />

WITH<br />

CEO<br />

28<br />

WIND<br />

TURBINE<br />

SOURCING<br />

42<br />

INFRASTRUCTURE:<br />

ARRESTED<br />

DEVELOPMENT?

Strive for Net Zero<br />

while saving money at the same time!<br />

Rooftop, solar car-ports, ground mounted solar, and agri-voltaics represent the best value energy<br />

available to the energy customer in South Africa.<br />

Blue Sky Energy are experts in the design, procurement and construction of such plants.<br />

Battery energy storage installations provide access to solar energy daily during peak hours when the<br />

sun is not shining and enable users to bridge their primary energy needs through grid interruptions.<br />

While the levelised cost of hybrid solar + battery storage installations is significantly greater than solar<br />

PV only, appropriately sized solutions can be commercially feasible.<br />

Would you like to know if your property or business can achieve energy security at the same cost or<br />

less than what you are paying currently?<br />

Did you know that Section<br />

12B of the Tax Act allows for<br />

the accelerated depreciation<br />

of your power generation capex<br />

resulting in a 27.5% saving on<br />

your project installation?<br />

Agri-Voltaics and<br />

Solar Car Ports<br />

Blue Sky Energy works<br />

with leading light steel<br />

frame construction<br />

suppliers to offer a range<br />

of innovative solutions<br />

such as agrivoltaics and<br />

solar car-ports.<br />

Have you considered<br />

putting your spare space<br />

to work? Whether you<br />

have low value land or<br />

large parking spaces,<br />

bring them to life through<br />

solar PV installations that<br />

create energy and high<br />

value spaces such as<br />

shade for parking or<br />

tunnels for agriculture.<br />

123RF<br />

123RF<br />

Website: www.blue-sky.energy Email: enquiries@blue-sky.energy<br />

CONTACT THE EXPERTS AT BLUE SKY ENERGY RIGHT NOW!

NATURE RESERVE

PUBLISHER’S NOTE<br />

Recently a new ministerial portfolio was created, and the Honourable<br />

Minister of Electricity, Dr Kgosientso Ramokgopa, was appointed. But<br />

what do we know about him? According to Wikipedia, Kgosientso<br />

“Sputla” Ramokgopa is a South African politician who was the Mayor<br />

of Tshwane from 2010 to 2016. His academic background includes<br />

a Bachelor’s degree in civil engineering, Master’s degrees in public<br />

administration and business leadership and a PhD in public affairs.<br />

He was born in 1975.<br />

I read in media that Ramokgopa left the City of Tshwane bankrupt<br />

after the legal settlement with PEU Capital Partners over a deal to roll<br />

out smart electricity meters across the City ended in litigation.<br />

I would like to share a few first-hand details about Ramokgopa’s<br />

performance at City of Tshwane. It may give an idea as to how he will<br />

tackle his current monumental challenge.<br />

We ran the Sustainability Week conference in partnership with<br />

the City of Tshwane from 2011 to 2016, and Ramokgopa was the<br />

patron of the event. Among a great many other positive projects and<br />

happenings in the green economy that the event’s many sub-sector<br />

conferences focused on, we also showcased the work of Tshwane’s<br />

City Sustainability Unit under the leadership of Dorah Modise,<br />

subsequently influential CEO of <strong>Green</strong> Building Council SA.<br />

The team under Romokgopa were trailblazers. Aside from many<br />

other achievements, they developed the first <strong>Green</strong> Service Delivery<br />

Strategy in South Africa and were mandated to act into all City<br />

departments to guide the implementation of interventions aimed at<br />

achieving the stated objectives.<br />

Their projects ranged from the first wheeling deal which facilitated<br />

the Bio2Watt biogas project in Bronkhorstspruit, making electricity<br />

out of various waste streams including sorted municipal solid waste<br />

(MSW) and supplying power to the BMW Rosslyn plant and free WiFi to<br />

all Tshwane residents, to the first fully-mechanised materials recovery<br />

facility (MURF), and the roll-out of smart electricity meters that would<br />

enable net metering for small-scale embedded generation.<br />

Ultimately, Ramakgopa was unseated by an ANC opponent before<br />

they lost the City to the DA.<br />

Having worked with Ramokgopa, albeit at some distance, I feel<br />

optimistic that if anyone in the ANC can pull this mandate through,<br />

it is him.<br />

G R E E N<br />

<strong>Economy</strong><br />

journal<br />

EDITOR:<br />

CO-PUBLISHERS:<br />

LAYOUT AND DESIGN:<br />

OFFICE ADMINISTRATOR:<br />

WEB, DIGITAL AND SOCIAL MEDIA:<br />

SALES:<br />

PRINTERS:<br />

GENERAL ENQUIRIES:<br />

ADVERTISING ENQUIRIES:<br />

Alexis Knipe<br />

alexis@greeneconomy.media<br />

Gordon Brown<br />

gordon@greeneconomy.media<br />

Alexis Knipe<br />

alexis@greeneconomy.media<br />

Danielle Solomons<br />

danielle@greeneconomy.media<br />

CDC Design<br />

Melanie Taylor<br />

Steven Mokopane<br />

Gerard Jeffcote<br />

Glenda Kulp<br />

Nadia Maritz<br />

Tanya Duthie<br />

Vania Reyneke<br />

FA Print<br />

info@greeneconomy.media<br />

alexis@greeneconomy.media<br />

REG NUMBER: 2005/003854/07<br />

VAT NUMBER: 4750243448<br />

PUBLICATION DATE: April 2023<br />

www.greeneconomy.media<br />

G R E E N<br />

<strong>Economy</strong><br />

journal<br />

CONTENTS<br />

6 NEWS AND SNIPPETS<br />

ENERGY<br />

10 What the world is learning from SA’s energy transition<br />

16 The Just Energy Transition – what it should be ...<br />

22 It’s time for solar to shine: interview with SAPVIA CEO<br />

26 Business Partners urges companies to go solar<br />

28 The future of onshore wind turbine sourcing<br />

32 Wind energy’s leading role in SA’s Energy Action Plan<br />

36 REVOV says that we are morally bound to demand<br />

environmentally sound batteries<br />

38 Bringing power back to LiFe: we interview REVOV CEO<br />

WASTE<br />

20 NCPC-SA’s waste minimisation programme is improving lives<br />

DECARBONISATION<br />

34 Climate impact imperatives by SRK Consulting<br />

16<br />

28<br />

42<br />

Publisher<br />

EDITOR’S NOTE<br />

Africa is blessed with land and resources, enough to supply the whole<br />

world, and needs to capitalise on this in a sustainable way. We have<br />

sunshine for solar, water for hydro and wind for renewable capacity<br />

and an abundance of biomass and waste that can be converted<br />

to energy. Chris Whyte, ACEN, points out that the key focus here<br />

is energy, and the simple reality is that Africa will never be able to<br />

achieve the SDGs without energy. Everything is reliant on energy: we<br />

need to avoid the expensive mistakes of before and rather implement<br />

viable energy generation (page 16).<br />

The push for renewable energy is showing an increase in solar PV<br />

across the country, which in turn drives demand for components and<br />

services. Don’t miss our interview with the CEO of SAPVIA (page 22)<br />

or our article on wind turbine sourcing (page 28).<br />

Our thought leadership article indicates that despite the speed with<br />

which solar and wind power plants could be built, South Africa’s grid<br />

itself does not have the capacity to distribute that power (page 42).<br />

Alexis Knipe<br />

Editor<br />

All Rights Reserved. No part of this publication may be reproduced or transmitted in any way or<br />

in any form without the prior written permission of the Publisher. The opinions expressed herein<br />

are not necessarily those of the Publisher or the Editor. All editorial and advertising contributions<br />

are accepted on the understanding that the contributor either owns or has obtained all necessary<br />

copyrights and permissions. The Publisher does not endorse any claims made in the publication<br />

by or on behalf of any organisations or products. Please address any concerns in this regard to<br />

the Publisher.<br />

WOOD PULP AND PAPER<br />

8 PAMSA on the circular economy<br />

40 Forestry: a greener more sustainable future<br />

THOUGHT LEADERSHIP<br />

42 Quo vadis infrastructure development<br />

46 DQS Academy: simply leveraging quality<br />

READ REPORT<br />

THOUGHT [ECO]NOMY<br />

greeneconomy/report recycle<br />

To access the full report in our Thought [ECO]nomy report boxes:<br />

Click on the READ REPORT wording or image in the box and you will<br />

gain access to the original report. Turn to the page numbers (example<br />

below) for key takeouts of the report.<br />

01 02 03<br />

key takeouts<br />

of the report<br />

key takeouts<br />

of the report<br />

key takeouts<br />

of the report<br />

4<br />

5

NEWS & SNIPPETS<br />

NEWS & SNIPPETS<br />

SA WELCOMES CLIMATE CHANGE REPORT<br />

South Africa welcomes the release<br />

of the Intergovernmental Panel on<br />

Climate Change (IPCC)’s Summary for<br />

Policy Makers and a longer synthesis<br />

report of the Sixth Assessment Cycle.<br />

“The report brings together the work<br />

of leading global scientists over the<br />

past six years and clearly shows that<br />

more than a century of burning fossil<br />

fuels and unsustainable energy and<br />

land use worldwide, but in particular in<br />

developed countries, has led to global<br />

Minister Creecy.<br />

warming of 1.1°C since the start of the<br />

industrial revolution,” says the Minister of Forestry, Fisheries and<br />

the Environment, Barbara Creecy.<br />

The IPCC finds that with every increment of warming, the risks,<br />

impacts, related losses and damages escalate. When these risks<br />

combine with other adverse events, such as pollution and loss of<br />

biological diversity, they cascade across sectors and regions and<br />

become increasingly difficult to manage. Nothing less than an<br />

emergency response will suffice.<br />

“It is therefore important, particularly in this decade, to accelerate<br />

efforts to adapt to the reality of a rapidly changing climate and to<br />

close the existing adaptation gap,” says Minister Creecy.<br />

The scientists tell us that global emissions should already be<br />

decreasing and be cut by almost half by 2030. Ultimately, the only<br />

way to stabilise warming is to reach net zero CO2 emissions. To limit<br />

warming to 1.5°C would require net zero CO2 in the early 2050s,<br />

followed by net negative CO2 emissions in the decades thereafter.<br />

“Through the Just Energy Transition Investment Plan (JET-IP) we<br />

have identified measures in the electricity, transport and hydrogen<br />

sectors and value chains to contribute to decarbonisation of our<br />

economy. It is not just an energy transition plan, but a just one –<br />

and this puts workers and communities at the centre of defining<br />

their future in a low carbon economy. The JETP-IP will require over<br />

R1.5-trillion to be fully implemented. We have challenged our<br />

partners and multilateral development banks to increase finance<br />

for climate investments. This is important to achieve global<br />

climate goals and our view is that there is sufficient global capital<br />

to close the gaps.”<br />

The IPCC indicates that these finance gaps and opportunities<br />

are greatest in developing economies. A rapid scaling up of<br />

finance flows from global capital markets and supporting public<br />

funding from developed economies for enhanced mitigation and<br />

accelerated adaptation, can act as a catalyst for accelerating the<br />

global shift to sustainable development.<br />

More importantly, the IPCC indicates that grant-based public<br />

financing is crucial to accelerate adaptation activity, which is<br />

severely underfunded. The greatest gains in wellbeing can be<br />

achieved by prioritising finance to reduce climate risk for the most<br />

vulnerable regions (especially in Sub-Saharan Africa), and for the<br />

most vulnerable, low-income and marginalised communities.<br />

Mitigation faces a different challenge: leveraging private finance<br />

through public financing by reducing some of the risks inherent<br />

in upscaling mitigation, especially in newer sectors, and in developing<br />

regions, including those facing debt and public financing<br />

macroeconomic constraints. The JET-IP needs to support social<br />

justice, including in financial terms.<br />

JET MUST CONSIDER AFRICA’S NEEDS<br />

Africa must be given the space to transition from high carbon usage<br />

to low carbon at a pace and cost that it can afford, says Minister of<br />

Mineral Resources and Energy Gwede Mantashe.<br />

“Their voice [African people] on the energy transition must be heard.<br />

That is the voice that says, energy production in Africa must be aligned<br />

to Africa’s socio-economic development. This means that there must be<br />

a balance between energy demand for socio-economic development<br />

and energy supply that is premised on low carbon emissions,” he says.<br />

Africa’s mineral resources<br />

Mantashe says the continent’s rich endowment with minerals that<br />

are suitable for clean energy production could mean a boost for the<br />

continent’s economies. “We believe that it is in the interest of Africa<br />

that a rigorous mineral exploration programme is implemented to<br />

uncover these unknown deposits in many other countries of our<br />

continent. For its part, South Africa continues to mobilise investments<br />

in exploration informed by the understanding that it is the lifeblood of<br />

mining, which has been the backbone of our economic development<br />

for over 150 years.”<br />

NEW CEO FOR PRO ALLIANCE<br />

The Paper and Packaging PRO Alliance has announced the<br />

appointment of Dorah Modise as its new chief executive officer,<br />

effective from 1 April 2023. Modise’s personal philosophy,<br />

backed by considerable experience, is fully attuned to her new<br />

set of responsibilities.<br />

“I look forward to working with alliance partners in leading this<br />

great organisation that will demonstrate the power of collective<br />

action in a dynamic sector that is largely untapped. Waste is the<br />

new gold and with industry taking the lead on massifying recycling,<br />

recovery, beneficiation and market enhancement programmes, we<br />

will take several steps towards achieving sustainability,” she says.<br />

WOLF WIND BREEZES CLOSER TO NATIONAL GRID<br />

An 84MW Wolf Wind project in the Eastern Cape has reached<br />

financial close and is projected to start generating electricity for<br />

the national grid by the first quarter of 2024.<br />

Juwi Renewable Energies reports that exploding public and<br />

private demand for large-scale renewables because of South Africa’s<br />

energy crisis has led to the rapid expansion of its national footprint,<br />

with more than 1.5GW of wind, 2GW of solar and 500MW of hybrid<br />

projects incorporating storage in development for private and public<br />

energy users.<br />

The Wolf Wind project was successfully bid by Red Rocket in<br />

Round 5 of the government’s Renewable Energy Independent<br />

Power Producers Procurement Programme (REI4P). Wolf Wind is<br />

the second wind project developed by Juwi to reach financial close<br />

under the REI4P – the first being the 138MW Garob Wind Project,<br />

which reached commercial operation in 2021. The Wolf Wind Project<br />

is expected to generate more than 360GWh of clean electricity<br />

for the South African grid each year, offsetting 374 400 tons of<br />

CO2 each year.<br />

Positive economic contribution<br />

Wind has significantly demonstrated its positive economic contribution<br />

with a total procurement by wind IPPs during construction and<br />

operations to date exceeding R9-billion in value.<br />

SAWEA’s chief communications officer, Morongoa Ramaboa, says<br />

the Association welcomes the government’s approach to accelerate<br />

private investment in generation capacity, through the removal of<br />

the licensing requirement for generation projects of any size, the<br />

RECYCLABLE WIND TURBINE BLADES<br />

Nordex Group is participating as one of the 18 partners, in a<br />

sustainability project funded by the European Union, to drive<br />

the recycling of high-value rotor blade materials from wind<br />

turbine blades.<br />

Currently, 85% to 95% of a Nordex wind turbine is recyclable. For<br />

many of the materials used, there are established recycling processes<br />

for environmentally-friendly disposal – especially for steel and<br />

concrete, which make up the largest share of a wind turbine in the<br />

tower and foundation.<br />

Turbine rotor blades consist of a combination of different materials<br />

such as wood, various metals, adhesives, paints and composites.<br />

The composites are glass-fibre-reinforced plastics, as well as carbonfibre-reinforced<br />

plastics. At the end of their life, rotor blades are more<br />

challenging to recycle due to the heterogeneity of the material and<br />

the strong adhesion between the fibres and polymers. Recycling<br />

processes for these materials are not yet fully established, and reuse<br />

of recycled materials is not widespread.<br />

reduction of timeframes for regulatory approvals, as well as the<br />

establishment of a “one-stop shop” for energy projects through<br />

Invest SA.<br />

“The ideal is to create an environment that encourages and<br />

accelerates investment injection into the economy, removing the<br />

pressure from public fiscus, and to stimulate the private sector to<br />

invest in their own energy supply and create new industries,” she says.<br />

Niveshen Govender, SAWEA CEO, says a clearly defined queueing<br />

system needs to be urgently implemented with a balanced view<br />

between publicly and privately procured electricity.<br />

“Ministerial determination for over 18 000MW of new generation<br />

capacity from wind, solar and battery storage should be prioritised<br />

since it was published in August last year,” he says, noting that the<br />

intention to enable businesses and households to invest in rooftop<br />

solar is a good start towards addressing the country’s energy<br />

crisis. This requires the development of a net billing framework for<br />

municipalities to enable customers to feed electricity from rooftop<br />

solar installations into the grid.<br />

“To realise our vision of becoming a thriving commercial wind<br />

power industry that supports government in its mandate to secure<br />

energy for South Africa, we cannot afford a repeat of the latest failed<br />

public procurement bid window (BW6), which has resulted in the loss<br />

of investment and market confidence.<br />

“The current system for allocating grid access remains a pressure<br />

point as it marginalises capable and willing organisations that can<br />

contribute significantly to the supply of electricity,” Govender says.<br />

By Neesa Moodley. Courtesy Daily Maverick.<br />

“In line with our group’s Sustainability Strategy 2025, ambitious<br />

goals have been set, including offering the market a fully recyclable<br />

blade within the next decade, with the target set for 2032,”<br />

explained Nordex MD, Compton Saunders.<br />

To reach this goal, Nordex have conducted and participated in<br />

several Research and Development projects, one of which is the<br />

European-funded “Wind turbine blades End of Life through Open<br />

HUBs for circular materials in sustainable business models”, or<br />

EoLO-HUBS for short.<br />

The objective of the EoLO-HUBS project is to demonstrate and<br />

validate a set of innovative composite material recycling technologies<br />

which will provide answers to the three main areas involved in endof-life<br />

wind farm recycling: de-commissioning and pre-treatment<br />

of wind turbine blades; sustainable fibre reclamation processes<br />

addressing two alternative routes: low-carbon pyrolysis and green<br />

chemistry solvolysis; upgrading processes for the recovered fibres<br />

addressing mainly glass fibres as well as carbon fibres.<br />

6<br />

7

ENERGY<br />

ENERGY<br />

What the world<br />

is learning<br />

from SA’s nascent<br />

JUST ENERGY TRANSITION<br />

INVESTMENT PLAN<br />

Ramaphosa has been praised by global leaders for South Africa’s efforts to prevent and avert the<br />

worst effects of human-induced climate change as part of its Just Energy Transition Investment Plan.<br />

BY ETHAN VAN DIEMEN<br />

South Africa’s Just Energy Transition Investment Plan (JET-IP) is<br />

designed to accelerate the move away from coal in a way that<br />

protects vulnerable workers and communities and develop<br />

new economic opportunities such as green hydrogen and electric<br />

vehicles (EVs). It is part of South Africa’s efforts to prevent and avert<br />

the worst effects of human-induced climate change.<br />

UK Prime Minister Rishi Sunak, US President Joe Biden, French<br />

President Emmanuel Macron and German Chancellor Olaf Scholz<br />

have commended South Africa for its commitment to clean energy<br />

but importantly the country’s emphasis on assisting workers and<br />

communities who will be affected by job losses as we become less<br />

reliant on the coal industry.<br />

Earthlife Africa director Makoma Lekalakala welcomed the five-year<br />

R1.5-trillion investment plan, summing up why our JET-IP is a gamechanger<br />

for South Africans. “We need clean, cheap renewable energy<br />

to end the loadshedding caused by our failing coal fleet, and to address<br />

the energy poverty that is hampering social justice and development<br />

for all.”<br />

South Africa is among the top 20 highest emitters of planet-warming<br />

greenhouse gases in the world and accounts for nearly a third of all<br />

of Africa’s emissions, due in large part to Eskom’s legacy dependence<br />

on coal for electricity generation. From the way we move people and<br />

goods around to how we light up our streets and homes, the plan seeks<br />

to clean up South Africa’s act without leaving anyone behind.<br />

Mandy Rambharos, former general manager of the Just Energy<br />

Transition office at Eskom said several banks, including the World Bank<br />

and African Development Bank, said South Africa’s plan is the best they<br />

had seen on the table out of 14 plans from around the world. “While I<br />

was at Eskom, we were approached by the Vietnamese, Indonesians,<br />

Philippines and Indians ... wanting to collaborate with us.”<br />

One of the reasons that South Africa is recognised as a leader in its<br />

moves towards JET is because of the multistakeholder consultative<br />

process that saw the drafting of a Just Transition Framework.<br />

The Presidential Climate Commission (PCC) in July last year released<br />

the framework that sets out a shared vision for JET, principles to guide<br />

the transition, and policies and governance arrangements to give<br />

effect to the transition from an economy that is predominantly reliant<br />

on fossil fuel-based energy, towards a low-emissions and climateresilient<br />

economy. Dr Crispian Olver, executive director of PCC, said<br />

that “a lot of the international partners … are looking to build a model<br />

[such as] in South Africa, and then expand it and replicate it elsewhere.<br />

“We’ve also heard the same from many of our sister developing<br />

countries and they’re not looking to exactly replicate what we’re doing<br />

… but we’re acutely aware that countries like Indonesia, Vietnam, India,<br />

Brazil and several African partners are all embarking on very similar<br />

energy transitions and they’re having to grapple with the economic<br />

and social consequences of those transitions”.<br />

Olver shared some of the lessons that South Africa offers to other<br />

countries. These include to:<br />

• Be consultative<br />

• Be inclusive<br />

• Make use of forums such as climate commissions<br />

At COP26, in what was hailed as a “watershed” moment for South Africa<br />

and international collaboration, a political declaration announced the<br />

mobilisation of $8.5-billion to accelerate our move away from its ageing,<br />

10 11

ENERGY<br />

ENERGY<br />

polluting and unreliable coal fleet towards renewable energy sources.<br />

The declaration heralded the first step in developing a pioneering<br />

model for climate-focused partnerships and collaborations between<br />

developed and developing countries.<br />

United Nations (UN) Secretary-General António Guterres, at the<br />

conclusion of the conference said, “To help lower emissions in many<br />

other emerging economies, we need to build coalitions of support<br />

including developed countries, financial institutions and those with<br />

the technical know-how. This is crucial to help each of those emerging<br />

countries speed the transition from coal and accelerate the greening<br />

of their economies.<br />

“The partnership with South Africa announced a few days ago is<br />

a model for doing just that,” the UN chief added.<br />

The model was formed after the governments of South Africa, France,<br />

Germany, UK, US and the European Union – collectively known as the<br />

International Partners Group (IPG) – signed the political declaration.<br />

The coalition of rich countries and South Africa came to be known as the<br />

Just Energy Transition Partnership (JETP) and spurred the development<br />

of both the investment plan as well as a framework for how best to<br />

move away from coal in a way that doesn’t leave workers along the coal<br />

value chain – particularly in Mpumalanga – stranded and destitute.<br />

Plans and pledges became reality when South Africa signed<br />

separate, highly concessional loan agreements with the French and<br />

German public development banks, AFD and KfW, worth €600-million<br />

(R10.7-billion). France and Germany are two of the partners in South<br />

Africa’s JETP, along with the US, the UK and the European Union. With<br />

associated interest rates for loans agreed at 3.6% and 3%, respectively,<br />

the loans are more palatable than the 8.9% the government would<br />

expect to raise an equivalent loan today in the open market.<br />

Amar Bhattacharya, a senior fellow in the Centre for Sustainable<br />

Development, housed in the Global <strong>Economy</strong> and Development<br />

programme at Brookings Institution, described our investment<br />

To help lower emissions in many<br />

other emerging economies, we<br />

need to build coalitions of support<br />

including developed countries,<br />

financial institutions and those with<br />

the technical know-how.<br />

PIPELINE OF PROJECTS<br />

Fumani Mthembi from Knowledge points out that what is needed<br />

is increased investment in improving capacity and competence<br />

amongst policymakers, investors and project developers. In addition,<br />

the development of specialised vehicles for project incubation<br />

and aggregation; working with existing project portfolios to effect<br />

change; reforming financial institution and financial sector incentive<br />

structures, reporting, benchmarks and project valuation frameworks<br />

and improving flexibility of public sector financing frameworks.<br />

Mthembi explains that the potential to upscale community projects<br />

was hampered by several factors including regulatory challenges.<br />

She explains that “just transition projects, by their nature, introduce<br />

technologies and ways of generating value that are novel, to the<br />

extent that decarbonisation has not historically been central to the<br />

impetus of job creation. Consequently, they often run into regulatory<br />

challenges, requiring changes to be made to enable project viability.”<br />

She says that “funding typically supports the operational aspects of<br />

project rollouts but the demand on developers to advance the more<br />

systemic changes required to enable scale is not incorporated into<br />

the funding package, placing added burden on project developers.<br />

Regulatory change is, therefore, often the product of the unpaid<br />

labour of developers who stretch and strain themselves to generate<br />

the public good that is an enabling regulatory environment.”<br />

Other issues include the need for public-private partnerships; the<br />

need to factor in the broader political context of implementing such<br />

projects especially at a community level and time is a key factor in<br />

developing community projects for scale. Finally, there is the issue<br />

of gender when it comes to small-scale projects and how so-called<br />

“women’s work” often is under-remunerated.<br />

Article courtesy Daily Maverick<br />

plan as “precisely the kind of model that is needed to lay out<br />

an actionable plan. It has got justice running through it … I want to<br />

emphasise something … this is a sustained effort, five years to start<br />

with is good but it will require a generational shift.”<br />

Lebogang Mulaisi, head of policy at COSATU, was lukewarm about<br />

the JETP and the investment plan that came of it. “It’s a start for a<br />

broader conversation around how to finance the transition … I’m not<br />

convinced, as yet … that we go deep into how we’re going to address<br />

ownership structures in South Africa.”<br />

She said reskilling and upskilling is great, “but we have an ownership<br />

crisis in our country … and I just don’t feel we’ve addressed the issue<br />

of addressing inequality decisively”.<br />

Indonesia and India are two developing countries with similar coal<br />

dependencies and are at different stages of their transitions.<br />

Dr Sandeep Pai is a senior research lead with the Global Just<br />

Transition Network at the Centre for Strategic and International<br />

Studies (CSIS). His expertise spans the political economy of energy<br />

transitions, coal sector dynamics, energy access and just transitions.<br />

“Indonesia is very interested in multilateral financing to phase<br />

out coal in the long term. India, not so much. India considers coal<br />

as a key energy security source. Generally, India is not interested in<br />

any deals that focus on coal phase-out or phase-down. However,<br />

both countries are in JETP negotiations with G7 countries. G7 and<br />

Indonesian negotiations are at advanced stages but negotiations<br />

with India are going slow,” he said.<br />

Asked whether South Africa’s JETP can be considered a model, Pai<br />

said “Yes, JETP partnerships theoretically could be a model for<br />

catalysing a coal phase down in India and even Indonesia. However,<br />

not the way it has played out in South Africa. India and Indonesia<br />

need to learn many lessons from South Africa’s JETP model. India<br />

and Indonesia need to come up with investment plans … do<br />

their homework, identify projects they want to execute, and then<br />

negotiate JETPs with rich countries … I don’t think either of these<br />

countries has done their homework yet.<br />

“[The] South African JETP model – although very relevant for India<br />

and Indonesia – won’t be meaningful for workers and the climate in its<br />

current form.<br />

“India and Indonesia have a lot to learn from South Africa<br />

about how to run and engage a variety of stakeholders, including<br />

unions, regions and municipalities in Mpumalanga, to very concrete<br />

technical issues such as how to repurpose coal plants being<br />

undertaken by Eskom.”<br />

Dr Rahul Tongia, a senior fellow with the Centre for Social and<br />

Economic Progress in New Delhi, largely concurred with Pai. He<br />

is also a non-resident senior fellow in the Energy Security and<br />

Climate Initiative at the Brookings Institution. He explained that<br />

while lessons can be drawn from the South African experience, the<br />

country’s JETP is more accurately described as a “reference point”<br />

for India and other countries with heavy coal dependencies. “South<br />

Africa is heavily coal dependent, more so for its power sector, but<br />

there are critical differences with, say, India, that make South<br />

Africa’s JETP more useful as a reference point than as a template.<br />

Most South African coal power plants are multiple decades old,<br />

and thus close to end of life. “In contrast, the median age of India’s<br />

fleet is close to just over a decade old.”<br />

Sinthya Roesly is director of finance and risk management at<br />

Perusahaan Listrik Negara (PLN) – an Indonesian state-owned<br />

electricity distribution monopoly which supplies most of the coalfired<br />

power to the country. PLN, for all intents and purposes, can<br />

be considered the Indonesian Eskom. She acknowledged that while<br />

there were lessons to be learnt from South Africa’s experience,<br />

Indonesia needs to “look into every aspect of the transition” and<br />

that it is important to be “cautious in early retirement [of coal power<br />

plants]… balancing all energy sources to support the economy”.<br />

Roesly’s sentiments accorded with those of Gwede Mantashe,<br />

Minister of Mineral Resources and Energy, who in a parliamentary<br />

debate on JET said, “Our transition cannot only be about reaching<br />

climate change targets. It must also address energy poverty,<br />

which includes lack of access to energy, unaffordability of energy<br />

and electricity interruptions or loadshedding. A pendulum swing<br />

from coal-powered energy generation to renewable energy does<br />

not guarantee baseload stability. It will sink the country into a<br />

baseload crisis.”<br />

Amos Wemanya, the senior renewable energy and just transition<br />

JET-IP, SET, GO<br />

JET-IP identifies USD98-billion in financial requirements over the next five years to come from both public and private sectors. The JET-IP goal<br />

is to decarbonise our economy to within the NDC target range of 350-420MtCO 2 by 2030 in a just manner. JET-IP is centred on decarbonisation,<br />

social justice, economic growth and inclusivity as well as governance. The investment criteria for the Plan include projects that deliver on<br />

greenhouse gas emissions reduction and JET outcomes and are catalytic in nature and ready to implement. Key investments include:<br />

• Electricity. Decommissioning (repowering and repurposing with clean technologies), transmitter grid strengthening and expansion, and<br />

renewable energy.<br />

• New Energy Vehicles. Decarbonising the automotive sector and supporting supply chain transition towards green manufacturing.<br />

• Gaseous Hydrogen. Essential planning and feasibilities including port investment to enhance exports and boost employment and GDP.<br />

• Cross-cutting. Investment in skills development and municipalities.<br />

12<br />

13

ENERGY<br />

AfricaBusiness.com<br />

JET POLICY DEVELOPMENTS<br />

The National Development Plan (NDP), draft Integrated Energy Plan (IEP),<br />

Renewable Energy White Paper, Nationally Determined Contribution (NDC),<br />

Just Transition Framework and enabling policies under development and in<br />

implementation, outline the policy foundation for energy transition in South<br />

Africa and the move away from carbon-fuelled energy.<br />

The Integrated Resource Plan (IRP) 2019 covers the government’s plans for<br />

power until 2030 and outlines a decreased reliance on coal-powered energy<br />

and an increased focus on a diversified energy mix that includes renewable<br />

energy, distributed generation and battery storage.<br />

The Renewable Energy Independent Power Producer Procurement Programme<br />

(REIPPPP), introduced in 2011, outlined the procurement of renewable energy<br />

in the country. The sixth round of the REIPPP kicked off in 2022 and aims to<br />

procure 2.6GW of solar and wind power.<br />

To incentivise the self-generation of renewable energy, the government<br />

has indicated that it proposes to scrap the threshold for distributed energy<br />

generation of 100MW.<br />

Other developments include, inter alia, the South African Automotive<br />

Masterplan, Climate Change Bill, <strong>Green</strong> Taxonomy and carbon tax increases.<br />

Further policies such as the National Energy Efficiency Strategy and <strong>Green</strong><br />

Transport Strategy also have a role to play.<br />

Trading in carbon offsets in the carbon market, where companies can pay<br />

other entities to offset their emissions for them, is also growing in popularity in<br />

emerging markets. In August 2022, the JSE announced that it was investigating<br />

the possibility of introducing a carbon trading market in South Africa.<br />

In February 2022, the South African Hydrogen Society Roadmap was published<br />

by government. The roadmap is an important marker on its path towards<br />

implementing hydrogen development.<br />

Eskom identified 18 IPP bids in terms of an auction relating to the use of vacant<br />

land it owned in Mpumalanga situated in proximity to its coal-fired power stations<br />

with direct access to the national transmission network that will enable wheeling.<br />

The projects will add almost 1 800MW of renewable power to the grid.<br />

Recent amendments to the Electricity Regulation Act were proposed by<br />

DMRE and are likely to address the electricity supply deficit, vertical structure<br />

of the market and lack of competition, introduction of a multi-market including<br />

IPPs as well as the formation of a central purchasing agency. The amendments<br />

will address the introduction of a day-ahead market to accommodate hourly<br />

supply and demand, direct procurement of power by municipalities, increase in<br />

the threshold pertaining to self-generation, need to accommodate low carbonemitting<br />

generation technologies, timing of licensing applications, changes in<br />

transmission system operation including power trading and the creation of<br />

additional regulatory capability. The aim is to accelerate affordable, decentralised,<br />

diversely-owned renewable energy systems.<br />

adviser at Power Shift Africa, a Pan-African think-tank,<br />

called for caution. He said, “If done right, JETPs could offer<br />

an opportunity for piloting transformative approaches to<br />

addressing aspects of the energy transitions – like early coal<br />

retirement – in a principled way. They can also potentially<br />

help aspiring oil and gas producers such as Senegal choose<br />

climate-friendly development pathways.<br />

“However,” Wemanya added, “JETPs could also perpetuate<br />

the continuation of a troubling donor-driven approach<br />

to climate finance that maintains unequal global power<br />

relations, picks winners and losers, and serves geopolitical<br />

interests. JETPs must be considered within the wider climate<br />

finance architecture and as a mechanism to put more and<br />

faster climate finance on the table, particularly from major<br />

historical polluters.<br />

“It is also important to recognise that ambitious goals<br />

such as achieving just energy transitions in Africa will require<br />

solutions that lie well outside the boundaries of JETPs.”<br />

JET-IP SETTER<br />

Discussing her research which focused on just transition<br />

project needs and finance response, Chantal Naidoo<br />

from Rabia Transitions says, “Projects are the primary<br />

channel where finance is exchanged in pursuit of the just<br />

transition vision.” She adds, “The distinguishing features<br />

of just transition projects are their focus on regenerative<br />

and transformative outcomes to people and planet due to<br />

deliberate shifts in systemic conditions and factors outside<br />

of the control of vulnerable stakeholders.<br />

“Just transition-related projects are interdependent,<br />

where one is the prerequisite for the next. This requires a<br />

portfolio approach to just transition-related investment,<br />

where projects are not viewed in isolation or cherry-picked<br />

by investors.”<br />

ESG | MINING<br />

WATER | ENERGY<br />

INFRASTRUCTURE<br />

READ REPORT<br />

THOUGHT [ECO]NOMY<br />

SOUTH AFRICA’S JUST ENERGY TRANSITION INVESTMENT PLAN (JET IP) FOR THE INITIAL<br />

PERIOD 2023-2027 | The Presidency Republic of South Africa | NDP 2030<br />

The JET-IP focus on electricity, new energy vehicles and green hydrogen (GH2) is a deliberate strategic<br />

decision, based on a clear understanding that as South Africa’s electricity sector decarbonises, there are<br />

significant gains to be made by unlocking growth in these sectors at the same time.<br />

greeneconomy/report recycle South Africa’s exports from “hard to abate” sectors and of ICE vehicles will be negatively affected by the<br />

proposed border tax adjustments of some of the country’s main trading partners, if accelerated mitigation<br />

measures in these sectors are not implemented. As the energy transition advances globally:<br />

- More complex linkages between sectors will develop, as zero-carbon electricity use replaces the use of fossil<br />

fuels in industry, transport and other sectors, and thus the benefits of an integrated energy policy approach,<br />

which incorporates energy policy closely with other key policy areas such as industrial policy are significant.<br />

- Technologies will become progressively cheaper through economies of scale and where policies mitigate investment risks and/or technological<br />

breakthroughs. When they pass below the cost levels at which such technologies become pervasive, the technologies are described as “disruptive”<br />

and are said to have passed “tipping points”. Sector coupling means that tipping points in different technologies reinforce each other.<br />

- Clean energy investments scale up most rapidly when they experience certainty about demand for their production. Security of demand mitigates<br />

investment risk.<br />

- Investments in existing storage technologies such as pumped storage; emerging technologies which include utility-scale batteries at all scales;<br />

thermal storage in concentrating solar power (CSP) plants and elsewhere; and other potential technologies such as GH2 will enable faster uptake of<br />

renewable electricity generation in electricity systems and will become more and more important as the electricity system is decarbonised.<br />

14

ENERGY<br />

ENERGY<br />

THE JUST ENERGY<br />

TRANSITION – what it should be…<br />

There has been a lot of press recently regarding the Just Energy Transition Partnership in South<br />

Africa with links to international funds to facilitate this transition – but what exactly is a “just” energy<br />

transition? First, we need to contextualise the problem and understand the solutions.<br />

BY CHRIS WHYTE, ACEN*<br />

Africa currently has a population of about 1.34-billion people,<br />

and this is expected to rise to almost 2.5-billion by 2050.<br />

Globally, there is a focus on understanding this dynamic<br />

regarding sustainability, and climate change is a key component<br />

of this focus. World leaders urge sustainability and achievement<br />

of the UN Sustainability Development Goals (SDGs). This vision<br />

and reality are somewhat different for Africa. Africa currently faces<br />

massive unemployment and poverty with its existing population.<br />

Some 650-million people on the continent currently have no access<br />

to electricity.<br />

The key focus here is energy, and the simple reality is that Africa<br />

will never be able to achieve the SDGs without energy. Everything<br />

is reliant on energy: access to reticulated water, agriculture, foodsecurity,<br />

agri-processing, manufacturing, transport, infrastructure,<br />

tourism, mining, education, health and just about any other sector<br />

you can name.<br />

To put into perspective, Africa relies on around 700 000GWh electrical<br />

16<br />

consumption capacity. South Africa, as one of 54 countries on the<br />

continent, supplies more than 30% of this. In 2018/19, South Africa<br />

sold 208 319GWH of electricity for consumption which made up<br />

close to 30% of the estimated 700 000GWh of electricity used in<br />

Africa in 2018. To put this into a global perspective, South Korea<br />

generated 530 000GWh at 0.33% the area of Africa and only 3.4%<br />

of Africa’s population. The size of Africa is often underestimated<br />

because of traditional Mercator projections on maps – the reality is<br />

that we can fit all of Europe, USA, China and India into Africa with<br />

space for many other countries. Africa is blessed with land and<br />

resources, enough to supply the whole world, and needs to capitalise<br />

on this but must follow a sustainable path. We have sunshine for solar,<br />

water for hydro and wind for renewable capacity and an abundance<br />

of biomass and waste that can be converted to energy.<br />

What we need to do as a continent, is avoid the expensive and<br />

unsustainable mistakes of the developed North and rather implement<br />

scaled, sustainable and viable energy generation. Transmission in<br />

traditional high-voltage lines is inefficient and the massive distances<br />

needed to transmit power across the vast mass of Africa simply does<br />

not make sense.<br />

The intense capital required for this also excludes normal people<br />

from benefitting from this abundance, so governments and global<br />

corporates control energy and drive the equality gap even further.<br />

The Gini index is a measure of the distribution of income across a<br />

population, and South Africa had the highest inequality in income<br />

distribution globally in 2021 with a Gini score of 63. This can be<br />

changed, and all the technology and applications are available to<br />

do this to ensure a just transition to energy access.<br />

The focus needs to be changed to small-scale systems tied into<br />

microgrids, where ordinary citizens can benefit from cheaper and<br />

more reliable electricity, but importantly also be direct beneficiaries<br />

of this (Power to the People!). Renewable and sustainable energy can<br />

be scaled from the household to the village to the city:<br />

• Scaled applications in solar energy can change the dynamic in<br />

Africa, reducing the reliance on poor service delivery from the<br />

public sector.<br />

• Hydropower can be delivered at microturbine level from as small<br />

as 1kW output without the need for billion-dollar hydroelectric<br />

schemes that displace communities, create cross-border conflict<br />

and destroy biodiversity and riverine ecology.<br />

• Vertical and horizontal wind turbines can work at the household<br />

or community level.<br />

• Waste organics can be scaled to provide gas or electricity.<br />

• Biomass can be grown or harvested to supply small-scale gasifiers,<br />

avoiding the need for deforestation and charcoal production.<br />

• The East African Rift Valley provides massive potential for clean<br />

geothermal energy, untapped to date.<br />

• Waste plastics (where there is no local circular market for<br />

recycling) can be converted to fuel for generators or gasified<br />

directly into electricity.<br />

• Water can be reticulated for household or irrigation use using<br />

ram-pumps that need no electricity.<br />

Africa is blessed with land<br />

and resources, enough to<br />

supply the whole world.<br />

17

ENERGY<br />

The focus needs to be changed<br />

to small-scale systems tied into<br />

microgrids, where ordinary<br />

citizens can benefit from cheaper<br />

and more reliable electricity.<br />

There literally is no need for massive hydro investments or fossil fuel<br />

extraction that impact the land and the air and destroy biodiversity<br />

and ecosystems. In South Africa, the biggest polluter by some margin<br />

is our own debt-ridden Eskom. The Mpumalanga Highveld region has<br />

12 coal-fired power stations, which have gained a reputation as being<br />

the most toxic and polluting group in the world.<br />

South Africa is the 12 th biggest emitter of sulphur, Nitrogen and<br />

carbon dioxide in the world. Most of this comes from our 80% energy<br />

dependence on coal and the US$8.94-billion concessional funding<br />

pledged to us at CoP26 in Glasgow is intended to wean us off this<br />

dependence. Not because we are a good investment destination,<br />

but rather because we are globally recognised for literally killing<br />

thousands of our own citizens every year from respiratory illnesses<br />

considering the above rankings.<br />

A just transition is not just about equitable economic distribution.<br />

It is also about environmental and social justice to achieve a healthy<br />

and safe South Africa for all our citizens. The remainder of Africa still<br />

needs to attain energy independence, and it is essential that we<br />

follow a just transition approach across the continent.<br />

*African Circular <strong>Economy</strong> Network (ACEN)<br />

18

WASTE<br />

Waste minimisation programme<br />

IMPROVING LIVELIHOODS in Limpopo<br />

Waste management, inadequate diversion and the depletion of landfill space remains a challenge<br />

in South Africa. However, there are opportunities to not only alleviate the waste but also create<br />

jobs and positively impact livelihoods.<br />

Invest in<br />

Industrial Efficiency<br />

• Long term sustainability through resource savings<br />

• Economic growth<br />

• Environmental compliance<br />

• Contributes to social development<br />

Services include:<br />

<strong>Green</strong> skills development<br />

National Cleaner<br />

Production Centre<br />

South Africa<br />

A national industrial<br />

support programme that<br />

partners with industry to<br />

drive the transition towards<br />

a green economy and<br />

save money.<br />

BY NCPC-SA<br />

A<br />

recent event hosted by the Limpopo Department of Economic<br />

Development, Environment and Tourism in collaboration<br />

with the National Cleaner Production Centre of South<br />

Africa (NCPC-SA) highlighted the impact made through a waste<br />

minimisation programme in the province over the past three years.<br />

Since taking off in 2019, the Industrial Symbiosis Programme or ISP<br />

as it is more commonly known has successfully diverted 49 518 tons of<br />

waste from landfills, saving 181 370 tons in CO 2 emissions and unlocked<br />

economic opportunities in the province.<br />

National programme manager, Victor Manavhela, says, “This event is<br />

evidence that we can transition to a waste-free society and use waste<br />

as a resource to change lives. We are looking to replicate this work in all<br />

the provinces in the next few years.”<br />

The ISP, facilitated by the NCPC-SA, has been a successful partnership<br />

project in many provinces that aims to reduce waste to landfills and<br />

encourage waste circularity or resource exchanges.<br />

NATIONAL PROGRAMME, LOCAL IMPACT<br />

A year after establishing the industrial symbiosis partnership,<br />

Dziphathutshedzo <strong>Green</strong> Surfacing and PWK Waste Management<br />

Recycling has already diverted 11 tons of waste from the landfill.<br />

Dziphathutshedzo <strong>Green</strong> Surfacing recycled HDPE plastic that<br />

was collected and stockpiled by PWK Waste Management and<br />

manufactured it into eco-friendly and durable paving bricks and<br />

stepping stones.<br />

This is just one of the 40 IS success stories that were celebrated at<br />

the Limpopo ISP impact and information-sharing workshop. The<br />

The NCPC-SA team: Victor Manavhela, Annah Mothapo and Matimba Makhani.<br />

We can transition to a waste-free<br />

society and use waste as a resource<br />

to change lives.<br />

Industry and sector knowledge sharing<br />

Company technical support<br />

Contact us for a free assessment<br />

www.ncpc.co.za<br />

ncpc@csir.co.za<br />

workshops demonstrated how Limpopo ISP assisted industry in the<br />

surrounding area to recover and redirect residual resources for reuse by<br />

employing IS principles.<br />

The ISP is a free facilitation service that promotes the exchange of<br />

one company’s residual resources (material, energy, water, waste,<br />

assets, logistics and expertise, etc) with another that can benefit from<br />

them.<br />

Including Limpopo, the NCPC-SA implements the ISP in Gauteng,<br />

KwaZulu-Natal, Mpumalanga and the Free State. The NCPC-SA is a<br />

national industry support programme managed by the Council for<br />

Scientific and Industrial Research on behalf of the Department of Trade,<br />

Industry and Competition.<br />

To find out more about the ISP and/or the work of the NCPC-SA,<br />

please visit www.ncpc.co.za or email ncpc@csir.co.za.<br />

THA 05-2023<br />

Funded by the dtic, hosted by the CSIR<br />

Victor Manavhela, NCPC-SA national programme manager at Limpopo ISP.<br />

21

ENERGY<br />

ENERGY<br />

It’s time for<br />

SOLAR<br />

TO SHINE<br />

<strong>Green</strong> <strong>Economy</strong> <strong>Journal</strong><br />

interviews the CEO of SAPVIA<br />

SAPVIA CEO, Dr Rethabile Melamu, believes that the wide deployment of solar PV and broader<br />

renewable energy technologies can support a resilient energy system in South Africa. Will the tax<br />

relief programme anchor our green economy transition? The <strong>Journal</strong> caught up with Dr Melamu,<br />

the illustrious leader at the coalface of it all.<br />

Please tell us about your first year as CEO of SAPVIA.<br />

It has been an incredible year. A year of immense growth, stretching<br />

and learning. I inherited a good and a growing brand, with a lean but<br />

supportive team and the Board. Leading a member-led organisation is<br />

unique and it is like nothing I’ve done before. It is rewarding to be of<br />

service, but is it not without its unique demands of attending to the<br />

vastly different needs of 500+ members.<br />

I hope to continue to meet and to add value to all members. This<br />

year has been challenging for all South Africans, but together with our<br />

members, we are providing an alternative and immensely sustainable<br />

solution to the loadshedding and energy security challenges. Overall,<br />

it is a privilege to work with and alongside those that are providing<br />

solutions to the most pressing challenges.<br />

Does government consult with SAPVIA for matters relating to the<br />

development, regulation and promotion of solar PV in South Africa?<br />

Most definitely, we have had good engagements with different spheres<br />

of government, from national, provincial and to the local level. For<br />

instance, we have supported the Department of Mineral Resources<br />

and Energy (DMRE) as well as the Department of Trade, Industry<br />

and Competition (the dtic) in the development of the South African<br />

Renewable Energy Masterplan (SAREM).<br />

22<br />

We have contributed to Eskom’s grid planning and access processes<br />

in partnership with our sister association, South African Wind Energy<br />

Association (SAWEA) and we enjoy a great relationship with the<br />

Independent Power Producers Office (IPPO).<br />

That said, we have called on the powers that be for more involvement<br />

in the decision-making that involves our sector and members. For<br />

instance, we would have valued engagement in the design of tax<br />

incentives for the solar PV sector. We have views on areas that needed<br />

to be prioritised.<br />

Please talk to us about policy certainty in this space.<br />

There is generally a commitment to the transition towards a lowcarbon<br />

energy mix. This is evident in government’s recent regulatory<br />

reforms that removed the need for independent power producers<br />

who develop private projects to hold a generation licence, which has<br />

been touted a good move. This aims to speed up the addition of new<br />

generation capacity to the grid. The results are beginning to show,<br />

with 0.5 GW of utility scale projects registered with the National Energy<br />

Regulator of South Africa (NERSA) in the first months of 2023.<br />

The Integrated Resource Plan is being updated to comprehensively<br />

address the current change and long-term planning. However, there<br />

is more to be done to effectively enable the roll-out of embedded<br />

generation projects and the development of grid infrastructure to<br />

enable uptake of new generation capacity, in particular renewable<br />

energy projects. That requires for Eskom and municipalities to<br />

create rules, regulations and tariffs. A clearer articulation of Just Energy<br />

Transition action as well as the envisaged role of the industry is needed.<br />

A nationwide wheeling framework for private projects will further<br />

enable ease of project developments.<br />

How will a rapid growth in solar installations affect the market?<br />

SAPVIA estimates that the installed solar PV capacity exceeded 1 GW<br />

for the first time in 2022. We have seen substantial growth in private<br />

projects registered with NERSA and not signed up. We are expecting<br />

sustained growth, especially in the private sector where investment in<br />

utility scale renewable energy projects both for direct consumption,<br />

i.e. behind the meter or embedded generation, and for wheeling,<br />

where generation and consumption are at two different sites.<br />

Dr Melamu, do you have any reservations about the rooftop solar<br />

PV tax incentives? If so, what are your concerns?<br />

The individual tax incentive has prioritised middle to high-income<br />

households who already have access to capital to invest in solar PV<br />

systems. This completely leaves out low-income households, who are<br />

not able to access instruments availed by financial institutions and<br />

other industry players. The fact that incentives cover modules alone<br />

while most households install hybrid systems (PV, inverter and battery<br />

system) is a surprise. The administrative requirements for accessing<br />

the tax incentive are confusing – mainly that only a certificate of<br />

compliance is required for accessing the incentive, which covers the<br />

part of the system that is not incentivised.<br />

SAPVIA has indicated that the waiting period for the installation<br />

of solar PV is increasing. Why is this?<br />

There is a shortage of skilled installers with adequate experience and<br />

training. Those reputable installers tend to be inundated. As such,<br />

SAPVIA is working with various partners such as the Energy and Water<br />

Sector Education Training Authority (EWSETA), the Small Enterprise<br />

Finance Agency (SEFA) and the Small Enterprise Development Agency<br />

(SEDA) to increase the pool of installers.<br />

Please talk to us about the importance of economies of scales<br />

and predictable demand for facilitating investments needed for<br />

the manufacture of solar PV installation components.<br />

This is mainly driven by increased demand for PV components,<br />

exacerbated by the frequent episodes of loadshedding. First, there<br />

needs to be an understanding of localisation potential, that’s why<br />

SAPVIA developed a study to assess opportunities along the solar PV<br />

THE RENEWABLE ENERGY TAX INCENTIVE<br />

The tax incentive available for businesses to promote renewable<br />

energy will have no thresholds on the size of the projects that<br />

qualify and the incentive will be available for two years to<br />

stimulate investment in the short term.<br />

Businesses can deduct 50% of the costs in the first year, 30%<br />

in the second and 20% in the third for qualifying investments in<br />

wind, concentrated solar, hydropower below 30 MW, biomass and<br />

PV projects above 1 MW. Investors in PV projects below 1 MW can<br />

deduct 100% of the cost in the first year. Under the expanded<br />

incentive, businesses will be able to claim a 125% deduction in<br />

the first year for all renewable energy projects with no thresholds<br />

on generation capacity.<br />

The incentive will only be available for investments brought into<br />

use for the first time between 1 March 2023 and 28 February 2025.<br />

SOLAR TAX BREAKS<br />

In the 2023 Budget Speech, a R9-billion tax relief programme<br />

was introduced to support the clean energy transition. While<br />

R4-billion is for households that install solar panels, R5-billion<br />

will go to companies through an expansion of the renewable<br />

energy incentive. The tax incentive available for businesses will be<br />

temporarily expanded to encourage rapid private investment to<br />

alleviate the energy crisis. The current incentive allows businesses<br />

to deduct the costs of qualifying investments over a one- or threeyear<br />

period.<br />

Government’s proposed rooftop solar incentive for households<br />

means that individuals will be able to receive a tax rebate to the<br />

value of 25% of the cost of any new and unused solar PV panels.<br />

To qualify, the solar panels must be purchased and installed at a<br />

private residence and a certificate of compliance for the installation<br />

must be issued from 1 March 2023 to 29 February 2024.<br />

Solar-related loans for small and medium enterprises on a 20%<br />

first-loss basis were confirmed by government.<br />

There is a shortage of skilled<br />

installers with adequate<br />

experience and training.<br />

23

ENERGY<br />

value chain. With this better understood and with recommendation<br />

from the advanced SAREM, there will be clarity on which aspect of the<br />

value chain localisation should be pursued in the immediate, medium<br />

and long term.<br />

What stands in the way of the domestic market penetration of key<br />

solar PV components?<br />

There are a list of designated materials and components that should<br />

be procured in South Africa, the extent to which that is implemented,<br />

especially for private projects, is unclear.<br />

Why does SAPVIA advocate for the incentivisation of domestic<br />

systems to contribute to demand-side management efforts?<br />

It reduces the national electricity demand during peak times, but it also<br />

shields end users against the impact of loadshedding. Lastly, energy<br />

efficiency and adoption of roof-top solar PV is the quickest and the<br />

most cost-effective way to address current energy shortages.<br />

What is your personal wish for the future of the solar industry?<br />

My personal wish is properly aligned with SAPVIA’s: for solar PV to be<br />

a significant and reliable contributor to the South African electricity<br />

mix towards an energy secure country. Also, my wish is for the sector to<br />

achieve policy and market alignment. Lastly, for solar PV to significantly<br />

contribute to decarbonising the energy mix environmental and for the<br />

sector to contribute towards economic development imperatives in<br />

the country.<br />

It is a privilege<br />

to work with and<br />

alongside those<br />

that are providing<br />

solutions to the most<br />

pressing challenges.<br />

BRIEF BIO<br />

A chemical and environmental engineer by training, Dr Melamu<br />

is renowned for her global expertise in the green economy and<br />

energy sectors. She has leveraged both the theoretical and<br />

practical to harness innovative smart technologies to mitigate<br />

the impact of climate change in society with a dedicated focus<br />

on African sustainable development.<br />

Get 10% Off Energy Meter Purchases<br />

Use Code: Acu<strong>Green</strong>3<br />

Valid From 1 April 2023 - 31 May 2023<br />

Terms and Conditions Apply<br />

READ REPORT<br />

THOUGHT [ECO]NOMY<br />

greeneconomy/report recycle<br />

INSIGHTS INTO THE SOLAR PHOTOVOLTAIC MANUFACTURING VALUE CHAIN IN SOUTH<br />

AFRICA | Trade & Industrial Policies (TIPS) | WWF South Africa | Kate Rivett-Carnac | [August 2022]<br />

The push for more electricity generation, particularly renewable energy generation, is showing a<br />

significant increase in Solar PV projects across the country. This in turn drives demand for the components<br />

and services.<br />

While South African renewable energy stakeholders focus on building local capabilities, there are a range<br />

of geopolitical and macroeconomic challenges beyond domestic borders that are likely to impact the work<br />

and potential. This presents challenges and opportunities. For manufacturers supplying private Solar PV<br />

projects that are outside of REI4P, there appears to be considerable opportunity for expansion, not just in<br />

South Africa but also into the rest of the continent (and, indeed, South African firms are already doing so).<br />

Plans for future solar PV manufacturing in South Africa will need to consider global shifts and future<br />

volatility in renewable energy markets in addition to local conditions and industry potential.<br />

24

Go green with<br />

Business Partners Ltd<br />

finance.<br />

It’s time to harness renewable<br />

energy, go off grid, harvest<br />

rainwater, and ultimately reduce<br />

your business’ running costs.<br />

Business Finance<br />

Our <strong>Green</strong> Buildings Finance Programme provides<br />

up to 100% property finance ranging from R500 000 to<br />

R50 million to established entrepreneurs with a viable<br />

business who want to invest in green buildings and<br />

achieve green building certification. We finance the<br />

purchase, construction, and/or retrofit of buildings if<br />

their designs are certified under an eligible green<br />

building certification.<br />

www.businesspartners.co.za<br />

Property Finance<br />

Property Joint<br />

Venture Fund<br />

Extra benefits:<br />

Mentorship and<br />

Technical Assistance<br />

<strong>Green</strong> Buildings<br />

Finance<br />

The cost of green certification is covered by a nonrefundable<br />

grant of up to R150 000. We offer a rebate<br />

of up to 40 percent of the capital expenditure needed<br />

to green your building and achieve green buildings<br />

certified status.<br />

Small businesses<br />

urged to<br />

ECONOMY<br />

GO SOLAR<br />

If anything, the 2023 Budget Speech revealed that devising a targeted plan to solve South Africa’s<br />

ongoing energy crisis remains the government’s top priority. The immediate future will see a<br />

concerted and collective focus on bringing together the public and private sectors in a bid to fuel<br />

the clean-energy transition and end loadshedding.<br />

BY BUSINESS PARTNERS LIMITED<br />

For small businesses looking to ride this wave on the path to<br />

post-pandemic recovery, the key is to go solar. This is the<br />

opinion of Jeremy Lang, chief investment officer at independent<br />

small- and medium-sized enterprise (SME) financier, Business<br />

Partners Limited. Prior to the Budget Speech, Lang aired hopes<br />

that “large-scale interventions” would be on the cards for the small<br />

business sector in the form of much-needed relief measures.<br />

In light of the almost single-minded focus on boosting embedded<br />

generation efforts through various fiscal measures and policy reforms,<br />

this year’s speech delivered little in the way of SME-specific relief. It did,<br />

however, propose several measures that speak to the urgent need for<br />

government to address the resounding impact that rolling blackouts<br />

have had on small businesses.<br />

On this, Lang suggests that South African small businesses review the<br />

viability of installing solar energy systems to power their operations.<br />

“Not only will this help to alleviate pressure on the national grid,<br />

but it will also ensure business continuity – a vital factor given that<br />

loadshedding will likely persist for a long while longer. This could also<br />

bring good news for small businesses in the formal sector, who will<br />

realise gains in the form of a 125% deduction in tax in the first year for<br />

all renewable energy projects,” says Lang.<br />

Further state-led interventions aimed at benefiting the SME sector<br />

include the government’s proposal to provide solar-related loans for<br />

SMEs on a 20% first-loss basis. “What this means essentially is that<br />

going forward, small businesses will be able to secure loans from<br />

finance providers where the National Treasury will assume 20% of the<br />

initial loss. This will help to mitigate the total risk on behalf of lenders<br />

and hopefully make these loans more accessible to a wider base,”<br />

explains Lang.<br />

For small businesses looking to<br />

ride this wave on the path to post-pandemic<br />

recovery, the key is to go solar.<br />

This development will likely form part of the proposed Energy<br />

Bounce Back Scheme, set to launch in April 2023 – an extension of<br />

the Bounce Back scheme initiated during the pandemic years to assist<br />

SMEs in recovering Covid-19-related losses. On the effectiveness of this<br />

particular measure, Lang remains hopeful that the new solar-directed<br />

slant of the scheme will attract more uptake than its predecessor<br />

which saw only R140-million in loans being approved and R77-million<br />

disbursed of the proposed R15-billion.<br />

“This is where the cooperation of state entities, governmental<br />

departments, private sector players and financiers will play a crucial role<br />

Jeremy Lang, Chief<br />

Investment Officer,<br />

Business Partners.<br />

in reaching out to the thousands of small businesses in need of relief,<br />

facilitating a streamlined loan application process and deploying<br />

funds efficiently,” says Lang.<br />

Overall, government’s R5-billion investment into the expansion of<br />

the renewable energy tax incentive is a welcomed development, in<br />

tandem with the decision not to increase fuel levies.<br />

Additionally, this year’s extended Budget Review revealed that<br />

the Department of Small Business Development has been allocated<br />

R2.8-billion as part of a fund to support 12 000 townships and rural<br />

enterprises. The measures on which these funds will be spent remain<br />

unclear, but as Lang asserts, “a meaningful impact on informal<br />

SMEs and the economy can be made by funding a concerted effort<br />

to formalise the many township and rural businesses that exist in<br />

South Africa.<br />

“In pushing the agenda to formalise these businesses, government<br />

will achieve the dual purpose of ‘providing more support and<br />

regulatory protection to small businesses, while expanding the<br />

tax base.”<br />

On this Lang believes the temporary diversion of focus to a more<br />

consolidated effort to solve the energy crisis is well-warranted and<br />

that a “solution that includes and benefits small businesses is a<br />

solution that benefits all South Africans”.<br />

As he concludes: “In light of the changes that are afoot in South<br />

Africa’s tax regime, small business owners would do well to seek the<br />

advice and guidance of tax professionals and remain informed, via<br />

the available knowledge bases, to understand how they can make the<br />

most of the tax-related benefits on offer for the foreseeable future,<br />

this is where further relief will stem from.”<br />

011 713 6600<br />

enquiries@businesspartners.co.za<br />

www.businesspartners.co.za<br />

27

ENERGY<br />

ENERGY<br />

The future of<br />

ONSHORE WIND<br />

TURBINE SOURCING<br />

Kearney Analysis<br />

Figure 1. Turbine manufacturers are reporting sharp drops in their margins.<br />

Three factors are triggering OEMs’ troubled performance. First,<br />