Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

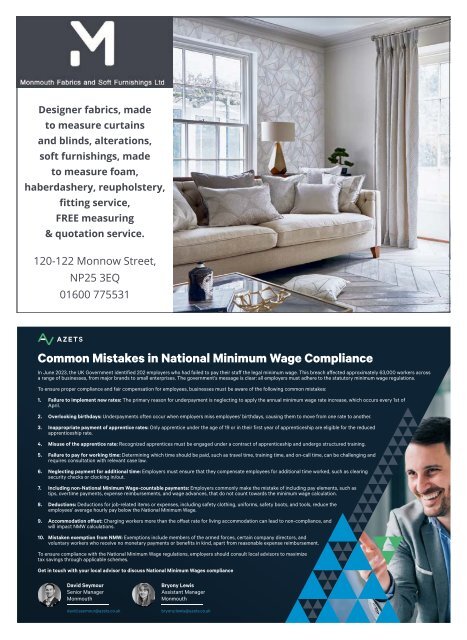

Designer fabrics, made<br />

to measure curtains<br />

and blinds, alterations,<br />

soft furnishings, made<br />

to measure foam,<br />

haberdashery, reupholstery,<br />

fitting service,<br />

FREE measuring<br />

& quotation service.<br />

120-122 Monnow Street,<br />

NP25 3EQ<br />

01600 775531<br />

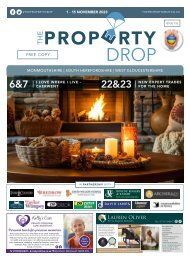

Common Mistakes in National Minimum Wage Compliance<br />

In June 2023, the UK Government identified 202 employers who had failed to pay their staff the legal minimum wage. This breach affected approximately 63,000 workers across<br />

a range of businesses, from major brands to small enterprises. The government’s message is clear: all employers must adhere to the statutory minimum wage regulations.<br />

To ensure proper compliance and fair compensation for employees, businesses must be aware of the following common mistakes:<br />

1. Failure to implement new rates: The primary reason for underpayment is neglecting to apply the annual minimum wage rate increase, which occurs every 1st of<br />

April.<br />

2. Overlooking birthdays: Underpayments often occur when employers miss employees’ birthdays, causing them to move from one rate to another.<br />

3. Inappropriate payment of apprentice rates: Only apprentice under the age of 19 or in their first year of apprenticeship are eligible for the reduced<br />

apprenticeship rate.<br />

4. Misuse of the apprentice rate: Recognized apprentices must be engaged under a contract of apprenticeship and undergo structured training.<br />

5. Failure to pay for working time: Determining which time should be paid, such as travel time, training time, and on-call time, can be challenging and<br />

requires consultation with relevant case law.<br />

6. Neglecting payment for additional time: Employers must ensure that they compensate employees for additional time worked, such as clearing<br />

security checks or clocking in/out.<br />

7. Including non-National Minimum Wage-countable payments: Employers commonly make the mistake of including pay elements, such as<br />

tips, overtime payments, expense reimbursements, and wage advances, that do not count towards the minimum wage calculation.<br />

8. Deductions: Deductions for job-related items or expenses, including safety clothing, uniforms, safety boots, and tools, reduce the<br />

employees’ average hourly pay below the National Minimum Wage.<br />

9. Accommodation offset: Charging workers more than the offset rate for living accommodation can lead to non-compliance, and<br />

will impact NMW calculations.<br />

10. Mistaken exemption from NMW: Exemptions include members of the armed forces, certain company directors, and<br />

voluntary workers who receive no monetary payments or benefits in kind, apart from reasonable expense reimbursement.<br />

To ensure compliance with the National Minimum Wage regulations, employers should consult local advisors to maximize<br />

tax savings through applicable schemes.<br />

Get in touch with your local advisor to discuss National Minimum Wages compliance<br />

David Seymour<br />

Senior Manager<br />

Monmouth<br />

david.seymour@azets.co.uk<br />

Bryony Lewis<br />

Assistant Manager<br />

Monmouth<br />

bryony.lewis@azets.co.uk