2024 State of the Industry Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

This can be compared to US data showing that <strong>the</strong><br />

GFC devastated <strong>the</strong> US jewellery industry. A census by<br />

<strong>the</strong> Jewelers Board <strong>of</strong> Trade (JBT) - a not-for-pr<strong>of</strong>it,<br />

member-owned association - found that “<strong>the</strong> number<br />

<strong>of</strong> jewellery doors which closed in 2008 is estimated to<br />

be around 1,500, though some believe it was closer to<br />

2,000.”<br />

The 2010 SOIR stressed ‘retirement’ was ano<strong>the</strong>r<br />

common reason for independent jewellery store<br />

closures. Small, family businesses have always<br />

dominated jewellery retailing, and <strong>the</strong> post-war baby<br />

boomers had caused a spiral in store closures.<br />

Jeweller reported 13 years ago that if no family<br />

member is willing to take over, <strong>the</strong> only o<strong>the</strong>r option<br />

is to close <strong>the</strong> business. Succession planning is<br />

notoriously difficult for retailers.<br />

In addition, it’s challenging to sell a jewellery business<br />

as it is capital intensive – meaning a significant<br />

investment in stock and fit-out - and requires a higher<br />

degree <strong>of</strong> expertise than many o<strong>the</strong>r retail categories.<br />

Jewellery knowledge is <strong>the</strong> most basic requirement<br />

- and gemmology, jewellery designing, and<br />

manufacturing skills are desirable.<br />

Selling <strong>the</strong> business is always an option, but it is not<br />

easily sold if pr<strong>of</strong>itability is marginal. And again, this is<br />

a trend in <strong>the</strong> Western world, supported by US data.<br />

The JBT data dates to 1987, and in 2009, it was<br />

reported that every year – except three years in<br />

<strong>the</strong> early 1990s – <strong>the</strong> number <strong>of</strong> US retail jewellery<br />

businesses had declined.<br />

Our 2010 study also noted, anecdotally at least, that<br />

recessions and difficult trading conditions tend to<br />

separate <strong>the</strong> ‘wheat from <strong>the</strong> chaff’.<br />

Unsuccessful small businesses will <strong>of</strong>ten use <strong>the</strong><br />

excuse <strong>of</strong> a ‘recession’ to save face when <strong>the</strong>y<br />

announce closure ra<strong>the</strong>r than taking responsibility<br />

for <strong>the</strong>ir business failings.<br />

That is, it’s easy to make money in good times, and<br />

if you own a business that is only marginally pr<strong>of</strong>itable<br />

Only 33 per cent <strong>of</strong> independent jewellery retailers<br />

report that <strong>the</strong>ir business is pr<strong>of</strong>itable today than it<br />

was before <strong>the</strong> pandemic.<br />

when difficult trading conditions arrive - as <strong>the</strong>y indeed<br />

will - a borderline business will not survive.<br />

Hold your horses<br />

Having established several reasons why independent<br />

jewellery stores would naturally decline in number, <strong>the</strong><br />

<strong>2024</strong> study finds that <strong>the</strong>re are around 2,000 stores today.<br />

This is a loss <strong>of</strong> around 700, or 25 per cent, since 2010.<br />

Now, before anyone cries wolf, hold your horses!<br />

This reduction needs fur<strong>the</strong>r clarification because<br />

some <strong>of</strong> it can be attributed to Jeweller’s change in <strong>the</strong><br />

definition or classification <strong>of</strong> a ‘jewellery store’ caused<br />

by enormous structural shifts in <strong>the</strong> industry over <strong>the</strong><br />

past decade.<br />

The 2010 study was an attempt to measure <strong>the</strong><br />

number <strong>of</strong> stores that sell jewellery to consumers,<br />

Custom made and bespoke jewellery has become<br />

an increasingly important category for Australia's<br />

independent jewellery retailers in <strong>the</strong> past decade.<br />

and in doing so, <strong>the</strong>re was a need to define different<br />

business archetypes.<br />

These included fine and fashion jewellery, chain<br />

stores, and stores classified as brand-only and/or<br />

flagship locations. To measure anything, it must first<br />

be defined.<br />

In 2010, <strong>the</strong> definition <strong>of</strong> a jewellery retailer included<br />

businesses that were not ‘traditional stores’. For<br />

example, our data included jewellers and designers<br />

who operated from what we defined as ‘upstairs<br />

premises’ or studios and workshops.<br />

Many, if not most, <strong>of</strong> <strong>the</strong>se businesses legitimately deal<br />

with <strong>the</strong> public as customers and specialise in niche<br />

categories such as engagement, bridal jewellery, and<br />

bespoke design.<br />

Most operated from CBD locations in capital cities and<br />

were (and still are) located in <strong>the</strong> ‘jewellery buildings’<br />

such as <strong>the</strong> Century and Manchester buildings in<br />

Melbourne and <strong>the</strong> Dymocks and Trust buildings in<br />

Sydney, to name just a few.<br />

O<strong>the</strong>r capital cities have similar buildings, harking<br />

back to a period when jewellers and suppliers<br />

congregated in one location for convenience and<br />

security. A jeweller could source and purchase<br />

materials, such as diamonds and gemstones, by<br />

visiting a supplier on ano<strong>the</strong>r floor – without <strong>the</strong><br />

need to leave <strong>the</strong> building.<br />

These businesses were identified as ‘Retailer - No<br />

storefront’ and included in <strong>the</strong> store counts.<br />

Changing times<br />

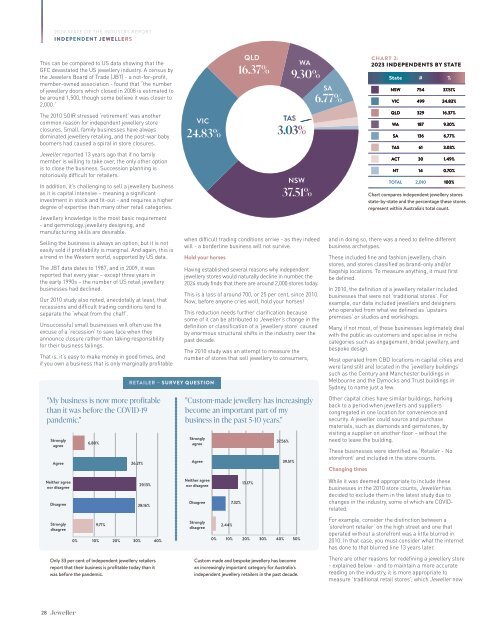

CHART 2:<br />

2023 INDEPENDENTS BY STATE<br />

<strong>State</strong> # %<br />

NSW 754 37.51%<br />

VIC 499 24.83%<br />

QLD 329 16.37%<br />

WA 187 9.30%<br />

SA 136 6.77%<br />

TAS 61 3.03%<br />

ACT 30 1.49%<br />

NT 14 0.70%<br />

TOTAL 2,010 100%<br />

Chart compares independent jewellery stores<br />

state-by-state and <strong>the</strong> percentage <strong>the</strong>se stores<br />

represent within Australia's total count.<br />

While it was deemed appropriate to include <strong>the</strong>se<br />

businesses in <strong>the</strong> 2010 store counts, Jeweller has<br />

decided to exclude <strong>the</strong>m in <strong>the</strong> latest study due to<br />

changes in <strong>the</strong> industry, some <strong>of</strong> which are COVIDrelated.<br />

For example, consider <strong>the</strong> distinction between a<br />

‘storefront retailer’ on <strong>the</strong> high street and one that<br />

operated without a storefront was a little blurred in<br />

2010. In that case, you must consider what <strong>the</strong> internet<br />

has done to that blurred line 13 years later.<br />

There are o<strong>the</strong>r reasons for redefining a jewellery store<br />

- explained below - and to maintain a more accurate<br />

reading on <strong>the</strong> industry, it is more appropriate to<br />

measure ‘traditional retail stores’, which Jeweller now<br />

28