Green Economy Journal Issue 61

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MOBILITY<br />

MOBILITY<br />

One of the key issues Tesla had initially, was not with the core vehicle<br />

technology but the scaling up and quality control of manufacturing<br />

cars in large numbers, something that traditional automakers tend<br />

to do very well. This will be a big part of why these tech companies<br />

have often partnered with traditional automakers or other large<br />

manufacturers with experience. This sort of approach could see<br />

another key shift in how the automotive market is structured, with<br />

traditional OEMs manufacturing the vehicle and tech companies<br />

providing the software and integration. The benefit for the end user<br />

would be a well-built vehicle that integrates seamlessly with all their<br />

other electronic devices.<br />

IDTechEx<br />

THE FUTURE OF EVs<br />

Evolution of the automotive industry and<br />

electrification beyond cars<br />

2023 has proven another momentous year for the electric vehicle market. Growth in 2023 was<br />

hampered by the poor performance of plug-in hybrids in Europe. However, even with less<br />

aggressive growth than in previous years, many will agree that EVs are the future, especially<br />

for the passenger car market. So, what else can be learned about the future of electrification?<br />

BY IDTechEx<br />

While the electric vehicle (EV) has become an everyday term<br />

that the public is now aware of, there are still certainly<br />

large technological and market trends occurring in the<br />

automotive market. Beyond this, many other vehicle segments are<br />

seeing electrification take off; these include various vehicles on the<br />

road (vans, trucks, buses, two-wheelers, three-wheelers, microcars,<br />

etc), but also off-road segments like construction vehicles and trains.<br />

It isn’t just vehicles on land either, with marine sectors and aerial<br />

vehicles like air taxis gaining increased interest and market traction.<br />

Each vehicle category is at a different stage of electrification and has<br />

its own technology and market demands depending on technical<br />

feasibility, consumer acceptance, government policy and several<br />

other factors.<br />

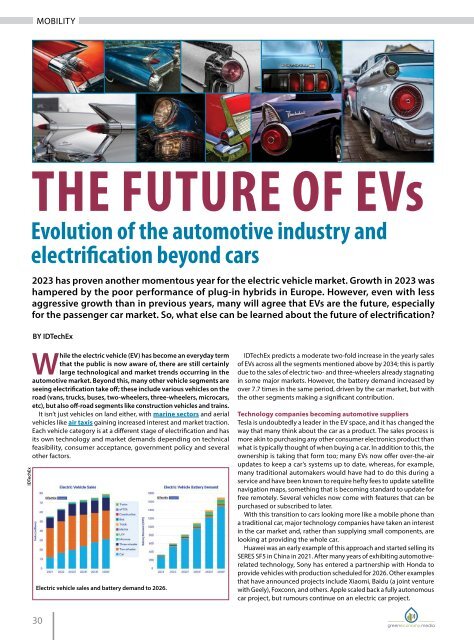

Electric vehicle sales and battery demand to 2026.<br />

IDTechEx predicts a moderate two-fold increase in the yearly sales<br />

of EVs across all the segments mentioned above by 2034; this is partly<br />

due to the sales of electric two- and three-wheelers already stagnating<br />

in some major markets. However, the battery demand increased by<br />

over 7.7 times in the same period, driven by the car market, but with<br />

the other segments making a significant contribution.<br />

Technology companies becoming automotive suppliers<br />

Tesla is undoubtedly a leader in the EV space, and it has changed the<br />

way that many think about the car as a product. The sales process is<br />

more akin to purchasing any other consumer electronics product than<br />

what is typically thought of when buying a car. In addition to this, the<br />

ownership is taking that form too; many EVs now offer over-the-air<br />

updates to keep a car’s systems up to date, whereas, for example,<br />

many traditional automakers would have had to do this during a<br />

service and have been known to require hefty fees to update satellite<br />

navigation maps, something that is becoming standard to update for<br />

free remotely. Several vehicles now come with features that can be<br />

purchased or subscribed to later.<br />

With this transition to cars looking more like a mobile phone than<br />

a traditional car, major technology companies have taken an interest<br />

in the car market and, rather than supplying small components, are<br />

looking at providing the whole car.<br />

Huawei was an early example of this approach and started selling its<br />

SERES SF5 in China in 2021. After many years of exhibiting automotiverelated<br />

technology, Sony has entered a partnership with Honda to<br />

provide vehicles with production scheduled for 2026. Other examples<br />

that have announced projects include Xiaomi, Baidu (a joint venture<br />

with Geely), Foxconn, and others. Apple scaled back a fully autonomous<br />

car project, but rumours continue on an electric car project.<br />

EVCIPA (China), EAFO (Europe), AFDC (US). Compiled by IDTechEx.<br />

Charging infrastructure growth required to meet EV demand<br />

The global EV charging infrastructure market is growing steadily.<br />

There were 2.7-million public charging points worldwide in 2022.<br />

Nearly 960k chargers were installed globally in that same year. It is<br />

estimated that 222-million chargers will be needed by 2034 to support<br />

the growing global EV fleet and that the cumulative global investment<br />

in global charging infrastructure will exceed US$123-billion by 2034<br />

(hardware cost alone).<br />

There is undoubtedly a huge push to build global public DC fast<br />

charging networks. China is leading the race with 1.797-million total<br />

public chargers deployed, taking ~70% of the global market share.<br />

The US government is providing more than $5-billion in funding and<br />

incentives to build a coast-to-coast fast charging network under The<br />

National Electric Vehicle Infrastructure (NEVI) Formula Program. The<br />

Alternative Fuels Infrastructure Regulation (AFIR) in the EU is similarly<br />

driving the growth of public charger installations by mandating a<br />

station every 60km along highways. DC fast chargers are forecasted<br />

to exhibit a higher growth rate in the coming decade, although AC<br />

chargers will dominate by unit volume in terms of deployment.<br />

Global charging infrastructure installations. Data shown as<br />

of April 2023.<br />

The global EV charging network remains fragmented, with many<br />

charge point operators battling for market share across regions. Leading<br />

automakers recently adopted Tesla’s North American Charging Standard<br />

(NACS) charging connector for their US models. Tesla operates the<br />

largest global public DC charging network, and in North America NACS<br />

outnumbers combined charging standard (CCS) two to one, which<br />

explains the switch to Tesla’s standard. Furthermore, the network is<br />

more reliable and has 20% to 70% lower deployment costs than their<br />

competitors due to in-house design and manufacturing of components.<br />

From a technical standpoint, Tesla’s connector is lightweight, supports<br />

both AC and DC through shared pins, and can support higher amperage<br />

due to immersion-cooled cables. Cars and EV supply equipment<br />

supporting CCS in the US will make up less than 50% market share by<br />

the end of the decade, although it will remain the dominant standard<br />

across the EU and UK regions.<br />

*Authors: Dr James Edmondson, principal technology analyst, and Shazan Siddiqi, senior technology analyst, IDTechEx.<br />

30<br />

31