Blue Chip Issue 90

Blue Chip Journal – The official publication of FPI Blue Chip is a quarterly journal for the financial planning industry and is the official publication of the Financial Planning Institute of Southern Africa NPC (FPI), effective from the January 2020 edition. Blue Chip publishes contributions from FPI and other leading industry figures, covering all aspects of the financial planning industry.

Blue Chip Journal – The official publication of FPI

Blue Chip is a quarterly journal for the financial planning industry and is the official publication of the Financial Planning Institute of Southern Africa NPC (FPI), effective from the January 2020 edition. Blue Chip publishes contributions from FPI and other leading industry figures, covering all aspects of the financial planning industry.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FINANCIAL PLANNING | Retirement<br />

BLUE<br />

CHIP<br />

Converting your retirement<br />

assets into an income should<br />

not be done lightly.<br />

die early. When you have a living annuity, you have to invest<br />

as though you are going to live to 100, as you cannot afford<br />

to run out of money.<br />

• Life insurance companies can afford to be a little more<br />

aggressive about how they invest the money, as they have large<br />

pools to invest. As an individual, you cannot afford to take a<br />

chance with your retirement capital, so you need to invest more<br />

conservatively and give up some potential growth.<br />

Downside of life annuities<br />

Life annuities are designed to provide you with a pension for the<br />

rest of your life. Once they are set up, there is very little flexibility.<br />

You lock yourself into a particular income stream and that will be<br />

paid to you for the rest of your life.<br />

The other weakness of the annuity is that it is not designed to<br />

pay an inheritance. With the living annuity, there will often be an<br />

amount that your children can inherit once you and your spouse<br />

have died.<br />

This is not the case with a life annuity, as your children will stand<br />

a much lower chance of inheriting because your pension will have<br />

dried up.<br />

I like to use a life annuity in conjunction with a living annuity.<br />

The life annuity is used to cover your fixed costs such as your utility<br />

bills and medical aid, and the living annuity covers the rest.<br />

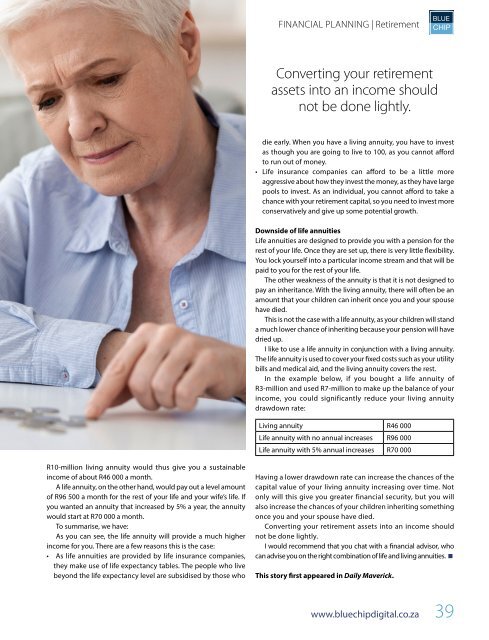

In the example below, if you bought a life annuity of<br />

R3-million and used R7-million to make up the balance of your<br />

income, you could significantly reduce your living annuity<br />

drawdown rate:<br />

Living annuity R46 000<br />

Life annuity with no annual increases R96 000<br />

Life annuity with 5% annual increases R70 000<br />

R10-million living annuity would thus give you a sustainable<br />

income of about R46 000 a month.<br />

A life annuity, on the other hand, would pay out a level amount<br />

of R96 500 a month for the rest of your life and your wife’s life. If<br />

you wanted an annuity that increased by 5% a year, the annuity<br />

would start at R70 000 a month.<br />

To summarise, we have:<br />

As you can see, the life annuity will provide a much higher<br />

income for you. There are a few reasons this is the case:<br />

• As life annuities are provided by life insurance companies,<br />

they make use of life expectancy tables. The people who live<br />

beyond the life expectancy level are subsidised by those who<br />

Having a lower drawdown rate can increase the chances of the<br />

capital value of your living annuity increasing over time. Not<br />

only will this give you greater financial security, but you will<br />

also increase the chances of your children inheriting something<br />

once you and your spouse have died.<br />

Converting your retirement assets into an income should<br />

not be done lightly.<br />

I would recommend that you chat with a financial advisor, who<br />

can advise you on the right combination of life and living annuities. <br />

This story first appeared in Daily Maverick.<br />

www.bluechipdigital.co.za<br />

39