Blue Chip Issue 90

Blue Chip Journal – The official publication of FPI Blue Chip is a quarterly journal for the financial planning industry and is the official publication of the Financial Planning Institute of Southern Africa NPC (FPI), effective from the January 2020 edition. Blue Chip publishes contributions from FPI and other leading industry figures, covering all aspects of the financial planning industry.

Blue Chip Journal – The official publication of FPI

Blue Chip is a quarterly journal for the financial planning industry and is the official publication of the Financial Planning Institute of Southern Africa NPC (FPI), effective from the January 2020 edition. Blue Chip publishes contributions from FPI and other leading industry figures, covering all aspects of the financial planning industry.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FPI | Certification<br />

BLUE<br />

CHIP<br />

Next Generation<br />

Certification Standards<br />

Want to become a CERTIFIED FINANCIAL PLANNER®? The Financial Planning Institute introduces the Next<br />

Generation Certification Standards.<br />

The FPI is excited to introduce the Next Generation<br />

Certification Standards for the CERTIFIED FINANCIAL<br />

PLANNER® (CFP®) designation. The assessment process<br />

to become a CFP® professional member of the FPI will be<br />

amended from 1 January 2025 to align closely with the current<br />

international requirements for CFP® certification.<br />

WHY WE ARE CHANGING<br />

When determining the competencies of financial planner<br />

candidates, the FPI assesses both their knowledge and whether they<br />

possess the required financial planning skills and abilities.<br />

In line with international trends, the FPI is adapting the assessment<br />

processes for CFP® to include a practical component in the form of a<br />

Capstone 1 course and a financial plan assessment.<br />

The entire assessment process, across the four Es required for<br />

certification (education, examination, experience and ethics), is<br />

being streamlined. This will ensure that a new CFP® professional<br />

is evaluated practically across the knowledge, skills and abilities<br />

components of financial planning, which includes the drafting of<br />

a financial plan.<br />

WHAT IS CHANGING?<br />

The CFP® professional competency examination in its current format<br />

will be discontinued at the end of 2024. From 2025, candidates on<br />

the two different pathways to CFP® certification will be required to<br />

complete the steps as shown in the table successfully.<br />

How does it affect candidates on our CFP® pathway?<br />

If you obtained your recognised underlying qualification during<br />

or before 2023, you will be encouraged to complete the FPI<br />

Professional Competency Examination (PCE) in its current format<br />

before the end of 2024. Should you not attempt the PCE, or not<br />

be successful in passing the PCE at this time, you will have<br />

to complete the three components of the CFP® RPL pathway<br />

examination requirement from 2025 onwards (multiple choice<br />

examination, Capstone course and financial plan).<br />

The FPI encourages all qualifying candidates to complete this<br />

examination and apply for CFP® membership as soon as possible.<br />

There will be four examination opportunities available in 2024.<br />

Visit www.fpi.co.za to register for the February (8-9) or April<br />

(25-26) PCE exams.<br />

FREQUENTLY ASKED QUESTIONS<br />

How will the FPI ensure that the standard of new entrants to<br />

the CFP® designation is upheld?<br />

Although the process and method of assessment is changing,<br />

it is still based on the global international standards and<br />

requirements for CFP® professionals. Education requirements<br />

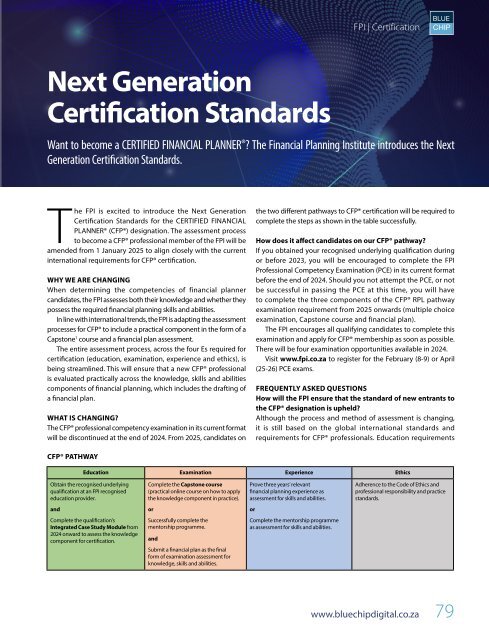

CFP® PATHWAY<br />

Education Examination Experience Ethics<br />

Obtain the recognised underlying<br />

qualification at an FPI recognised<br />

education provider.<br />

Complete the Capstone course<br />

(practical online course on how to apply<br />

the knowledge component in practice).<br />

Prove three years’ relevant<br />

financial planning experience as<br />

assessment for skills and abilities.<br />

Adherence to the Code of Ethics and<br />

professional responsibility and practice<br />

standards.<br />

and<br />

or<br />

or<br />

Complete the qualification’s<br />

Integrated Case Study Module from<br />

2024 onward to assess the knowledge<br />

component for certification.<br />

Successfully complete the<br />

mentorship programme.<br />

and<br />

Submit a financial plan as the final<br />

form of examination assessment for<br />

knowledge, skills and abilities.<br />

Complete the mentorship programme<br />

as assessment for skills and abilities.<br />

www.bluechipdigital.co.za<br />

79