What will your legacy be? (UK)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

LEGACY GIVING<br />

Investing in the future<br />

Legacy gifts have transformed Queen’s over the<br />

centuries. Starting with Ro<strong>be</strong>rt de Eglesfield and<br />

Queen Philippa in 1341, and continuing through the<br />

following seven centuries, these deeply personal gifts<br />

have enriched our students’ experience, developed<br />

our excellence in research and teaching, enhanced our<br />

historic buildings, and sustained the College community.<br />

‘Every <strong>legacy</strong> gift is an investment<br />

in the future of Queen’s and the<br />

next generation of students and<br />

researchers. We are most grateful.’<br />

– Dr Claire Craig, The Provost<br />

Legacy gifts are invested as part of the College’s<br />

endowment, where they join the generous gifts made<br />

by previous generations of Old Mem<strong>be</strong>rs and Friends.<br />

All <strong>legacy</strong> gifts are carefully stewarded so that they<br />

have a lasting impact – creating sustained income<br />

to support the current and future mem<strong>be</strong>rs of the<br />

Queen’s community.<br />

Recent <strong>legacy</strong> gifts have included support for the<br />

Library to purchase books and to digitise historical<br />

material in the Special Collections and Archives.<br />

Photo: Gareth Ardron<br />

PLANNING<br />

YOUR GIFT<br />

Legacy gifts are used to support our students<br />

achieve their ambitions and prepare for their futures.<br />

Thank you for <strong>your</strong> interest in leaving a gift in <strong>your</strong> <strong>will</strong> to<br />

Queen’s. We always advise speaking to a legal adviser<br />

when planning a <strong>legacy</strong> gift, so that <strong>your</strong> <strong>will</strong> meets<br />

<strong>your</strong> needs, supports <strong>your</strong> family and loved ones, and<br />

takes advantage of any tax <strong>be</strong>nefits from making a<br />

charitable gift.<br />

A gift in <strong>your</strong> <strong>will</strong> can <strong>be</strong> any amount and given as:<br />

• A fixed amount of money (pecuniary <strong>legacy</strong>)<br />

• A percentage, or the whole, of <strong>your</strong> estate<br />

(residuary <strong>legacy</strong>)<br />

• A particular object, asset or property<br />

(specific <strong>legacy</strong>).<br />

Photo: Edmund Blok<br />

PREPARING YOUR<br />

WORDING<br />

Here is sample wording for including Queen’s in <strong>your</strong><br />

<strong>will</strong> or living trust.<br />

‘I give________ (the whole, an amount or a percentage<br />

share) of my estate to the Provost and Scholars of<br />

The Queen’s College in the University of Oxford to <strong>be</strong><br />

used for__________, and I declare that the receipt of the<br />

Provost or other duly authorised officer shall <strong>be</strong> a full and<br />

sufficient discharge to my Executors.’<br />

If you have already made a <strong>will</strong>, you can add a gift to<br />

Queen’s by using a simple codicil. Please contact us<br />

for an example document.<br />

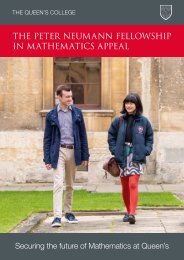

THE TABERDARS’ SOCIETY<br />

The Ta<strong>be</strong>rdars’ Society honours the<br />

generosity of those who intend to leave a gift to<br />

Queen’s in their <strong>will</strong>s. Our annual luncheon and<br />

other events give mem<strong>be</strong>rs the opportunity to meet<br />

old and new friends, and to learn about the latest<br />

developments at College. If you would like to join<br />

the Ta<strong>be</strong>rdars’ Society, we would <strong>be</strong> delighted to<br />

hear from you.<br />

Photo: David Fisher<br />

The Queen’s College is a charity and gifts left in <strong>your</strong><br />

<strong>will</strong> to Queen’s are exempt from <strong>UK</strong> inheritance tax.<br />

If more than 10% of <strong>your</strong> net estate is given to charity,<br />

the overall tax rate is reduced from 40% to 36%. More<br />

information about <strong>UK</strong> tax relief when leaving gifts to<br />

charity in <strong>your</strong> <strong>will</strong>: https://bit.ly/3ONaIK6<br />

Meeting the College Librarian, Dr Matthew Shaw,<br />

at the Ta<strong>be</strong>rdars’ Society Luncheon in 2023.