Download PDF - The Georgetown Chamber of Commerce & Industry

Download PDF - The Georgetown Chamber of Commerce & Industry

Download PDF - The Georgetown Chamber of Commerce & Industry

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

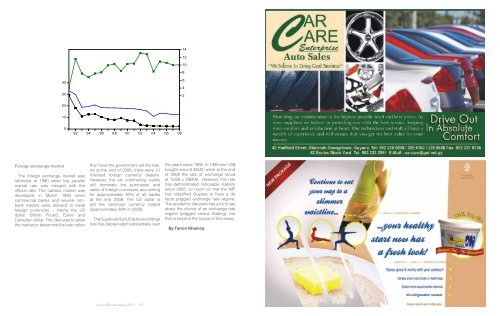

Foreign exchange market<br />

40<br />

30<br />

20<br />

10<br />

<strong>The</strong> foreign exchange market was<br />

reformed in 1990 when the parallel<br />

market rate was merged with the<br />

<strong>of</strong>ficial rate. <strong>The</strong> cambio market was<br />

developed in March 1990 when<br />

commercial banks and several nonbank<br />

traders were allowed to trade<br />

foreign currencies – mainly the US<br />

dollar, British Pound, Euros and<br />

Canadian dollar. <strong>The</strong> idea was to allow<br />

the market to determine the rate rather<br />

0<br />

92 94 96 98 00 02 04 06 08<br />

Average lending rate<br />

Average deposit rate<br />

SPREAD (right-axis)<br />

than have the government set the rate.<br />

As at the end <strong>of</strong> 2008, there were 21<br />

licensed foreign currency dealers.<br />

However, the six commercial banks<br />

still dominate the purchases and<br />

sales <strong>of</strong> foreign currencies accounting<br />

for approximately 90% <strong>of</strong> all trades<br />

at the end 2008. <strong>The</strong> US dollar is<br />

still the dominant currency traded<br />

(approximately 89% in 2008).<br />

<strong>The</strong> Guyana dollar/US dollar exchange<br />

rate has depreciated substantially over<br />

Guyana Business 2010 | 66<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

the years since 1990. In 1990 one US$<br />

bought around $G40, while at the end<br />

<strong>of</strong> 2008 the rate <strong>of</strong> exchange stood<br />

at 1US$ = G$206. However, this rate<br />

has demonstrated noticeable stability<br />

since 2005; so much so that the IMF<br />

has classified Guyana to have a de<br />

facto pegged exchange rate regime.<br />

<strong>The</strong> academic literature has a lot to say<br />

about the choice <strong>of</strong> an exchange rate<br />

regime (pegged versus floating); but<br />

that is beyond the scope <strong>of</strong> this essay.<br />

By Tarron Khemraj