A New Paradigm for Managing Shareholder Value

A New Paradigm for Managing Shareholder Value

A New Paradigm for Managing Shareholder Value

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Accenture Institute <strong>for</strong> High Per<strong>for</strong>mance Business<br />

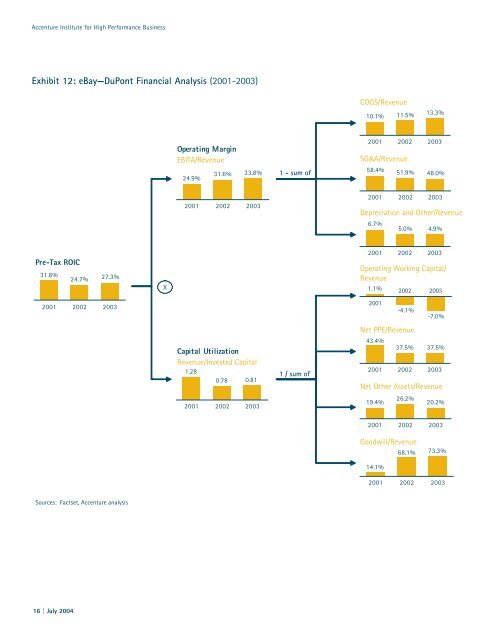

Exhibit 12: eBay—DuPont Financial Analysis (2001-2003)<br />

Pre-Tax ROIC<br />

31.8%<br />

16 | July 2004<br />

24.7%<br />

27.3%<br />

2001 2002 2003<br />

Sources: Factset, Accenture analysis<br />

X<br />

Operating Margin<br />

EBITA/Revenue<br />

24.9%<br />

31.6%<br />

33.8%<br />

2001 2002 2003<br />

Capital Utilization<br />

Revenue/Invested Capital<br />

1.28<br />

0.78 0.81<br />

2001 2002 2003<br />

1 - sum of<br />

1 / sum of<br />

COGS/Revenue<br />

10.1%<br />

43.4%<br />

11.5%<br />

13.3%<br />

2001 2002 2003<br />

SG&A/Revenue<br />

58.4%<br />

6.7%<br />

37.5% 37.5%<br />

2001 2002 2003<br />

14.1%<br />

51.9%<br />

5.0%<br />

68.1%<br />

48.0%<br />

2001 2002 2003<br />

Depreciation and Other/Revenue<br />

4.9%<br />

2001 2002 2003<br />

Operating Working Capital/<br />

Revenue<br />

1.1% 2002 2003<br />

2001<br />

19.4%<br />

-4.1%<br />

Net PPE/Revenue<br />

26.2%<br />

-7.0%<br />

Net Other Assets/Revenue<br />

20.2%<br />

2001 2002 2003<br />

Goodwill/Revenue<br />

73.3%<br />

2001 2002 2003