A New Paradigm for Managing Shareholder Value

A New Paradigm for Managing Shareholder Value

A New Paradigm for Managing Shareholder Value

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

managing current operations, is often<br />

not the competency they urgently need,<br />

getting a handle on future value.<br />

We have found, <strong>for</strong> example, that as of<br />

May 2003, 7 future value accounted <strong>for</strong><br />

77 percent of market capitalization and<br />

59 percent of the enterprise value 8 of<br />

the companies on the Russell 3000, an<br />

index that covers 98 percent of all<br />

listed US equities (see Exhibit 1).<br />

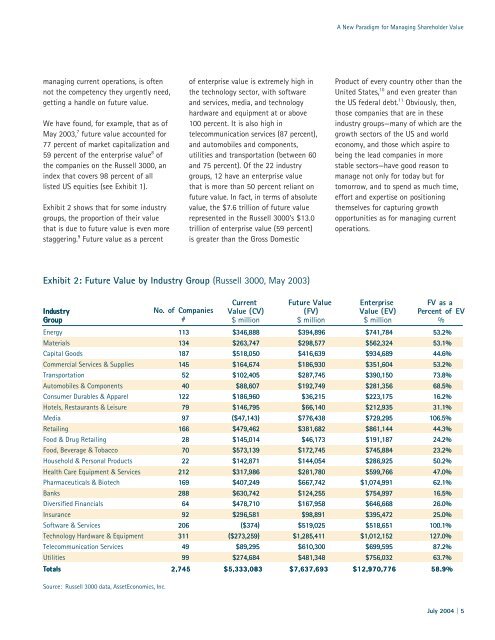

Exhibit 2 shows that <strong>for</strong> some industry<br />

groups, the proportion of their value<br />

that is due to future value is even more<br />

staggering. 9 Future value as a percent<br />

Industry<br />

Group<br />

Energy<br />

Materials<br />

Capital Goods<br />

Commercial Services & Supplies<br />

Transportation<br />

Automobiles & Components<br />

Consumer Durables & Apparel<br />

Hotels, Restaurants & Leisure<br />

Media<br />

Retailing<br />

Food & Drug Retailing<br />

Food, Beverage & Tobacco<br />

Household & Personal Products<br />

Health Care Equipment & Services<br />

Pharmaceuticals & Biotech<br />

Banks<br />

Diversified Financials<br />

Insurance<br />

Software & Services<br />

Technology Hardware & Equipment<br />

Telecommunication Services<br />

Utilities<br />

Totals Totals<br />

Source: Russell 3000 data, AssetEconomics, Inc.<br />

No. of Companies<br />

#<br />

113<br />

134 134<br />

187<br />

145<br />

52 52<br />

40 40<br />

122<br />

79 79<br />

97 97<br />

166<br />

28 28<br />

70 70<br />

22<br />

212<br />

169 169<br />

288<br />

64 64<br />

92 92<br />

206<br />

311<br />

49 49<br />

99 99<br />

2,745 2,745<br />

of enterprise value is extremely high in<br />

the technology sector, with software<br />

and services, media, and technology<br />

hardware and equipment at or above<br />

100 percent. It is also high in<br />

telecommunication services (87 percent),<br />

and automobiles and components,<br />

utilities and transportation (between 60<br />

and 75 percent). Of the 22 industry<br />

groups, 12 have an enterprise value<br />

that is more than 50 percent reliant on<br />

future value. In fact, in terms of absolute<br />

value, the $7.6 trillion of future value<br />

represented in the Russell 3000's $13.0<br />

trillion of enterprise value (59 percent)<br />

is greater than the Gross Domestic<br />

Exhibit 2: Future <strong>Value</strong> by Industry Group (Russell 3000, May 2003)<br />

Current<br />

<strong>Value</strong> (CV)<br />

$ million<br />

$346,888<br />

$263,747<br />

$518,050<br />

$164,674<br />

$102,405<br />

$88,607<br />

$186,960<br />

$146,795<br />

($47,143)<br />

$479,462<br />

$145,014<br />

$573,139<br />

$142,871<br />

$317,986<br />

$407,249<br />

$630,742<br />

$478,710<br />

$296,581<br />

($374)<br />

($273,259)<br />

$89,295<br />

$274,684<br />

$5,333,083<br />

Future <strong>Value</strong><br />

(FV)<br />

$ million<br />

$394,896<br />

$298,577<br />

$416,639<br />

$186,930<br />

$287,745<br />

$192,749<br />

$36,215<br />

$66,140<br />

$776,438<br />

$381,682<br />

$46,173<br />

$172,745<br />

$144,054<br />

$281,780<br />

$667,742<br />

$124,255<br />

$167,958<br />

$98,891<br />

$519,025<br />

$1,285,411<br />

$610,300<br />

$481,348<br />

$7,637,693<br />

A <strong>New</strong> <strong>Paradigm</strong> <strong>for</strong> <strong>Managing</strong> <strong>Shareholder</strong> <strong>Value</strong><br />

Product of every country other than the<br />

United States, 10 and even greater than<br />

the US federal debt. 11 Obviously, then,<br />

those companies that are in these<br />

industry groups—many of which are the<br />

growth sectors of the US and world<br />

economy, and those which aspire to<br />

being the lead companies in more<br />

stable sectors—have good reason to<br />

manage not only <strong>for</strong> today but <strong>for</strong><br />

tomorrow, and to spend as much time,<br />

ef<strong>for</strong>t and expertise on positioning<br />

themselves <strong>for</strong> capturing growth<br />

opportunities as <strong>for</strong> managing current<br />

operations.<br />

Enterprise<br />

<strong>Value</strong> (EV)<br />

$ million<br />

$741,784<br />

$562,324<br />

$934,689<br />

$351,604<br />

$390,150<br />

$281,356<br />

$223,175<br />

$212,935<br />

$729,295<br />

$861,144<br />

$191,187<br />

$745,884<br />

$286,925<br />

$599,766<br />

$1,074,991<br />

$754,997<br />

$646,668<br />

$395,472<br />

$518,651<br />

$1,012,152<br />

$699,595<br />

$756,032<br />

$12,970,776<br />

FV as a<br />

Percent of EV<br />

%<br />

53.2%<br />

53.1%<br />

44.6%<br />

53.2%<br />

73.8%<br />

68.5%<br />

16.2%<br />

31.1%<br />

106.5%<br />

44.3%<br />

24.2%<br />

23.2% 23.2%<br />

50.2%<br />

47.0% 47.0%<br />

62.1%<br />

16.5%<br />

26.0%<br />

25.0%<br />

100.1%<br />

127.0% 127.0%<br />

87.2% 87.2%<br />

63.7% 63.7%<br />

58.9%<br />

July 2004 | 5