A New Paradigm for Managing Shareholder Value

A New Paradigm for Managing Shareholder Value

A New Paradigm for Managing Shareholder Value

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

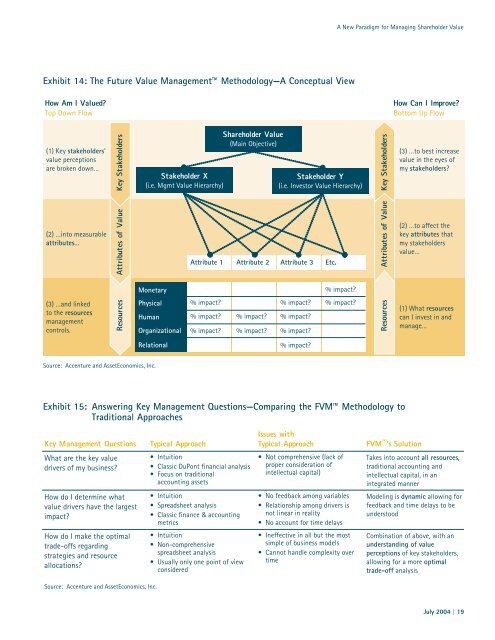

Exhibit 14: The Future <strong>Value</strong> Management™ Methodology—A Conceptual View<br />

How Am I <strong>Value</strong>d?<br />

Top Down Flow<br />

(1) Key stakeholders’<br />

value perceptions<br />

are broken down…<br />

(2) …into measurable<br />

attributes...<br />

(3) …and linked<br />

to the resources<br />

management<br />

controls.<br />

Resources Attributes of <strong>Value</strong> Key Stakeholders<br />

Source: Accenture and AssetEconomics, Inc.<br />

Stakeholder X<br />

(i.e. Mgmt <strong>Value</strong> Hierarchy)<br />

Monetary<br />

Physical<br />

Human<br />

Organizational<br />

Relational<br />

Attribute 1<br />

% impact?<br />

% impact?<br />

% impact?<br />

<strong>Shareholder</strong> <strong>Value</strong><br />

(Main Objective)<br />

Attribute 2<br />

% impact?<br />

% impact?<br />

Stakeholder Y<br />

(i.e. Investor <strong>Value</strong> Hierarchy)<br />

Attribute 3<br />

% impact?<br />

% impact?<br />

% impact?<br />

% impact?<br />

Etc.<br />

A <strong>New</strong> <strong>Paradigm</strong> <strong>for</strong> <strong>Managing</strong> <strong>Shareholder</strong> <strong>Value</strong><br />

% impact?<br />

% impact?<br />

Exhibit 15: Answering Key Management Questions—Comparing the FVM™ Methodology to<br />

Traditional Approaches<br />

Key Management Questions<br />

What are the key value<br />

drivers of my business?<br />

How do I determine what<br />

value drivers have the largest<br />

impact?<br />

How do I make the optimal<br />

trade-offs regarding<br />

strategies and resource<br />

allocations?<br />

Source: Accenture and AssetEconomics, Inc.<br />

Typical Approach<br />

Intuition<br />

Classic DuPont financial analysis<br />

Focus on traditional<br />

accounting assets<br />

Intuition<br />

Spreadsheet analysis<br />

Classic finance & accounting<br />

metrics<br />

Intuition<br />

Non-comprehensive<br />

spreadsheet analysis<br />

Usually only one point of view<br />

considered<br />

Issues with<br />

Typical Approach<br />

Not comprehensive (lack of<br />

proper consideration of<br />

intellectual capital)<br />

No feedback among variables<br />

Relationship among drivers is<br />

not linear in reality<br />

No account <strong>for</strong> time delays<br />

Ineffective in all but the most<br />

simple of business models<br />

Cannot handle complexity over<br />

time<br />

Key Stakeholders<br />

Attributes of <strong>Value</strong><br />

Resources<br />

How Can I Improve?<br />

Bottom Up Flow<br />

TM<br />

FVM ‘s Solution<br />

(3) …to best increase<br />

value in the eyes of<br />

my stakeholders?<br />

(2) …to affect the<br />

key attributes that<br />

my stakeholders<br />

value…<br />

(1) What resources<br />

can I invest in and<br />

manage…<br />

Takes into account all resources,<br />

traditional accounting and<br />

intellectual capital, in an<br />

integrated manner<br />

Modeling is dynamic allowing <strong>for</strong><br />

feedback and time delays to be<br />

understood<br />

Combination of above, with an<br />

understanding of value<br />

perceptions of key stakeholders,<br />

allowing <strong>for</strong> a more optimal<br />

trade-off analysis<br />

July 2004 | 19