Income Tax Fundamentals 2012, 30th ed. - CengageBrain

Income Tax Fundamentals 2012, 30th ed. - CengageBrain

Income Tax Fundamentals 2012, 30th ed. - CengageBrain

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Licens<strong>ed</strong> to:<br />

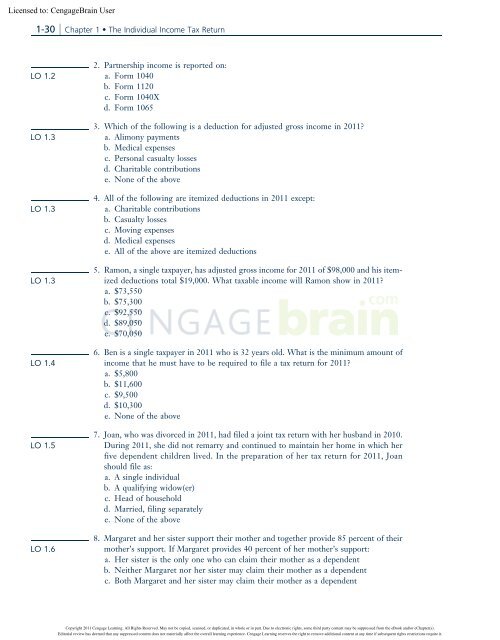

1-30 Chapter 1 The Individual <strong>Income</strong> <strong>Tax</strong> Return<br />

LO 1.2<br />

LO 1.3<br />

LO 1.3<br />

LO 1.3<br />

LO 1.4<br />

LO 1.5<br />

LO 1.6<br />

2. Partnership income is report<strong>ed</strong> on:<br />

a. Form 1040<br />

b. Form 1120<br />

c. Form 1040X<br />

d. Form 1065<br />

3. Which of the following is a d<strong>ed</strong>uction for adjust<strong>ed</strong> gross income in 2011?<br />

a. Alimony payments<br />

b. M<strong>ed</strong>ical expenses<br />

c. Personal casualty losses<br />

d. Charitable contributions<br />

e. None of the above<br />

4. All of the following are itemiz<strong>ed</strong> d<strong>ed</strong>uctions in 2011 except:<br />

a. Charitable contributions<br />

b. Casualty losses<br />

c. Moving expenses<br />

d. M<strong>ed</strong>ical expenses<br />

e. All of the above are itemiz<strong>ed</strong> d<strong>ed</strong>uctions<br />

5. Ramon, a single taxpayer, has adjust<strong>ed</strong> gross income for 2011 of $98,000 and his itemiz<strong>ed</strong><br />

d<strong>ed</strong>uctions total $19,000. What taxable income will Ramon show in 2011?<br />

a. $73,550<br />

b. $75,300<br />

c. $92,550<br />

d. $89,050<br />

e. $70,050<br />

6. Ben is a single taxpayer in 2011 who is 32 years old. What is the minimum amount of<br />

income that he must have to be requir<strong>ed</strong> to file a tax return for 2011?<br />

a. $5,800<br />

b. $11,600<br />

c. $9,500<br />

d. $10,300<br />

e. None of the above<br />

7. Joan, who was divorc<strong>ed</strong> in 2011, had fil<strong>ed</strong> a joint tax return with her husband in 2010.<br />

During 2011, she did not remarry and continu<strong>ed</strong> to maintain her home in which her<br />

five dependent children liv<strong>ed</strong>. In the preparation of her tax return for 2011, Joan<br />

should file as:<br />

a. A single individual<br />

b. A qualifying widow(er)<br />

c. Head of household<br />

d. Marri<strong>ed</strong>, filing separately<br />

e. None of the above<br />

8. Margaret and her sister support their mother and together provide 85 percent of their<br />

mother’s support. If Margaret provides 40 percent of her mother’s support:<br />

a. Her sister is the only one who can claim their mother as a dependent<br />

b. Neither Margaret nor her sister may claim their mother as a dependent<br />

c. Both Margaret and her sister may claim their mother as a dependent<br />

Copyright 2011 Cengage Learning. All Rights Reserv<strong>ed</strong>. May not be copi<strong>ed</strong>, scann<strong>ed</strong>, or duplicat<strong>ed</strong>, in whole or in part. Due to electronic rights, some third party content may be suppress<strong>ed</strong> from the eBook and/or eChapter(s).<br />

Editorial review has deem<strong>ed</strong> that any suppress<strong>ed</strong> content does not materially affect the overall learning experience. Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require it.