Income Tax Fundamentals 2012, 30th ed. - CengageBrain

Income Tax Fundamentals 2012, 30th ed. - CengageBrain

Income Tax Fundamentals 2012, 30th ed. - CengageBrain

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Licens<strong>ed</strong> to:<br />

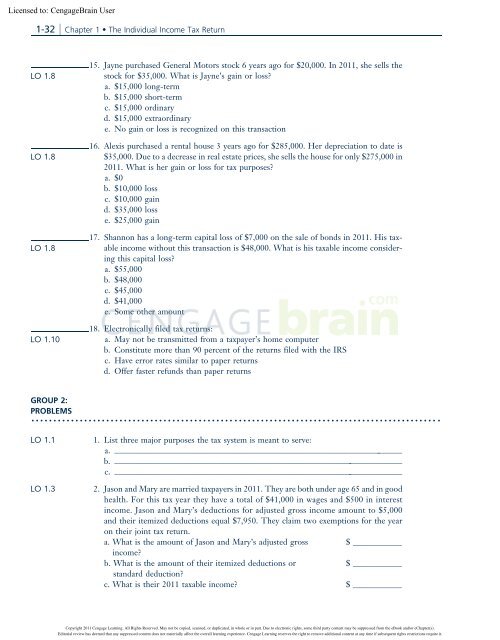

1-32 Chapter 1 The Individual <strong>Income</strong> <strong>Tax</strong> Return<br />

LO 1.8<br />

LO 1.8<br />

LO 1.8<br />

LO 1.10<br />

15. Jayne purchas<strong>ed</strong> General Motors stock 6 years ago for $20,000. In 2011, she sells the<br />

stock for $35,000. What is Jayne’s gain or loss?<br />

a. $15,000 long-term<br />

b. $15,000 short-term<br />

c. $15,000 ordinary<br />

d. $15,000 extraordinary<br />

e. No gain or loss is recogniz<strong>ed</strong> on this transaction<br />

16. Alexis purchas<strong>ed</strong> a rental house 3 years ago for $285,000. Her depreciation to date is<br />

$35,000. Due to a decrease in real estate prices, she sells the house for only $275,000 in<br />

2011. What is her gain or loss for tax purposes?<br />

a. $0<br />

b. $10,000 loss<br />

c. $10,000 gain<br />

d. $35,000 loss<br />

e. $25,000 gain<br />

17. Shannon has a long-term capital loss of $7,000 on the sale of bonds in 2011. His taxable<br />

income without this transaction is $48,000. What is his taxable income considering<br />

this capital loss?<br />

a. $55,000<br />

b. $48,000<br />

c. $45,000<br />

d. $41,000<br />

e. Some other amount<br />

18. Electronically fil<strong>ed</strong> tax returns:<br />

a. May not be transmitt<strong>ed</strong> from a taxpayer’s home computer<br />

b. Constitute more than 90 percent of the returns fil<strong>ed</strong> with the IRS<br />

c. Have error rates similar to paper returns<br />

d. Offer faster refunds than paper returns<br />

GROUP 2:<br />

PROBLEMS<br />

.............................................................................................<br />

LO 1.1 1. List three major purposes the tax system is meant to serve:<br />

a. _______________________________________________________________________<br />

b. _______________________________________________________________________<br />

c. _______________________________________________________________________<br />

LO 1.3 2. Jason and Mary are marri<strong>ed</strong> taxpayers in 2011. They are both under age 65 and in good<br />

health. For this tax year they have a total of $41,000 in wages and $500 in interest<br />

income. Jason and Mary’s d<strong>ed</strong>uctions for adjust<strong>ed</strong> gross income amount to $5,000<br />

and their itemiz<strong>ed</strong> d<strong>ed</strong>uctions equal $7,950. They claim two exemptions for the year<br />

on their joint tax return.<br />

a. What is the amount of Jason and Mary’s adjust<strong>ed</strong> gross $ ____________<br />

income?<br />

b. What is the amount of their itemiz<strong>ed</strong> d<strong>ed</strong>uctions or<br />

$ ____________<br />

standard d<strong>ed</strong>uction?<br />

c. What is their 2011 taxable income? $ ____________<br />

Copyright 2011 Cengage Learning. All Rights Reserv<strong>ed</strong>. May not be copi<strong>ed</strong>, scann<strong>ed</strong>, or duplicat<strong>ed</strong>, in whole or in part. Due to electronic rights, some third party content may be suppress<strong>ed</strong> from the eBook and/or eChapter(s).<br />

Editorial review has deem<strong>ed</strong> that any suppress<strong>ed</strong> content does not materially affect the overall learning experience. Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require it.