Chatroom - Hong Kong Exchanges and Clearing Limited

Chatroom - Hong Kong Exchanges and Clearing Limited

Chatroom - Hong Kong Exchanges and Clearing Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

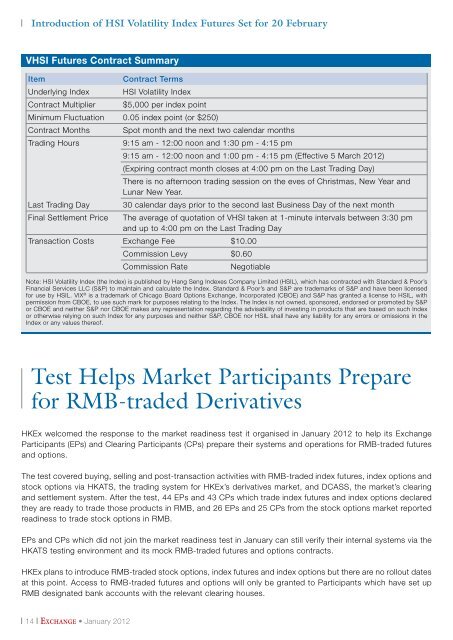

Introduction of HSI Volatility Index Futures Set for 20 February<br />

VHSI Futures Contract Summary<br />

Item Contract Terms<br />

Underlying Index HSI Volatility Index<br />

Contract Multiplier $5,000 per index point<br />

Minimum Fluctuation 0.05 index point (or $250)<br />

Contract Months Spot month <strong>and</strong> the next two calendar months<br />

Trading Hours 9:15 am - 12:00 noon <strong>and</strong> 1:30 pm - 4:15 pm<br />

14 Exchange • January 2012<br />

9:15 am - 12:00 noon <strong>and</strong> 1:00 pm - 4:15 pm (Effective 5 March 2012)<br />

(Expiring contract month closes at 4:00 pm on the Last Trading Day)<br />

There is no afternoon trading session on the eves of Christmas, New Year <strong>and</strong><br />

Lunar New Year.<br />

Last Trading Day 30 calendar days prior to the second last Business Day of the next month<br />

Final Settlement Price The average of quotation of VHSI taken at 1-minute intervals between 3:30 pm<br />

<strong>and</strong> up to 4:00 pm on the Last Trading Day<br />

Transaction Costs Exchange Fee $10.00<br />

Commission Levy $0.60<br />

Commission Rate Negotiable<br />

Note: HSI Volatility Index (the Index) is published by Hang Seng Indexes Company <strong>Limited</strong> (HSIL), which has contracted with St<strong>and</strong>ard & Poor’s<br />

Financial Services LLC (S&P) to maintain <strong>and</strong> calculate the Index. St<strong>and</strong>ard & Poor’s <strong>and</strong> S&P are trademarks of S&P <strong>and</strong> have been licensed<br />

for use by HSIL. VIX ® is a trademark of Chicago Board Options Exchange, Incorporated (CBOE) <strong>and</strong> S&P has granted a license to HSIL, with<br />

permission from CBOE, to use such mark for purposes relating to the Index. The Index is not owned, sponsored, endorsed or promoted by S&P<br />

or CBOE <strong>and</strong> neither S&P nor CBOE makes any representation regarding the advisability of investing in products that are based on such Index<br />

or otherwise relying on such Index for any purposes <strong>and</strong> neither S&P, CBOE nor HSIL shall have any liability for any errors or omissions in the<br />

Index or any values thereof.<br />

Test Helps Market Participants Prepare<br />

for RMB-traded Derivatives<br />

HKEx welcomed the response to the market readiness test it organised in January 2012 to help its Exchange<br />

Participants (EPs) <strong>and</strong> <strong>Clearing</strong> Participants (CPs) prepare their systems <strong>and</strong> operations for RMB-traded futures<br />

<strong>and</strong> options.<br />

The test covered buying, selling <strong>and</strong> post-transaction activities with RMB-traded index futures, index options <strong>and</strong><br />

stock options via HKATS, the trading system for HKEx’s derivatives market, <strong>and</strong> DCASS, the market’s clearing<br />

<strong>and</strong> settlement system. After the test, 44 EPs <strong>and</strong> 43 CPs which trade index futures <strong>and</strong> index options declared<br />

they are ready to trade those products in RMB, <strong>and</strong> 26 EPs <strong>and</strong> 25 CPs from the stock options market reported<br />

readiness to trade stock options in RMB.<br />

EPs <strong>and</strong> CPs which did not join the market readiness test in January can still verify their internal systems via the<br />

HKATS testing environment <strong>and</strong> its mock RMB-traded futures <strong>and</strong> options contracts.<br />

HKEx plans to introduce RMB-traded stock options, index futures <strong>and</strong> index options but there are no rollout dates<br />

at this point. Access to RMB-traded futures <strong>and</strong> options will only be granted to Participants which have set up<br />

RMB designated bank accounts with the relevant clearing houses.