Where the world comes to bank - Emirates NBD

Where the world comes to bank - Emirates NBD

Where the world comes to bank - Emirates NBD

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

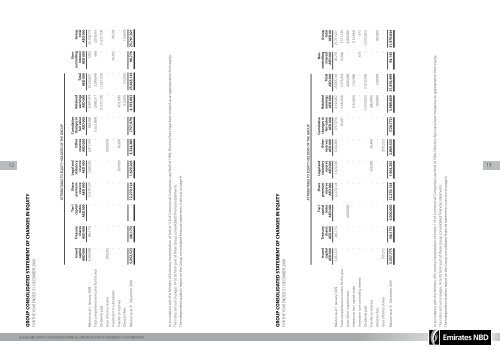

ATTRIBUTABLE TO EQUITY HOLDERS OF THE GROUP<br />

12 13<br />

GROUP CONSOLIDATED STATEMENT OF CHANGES IN EQUITY<br />

FOR THE YEAR ENDED 31 DECEMBER 2009<br />

Tier I Share Legal and Cumulative Non-<br />

Issued Treasury capital premium statu<strong>to</strong>ry O<strong>the</strong>r changes in Retained controlling Group<br />

capital shares notes reserve reserve reserves fair value earnings Total interest <strong>to</strong>tal<br />

AED 000 AED 000 AED 000 AED 000 AED 000 AED 000 AED 000 AED 000 AED 000 AED 000 AED 000<br />

Balance as at 1 January 2008 4,393,498 (46,175) - 12,270,124 1,260,205 3,917,410 863,890 2,497,919 25,156,871 1,903 25,158,774<br />

Total comprehensive income for <strong>the</strong> year - - - - - - (1,621,869) 3,680,517 2,058,648 668 2,059,316<br />

Dividends paid - - - - - - - (1,537,724) (1,537,724) - (1,537,724)<br />

Issue of bonus shares 659,025 - - - - (659,025) - - - - -<br />

Investment in subsidiaries - - - - - - - - - 94,205 94,205<br />

Transfer <strong>to</strong> reserves - - - - 369,000 66,000 - (435,000) - - -<br />

Direc<strong>to</strong>rs’ fees - - - - - - - (12,650) (12,650) - (12,650)<br />

irates <strong>NBD</strong> <strong>Emirates</strong> | Annual <strong>NBD</strong> | Review GROUP CONSOLIDATED 2009 FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2009<br />

Balance as at 31 December 2008 5,052,523 (46,175) - 12,270,124 1,629,205 3,324,385 (757,979) 4,193,062 25,665,145 96,776 25,761,921<br />

In accordance with <strong>the</strong> Ministry of Economy interpretation of Article 118 of Commercial Companies Law No.8 of 1984, Direc<strong>to</strong>rs’ fees have been treated as an appropriation from equity.<br />

The notes set out on pages 14 <strong>to</strong> 92 form part of <strong>the</strong>se Group consolidated financial statements.<br />

The independent audi<strong>to</strong>rs’ report on <strong>the</strong> Group consolidated financial statements is set out on page 6.<br />

GROUP CONSOLIDATED STATEMENT OF CHANGES IN EQUITY<br />

FOR THE YEAR ENDED 31 DECEMBER 2009<br />

A TTRIBUTABLE TO EQUITY HOLDERS OF THE GROUP<br />

Tier I Share Legal and Cumulative Non-<br />

Issued Treasury capital premium statu<strong>to</strong>ry O<strong>the</strong>r changes in Retained controlling Group<br />

capital shares notes reserve reserve reserves fair value earnings Total interest <strong>to</strong>tal<br />

AED 000 AED 000 AED 000 AED 000 AED 000 AED 000 AED 000 AED 000 AED 000 AED 000 AED 00<br />

Balance as at 1 January 2009 5,052,523 (46,175) - 12,270,124 1,629,205 3,324,385 (757,979) 4,193,062 25,665,145 96,776 25,761,921<br />

Total comprehensive income for <strong>the</strong> year - - - - - - 29,207 3,345,836 3,375,043 (3,304) 3,371,739<br />

Issue of tier I capital notes - - 4,000,000 - - - - - 4,000,000 - 4,000,000<br />

Interest on tier I capital notes - - - - - - - (132,584) (132,584) - (132,584)<br />

Increase in non-controlling interest - - - - - - - - - 673 673<br />

Dividends paid - - - - - - - (1,010,505) (1,010,505) - (1,010,505)<br />

Transfer <strong>to</strong> reserves - - - - 335,000 50,400 - (385,400) - - -<br />

Direc<strong>to</strong>rs’ fees - - - - - - - (20,600) (20,600) - (20,600)<br />

Issue of bonus shares 505,252 - - - - (505,252) - - - - -<br />

Balance as at 31 December 2009 5,557,775 (46,175) 4,000,000 12,270,124 1,964,205 2,869,533 (728,772) 5,989,809 31,876,499 94,145 31,970,644<br />

In accordance with <strong>the</strong> Ministry of Economy interpretation of Article 118 of Commercial Companies Law No.8 of 1984, Direc<strong>to</strong>rs’ fees have been treated as an appropriation from equity.<br />

The notes set out on pages 14 <strong>to</strong> 92 form part of <strong>the</strong>se Group consolidated financial statements.<br />

The independent audi<strong>to</strong>rs’ report on <strong>the</strong> Group consolidated financial statements is set out on page 6.