Where the world comes to bank - Emirates NBD

Where the world comes to bank - Emirates NBD

Where the world comes to bank - Emirates NBD

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE GROUP CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 DECEMBER 2009<br />

47 RISK MANAGEMENT (continued)<br />

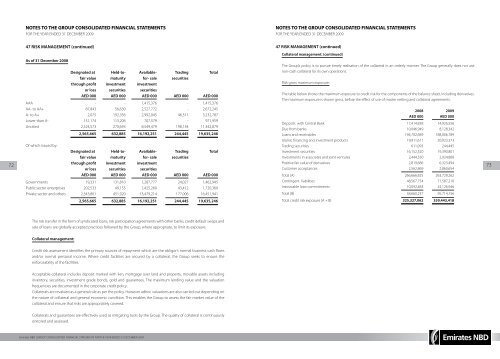

As of 31 December 2008<br />

Designated at Held-<strong>to</strong>- Available- Trading Total<br />

fair value maturity for- sale securities<br />

through profit investment investment<br />

or loss securities securities<br />

AED 000 AED 000 AED 000 AED 000 AED 000<br />

AAA - - 1,415,376 - 1,415,376<br />

AA- <strong>to</strong> AA+ 87,843 56,630 2,527,772 - 2,672,245<br />

A- <strong>to</strong> A+ 2,075 192,356 2,992,045 46,311 3,232,787<br />

Lower than A- 151,174 113,206 707,579 - 971,959<br />

Unrated 2,324,573 270,693 8,549,479 198,134 11,342,879<br />

2,565,665 632,885 16,192,251 244,445 19,635,246<br />

Of which issued by:<br />

Designated at Held-<strong>to</strong>- Available- Trading Total<br />

fair value maturity for- sale securities<br />

through profit investment investment<br />

or loss securities securities<br />

AED 000 AED 000 AED 000 AED 000 AED 000<br />

Governments 19,331 131,810 1,287,777 24,027 1,462,945<br />

Public sec<strong>to</strong>r enterprises 202,533 49,155 1,425,260 43,412 1,720,360<br />

Private sec<strong>to</strong>r and o<strong>the</strong>rs 2,343,801 451,920 13,479,214 177,006 16,451,941<br />

2,565,665 632,885 16,192,251 244,445 19,635,246<br />

72 73<br />

The risk transfer in <strong>the</strong> form of syndicated loans, risk participation agreements with o<strong>the</strong>r <strong>bank</strong>s, credit default swaps and<br />

sale of loans are globally accepted practices followed by <strong>the</strong> Group, where appropriate, <strong>to</strong> limit its exposure.<br />

Collateral management:<br />

Credit risk assessment identifies <strong>the</strong> primary sources of repayment which are <strong>the</strong> obligor’s normal business cash flows<br />

and/or normal personal income. <strong>Where</strong> credit facilities are secured by a collateral, <strong>the</strong> Group seeks <strong>to</strong> ensure <strong>the</strong><br />

enforceability of <strong>the</strong> facilities.<br />

Acceptable collateral includes deposit marked with lien, mortgage over land and property, movable assets including<br />

inven<strong>to</strong>ry, securities, investment grade bonds, gold and guarantees. The maximum lending value and <strong>the</strong> valuation<br />

frequencies are documented in <strong>the</strong> corporate credit policy.<br />

Collaterals are revalued as a general rule as per <strong>the</strong> policy. However adhoc valuations are also carried out depending on<br />

<strong>the</strong> nature of collateral and general economic condition. This enables <strong>the</strong> Group <strong>to</strong> assess <strong>the</strong> fair market value of <strong>the</strong><br />

collateral and ensure that risks are appropriately covered.<br />

Collaterals and guarantees are effectively used as mitigating <strong>to</strong>ols by <strong>the</strong> Group. The quality of collateral is continuously<br />

oni<strong>to</strong>red and assessed.<br />

irates <strong>NBD</strong> <strong>Emirates</strong> | Annual <strong>NBD</strong> | Review GROUP CONSOLIDATED 2009 FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2009<br />

NOTES TO THE GROUP CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 DECEMBER 2009<br />

47 RISK MANAGEMENT (continued)<br />

Collateral management: (continued)<br />

The Group’s policy is <strong>to</strong> pursue timely realisation of <strong>the</strong> collateral in an orderly manner. The Group generally does not use<br />

non-cash collateral for its own operations.<br />

Risk gross maximum exposure:<br />

The table below shows <strong>the</strong> maximum exposure <strong>to</strong> credit risk for <strong>the</strong> components of <strong>the</strong> balance sheet, including derivatives.<br />

The maximum exposure is shown gross, before <strong>the</strong> effect of use of master netting and collateral agreements.<br />

2008 2009<br />

AED 000 AED 000<br />

Deposits with Central Bank 17,414,858 14,926,556<br />

Due from <strong>bank</strong>s 10,046,949 8,128,342<br />

Loans and receivables 194,702,689 188,006,789<br />

Islamic financing and investment products 19,911,611 20,923,373<br />

Trading securities 611,093 244,445<br />

Investment securities 16,152,520 19,390,801<br />

Investments in associates and joint ventures 2,444,550 2,924,808<br />

Positive fair value of derivatives 2,819,686 6,323,494<br />

Cus<strong>to</strong>mer acceptances 2,562,869 2,860,654<br />

Total (A) 266,666,825 263,729,262<br />

Contingent liabilities 48,567,754 71,587,210<br />

Irrevocable loan commitments 10,092,483 24,126,946<br />

Total (B) 58,660,237 95,714,156<br />

Total credit risk exposure (A + B) 325,327,062 359,443,418