Where the world comes to bank - Emirates NBD

Where the world comes to bank - Emirates NBD

Where the world comes to bank - Emirates NBD

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

84 85<br />

NOTES TO THE GROUP CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 DECEMBER 2009<br />

47 RISK MANAGEMENT (continued)<br />

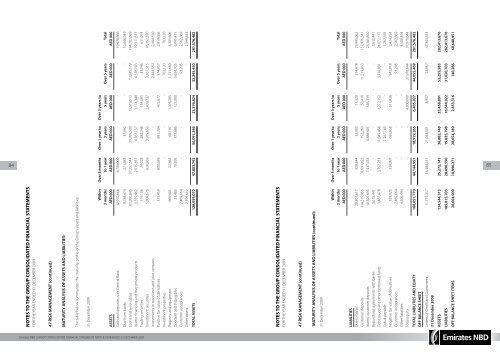

MATURITY ANALYSIS OF ASSETS AND LIABILITIES:<br />

irates <strong>NBD</strong> <strong>Emirates</strong> | Annual <strong>NBD</strong> | Review GROUP CONSOLIDATED 2009 FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2009<br />

The table below summarizes <strong>the</strong> maturity profile of <strong>the</strong> Group’s assets and liabilities:<br />

31 December 2009<br />

Within Over 3 months Over 1 year <strong>to</strong> Over 3 years <strong>to</strong><br />

3 months <strong>to</strong> 1 year 3 years 5 years Over 5 years Total<br />

ASSETS AED 000 AED 000 AED 000 AED 000 AED 000 AED 000<br />

Cash and deposits with Central Bank 12,970,666 6,700,000 - - - 19,670,666<br />

Due from <strong>bank</strong>s 9,738,474 271,383 37,092 - - 10,046,949<br />

Loans and receivables 87,980,845 37,257,644 39,999,509 15,619,512 13,845,179 194,702,689<br />

Islamic financing and investment products 5,359,462 2,035,851 4,763,157 3,174,348 4,578,793 19,911,611<br />

Trading securities 119,106 24,028 282,348 154,065 31,546 611,093<br />

Investment securities 5,808,676 820,939 3,915,653 2,439,737 3,167,515 16,152,520<br />

Investments in associates and joint ventures - - - - 2,444,550 2,444,550<br />

Positive fair value of derivatives 319,459 600,689 851,704 472,877 574,957 2,819,686<br />

Investment properties - - - - 703,120 703,120<br />

Property and equipment 669,601 22,863 68,197 1,393,285 1,151,660 3,305,606<br />

Goodwill and Intangibles 23,465 70,395 173,686 123,000 5,654,925 6,045,471<br />

Cus<strong>to</strong>mer acceptances 2,469,664 - - - 93,205 2,562,869<br />

O<strong>the</strong>r assets 2,599,652 - - - - 2,599,652<br />

TOTAL ASSETS 128,059,070 47,803,792 50,091,346 23,376,824 32,245,450 281,576,482<br />

NOTES TO THE GROUP CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 DECEMBER 2009<br />

47 RISK MANAGEMENT (continued)<br />

MATURITY ANALYSIS OF ASSETS AND LIABILITIES (continued):<br />

31 December 2009<br />

Within Over 3 months Over 1 year <strong>to</strong> Over 3 years <strong>to</strong><br />

3 months <strong>to</strong> 1 year 3 years 5 years Over 5 years Total<br />

AED 000 AED 000 AED 000 AED 000 AED 000 AED 000<br />

LIABILITIES<br />

Due <strong>to</strong> <strong>bank</strong>s 28,807,617 928,844 32,303 11,320 214,978 29,995,062<br />

Cus<strong>to</strong>mer deposits 114,519,456 31,691,422 192,260 53,410 11,519,993 157,976,541<br />

Islamic cus<strong>to</strong>mer deposits 10,305,695 7,437,435 4,886,401 556,319 - 23,185,850<br />

Repurchase agreements with <strong>bank</strong>s 3,615,441 - - - - 3,615,441<br />

Debt issued and o<strong>the</strong>r borrowed funds 3,487,478 3,752,253 11,849,458 1,272,152 3,710,831 24,072,172<br />

Sukuk payable - - 1,267,185 - - 1,267,185<br />

Negative fair value of derivatives 339,925 334,997 691,658 511,826 545,818 2,424,224<br />

Cus<strong>to</strong>mer acceptances 2,469,664 - - - 93,205 2,562,869<br />

O<strong>the</strong>r liabilities 4,506,494 - - - - 4,506,494<br />

Total equity - - - 4,000,000 27,970,644 31,970,644<br />

TOTAL LIABILITIES AND EQUITY 168,051,770 44,144,951 18,919,265 6,405,027 44,055,469 281,576,482<br />

OFF BALANCE SHEET<br />

Letters of Credit and Guarantees 11,779,357 14,484,451 21,048,501 8,957 22,067 47,343,333<br />

31 December 2008<br />

ASSETS 134,544,313 25,272,141 36,882,748 32,458,891 53,255,583 282,413,676<br />

LIABILITIES 185,815,703 28,496,550 19,835,798 16,644,922 31,620,703 282,413,676<br />

OFF BALANCE SHEET ITEMS 26,004,909 10,996,271 28,654,189 2,853,316 140,266 68,648,951