ACCOR ex. Doc de r.f GB

ACCOR ex. Doc de r.f GB

ACCOR ex. Doc de r.f GB

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

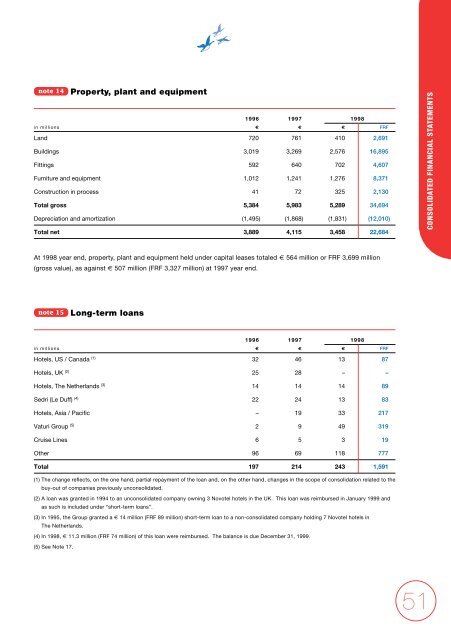

note 14<br />

Property, plant and equipment<br />

1996 1997 1998<br />

in millions € € € FRF<br />

Land 720 761 410 2,691<br />

Buildings 3,019 3,269 2,576 16,895<br />

Fittings 592 640 702 4,607<br />

Furniture and equipment 1,012 1,241 1,276 8,371<br />

Construction in process 41 72 325 2,130<br />

Total gross 5,384 5,983 5,289 34,694<br />

Depreciation and amortization (1,495) (1,868) (1,831) (12,010)<br />

Total net 3,889 4,115 3,458 22,684<br />

At 1998 year end, property, plant and equipment held un<strong>de</strong>r capital leases totaled € 564 million or FRF 3,699 million<br />

(gross value), as against € 507 million (FRF 3,327 million) at 1997 year end.<br />

note 15<br />

Long-term loans<br />

1996 1997 1998<br />

in millions € € € FRF<br />

Hotels, US / Canada (1) 32 46 13 87<br />

Hotels, UK (2) 25 28 – –<br />

Hotels, The Netherlands (3) 14 14 14 89<br />

Sedri (Le Duff) (4) 22 24 13 83<br />

Hotels, Asia / Pacific – 19 33 217<br />

Vaturi Group (5) 2 9 49 319<br />

Cruise Lines 6 5 3 19<br />

Other 96 69 118 777<br />

Total 197 214 243 1,591<br />

(1) The change reflects, on the one hand, partial repayment of the loan and, on the other hand, changes in the scope of consolidation related to the<br />

buy-out of companies previously unconsolidated.<br />

(2) A loan was granted in 1994 to an unconsolidated company owning 3 Novotel hotels in the UK. This loan was reimbursed in January 1999 and<br />

as such is inclu<strong>de</strong>d un<strong>de</strong>r “short-term loans”.<br />

(3) In 1995, the Group granted a € 14 million (FRF 89 million) short-term loan to a non-consolidated company holding 7 Novotel hotels in<br />

The Netherlands.<br />

(4) In 1998, € 11.3 million (FRF 74 million) of this loan were reimbursed. The balance is due December 31, 1999.<br />

(5) See Note 17.<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

51