Synergies between the two companies

Synergies between the two companies

Synergies between the two companies

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

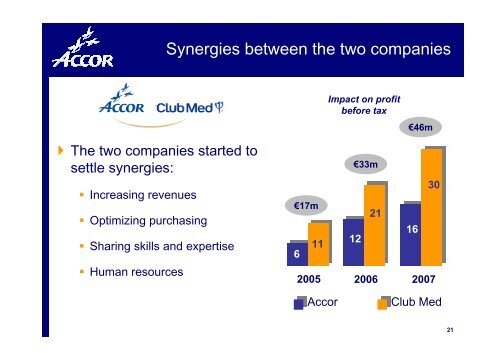

� The <strong>two</strong> <strong>companies</strong> started to<br />

settle synergies:<br />

� Increasing revenues<br />

� Optimizing purchasing<br />

� Sharing skills and expertise<br />

� Human resources<br />

<strong>Synergies</strong> <strong>between</strong> <strong>the</strong> <strong>two</strong> <strong>companies</strong><br />

€17m<br />

6<br />

11<br />

2005<br />

Impact on profit<br />

before tax<br />

€33m<br />

12<br />

21<br />

2006<br />

€46m<br />

16<br />

30<br />

2007<br />

Accor Club Med<br />

21

Club MedColombus -Bahamas<br />

22

Creation of <strong>the</strong> European leader in casinos<br />

� Jointly held by <strong>the</strong> Desseigne-Barrière family (51%), Accor (34%) and<br />

Colony Capital (15%)<br />

� €1 billion in revenues<br />

� 37 casinos<br />

� 13 luxury hotels<br />

� Restaurants<br />

Casino Barrière d'Enghien-les-Bains<br />

� Unique positioning to capitalize on <strong>the</strong> ongoing consolidation of <strong>the</strong><br />

casino industry in Europe: concession won for <strong>the</strong> new Toulouse casino<br />

� Shareholders’ pact for company management and pooling of skills<br />

� Capital gain of €83 million for Accor<br />

23

Casino Nice<br />

24

Casino Deauville<br />

25

Hôtel Normandy<br />

26

Travel agencies<br />

� Acquisition of Maritz Corporate Travel in <strong>the</strong> United<br />

States<br />

� Acquisition of Protravel in France<br />

Carlon Wagonlit Travel streng<strong>the</strong>ns<br />

its its # 2 position worldwide<br />

27

� 2004 Results<br />

� 2005 Q1 sales<br />

� Strategic Vision<br />

Outline<br />

28

�Revenues of €1,676m:<br />

up 5.6% as published<br />

�At constant scope of consolidation<br />

and exchange rates: up 3.8%<br />

� Hotels: up 2.1%<br />

� Services: up 11.8%<br />

� O<strong>the</strong>r businesses: up 6.6%<br />

First-quarter 2005 revenues up 5.6%,<br />

confirming a good overall trend<br />

4.3%<br />

Q1 04<br />

Like-for-like change<br />

6.1%<br />

Q2 04<br />

2.9%<br />

Q3 04<br />

Excl. impact of Easter<br />

vacation calendar and 29<br />

days in February<br />

5.1%<br />

Q4 04<br />

5.4%<br />

3.8%<br />

Q1 05<br />

29

� 2004 Results<br />

� 2005 Q1 sales<br />

� Strategic Vision<br />

� An international strategic investor for<br />

Accor<br />

� A new asset management policy<br />

� Accelerated expansion<br />

Outline<br />

30

invests<br />

via Colony VI et Colyzéo<br />

€ 1 billion<br />

in<br />

31

� International investment fund<br />

specialized in real estate and hotels<br />

Colony Capital<br />

� Since 1991, Colony Capital has invested $12.5 billion<br />

with an average return on investment of 21%<br />

32

Los<br />

Angeles<br />

Hawaii<br />

Head office<br />

Offices<br />

Boston<br />

New York<br />

International presence of Colony<br />

London<br />

Paris<br />

Madrid<br />

Rome<br />

Beirut<br />

Seoul<br />

Shanghai<br />

Hong Kong<br />

Tokyo<br />

Taipei<br />

Current investments : 1/3 Europe, 1/3 North America , 1/3 Asia<br />

33

� Accor Casinos<br />

� Group Lucien Barrière<br />

� Sofitel Demeure et Libertel<br />

� Novotel Paris Tour Eiffel<br />

Accor's traditional partner since 1998<br />

Novotel Paris Tour Eiffel<br />

34

Benefits for Accor<br />

A sizeable investment from an international strategic investor<br />

for Accor :<br />

� Give additional equity resources<br />

� Speed up expansion<br />

� Provide international expertise in hotel expansion<br />

A catalyst for for <strong>the</strong> <strong>the</strong> Accor share price<br />

35

ORAs<br />

(mandatory notes)<br />

� Amount: €500 million<br />

� Maturity: 3 years<br />

� Interest: 4.5%<br />

� Issue price €39<br />

(10% premium on <strong>the</strong> average<br />

share price of <strong>the</strong> past month)<br />

Terms of <strong>the</strong> transaction (1/2)<br />

Convertible notes<br />

� Amount: €500 million<br />

� Maturity: 5 years (put at 3 years)<br />

� Interest: 3.25%<br />

� Conversion price €43<br />

(21% premium on <strong>the</strong> average<br />

share price of <strong>the</strong> past month)<br />

36

� Specific clauses for <strong>the</strong> subscriber<br />

� No conversion before January 1, 2007<br />

� Six-month standstill following conversion<br />

� No short over <strong>the</strong> period<br />

� Corporate governance :<br />

Terms of <strong>the</strong> transaction(2/2)<br />

� Colony joins <strong>the</strong> Supervisory Board and <strong>the</strong> commitments<br />

committee<br />

37

� 2004 Results<br />

� 2005 Q1 sales<br />

� Strategic Vision<br />

� An international strategic investor for<br />

Accor<br />

� A new asset management policy<br />

� Accelerated expansion<br />

Outline<br />

38

Innovative asset management<br />

to support <strong>the</strong> Hotel strategy<br />

An innovative<br />

asset externalization program<br />

designed to:<br />

� Reduce capital intensity in upscale hotels<br />

� Variabilize holding costs in <strong>the</strong> midscale segment<br />

Focus on on operating hotels<br />

and<br />

Reinforce expansion strategy<br />

39

Using <strong>the</strong> right operating structure<br />

for each segment<br />

Hotel segment Preferred operating structure<br />

� Management contracts<br />

with minority stake<br />

� Variable rents, based on<br />

a % of revenues<br />

� Franchises<br />

� Fixed/variable rents<br />

� Franchises<br />

40