Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

modern SPECIAL REPORT<br />

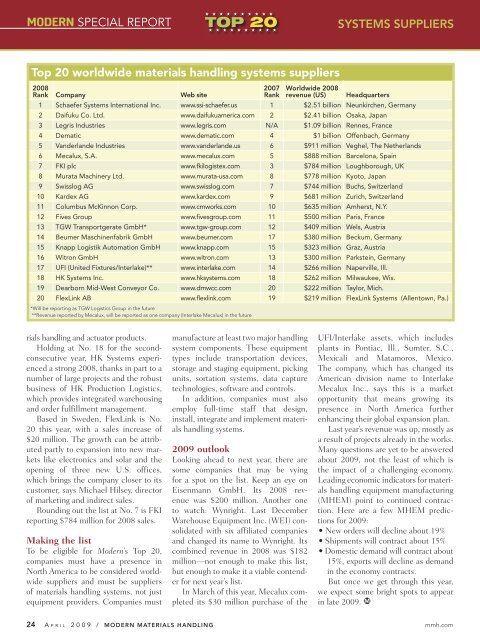

Top <strong>20</strong> worldwide materials handling systems suppliers<br />

<strong>20</strong>08<br />

Rank Company Web site<br />

rials handling and actuator products.<br />

Holding at No. 18 for the secondconsecutive<br />

year, HK Systems experienced<br />

a strong <strong>20</strong>08, thanks in part to a<br />

number of large projects and the robust<br />

business of HK Production Logistics,<br />

which provides integrated warehousing<br />

and order fulfillment management.<br />

Based in Sweden, FlexLink is No.<br />

<strong>20</strong> this year, with a sales increase of<br />

$<strong>20</strong> million. The growth can be attributed<br />

partly to expansion into new markets<br />

like electronics and solar and the<br />

opening of three new U.S. offices,<br />

which brings the company closer to its<br />

customer, says Michael Hilsey, director<br />

of marketing and indirect sales.<br />

Rounding out the list at No. 7 is FKI<br />

reporting $784 million for <strong>20</strong>08 sales.<br />

Making the list<br />

To be eligible for <strong>Modern</strong>’s Top <strong>20</strong>,<br />

companies must have a presence in<br />

North America to be considered worldwide<br />

suppliers and must be suppliers<br />

of materials handling systems, not just<br />

equipment providers. Companies must<br />

manufacture at least two major handling<br />

system components. These equipment<br />

types include transportation devices,<br />

storage and staging equipment, picking<br />

units, sortation systems, data capture<br />

technologies, software and controls.<br />

In addition, companies must also<br />

employ full-time staff that design,<br />

install, integrate and implement materials<br />

handling systems.<br />

<strong>20</strong>09 outlook<br />

Looking ahead to next year, there are<br />

some companies that may be vying<br />

for a spot on the list. Keep an eye on<br />

Eisenmann GmbH. Its <strong>20</strong>08 revenue<br />

was $<strong>20</strong>0 million. Another one<br />

to watch: Wynright. Last December<br />

Warehouse Equipment Inc. (WEI) consolidated<br />

with six affiliated companies<br />

and changed its name to Wynright. Its<br />

combined revenue in <strong>20</strong>08 was $182<br />

million—not enough to make this list,<br />

but enough to make it a viable contender<br />

for next year’s list.<br />

In March of this year, Mecalux completed<br />

its $30 million purchase of the<br />

UFI/Interlake assets, which includes<br />

plants in Pontiac, Ill., Sumter, S.C.,<br />

Mexicali and Matamoros, Mexico.<br />

The company, which has changed its<br />

American division name to Interlake<br />

Mecalux Inc., says this is a market<br />

opportunity that means growing its<br />

presence in North America further<br />

enhancing their global expansion plan.<br />

Last year’s revenue was up, mostly as<br />

a result of projects already in the works.<br />

Many questions are yet to be answered<br />

about <strong>20</strong>09, not the least of which is<br />

the impact of a challenging economy.<br />

Leading economic indicators for materials<br />

handling equipment manufacturing<br />

(MHEM) point to continued contraction.<br />

Here are a few MHEM predictions<br />

for <strong>20</strong>09:<br />

• New orders will decline about 19%<br />

• Shipments will contract about 15%<br />

• Domestic demand will contract about<br />

15%, exports will decline as demand<br />

in the economy contracts.<br />

But once we get through this year,<br />

we expect some bright spots to appear<br />

in late <strong>20</strong>09.<br />

24 A PRIL <strong>20</strong>09 / MODERN MATERIALS HANDLING mmh.com<br />

<strong>20</strong>07<br />

Rank<br />

Worldwide <strong>20</strong>08<br />

revenue (US) Headquarters<br />

1 Schaefer Systems International Inc. www.ssi-schaefer.us 1 $2.51 billion Neunkirchen, Germany<br />

2 Daifuku Co. Ltd. www.daifukuamerica.com 2 $2.41 billion Osaka, Japan<br />

3 Legris Industries www.legris.com N/A $1.09 billion Rennes, France<br />

4 Dematic www.dematic.com 4 $1 billion Offenbach, Germany<br />

5 Vanderlande Industries www.vanderlande.us 6 $911 million Veghel, The Netherlands<br />

6 Mecalux, S.A. www.mecalux.com 5 $888 million Barcelona, Spain<br />

7 FKI plc www.fkilogistex.com 3 $784 million Loughborough, UK<br />

8 Murata Machinery Ltd. www.murata-usa.com 8 $778 million Kyoto, Japan<br />

9 Swisslog AG www.swisslog.com 7 $744 million Buchs, Switzerland<br />

10 Kardex AG www.kardex.com 9 $681 million Zurich, Switzerland<br />

11 Columbus McKinnon Corp. www.cmworks.com 10 $635 million Amherst, N.Y.<br />

12 Fives Group www.fivesgroup.com 11 $500 million Paris, France<br />

13 TGW Transportgerate GmbH* www.tgw-group.com 12 $409 million Wels, Austria<br />

14 Beumer Maschinenfabrik GmbH www.beumer.com 17 $380 million Beckum, Germany<br />

15 Knapp Logistik Automation GmbH www.knapp.com 15 $323 million Graz, Austria<br />

16 Witron GmbH www.witron.com 13 $300 million Parkstein, Germany<br />

17 UFI (United Fixtures/Interlake)** www.interlake.com 14 $266 million Naperville, Ill.<br />

18 HK Systems Inc. www.hksystems.com 18 $262 million Milwaukee, Wis.<br />

19 Dearborn Mid-West Conveyor Co. www.dmwcc.com <strong>20</strong> $222 million Taylor, Mich.<br />

<strong>20</strong> FlexLink AB www.flexlink.com 19 $219 million FlexLink Systems (Allentown, Pa.)<br />

*Will be reporting as TGW Logistics Group in the future<br />

**Revenue reported by Mecalux, will be reported as one company (Interlake Mecalux) in the future<br />

<strong>TOP</strong> <strong>20</strong> SYSTEMS SUPPLIERS