Amtel Holdings Berhad - Company Announcements - Bursa Malaysia

Amtel Holdings Berhad - Company Announcements - Bursa Malaysia

Amtel Holdings Berhad - Company Announcements - Bursa Malaysia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

68<br />

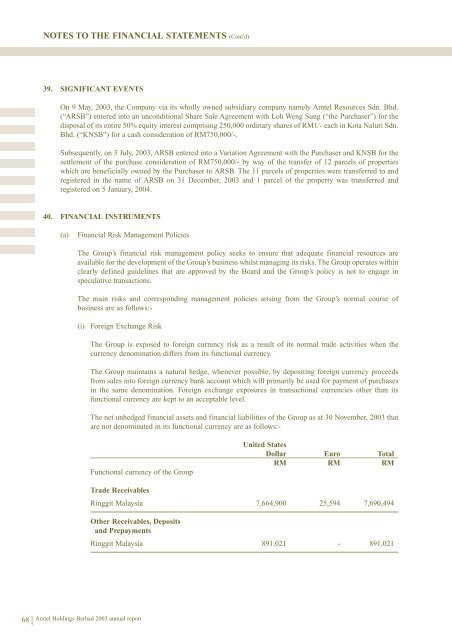

NOTES TO THE FINANCIAL STATEMENTS (Cont’d)<br />

39. SIGNIFICANT EVENTS<br />

On 9 May, 2003, the <strong>Company</strong> via its wholly owned subsidiary company namely <strong>Amtel</strong> Resources Sdn. Bhd.<br />

(“ARSB”) entered into an unconditional Share Sale Agreement with Loh Weng Sung (“the Purchaser”) for the<br />

disposal of its entire 50% equity interest comprising 250,000 ordinary shares of RM1/- each in Kota Naluri Sdn.<br />

Bhd. (“KNSB”) for a cash consideration of RM750,000/-.<br />

Subsequently, on 3 July, 2003, ARSB entered into a Variation Agreement with the Purchaser and KNSB for the<br />

settlement of the purchase consideration of RM750,000/- by way of the transfer of 12 parcels of properties<br />

which are beneficially owned by the Purchaser to ARSB. The 11 parcels of properties were transferred to and<br />

registered in the name of ARSB on 31 December, 2003 and 1 parcel of the property was transferred and<br />

registered on 5 January, 2004.<br />

40. FINANCIAL INSTRUMENTS<br />

(a) Financial Risk Management Policies<br />

The Group’s financial risk management policy seeks to ensure that adequate financial resources are<br />

available for the development of the Group’s business whilst managing its risks. The Group operates within<br />

clearly defined guidelines that are approved by the Board and the Group’s policy is not to engage in<br />

speculative transactions.<br />

The main risks and corresponding management policies arising from the Group’s normal course of<br />

business are as follows:-<br />

(i) Foreign Exchange Risk<br />

The Group is exposed to foreign currency risk as a result of its normal trade activities when the<br />

currency denomination differs from its functional currency.<br />

The Group maintains a natural hedge, whenever possible, by depositing foreign currency proceeds<br />

from sales into foreign currency bank account which will primarily be used for payment of purchases<br />

in the same denomination. Foreign exchange exposures in transactional currencies other than its<br />

functional currency are kept to an acceptable level.<br />

The net unhedged financial assets and financial liabilities of the Group as at 30 November, 2003 that<br />

are not denominated in its functional currency are as follows:-<br />

Functional currency of the Group<br />

<strong>Amtel</strong> <strong>Holdings</strong> <strong>Berhad</strong> 2003 annual report<br />

United States<br />

Dollar Euro Total<br />

RM RM RM<br />

Trade Receivables<br />

Ringgit <strong>Malaysia</strong> 7,664,900 25,594 7,690,494<br />

Other Receivables, Deposits<br />

and Prepayments<br />

Ringgit <strong>Malaysia</strong> 891,021 - 891,021