EXERCISE 7-23 (20 MINUTES) 1. Break-even point (in units ...

EXERCISE 7-23 (20 MINUTES) 1. Break-even point (in units ...

EXERCISE 7-23 (20 MINUTES) 1. Break-even point (in units ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Solution to Chapter 7<br />

E7‐<strong>23</strong>,27,28 P7‐31,34,32,33,35<br />

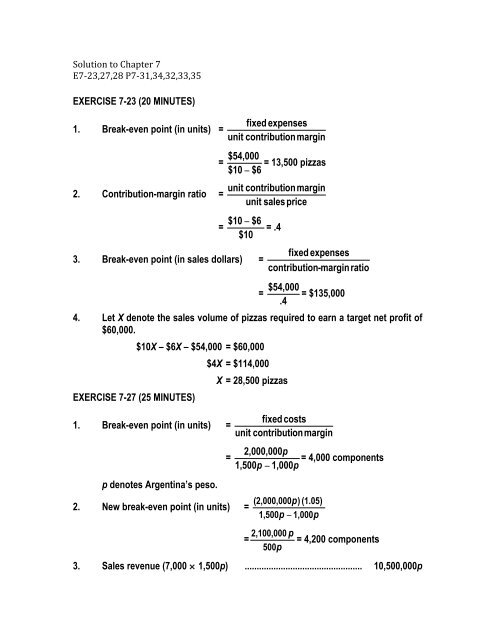

<strong>EXERCISE</strong> 7-<strong>23</strong> (<strong>20</strong> <strong>MINUTES</strong>)<br />

<strong>1.</strong> <strong>Break</strong>-<strong>even</strong> <strong>po<strong>in</strong>t</strong> (<strong>in</strong> <strong>units</strong>) =<br />

2. Contribution-marg<strong>in</strong> ratio =<br />

= = 13,500 pizzas<br />

= = .4<br />

3. <strong>Break</strong>-<strong>even</strong> <strong>po<strong>in</strong>t</strong> (<strong>in</strong> sales dollars) =<br />

= = $135,000<br />

4. Let X denote the sales volume of pizzas required to earn a target net profit of<br />

$60,000.<br />

<strong>EXERCISE</strong> 7-27 (25 <strong>MINUTES</strong>)<br />

$10X – $6X – $54,000 = $60,000<br />

<strong>1.</strong> <strong>Break</strong>-<strong>even</strong> <strong>po<strong>in</strong>t</strong> (<strong>in</strong> <strong>units</strong>) =<br />

p denotes Argent<strong>in</strong>a’s peso.<br />

$4X = $114,000<br />

2. New break-<strong>even</strong> <strong>po<strong>in</strong>t</strong> (<strong>in</strong> <strong>units</strong>) =<br />

X = 28,500 pizzas<br />

= = 4,000 components<br />

= = 4,<strong>20</strong>0 components<br />

3. Sales r<strong>even</strong>ue (7,000 × 1,500p) ................................................. 10,500,000p

Variable costs (7,000 × 1,000p) ....................................................... 7,000,000p<br />

Contribution marg<strong>in</strong> ......................................................................... 3,500,000p<br />

Fixed costs ........................................................................................ 2,000,000p<br />

Net <strong>in</strong>come......................................................................................... 1,500,000p<br />

4. New break-<strong>even</strong> <strong>po<strong>in</strong>t</strong> (<strong>in</strong> <strong>units</strong>) =<br />

5. Analysis of price change decision:<br />

= 5,000 components<br />

Price<br />

1,500p 1,400p<br />

Sales r<strong>even</strong>ue: (7,000 × 1,500p) ................................ 10,500,000p<br />

(8,000 × 1,400p) ................................<br />

11,<strong>20</strong>0,000p<br />

Variable costs: (7,000 × 1,000p) ................................ 7,000,000p<br />

(8,000 × 1,000p) ................................<br />

8,000,000p<br />

Contribution marg<strong>in</strong>..................................................... 3,500,000p 3,<strong>20</strong>0,000p<br />

Fixed expenses ............................................................ 2,000,000p 2,000,000p<br />

Net <strong>in</strong>come (loss) ......................................................... 1,500,000p 1,<strong>20</strong>0,000p<br />

The price cut should not be made, s<strong>in</strong>ce projected net <strong>in</strong>come will decl<strong>in</strong>e by<br />

300,000p.

<strong>EXERCISE</strong> 7-28 (25 <strong>MINUTES</strong>)<br />

<strong>1.</strong> (a) Traditional <strong>in</strong>come statement:<br />

2.<br />

PACIFIC RIM PUBLICATIONS, INC.<br />

INCOME STATEMENT<br />

FOR THE YEAR ENDED DECEMBER 31, <strong>20</strong>XX<br />

Sales ......................................................................... $1,000,000<br />

Less: Cost of goods sold......................................... 750,000<br />

Gross marg<strong>in</strong>................................................................ $ 250,000<br />

Less: Operat<strong>in</strong>g expenses:<br />

Sell<strong>in</strong>g expenses ............................................ $75,000<br />

Adm<strong>in</strong>istrative expenses............................... 75,000 150,000<br />

Net <strong>in</strong>come.................................................................... $ 100,000<br />

(b) Contribution <strong>in</strong>come statement:<br />

PACIFIC RIM PUBLICATIONS, INC.<br />

INCOME STATEMENT<br />

FOR THE YEAR ENDED DECEMBER 31, <strong>20</strong>XX<br />

Sales ......................................................................... $1,000,000<br />

Less: Variable expenses:<br />

Variable manufactur<strong>in</strong>g ................................. $500,000<br />

Variable sell<strong>in</strong>g............................................... 50,000<br />

Variable adm<strong>in</strong>istrative.................................. 15,000 565,000<br />

Contribution marg<strong>in</strong> .................................................... $ 435,000<br />

Less: Fixed expenses:<br />

Fixed manufactur<strong>in</strong>g...................................... $ 250,000<br />

Fixed sell<strong>in</strong>g ................................................... 25,000<br />

Fixed adm<strong>in</strong>istrative ...................................... 60,000 335,000<br />

Net <strong>in</strong>come.................................................................... $ 100,000

<strong>EXERCISE</strong> 7-28 (CONTINUED)<br />

3.<br />

= 12% × 4.35<br />

= 52.2%<br />

4. Most operat<strong>in</strong>g managers prefer the contribution <strong>in</strong>come statement for answer<strong>in</strong>g this<br />

type of question. The contribution format highlights the contribution marg<strong>in</strong> and<br />

separates fixed and variable expenses.<br />

<strong>EXERCISE</strong> 7-31 (25 <strong>MINUTES</strong>)<br />

<strong>1.</strong> The follow<strong>in</strong>g <strong>in</strong>come statement, often called a common-size <strong>in</strong>come<br />

statement, provides a convenient way to show the cost structure.<br />

2.<br />

3.<br />

Amount Percent<br />

R<strong>even</strong>ue ............................................................... $1,500,000 100<br />

Variable expenses............................................... 900,000 60<br />

Contribution marg<strong>in</strong>............................................ $600,000 40<br />

Fixed expenses ................................................... 450,000 30<br />

Net <strong>in</strong>come........................................................... $ 150,000 10<br />

Decrease <strong>in</strong> Contribution Marg<strong>in</strong><br />

Decrease <strong>in</strong><br />

R<strong>even</strong>ue<br />

Percentage<br />

Net Income<br />

$300,000* × 40% † = $1<strong>20</strong>,000<br />

*$300,000 = $1,500,000 × <strong>20</strong>%<br />

† 40% = $600,000/$1,500,000

4.<br />

<strong>EXERCISE</strong> 7-32 (10 <strong>MINUTES</strong>)<br />

Requirement (1) Requirement (2)<br />

R<strong>even</strong>ue ....................................................... $1,875,000 $1,500,000<br />

Less: Variable expenses........................... 1,125,000 1,800,000<br />

Contribution marg<strong>in</strong>.................................... $ 750,000 $ (300,000)<br />

Less: Fixed expenses ............................... 675,000 350,000<br />

Net Income (loss) ........................................ $ 75,000 $ (650,000)<br />

<strong>EXERCISE</strong> 7-33 (<strong>20</strong> <strong>MINUTES</strong>)<br />

<strong>1.</strong><br />

2.<br />

3. Service r<strong>even</strong>ue required to earn<br />

target after-tax <strong>in</strong>come of<br />

$1<strong>20</strong>,000<br />

4. A change <strong>in</strong> the tax rate will have no effect on the firm's break-<strong>even</strong> <strong>po<strong>in</strong>t</strong>. At the break<strong>even</strong><br />

<strong>po<strong>in</strong>t</strong>, the firm has no profit and does not have to pay any <strong>in</strong>come taxes.

SOLUTIONS TO PROBLEMS<br />

PROBLEM 7-34 (30 <strong>MINUTES</strong>)<br />

<strong>1.</strong> <strong>Break</strong>-<strong>even</strong> <strong>po<strong>in</strong>t</strong> <strong>in</strong> sales dollars, us<strong>in</strong>g the contribution-marg<strong>in</strong> ratio:<br />

2. Target net <strong>in</strong>come, us<strong>in</strong>g contribution-marg<strong>in</strong> approach:<br />

3. New unit variable manufactur<strong>in</strong>g cost = $12 × 110%<br />

<strong>Break</strong>-<strong>even</strong> <strong>po<strong>in</strong>t</strong> <strong>in</strong> sales dollars:<br />

= $13.<strong>20</strong>

PROBLEM 7-34 (CONTINUED)<br />

4. Let P denote the sell<strong>in</strong>g price that will yield the same contribution-marg<strong>in</strong> ratio:<br />

Check: New contribution-marg<strong>in</strong> ratio is:<br />

PROBLEM 7-35 (30 <strong>MINUTES</strong>)<br />

<strong>1.</strong><br />

2.<br />

3. Number of sales <strong>units</strong> required to<br />

earn target net profit<br />

4. Marg<strong>in</strong> of safety = budgeted sales r<strong>even</strong>ue – break-<strong>even</strong> sales r<strong>even</strong>ue<br />

= (140,000)($25) – $3,375,000 = $125,000<br />

5. <strong>Break</strong>-<strong>even</strong> <strong>po<strong>in</strong>t</strong> if direct-labor costs <strong>in</strong>crease by 10 percent:<br />

New unit contribution marg<strong>in</strong> = $25.00 – $8.<strong>20</strong> – ($4.00)(<strong>1.</strong>10) – $6.00 – $<strong>1.</strong>60

<strong>Break</strong>-<strong>even</strong> <strong>po<strong>in</strong>t</strong><br />

PROBLEM 7-35 (CONTINUED)<br />

6. Contribution marg<strong>in</strong> ratio<br />

Old contribution-marg<strong>in</strong> ratio<br />

= $4.80<br />

Let P denote sales price required to ma<strong>in</strong>ta<strong>in</strong> a contribution-marg<strong>in</strong> ratio of .<strong>20</strong>8. Then<br />

P is determ<strong>in</strong>ed as follows:<br />

Check: New contribution-<br />

marg<strong>in</strong> ratio