April 2011 - Malnor

April 2011 - Malnor

April 2011 - Malnor

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Cool Chain Association<br />

Following a successful workshop last year in Cape Town,<br />

South Africa, the German Cool Chain Association (CCA) AGM<br />

<strong>2011</strong> will be hosted by FloraHolland in the scenically faultless<br />

city of Aalsmeer, The Netherlands.<br />

For three days, 25 to 27 May <strong>2011</strong>, cold chain experts from<br />

around the world will meet in the very heart of the<br />

international floriculture sector to discuss, debate and<br />

communicate to attendees their “End-to-End Solutions” for<br />

the cool supply chain.<br />

Reputed for the high quality of floriculture products it<br />

produces, The Netherlands has an intricate network of<br />

premium companies – ranging from leading breeders and<br />

growers to sales experts and export firms, representing every<br />

aspect of the business.<br />

The Netherlands is the place where supply and demand come<br />

together. FloraHolland flower auction plays a key role in the<br />

Netherlands’ land of floriculture where its position as<br />

marketplace fulfils the role of matchmaker, intermediary and<br />

knowledge centre.<br />

AGM <strong>2011</strong><br />

FloraHolland is a modern business with six auction centres, a<br />

nationally operated intermediary organisation and a dedicated<br />

import department. Attendees to the CCA’s AGM<strong>2011</strong> will<br />

also get a rare opportunity to visit the facilities and learn<br />

more about the internal workings of the flower business.<br />

As well as input from FloraHolland’s own experts, included in<br />

this year’s programme for delegates is valuable input from<br />

the likes of airline cargo and container experts, marine<br />

terminal operators, and customs authorities.<br />

If you’ve anything to do with the cool supply chain, this<br />

meeting should be on your calendar!<br />

For further information, please visit: www.coolchain.org<br />

or send an e-mail to Kerstin Belgardt kerstin.belgardt@coolchain.org

4<br />

7<br />

12<br />

15<br />

16<br />

18<br />

19<br />

21<br />

Officially endorsed by Wesgro and<br />

the Exporters Clubs of South<br />

Africa – Eastern Cape and<br />

Western Cape<br />

Cover Story<br />

Boosting warehousing<br />

operating efficiencies<br />

Port of the Month<br />

Port of the whales<br />

Port of the Month<br />

Trusted partners<br />

Packaging<br />

Responsible, safe<br />

transportation<br />

Warehousing<br />

Optimising your warehouse<br />

with technology<br />

Import<br />

Challenging supply<br />

tradition<br />

Risk Management<br />

Risky business<br />

Standards<br />

ZABS and the Pre-Export<br />

Programme<br />

Regulars<br />

2 Editor’s Comment: Werk net<br />

EXPORT & IMPORT SA // APRIL <strong>2011</strong><br />

contents<br />

<strong>April</strong> <strong>2011</strong> // Volume 9 Number 4<br />

14<br />

19<br />

31<br />

6 export & import International: World News<br />

20 IT: Effective organisations need effective people<br />

22 Country profiles: Gabonese Republic and Jordan<br />

27 Trade News: Local news updates<br />

32 <strong>2011</strong> Calendar<br />

4<br />

7<br />

28<br />

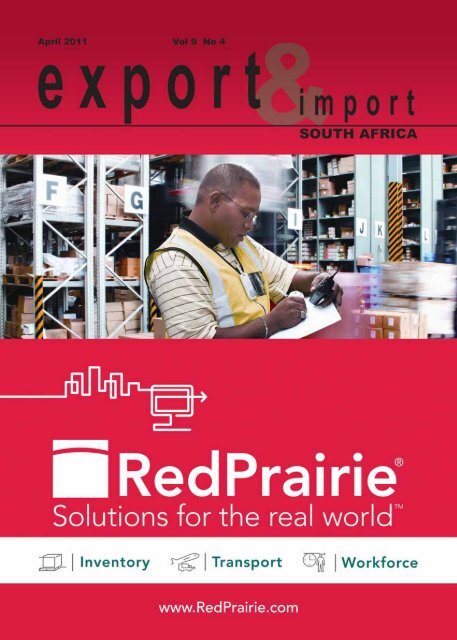

Cover story:<br />

Boosting your<br />

warehousing operating<br />

efficiencies with Red<br />

Prairie<br />

Page 4<br />

1

Editor’s Comment<br />

2<br />

Publisher:<br />

Ken Nortje<br />

kenn@malnormags.co.za<br />

Editor:<br />

Jodi Newton<br />

jodin@malnormags.co.za<br />

Advertising:<br />

Debbie Poggiolini<br />

debbiep@malnormags.co.za<br />

George Papatheodorou<br />

georgep@malnormags.co.za<br />

Sales manager:<br />

Sophia Nel<br />

sophian@malnormags.co.za<br />

Production:<br />

Johan Malherbe<br />

Meinardt Tydeman<br />

Advertising material:<br />

Lebohang Molefe<br />

traffict@malnormags.co.za<br />

Layout:<br />

Boago Kedikilwe<br />

Dispatch:<br />

Willie Molefe<br />

Circulation/Subscriptions:<br />

circulation@malnormags.co.za<br />

Subscription rates:<br />

Local R235,00<br />

Africa R260,00<br />

Overseas R1 470,00<br />

Published:<br />

Monthly<br />

Address:<br />

<strong>Malnor</strong> (Pty) Limited<br />

2 Hermitage Terrace, Richmond, 2092<br />

Private Bag X20, Auckland Park, 2006<br />

Tel: 011 726 3081/2<br />

Fax: 011 726 3017<br />

e-mail: exportsa@malnormags.co.za<br />

www.malnormags.co.za<br />

www.exportsa.co.za<br />

BEE compliant<br />

Werk net<br />

Jodi Newton, export & import SA Editor<br />

If it’s networking and meaningful<br />

debate you’re after, the next few<br />

frosty months shouldn’t<br />

disappoint. No fewer than six<br />

must-attend conventions,<br />

exhibitions, and networking functions<br />

have been packed into the start of<br />

the next quarter just for you.<br />

The number of good events held<br />

throughout this country each year<br />

(and events relevant to readers of<br />

export & import SA) is astounding.<br />

My tally of recommended meetings<br />

has gone far beyond the dozen<br />

mark already.<br />

Next month (May) we’ll see China<br />

come to us when the doors to<br />

IMEXPO <strong>2011</strong> open at Nasrec,<br />

Gauteng. This is said to be the<br />

biggest trade fair and investment<br />

forum ever to be held in southern<br />

Africa. Delegates from 13 SADC<br />

countries (with the exception of<br />

Madagascar and Angola), and<br />

representatives from around 100 of<br />

China’s major industries and state<br />

owned enterprises, as well as<br />

industries and parastatals from<br />

across the SADC region will be<br />

coming together.<br />

As the organisers of IMEXPO put it:<br />

When it comes to investment into<br />

SADC countries, China has already<br />

proved that it recognises the<br />

strength of the region as an<br />

investment partner. The region<br />

recorded an aggregate GDP of<br />

USD 226,1 billion in 2010. This,<br />

coupled with significant reform<br />

measures aimed at promoting<br />

macroeconomic stability and growth h<br />

in the majority of the member<br />

countries, further cements the<br />

region’s importance in the global<br />

market.<br />

As well as the eighth annual Africa<br />

Ports and Harbours Congress in<br />

June, the same month offers two<br />

transport and freight events gems.<br />

And the timing, for these meetings<br />

and their respective sectors in<br />

particular, couldn’t have been better.<br />

I’d advise ANY person to make the<br />

little trip to our northern neighbour<br />

for this year’s Road Freight<br />

Association’s annual convention<br />

(in Botswana this year). I don’t<br />

think I need to elaborate on the<br />

significance of the scheduled<br />

programme (which includes “those”<br />

Gauteng tolls and AARTO). Also<br />

in the same month is the not-to-bemissed<br />

meeting of the South African<br />

Association of Freight Forwarders<br />

(SAAFF) at Emperors Palace – a<br />

smorgasbord of important topics<br />

are lined up for this meet. Expect<br />

some hefty debate at both<br />

gatherings.<br />

The list of fine events goes on:<br />

Intermodal World, SAITEX and<br />

Africa’s Big Seven, SAPICS, Africa<br />

Rail . . . There’s really no defence<br />

for not having your say in your<br />

respective industry or attaining<br />

every ounce of knowledge that’s<br />

needed for your business to thrive.<br />

How much more opportunity do<br />

we need? ◆<br />

Enjoy the issue (and shows) folks,<br />

Jodi<br />

export & import SA<br />

is now available online.<br />

Be sure to visit<br />

www.exportsa.co.za<br />

EXPORT & IMPORT SA // APRIL <strong>2011</strong>

18751 Export 04/<strong>2011</strong>

Cover Story<br />

Boosting warehouse<br />

operating efficiencies<br />

Written for export & import SA by David Levin,<br />

Director, RedPrairie Africa<br />

In southern Africa, many warehousing operations are still<br />

running on paper-based environments, which are<br />

manually driven and controlled. Most growing operations<br />

reach a point where opportunities for refinement of<br />

manual warehouse processes have been exhausted, and<br />

the next level of efficiency cannot be achieved without the<br />

support of technology.<br />

A common question asked by companies, when investing in<br />

technology of any kind, is what is the appropriate level of<br />

sophistication required? A company can either be over-sold<br />

on the benefits, and invest in something which is unable to<br />

deliver returns, or be tempted into installing a cheaper<br />

system that cannot meet the longer-term functional<br />

requirements of the business.<br />

Another key consideration is the speed of return on<br />

investment. Over the past ten or so years there have been<br />

some interesting changes in the local WMS software market.<br />

The nominal cost of skilled and semi-skilled warehouse<br />

labour has approximately doubled since 2000, while the<br />

rand cost of WMS software has in fact reduced over that<br />

same period (due to a combination of increased market<br />

competition and rand strength).<br />

As a result, returns on investment in such technology have<br />

substantially improved, and with that the justification for<br />

making such investments. An investment in WMS technology<br />

can be the trigger to boost warehouse efficiencies and take<br />

supply chain productivity to the next level.<br />

The typical reasons for installing a WMS include:<br />

� Increased growth and complexity: Often this means either<br />

moving to a larger location and employing more staff, or<br />

otherwise investing in a WMS that allows for improved<br />

productivity and flow while keep the same fixed<br />

infrastructure and people costs.<br />

� Clear business case based on manual inefficiencies: A<br />

manually run warehouse will not be run as efficiently and<br />

investment in technology can often yield a reasonably<br />

quick return (sometimes inside of 12 months).<br />

� Quality and business risk issues: Issues such as<br />

inventory control and losses, batch or serial number<br />

traceability and recall, or risks around staff retention<br />

(manual systems require product recognition and<br />

therefore greater reliance on experience).<br />

The business benefits or justification for making an<br />

investment in a WMS is to use the technology to assist the<br />

operations to build the capacity and capability to manage<br />

more with the same or less resources. This is best achieved<br />

by having the necessary technology, a WMS, to best assign<br />

4<br />

and manage these<br />

new activities within<br />

its available pool of<br />

resources.<br />

For example, to<br />

illustrate this<br />

concept, in a typical warehousing operation with low levels of<br />

technology, MHE resources are usually assigned to focus on<br />

either inbound activities like receiving and put-away tasks or<br />

outbound activities like let-downs and picking tasks. This is<br />

not necessarily the most efficient use of these resources. In<br />

a WMS scenario, the system considers all these MHE<br />

resources as available to perform any task within the<br />

warehouse while considering each resources physical<br />

handling constraints. The WMS then dynamically assigns<br />

tasks in real time to these resources, based on optimisation<br />

criteria such as reducing travel time and distance,<br />

eliminating “empty-leg” travelling of MHE and staff and<br />

reducing double-handling of goods.<br />

The further benefit of implementing a WMS is the<br />

accumulation of accurate activity records. This information<br />

can to be used to review and understand the best mix of<br />

resources (staff and MHE) required to increase throughput<br />

to meet both internal cost and customer service level<br />

objectives as well as understand cost drivers for<br />

improvement and budgeting.<br />

Through our various productivity solutions, RedPrairie have<br />

been assisting customers globally and in South Africa for<br />

many years by improving warehousing efficiencies, levels of<br />

productivity and service levels to the end customer.<br />

About RedPrairie, in existence for 35 years, delivers<br />

productivity solutions helping companies around the world in<br />

three categories – inventory, transportation and workforce.<br />

RedPrairie provides solutions to manufacturers, distributors<br />

and retailers looking to reduce cost, increase sales and<br />

create competitive advantage. Over 20 global offices,<br />

including South Africa, provide services to over 34 000 sites<br />

in 40 countries; companies trust RedPrairie inventory,<br />

workforce and transportation solutions to deliver an<br />

immediate increase in productivity – with the flexibility to<br />

adapt as business needs change. RedPrairie has supply<br />

chain execution applications for productivity, warehouse,<br />

transportation management, visibility and performance<br />

measurement delivered in line with RedPrairie’s core value<br />

of delivering customer value. ◆<br />

For further information, please visit www.RedPrairie.com<br />

EXPORT & IMPORT SA // APRIL <strong>2011</strong>

17626 Export 09/2010

export & import International<br />

Global trade news<br />

Compiled by J Newton<br />

Japan and world trade<br />

Japan – While certain Japanese import<br />

and export markets are reporting<br />

downturns as the country’s nuclear<br />

power problems impact manufacturing<br />

and consumer buying patterns and<br />

international airlines avoid the country’s<br />

capital city, imports of fresh fish to Japan from countries as<br />

far afield as Australia and Norway are likely to increase.<br />

Australian exports of coking coal and iron ore may though be<br />

negatively affected in the short term because many Japanese<br />

steels mills have been damaged and rolling power cuts<br />

already have forced manufacturers to cut production of two of<br />

Japan’s export staples – electrical goods and motor vehicles.<br />

Also, spare parts for many of the country’s export industries<br />

face aircraft space restrictions as international carriers cut<br />

back on schedules.<br />

In terms of exports, some buyer companies are turning to<br />

South Korean and other Asian firms for alternative supplies,<br />

leading to concerns that Japanese exporters’ supply deals<br />

could be threatened in the long term. Source: Aircargo<br />

Retraining Kenya’s drivers<br />

Kenya – In an effort to reduce carnage<br />

on Kenya’s road network, the country’s<br />

Transport Licensing Board has called<br />

for a complete overall of the driver<br />

training curriculum and testing criteria.<br />

Kenyan officials say fake road licences, driving licences, TLB<br />

certificates, insurance certificates and even good conduct<br />

certificates are in abundance.<br />

Fifty per cent of Kenyan drivers are said to be unqualified.<br />

The country has one of the highest road accident rates in<br />

the world.<br />

Oz beef exports set to gain<br />

Australia – The country’s cattle prices<br />

are expected to increase a further 5%<br />

in <strong>2011</strong>, due to low herd numbers<br />

and rising export demand. Following<br />

weaker demand in 2010, Australian<br />

beef exports are set to improve with<br />

new export markets emerging and competitors facing<br />

production constraints.<br />

In the past, around 85% of beef exports went to our major<br />

trading partners of Japan, Korea and the US. The country is<br />

now seeing new export growth for Australian beef, in<br />

particular, from Russia, South East Asia and the Middle East.<br />

6<br />

Source: Farm & Land<br />

New maritime centre opens in India<br />

Kakinada, India – Shipping line<br />

Safmarine celebrated the double<br />

opening of the Kakinada Maritime<br />

Community Centre and the ITF Seafarer<br />

Centre (pictured above) in the port of<br />

Kakinada in India recently. The centres<br />

aim to equip the local seafaring community with the<br />

necessary resources needed in the maritime industry.<br />

The main supporters of this project are ITF Seafarers’ Trust,<br />

Sailors’ Society, Safmarine and Safmarine customer, Cargill.<br />

These centres will be managed by UCSWA, the local<br />

partner of the Sailors’ Society, who will be responsible for<br />

providing ongoing support for seafarers who call there<br />

requiring information for their career development at sea.<br />

The centre will also support qualified and experienced<br />

seafarers by offering courses in order to enhance their<br />

areas of expertise.<br />

Airline adds to fleet<br />

Germany – Lufthansa has ordered<br />

35 new aircraft. Thirty of the aircraft<br />

are for the Passenger Business; the<br />

other five orders are for Boeing 777<br />

freighters for the business segment<br />

Logistics.<br />

The new 777 freighters are set to join the fleet from 2013.<br />

They will be utilised to seize growth opportunities fuelled by<br />

rising demand. Aside from their high fuel efficiency, the noise<br />

footprint of the new freighters is smaller than that of the<br />

existing fleet. The orders in total are valued at list price at<br />

close to $4 billion.<br />

Highs and lows of container volumes<br />

Europe – Moderate growth in container<br />

volumes across Europe is predicted for<br />

this year said a report by Hackett<br />

Associates and the Bremen Institute of<br />

Shipping Economics and Logistics.<br />

The latest Global Port Tracker: North Europe Trade Outlook<br />

has backtracked on a prediction last month that the growth in<br />

container volumes in Europe last year will not be repeated<br />

this year. It is now forecasting a strong recovery in March.<br />

Growth will not though be as good as in 2010, with imports<br />

showing an 8,6% increase, to reach a total of slightly more<br />

than 23 million teu, and exports just under 7%, to total<br />

16,63 million teu. Source: IFW<br />

EXPORT & IMPORT SA // APRIL <strong>2011</strong>

Port of the whales:<br />

Walvis Bay<br />

EXPORT & IMPORT SA // APRIL <strong>2011</strong><br />

Port of the Month<br />

18794 Export 04/<strong>2011</strong><br />

7

Port of the Month<br />

The desert country<br />

Although it ranks as second least densely populated<br />

country in the world (2 108 665 inhabitants, mostly<br />

Afrikaans) and is a seemingly desolate vastness of<br />

landscape, the Namibian Republic is important for<br />

southern African and international trade.<br />

At 824 268 square kilometres, Namibia is the 31st*<br />

largest country in the world and stretches for about<br />

1 300 km from south to north and varies from 480 to<br />

930 km in width from west to east. The country is<br />

bordered by South Africa in the south, Angola and Zambia<br />

in the north and Botswana and Zimbabwe in the east.<br />

13 regions make up the county (*Namibian government).<br />

*Namibia has a small open economy that is closely<br />

linked to South Africa. It is the fourth-largest non-fuel<br />

minerals exporter in Africa, the world’s fifth-largest<br />

producer of uranium and produces large quantities of<br />

lead, zinc, tin, silver and tungsten. Namibia’s total<br />

exports increased from US$3,1 billion in 2008 to<br />

US$3,4billion in 2009 while total imports increased<br />

from US$3,8 bilion in 2008 to US$4,3 billion in 2009.<br />

8<br />

“ . . . fourth-largest non-fuel minerals exporter<br />

in Africa, the world’s fifth-largest producer<br />

of uranium . . . ”<br />

Syncrolift<br />

General Cargo Berths<br />

Container<br />

Terminal Walvis Bay<br />

The Namibian economy is highly dependent on tourism<br />

and their mining sector – which accounts for 12,4% of<br />

GDP and provides more than 50% of foreign exchange<br />

earnings. (*Credit Guarantee Insurance/export & import<br />

SA 2009).<br />

The Central Plateau of the state acts as a vital<br />

transportation corridor from the heavily populated north<br />

and South Africa – the source of more than four-fifths of<br />

Namibia’s imports. The country also homes one of the<br />

region’s most important seaports.<br />

The whale’s tale<br />

Midway along the country’s temperate coast, with direct<br />

access to principal shipping routes, the Port of Walvis<br />

Bay is described as a “natural gateway” for international<br />

trade. Named after the abundance of whale (Walvish,<br />

Walvis) that once frequented the area and the whaling<br />

thereof, the harbour nowadays welcomes an abundance<br />

of vessels – around a thousand a year.<br />

The Port of Lüderitz is Namibia’s second-largest seaport.<br />

A fishing haven for some time, it has diversified to move<br />

cargo for the mining industry, to support petroleum<br />

exploration and diamond mining activities.<br />

As Namibia’s largest commercial port, Walvis Bay<br />

handles some 5 million tons of cargo with the ability<br />

to process a quarter of a million containers annually<br />

and about 275 000 twenty-foot equivalent units<br />

(TEUs) annually.<br />

Container throughput at the port has risen from 40,000<br />

TEU in 2003 to 200,000 TEU in 2008 with an average of<br />

38% growth per year since 2003.<br />

The port is amongst Africa’s most efficient and best<br />

equipped with world-class infrastructure and equipment,<br />

ensuring reliable and safe cargo handling. Port authority<br />

Namport has steadily improved its harbour facilities at<br />

the port and continues to do so – with significant<br />

investment made over the last few years.<br />

Ten years ago, the deepening process and the building of<br />

a new enlarged container terminal enabled the port to<br />

handle vessels with a capacity of some 2 000 to<br />

2 400 TEUs.<br />

to page 10<br />

EXPORT & IMPORT SA // APRIL <strong>2011</strong>

18669 Export 04/<strong>2011</strong>

Port of the Month<br />

“Port of the whales: Walvis Bay” from page 8<br />

The harbour today consists of two<br />

sections: the commercial port, which is<br />

managed by Namport, and the finishing<br />

harbour. The commercial harbour offers<br />

a range of terminal facilities that can<br />

handle bulk, containerised, frozen, and<br />

dry cargo. The turnaround time for<br />

which is competitive, with handling<br />

times for container vessels of around<br />

12 to 15 hours. Depending on the<br />

tonnage and shipment, the turnaround<br />

time for bulk vessels averages between<br />

24 and 48 hours, while for break-bulk<br />

vessels averages between 18 and 20 hours.<br />

The total length of the quay is about 1,5 kilometres<br />

divided into eight berths, with berths 1 to 3 deepened to<br />

12,8 M CD and berths 4 to 8 deepened to 10,6 M CD.<br />

The container terminal has a current capacity of 392<br />

groundslots for normal containers and 192 groundslots<br />

for reefer containers. The port offers a thriving Syncrolift<br />

ship repair facility. Deepwater anchorage is also available<br />

inside the harbour and is protected by the natural bay<br />

and by Namport.<br />

The port carries a low risk in respect of insurance, with<br />

no pilferage and ideal weather conditions. The port has<br />

reportedly not experienced a single loss of cargo in the<br />

last 15 years.<br />

The corridors and infrastructure<br />

Most of Namibia’s transport infrastructure, particularly<br />

its road network (around 48 000 kilometres), is well<br />

maintained. More than half a dozen major road upgrade<br />

projects are under way or near completion, including that<br />

of the 134 kilometre MR 110 Rundu to Elundu route<br />

upgrade which began in 2007.<br />

The country’s border posts with South Africa are efficient<br />

and mostly without delays. Bribery and general misuse of<br />

authority though still plagues the borders of its northern<br />

neighbours (not of Namibia). *2 382 kilometres of<br />

railway (narrow-gauge) connects Walvis Bay and Lüderitz<br />

with key destinations in Namibia and South Africa.<br />

Containerised traffic at Walvis Bay goes by rail, and the<br />

port has its own marshalling yard for maximum<br />

operational efficiency. The railway line from Walvis Bay to<br />

Grootfontein, where there are transhipment facilities,<br />

links in with the Trans-Caprivi Highway (*embNamibia).<br />

The Port of Walvis Bay offers the shortest access route<br />

to and from the SADC region, Europe and the Americas.<br />

South America of which serves as a new trade route to<br />

major shipping lines.<br />

10<br />

“ . . . ability to process a quarter of a million<br />

containers annually and about 275 000 twenty-foot<br />

equivalent units . . . ”<br />

Through the Walvis Bay<br />

Corridor, the infrastructure<br />

and location of the port<br />

makes it suitable to serve<br />

the SADC region’s import and<br />

export bound sea borne<br />

cargo. It also provides a costeffective<br />

alternative to the<br />

ports of southern Africa which<br />

operate (mostly) at maximum<br />

capacity.<br />

The Gauteng market can be<br />

reached via the Trans-Kalahari<br />

Corridor instead of via Durban<br />

or Cape Town, saving seven to<br />

11 days of transit time.<br />

The Port is linked to Namibia’s air, rail and road network<br />

making it well situated to service landlocked countries in<br />

southern Africa, especially through the main arteries of<br />

the Walvis Bay Corridor – the Trans-Caprivi, Trans-<br />

Kalahari, Trans-Cunene Highways and the Walvis Bay-<br />

Ndola-Lubumbashi Corridor.<br />

The Walvis Bay-Ndola-Lubumbashi Corridor, in particular,<br />

was set up by the governments of the Democratic<br />

Republic of Congo (DRC), Namibia and Zambia to identify<br />

and harmonise cross-border standards, to address<br />

obstacles to trade between the Corridor member<br />

countries and to promote economic development through<br />

transport, trade, investment and tourism for the mutual<br />

benefit of the DRC, Namibia and Zambia and the SADC<br />

region as a whole.<br />

“ The Gauteng market can be reached via the<br />

Trans-Kalahari Corridor instead of going via Durban or<br />

Cape Town, saving seven to 11 days of transit time. ”<br />

Transit time from Antwerp to the Port of Walvis Bay is<br />

17 days, and transhipment from the Port of Walvis Bay<br />

to Gauteng an additional 48 hours.<br />

Namibia has about 25 key airports – most of which are<br />

paved and open to commercial use.<br />

EXPORT & IMPORT SA // APRIL <strong>2011</strong>

Future Walvis Bay<br />

The port’s future is sound. Walvis<br />

Bay Port “prides itself on having the<br />

flexibility to deliver an increasing<br />

demand for customer services”.<br />

The port operates at 65% of its<br />

capacity currently but its total<br />

capacity equips it to handle 7 to<br />

8 million tons of cargo.<br />

Along with strategic expansion of the<br />

Walvis Bay Container Terminal and<br />

Walvis Bay Ship and Rig repair yard<br />

(pictured), the construction of a new<br />

marine petroleum offloading facility<br />

has begun and should be complete<br />

soon. The port has introduced<br />

maximum security measures and<br />

procedures and is International Ship<br />

and Port Facility Security (ISPS)<br />

code compliant.<br />

The expansion of Namibia’s port at<br />

Walvis Bay to handle larger quantities<br />

of copper (from Zambia) and uranium<br />

(from Namibia’s Erongo Region) will<br />

be completed by the end of 2012.<br />

The amount of cargo has increased in<br />

line with the country’s expansion of<br />

uranium mining operations.<br />

Construction of the new<br />

($264 million) terminal started in<br />

January <strong>2011</strong>. The total project<br />

cost is estimated at an equivalent<br />

of 200 million EUR (including<br />

dredging), infrastructure and handling<br />

equipment. The new container<br />

terminal would increase NamPort’s<br />

annual container handling capacity<br />

from 250,000 TEU to more than<br />

500,000 TEU. Berthing is at present<br />

limited to 3,500 TEU container<br />

vessels. ◆<br />

EXPORT & IMPORT SA // APRIL <strong>2011</strong><br />

Port of the Month<br />

Sources: Namport, Credit Guarantee,<br />

04/<strong>2011</strong><br />

Dredging Today, Namibian Government/<br />

Export<br />

Tourism 18736<br />

11

18652 Export 04/<strong>2011</strong><br />

Port of the Month<br />

Trusted partners:<br />

Walvis Bay and Maersk<br />

“ Our partnership has led to many improvements and development<br />

a state-owned entity, Namport is probably<br />

one of the best port Authorities to work with<br />

within Africa.” “As<br />

This comment, made by Maersk Line’s<br />

Namibian Country Manager Dries Oberholzer, is based<br />

predominantly on commercial considerations and the port<br />

authority’s “ability to listen and find a common way<br />

forward”.<br />

12<br />

initiatives resulting in continuous volume growth. ”<br />

“Namport has done all the right things: from deepening<br />

their draft (14,5 metres), investing in IT (NAVIS), proper<br />

handling equipment (RTGs and reach stackers) to expanding<br />

their storage capacity and improving their quay wall and<br />

berthing lengths. The next step for them should be to put<br />

measures in place to deliver sustainable high productivity<br />

and efficiencies to their liner customers.”<br />

Maersk Line was one of the first shipping lines to recognise<br />

Walvis Bay’s potential as a hub port as far back as 2004.<br />

“Our partnership has led to many improvements<br />

and development initiatives resulting in continuous<br />

volume growth for them,” explains Oberholzer.<br />

“We saw an increase in containerised (including<br />

transhipments) cargo of 26% from 2008 to 2009,<br />

but this amount decreased in 2010 with 16%”.<br />

The decrease can be attributed to the slow trading<br />

conditions in Angola, affecting both imports<br />

(destined for Southern Angola) and transhipment<br />

cargo that is normally feedered into Angola.<br />

“Obviously when competing for import, export and<br />

transshipment volumes any inefficiencies/<br />

efficiencies in competing ports has an effect on<br />

the way the Port of Walvis Bay is viewed by the<br />

various shipping lines and their end customers.<br />

However, all the container shipping lines (under<br />

the banner of CLOF) work closely with Namport<br />

and the Walvis Bay Corridor Group to ensure that<br />

we improve the port and corridors and the<br />

movement of cargo through them.<br />

“Maersk Line are indeed very focused on the<br />

environment and we are glad to say that so is<br />

Namport. They have very high standards in this<br />

regard, with dedicated staff overseeing the wellbeing<br />

of the port and its immediate environment<br />

at all times,” concludes Oberholzer.<br />

Maersk Line will soon be launching the new<br />

WAFMAX vessels. These will be largest ever to be<br />

deployed in West Africa and Walvis Bay will be the<br />

first port of call on their rotation. This in itself<br />

typifies the relationship between Maersk Line and<br />

Namport and the trust shown in the port<br />

to deliver what is required for us to be able to<br />

grow our business. ◆<br />

EXPORT & IMPORT SA // APRIL <strong>2011</strong>

The Mobicon machine: used by logistics<br />

companies at ports throughout the world to<br />

safely transport containers<br />

The mobile Mobicon container handling system from<br />

BLT is used at ports throughout the world to safely<br />

transport containers into secure warehouses for<br />

efficient inspection procedures.<br />

“This innovative mobile container handling system, which<br />

safely lifts loads onto and off trucks and carries containers<br />

securely around sites and into examination facilities,<br />

ensures optimum efficiency for customs authorities which<br />

require fast container turnaround times,” says Clinton van<br />

den Berg, products manager for BLT. “Customs services are<br />

now able to avoid port congestion by also receiving<br />

containers at night for the next morning’s inspection shift.<br />

This is an important factor when handling large shipments<br />

of containers. It means authorities are able to dictate their<br />

own workflow and are not reliant on transporters waiting in a<br />

queue at the port. This also further reduces the chances of<br />

demurrage costs or over-stay at the port.<br />

“Many unloading harbour yards are not designed to carry<br />

heavy container handling equipment. Pavements don’t meet<br />

specified requirements and very often yards themselves are<br />

small and narrow and cannot withstand the use of<br />

heavy vehicles.<br />

“An important advantage of this flexible system is that it<br />

utilises all parts of the yard and can turn in tight spaces<br />

and operate where conventional container handling<br />

equipment cannot go. The Mobicon can travel under<br />

awnings, through warehouse doors, inside buildings<br />

and up to docks which is very convenient, especially in wet<br />

weather conditions. Containers are now effectively taken<br />

directly to examination facilities and this capability, apart<br />

from speeding up inspections, also increases<br />

goods security.”<br />

This flexible system has a 33-ton lift capacity and is able to<br />

carry any size or type ISO specified container, without the<br />

need for modifications or additional lifting equipment. With<br />

EXPORT & IMPORT SA // APRIL <strong>2011</strong><br />

Advertorial<br />

Fast, safe container handling<br />

“ . . . a reputation as the fastest and safest container handler . . . ”<br />

this system, which is one of the lightest container handlers<br />

in the world, there is no need to couple and uncouple<br />

trailers from prime-movers during the unloading<br />

of containers.<br />

The container is lifted from the bottom, which allows the<br />

operator to easily handle flat beds, tank containers, half<br />

heights, over heights and curtain sided containers. The<br />

two tower design provides the flexibility to be able to<br />

operate on slightly sloping or uneven surfaces, as well as<br />

compacted gravel yards, bitumen or standard lightweight<br />

concrete.<br />

Enhanced safety has also been critical in the design of this<br />

system. The operator now has a clear view of the working<br />

area and does not have to travel with a container 3 metres<br />

in the air, as with conventional systems. Instead of staff<br />

having to work at a trailer’s height, they are now able to<br />

work safely at ground level.<br />

The Mobicon, with a reputation as the fastest and safest<br />

container handler on the market, also requires minimal<br />

maintenance. The simple design of the low-maintenance<br />

machine utilises an economical four cylinder 60 hp diesel<br />

engine, coupled to a hydrostatic drive system, for reduced<br />

fuel costs (consumption is 5 litres an hour compared to<br />

22 litres an hour for other machines.<br />

The container handling system, which is easy to operate and<br />

does not require a special licence, guarantees customs<br />

authorities improved efficiencies, faster handling times and<br />

increased safety.<br />

This efficient Mobicon container handling system, which is<br />

manufactured in Australia, is available exclusively throughout<br />

Africa from BLT. The company offers a technical advisory,<br />

parts and support service. ◆<br />

For further information, please contact: 031 274 8270<br />

15009 GD 05/2009<br />

13

Advertorial<br />

Your agent, your ally<br />

The role of a ships agent, although one of the oldest<br />

professions in the world, has not changed much.<br />

Technology has advanced and efficiencies have<br />

improved substantially but the fundamental role of<br />

the ships agent has remained the same. A ship<br />

owner or operator needs trusted eyes and ears in parts of<br />

the world where their vessels call and the trusted ships<br />

agent places the interests of the ship owner or operator<br />

above all else.<br />

Ocean Liner Services (a division of Manica Group Namibia<br />

Pty Limited) is represented in the Port of Walvis Bay in<br />

Namibia. The team is highly skilled, motivated, and has one<br />

common goal: to provide excellent ships’ agency services to<br />

international customers.<br />

Formed in 1995, Ocean Liner Services (previously Woker<br />

Freight Services Ships Agency Division) represents ship<br />

owners and operators of all types of vessels, including dry<br />

14<br />

bulk, breakbulk, containerised, Ro-Ro, reefer, seismic and<br />

supply, passenger and tanker vessels.<br />

In addition, Ocean Liner Services protects the interests of<br />

ship owners, operators and rig owners and operators of all<br />

types of vessels and oilrigs that require repairs. The<br />

company ensures quick turn around times for customers’<br />

vessels and also ensures that the port calls are costeffective<br />

by monitoring cargo operations, berthing and<br />

sailing and negotiating discounted rates for loyal customers.<br />

In shipping terms, this is referred to as “ships agency and<br />

husbandry” and Ocean Liner Services places emphasis on<br />

the “husbandry”. The company looks after the vessels and<br />

takes special care when rendering the services and also<br />

goes that extra mile to ensure the agency remains the<br />

ultimate choice.<br />

As long as there is a port, vessels will call and as long as<br />

vessels call a port, there will be ships agents. ◆<br />

EXPORT & IMPORT SA // APRIL <strong>2011</strong><br />

18676 Export 04/<strong>2011</strong>

Responsible,<br />

safe transportation<br />

South Africa’s legislation for the packaging<br />

and transportation of hazardous materials is<br />

a complex and difficult one to understand fully.<br />

Failure to comply though could result in heavy<br />

fines or penalties being levied on guilty parties.<br />

The repercussions of products being incorrectly packaged or<br />

transported could cause costly and devastating damage to<br />

the environment. As such it is important for organisations in<br />

the manufacturing, packaging and transportation industries<br />

that deal with dangerous goods, to understand the levity or<br />

the responsibility that they are carrying and to make sure<br />

that they are well informed on the latest regulations<br />

regarding their role in handling these goods.<br />

The RPMASA (Responsible Packaging Management<br />

Association of South Africa), the sole Industry representative<br />

from Africa on the UN Committees of Experts for Transport of<br />

dangerous goods and the GHS, undertook to host a biennial<br />

conference that would bring all the key role-players together,<br />

along with an esteemed panel of international experts on the<br />

subject matter, and offer them a forum to learn, discuss and<br />

share insights and ideas.<br />

The second International Transport and Environment<br />

Conference, organised by the RPMASA in partnership with<br />

the City of Durban and the Durban Chamber of Commerce<br />

and Industry was held at the ICC in Durban from 7 to<br />

9 March <strong>2011</strong>.<br />

“I believe the Conference was a great success,”<br />

said the RPMASA’s President Liz Anderson, “certainly the<br />

feedback from the Conference delegates was excellent<br />

regarding the valuable information gained on National<br />

and International Legislation, Regulations and Best<br />

Industry Practice, as well as the outstanding calibre of the<br />

speakers and presentations, to raise awareness of risks and<br />

help companies in our region improve their business<br />

compliance.”<br />

EXPORT & IMPORT SA // APRIL <strong>2011</strong><br />

At the recent RPMASA event<br />

(from left): Irfan Rahim, Head<br />

of Cargoes and Marine Safety<br />

for the International Maritime<br />

Organisation (IMO) in London;<br />

Liz Anderson, President of<br />

the Responsible Packaging<br />

Management Association of<br />

South Africa (RPMASA);<br />

Captain Sanjoy Sen, Marine<br />

Safety and Environment<br />

Manager for Transnet National<br />

Port Authority (TNPA)<br />

Packaging<br />

A challenge in holding a conference of this sort though,<br />

says the Association, is that it involves a wide audience from<br />

various industries (manufacturing, packaging and<br />

transportation) that perform very different functions and the<br />

regulations controlling one industry don’t necessarily apply to<br />

the other – which makes it difficult for them to find common<br />

ground. As such there was a marked lassitude from many<br />

organisations to attend the conference despite the critical<br />

nature of the subject matter.<br />

“Attendance from Industry was disappointing as this is a key<br />

issue,” says Liz, “Tsietsi Mokhle, CEO of SAMSA said that<br />

the movement of these cargoes through the Port of Durban<br />

accounted for more than R25 billion to the National GDP!”<br />

Along with the International Maritime Organisation’s Irfan<br />

Rahim (Head of Cargoes and Marine Safety), International<br />

speakers at the conference did include the esteemed likes of<br />

Mauser Corporation’s Christopher Lind (USA); Dr Jurgen<br />

Bruder, the Director of the International Confederation of<br />

Plastics Packaging Manufacturers; and Jonathan Krueger of<br />

the United Nations Institute for Training and Research.<br />

“International speakers Irfan Rahim, Peter MacKay of HCB,<br />

Dr Jurgen Bruder and Volker Krampe of AISE and FEA as well<br />

as the CAA, SAMSA and the TNPA have pledged to support<br />

and help plan for 2013 for an even better event and to<br />

encourage greater Industry participation,” adds Liz. We trust<br />

that all the relevant Industry Associations from Packaging,<br />

Chemicals and transport sectors will participate in the early<br />

stages and ensure their members participation in 2013.”<br />

Local input included that from the Road Freight Association’s<br />

Gavin Kelly, the Civil Aviation Authority’s Thami Zembe and<br />

Ndivhuho Raphulu of the National Cleaner Production Centre.<br />

Transnet National Ports Authority (TNPA) and the South<br />

African Maritime Safety Association (SAMSA) are two<br />

organisations that play a key role in the regulation of<br />

transporting dangerous goods participated both in the<br />

conference and by sponsoring the event.<br />

“The conference imparted valuable information to the<br />

mariner as it gave insight into the packaging industry<br />

operation and a fuller understanding as to why accidents<br />

happen on ships when packaging is not done correctly<br />

according to industry standards,” said Captain Mike Brophy,<br />

Chief Harbour Master for TNPA (see SAMSA’s input at the<br />

conference on page 31 of this issue).<br />

Government’s involvement in writing the legislation that<br />

governs the industry and regulating the rules once in place is<br />

also critical. Peter Lukey, Department of Environmental<br />

Affairs Acting Deputy Director-General for Climate Change<br />

spoke at the conference about the current status of South<br />

Africa’s Climate Change Response Strategy. “It is important<br />

to support good initiatives that are finding creative ways to<br />

combat climate change,” Lukey stated. “And there is room<br />

for working on such projects within the packaging industry,”<br />

he continued. Peter recommends that organisations look at<br />

South Africa’s Climate Change Policy (www.climateresponse.<br />

co.za). ◆<br />

For a full overview of the findings and resolutions drafted at<br />

the meeting, visit: www.rpmasa.org.za<br />

15

18747 Export 04/<strong>2011</strong><br />

Warehousing<br />

Companies can optimise warehouse<br />

operating efficiencies, customer<br />

service with integrated technology<br />

initiatives<br />

Considering the current global economic climate<br />

and increased concerns over variable inventory<br />

levels, 3PL warehouse providers may be hesitant<br />

to invest capital in software solutions. However,<br />

many companies are realising the benefits of<br />

utilising new technology to help maximise warehouse<br />

management systems (WMS) at this time.<br />

Despite the recessionary nature of the global economy,<br />

many freight forwarders and logistics providers are<br />

increasingly seeking value-added software solutions in order<br />

to boost warehouse operating efficiencies and better control<br />

inventory levels to meet demand variability.<br />

Integrating technology solutions into the warehouse function<br />

is enabling many companies to operate leaner, provide<br />

improved storage capacity and reduce overhead and<br />

operating costs significantly. While current inventory levels<br />

16<br />

by Andrea Robinson, Business Development<br />

Manager, CargoWise – UK (Published with<br />

permission of the author)<br />

are lower across the globe, proactive forwarding companies<br />

are finding that technology can be an invaluable tool in<br />

warehouse optimisation and can significantly help position<br />

companies to better compete when consumer demand<br />

returns and inventory volume levels return to normal.<br />

For many small to medium-sized enterprises (SMEs) finding<br />

the right IT solution isn’t always an easy task. Often good<br />

WMS options seem to trend toward stand alone solutions<br />

that can be costly and offer no integration with internal or<br />

external systems. Also, the stand alone option may not<br />

provide a computerised warehouse function at all; it may<br />

simply run on paperwork and spread sheets. There are<br />

potentially huge overheads incurred in these situations, with<br />

administrative work, operational expenses, transport<br />

planning and inventory management. Processing errors,<br />

time delays, high costs and general confusion are the usual<br />

symptoms of a disorganised warehouse and can suggest<br />

that the actual cost of units coming through the warehouse<br />

is providing only marginal profits.<br />

With a few simple but critical changes, smaller 3PL<br />

warehouse operators can realise significant gains<br />

throughout the warehousing operation with a software<br />

solution that is tailored specifically to its business. Taking<br />

ownership of a company’s WMS system without incurring<br />

lengthy development, implementation and training delays<br />

while minimising running costs is possible with some<br />

careful planning and the right software provider that<br />

understands your business and offers an integrated and<br />

diverse range of services.<br />

Therefore, to achieve maximum benefit, promote efficient<br />

inventory control processes and improve productivity,<br />

companies must select a WMS software program designed<br />

to integrate with internal operating systems. A thoroughly<br />

integrated WMS process will ensure a positive effect on<br />

cost reductions and bottom line profitability. A significant<br />

element of payback with investment into WMS software can<br />

be found in the reduction of errors, reduction in labour<br />

costs and a maximising of warehouse floor space. The<br />

introduction of electronic data interchange (EDI) into the<br />

warehousing process can also help reduce manual data<br />

entry, reduce duplication of paperwork and enable a more<br />

efficient inventory management process that reduces labour<br />

costs by optimising picks, locations and release of stock<br />

from storage.<br />

While companies can utilise software technology to<br />

streamline their warehousing process, they can also better<br />

meet customer demands and improve customer service by<br />

establishing and meeting key performance indicators (KPIs)<br />

EXPORT & IMPORT SA // APRIL <strong>2011</strong>

that will ensure the warehousing business sustains the<br />

current economic climate for both parties. Product tracking,<br />

stock visibility and traceability, along with automated data<br />

collection throughout the warehouse system should be<br />

standard features accessible to customers.<br />

Utilising RF technology is another initiative that can cut down<br />

on labour and data entry efforts while providing real-time<br />

information and complete stock visibility. With RF technology,<br />

online receipts, locations, movements and dispatches can<br />

be instantly applied to the back office warehouse<br />

management system without the need for rekeying<br />

information.<br />

Location management, automated billing, optimising stock<br />

replenishment -- even yard management and the improved<br />

utilisation of warehouse space all contribute to maximising<br />

profits and ensuring that improved ROI is achieved in a very<br />

short time.<br />

Ultimately, SMEs, in particular, can benefit from evaluating<br />

their warehouse processes in this economic climate by<br />

strategically identifying the actual unit costs across the<br />

entire warehouse process. By identifying where WMS<br />

performance can be enhanced through the implementation<br />

Warehousing fast fact<br />

The World’s Largest Warehouse is thought to be the Saudi<br />

Kayan Petrochemical Complex Project in Al-Jubail Industrial<br />

City, Kingdom of Saudi Arabia (140 000m2) of an enterprise software system, they can identify the<br />

greatest areas of expenditure in relation to inventory, space<br />

and transport planning and reduce costs in order to justify<br />

the initial and ongoing management expenses involved. The<br />

results may initially seem alarming; but with a strategic focus<br />

on why overheads are high, companies can determine how<br />

the inventory management process can be controlled with<br />

automated systems without adding to outlays, and take the<br />

necessary steps to improve warehouse efficiencies without<br />

reducing the value-added services that customers expect<br />

now and in the long term.<br />

About CargoWise edi:<br />

CargoWise edi provides solutions for forwarders, customs<br />

brokers and logistics service providers focused on supply<br />

chain execution capability in an integrated ERP-like globally<br />

capable system. It is a world-leading provider of low-cost,<br />

high-value software solutions and services for the freight<br />

forwarding, NVOCC, express courier, customs brokerage,<br />

contract warehouse, container freight station, ships’ agency,<br />

local cartage and other supply chain services.<br />

Every day, 1 300 logistics service providers, consisting of<br />

33 000 users in 45 countries, move goods through the<br />

global supply chain using CargoWise edi’s flagship product<br />

ediEnterprise. CargoWise edi offers supply chain logistics<br />

management systems that provide full integration across all<br />

departments and functionality for domestic, regional and<br />

global customers.<br />

Headquartered in the US, Australia and the UK, the Company<br />

operates from 12 worldwide offices across the US, Europe<br />

and Asia. More information on CargoWise edi can be found<br />

at: www.cargowise.com. ◆<br />

EXPORT & IMPORT SA // APRIL <strong>2011</strong><br />

Warehousing<br />

Working, safely, with<br />

your modern warehouse<br />

The TCM range of forklift trucks in this country has<br />

been extended to include FRSB-VIII reach trucks.<br />

Distributed exclusively in Africa by Criterion<br />

Equipment, the TCM range’s new electric sit-on<br />

reach truck series, with capacities between 1,4 tons and<br />

2,5 tons, offers extended run times pper battery y charge, g ,<br />

enhanced safety and improved<br />

operator comfort. .<br />

The new truck, says ays Criterion<br />

Equipment, can – with its 420<br />

Ah/6 hour battery y unit – work for<br />

11,5 hours in a specified work<br />

cycle pattern, at an operating rate<br />

of 55%.<br />

A load meter prevents vents overloading,<br />

thus improving proving safety.<br />

When the truck is s stationary and<br />

the hydraulic system tem is not<br />

active, the load meter shows the<br />

approximate weight ght of the load<br />

on the forks, to avoid an<br />

accident as a result sult of overloading.<br />

Another safety feature ature is<br />

the password entry try<br />

system which<br />

prevents the<br />

unauthorised<br />

operation of a<br />

truck. The travelling and load handling<br />

interlock system also increases safety of this series. If<br />

the operator leaves his seat during an operation, an alarm<br />

buzzer sounds and both the hydraulic and travel controls<br />

are automatically disabled. A travel and load handling<br />

speed limiter also enhances safety during operation. If the<br />

forks are raised to the maximum fork height with a load,<br />

the truck automatically detects the fork height and weight<br />

of the load in order to limit the travel, reach and sideshifting<br />

speeds.<br />

A number of additional safety and comfort features adorn<br />

the new lift truck and several optional extras are available.<br />

Criterion Equipment is a wholly owned subsidiary of Invicta<br />

Holdings Limited. The company’s service throughout<br />

southern Africa includes the sale of new and used forklift<br />

trucks, long and short-term rentals, service and<br />

maintenance contracts, as well as the supply of genuine<br />

TCM parts. ◆<br />

For further information, contact 011 966 9700<br />

17

Import<br />

Challenging<br />

supply<br />

tradition<br />

Traditionally, disparate elements governed the supply<br />

chain: funding came from one source and tended to<br />

take a one-size-fits-all approach, while managing<br />

logistics came from another. The common thread<br />

was the importing company’s lack of control.<br />

That approach is outdated in today’s business world and<br />

managing the import process and associated finance<br />

component effectively within the overall supply chain cycle<br />

is now even more critical in a global market.<br />

“ . . . far more retailers will start looking at<br />

If the acquisition of 51% of Massmart by global retail giant<br />

Walmart is approved by the Competition Tribunal many local<br />

retailers will be forced to relook their traditional financing<br />

models and supply chain processes. This is the view of<br />

Adam Orlin, CEO of Blue Strata, an imports solutions<br />

and finance provider.<br />

Orlins says from the outset Doug McMillon, President and<br />

CEO of Walmart International, has said it is Walmart’s<br />

mission to save people money and the group’s ability to<br />

source products internationally coupled with its bulk buying<br />

power will ensure a highly competitive pricing structure for<br />

Massmart. For local retailers pressure to become more<br />

price competitive will place additional strain both on gross<br />

margins, which are already relatively low, and traditional<br />

sourcing models.<br />

Orlin says now, more than ever, retailers need to integrate<br />

their financial and physical supply chain onto a single<br />

platform so they can better manage the order management,<br />

forex management, logistics and product costing in order to<br />

manage these risks.<br />

Orlin anticipates that far more retailers will start looking at<br />

direct imports. “One of the challenges of importing goods<br />

has traditionally been the retailer’s lack of warehousing<br />

capacity, or the associated cost of stockholding to hold<br />

extended stock ranges or large quantities or stock for an<br />

extended period. This has driven their preference for the<br />

18<br />

direct imports . . . ”<br />

CEO of Blue Strata, Adam Orlin<br />

flexibility of utilising a local holding supplier. But, with<br />

increased price competition, retailers are now being forced<br />

to rethink their sourcing and funding strategies.”<br />

In order to better manage costs and stock levels, large<br />

retailers are turning to centralised planning models but<br />

trying to integrate large numbers of vendors is proving<br />

problematic. “This is where a company like Blue Strata<br />

can step in, to help manage timelines and to provide<br />

feedback to help manage inventory relative to the<br />

sell-through rate to help avoid potential losses from mark<br />

downs or loss of revenue by having the incorrect supply<br />

for demand.<br />

“And,” explains Orlin, “if you add the funding component to<br />

the value-added services and access to economies of scale,<br />

savings can be passed through to customers to improve<br />

working capital cycles and reduce the quantum of working<br />

capital tied up in the import transaction. In turn, by freeing<br />

up working capital and increasing stock turn, we are<br />

effectively giving clients up to 40% more money to fund<br />

expansion and growth and the real ability to compete<br />

competitively on price.”<br />

Orlin says the company recently introduced a replenishment<br />

model for the retailers’ own imports which compares the<br />

costs and timelines associated with both a direct versus a<br />

local supply model, and then combines the best of both<br />

worlds. “In a direct model, the stock holding period is<br />

generally limited which places restrictions on monthly Open<br />

to Buy (OTB) positions and limits flexibility. In contrast, in a<br />

local timeline, stockholding is generally not an issue but<br />

there is a premium to pay for the service.” He adds that by<br />

Blue Strata facilitating direct imports as a local supplier, the<br />

combination of this off-balance sheet stock holding and<br />

increased stock holding period provides importers with<br />

the required increase in quantity and variety of stock to<br />

trade competitively.<br />

The bottom line is that a fully integrated model like this<br />

allows importers to mitigate their risks and release much<br />

needed working capital, providing them with the ability<br />

to either increase or retain margins relative to maintaining<br />

competitive selling prices,” concludes Orlin. ◆<br />

EXPORT & IMPORT SA // APRIL <strong>2011</strong>

Risky business<br />

“ South African companies believe in a local response over<br />

a central risk response action. ”<br />

Natural disasters, fires and explosions are<br />

uncommon supply chain risks within our<br />

operations. This was the input of South African<br />

companies participating in the MIT Global Risk<br />

Survey (Phase II).<br />

The recent natural disasters in Australia, New Zealand and<br />

particularly Japan are, however, proving the global impact<br />

of such incidents on shipping and sourcing and thereby,<br />

supply chains.<br />

The MIT Center for Transportation and Logistics Global Risk<br />

Survey is being undertaken in South Africa jointly by<br />

IMPERIAL Logistics and the Association for Operations<br />

Management of Southern Africa (SAPICS), in collaboration<br />

with MIT.<br />

“As the supplier of approximately 20% of semi-conductors<br />

and 40% of flash memory chips worldwide and a major<br />

supplier in the likes of the automotive sector, last week’s<br />

(March) earthquake and tsunami in Japan will force<br />

companies to rethink their approach to managing supply<br />

chain risk,” says Abrie de Swardt, IMPERIAL Logistics<br />

Marketing Director.<br />

In terms of risk mitigation perceptions, South African<br />

companies believe in a local response over a central risk<br />

response action. This falls in between the North American<br />

and European approaches, as identified by the global<br />

survey findings. “By addressing supply chain risk through<br />

a centralised approach, a company aligns its strategies<br />

to the holistic context. Response at a local level allows<br />

site level staff to apply their own actions immediately,”<br />

he explains.<br />

De Swardt says that supply chains are considerably more<br />

vulnerable as a result of being “very much international due<br />

to globalisation, involving trading partners from different<br />

regions, who speak different languages and have<br />

experienced different risks.” The survey identifies seven<br />

risk causal factors, including the inability to ship or<br />

deliver products, loss of raw material supply, disruption of<br />

internal operations, inability to communicate with vendors/<br />

other sites, running out of cash and a sudden drop in<br />

customer demand.<br />

All seven risks can be triggered locally due to cross-border<br />

supply chains. “The scale and unpredictability of the natural<br />

disasters occurring across continents requires a more<br />

EXPORT & IMPORT SA // APRIL <strong>2011</strong><br />

Risk Management<br />

holistic approach to supply chain risk mitigation, both<br />

for shippers and Logistics Service Providers (LSPs),”<br />

he says. “Comprehensive contingency plans are<br />

therefore needed.”<br />

For example, despite Japan’s main airports, Narita and<br />

Haneda having been reopened and road and rail disruption<br />

reportedly only localised, sea ports have been badly<br />

affected. Analysts forecast that “supply chain effects may<br />

be one of the longer lasting issues for the logistics sector,<br />

with global markets in air and sea freight depressed due to<br />

lack of volume.”<br />

Furthermore, with Japan being a major importer of iron<br />

ore and coking coal for steel production, as well as thermal<br />

coal for power generation, dry bulk shipping could be<br />

negatively affected.<br />

The survey finds that South Africa is more closely aligned to<br />

developed over developing economies, in terms of the top<br />

10 supply chain risk factors facing business. The country,<br />

however, not only resembles developing countries regarding<br />

“extended electricity loss” and “major software systems<br />

failure” but is required to address these issues more<br />

frequently.<br />

Extended loss of electricity is five times more likely to occur<br />

in South Africa, compared to the world average. “As a risk<br />

needing to be addressed, employee theft/executive<br />

misdeeds come in four times higher than the international<br />

average. Protracted labour disputes are 2,5 times more<br />

likely to transpire and disease/infestation, 2,3 times<br />

higher,” says de Swardt.<br />

South African companies rated raw material supplier failure<br />

as the top supply chain risk, followed by finished goods<br />

manufacturing failure, product quality failure, transportation<br />

carrier failure and economic recession/market collapse.<br />

“Notably, within South African supply chains, companies<br />

tend to work more with customers than suppliers in<br />

addressing risk management,” he adds.<br />

“As supply chain professionals, we must generate ways in<br />

which to make changes designed to increase agility and<br />

responsiveness, while reducing costs. This survey’s findings<br />

to date enable South African logistics and supply chain<br />

management professionals to not only apply best practice,<br />

but to lead it,” concludes de Swardt. ◆<br />

19

IT<br />

20<br />

Effective organisations need<br />

effective people<br />

Written for export & import SA by Jonathan Sims<br />

CA(SA), Core Freight Systems (Pty) Limited<br />

The prism revisited – a model for<br />

organisational effectiveness<br />

In a previous article the attributes of an effective<br />

organisation were considered, and the model of a prism<br />

introduced as a mechanism to communicate the ideas<br />

discussed. In summary it was asserted that the effective<br />

organisation would be a function of the following four<br />

aspects:<br />

� Clarity of purpose<br />

� Quality of decisions<br />

� Action<br />

� Ability to learn<br />

The concept may be illustrated using the graphic below.<br />

Leadership within the<br />

organisational context<br />

should intentionally address<br />

and refine each of the four<br />

issues identified – ensuring<br />

balance and congruency<br />

between them in order to<br />

optimise the overall<br />

performance of the<br />

business.<br />

Extending our use of the<br />

prism as an illustrative<br />

object, clearly the higher the quality of the constituent<br />

material the more effectively a prism fulfils its purpose of<br />

refracting light, providing transformed output through its<br />

operation. Likewise a business should seek to transform<br />

external inputs through the application of its internal<br />

qualities to add value to its stakeholders. It thus may be<br />

worth considering the impact of the material used in the<br />

construction of such a business.<br />

Organisational performance is a function of<br />

people performance<br />

It is not a new idea to propose that, irrespective of the<br />

advance of technology, the primary determinant of the<br />

ongoing success of an organisation is the people who are<br />

responsible for the execution of the activities required for<br />

the business to function. This raises the question of what<br />

qualities, or attributes, of the individuals are necessary to<br />

support this? Unfortunately I do not have the answer to this!<br />

Notwithstanding I do not believe that this should provide an<br />

excuse to ignore the subject and, at risk of proving my own<br />

ignorance, offer the following personal suggestions for<br />

consideration by the reader. In keeping with the simplicity<br />

inherent in the model used to provide focus for this article<br />

the list is restricted to the following four items, which could<br />

be associated with the internal facets of the prism.<br />

�� Intellect<br />

While there are many studies which show that raw<br />

intellect alone (perhaps measured by IQ) is not sufficient<br />

for job success I understand that equally there is a<br />

minimum intellectual requirement in order to fulfil most<br />

of the higher level functions required in the maintenance<br />

of any business of consequence. Leadership should<br />

therefore ensure that they have the appropriate level of<br />

intellectual competence available within their<br />

organisation.<br />

�� Emotional intelligence<br />

Emotional intelligence (EQ) has become a popular<br />

subject over the past 15 to 20 years. Basically it<br />

highlights the requirement for an individual to<br />

demonstrate both intra- and inter-personal skills<br />

in order to perform most effectively at higher<br />

levels. Generally this would manifest itself through<br />

competencies including high levels of self-awareness<br />

and control, empathy with others, and optimism<br />

tempered by an objective assessment of the reality<br />

of a situation.<br />

�� Endurance<br />

The ability to endure in the face of the threats and<br />

weaknesses which every business is exposed to is<br />

as important as capitalising on the strengths and<br />

opportunities which will present themselves. The<br />

individuals themselves within the organisation should<br />

therefore exhibit fortitude and perseverance, although<br />

this should obviously not be at the expense of adapting<br />

to changing circumstances.<br />

�� Accountability<br />

Accountability should not be a consequence of title<br />

within an organisation and implies the acceptance of<br />

responsibility to act in terms of a standard. As a<br />

minimum this requires acting in terms of personal<br />

integrity but is extended to provide for evaluation at the<br />

organisational level, necessitating not only avoiding<br />

doing things that are inappropriate but actively pursuing<br />

issues that which will benefit the organisation.<br />

The internal facets of the prism may thus be labelled per<br />

the illustration below.<br />

Passengers on the<br />

Organisational Express<br />

It has been observed, perhaps<br />

somewhat facetiously, that<br />

people may be placed in one<br />

of three categories: those that<br />

make things happen; those<br />

that watch things happen; and<br />

those that ask, “What<br />

happened?!” While<br />

organisational achievements<br />

are generally the result of a<br />

collective effort as individuals<br />

we need to consider which category we belong to. Are we<br />

passengers on the organisational train or do we actively<br />

work to make the right things happen? ◆<br />

EXPORT & IMPORT SA // APRIL <strong>2011</strong>

ZABS appoints SGS to manage Pre-Export<br />

Verification of Conformity Programme<br />

SGS has been appointed by the Zambia Bureau of<br />

Standards (ZABS) Authorities to implement and<br />

manage the Pre-Export Verification of Conformity<br />

Programme for all imported products that form part<br />

of the programme.<br />

The PVoC programme objective is to protect the country<br />

and the consumers against the importation of<br />

substandard products that can endanger public health,<br />

safety and environment, to prohibit the entry of<br />

unsafe and/or counterfeit products as well as to protect<br />

local manufacturers against unfair competition from<br />

imported products which do no comply with national<br />

standards.<br />

This programme is applicable to the following products<br />

exported to Zambia:<br />

1. Food and agricultural products<br />

2. Chemical/household products<br />

3. Textiles and textile products<br />

4. Footwear<br />

5. Toys and child care products<br />

6. Electrical and electronic products<br />

7. Automotive spare parts<br />

8. All used product<br />

Standards<br />

There are three routes of verification available to exporters:<br />

Route A – Unregistered suppliers or manufacturers of<br />

sensitive goods<br />

Route B – Registered suppliers or manufacturers of goods<br />

Route C – Certified (licenced) products<br />

The main benefits of this PVoC programme for the Zambian<br />

operators are:<br />

– Consumer and environment protection<br />

– Conformity assurance<br />

– Faster goods release at Zambian Customs office with the<br />

appropriate Certificate of Conformity (COC)<br />

Why SGS?<br />

SGS has the advantage to offer the “one-stop-service” to<br />

deliver customer focused solutions for inspection, testing<br />

and certification.<br />

SGS is currently active in Conformity Assessment<br />