S All asset categories end 2003 with positive returns - American ...

S All asset categories end 2003 with positive returns - American ...

S All asset categories end 2003 with positive returns - American ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FEBRUARY 2004<br />

Defined benefit benefit plans plans are are not not extinct<br />

extinct<br />

I<br />

I Iin in the the era era when when it it was was not<br />

not<br />

Iuncommon<br />

Iwork<br />

Iuncommon<br />

Iwork<br />

Iwork<br />

Iuncommon<br />

Iwork<br />

Iwork<br />

Iuncommon<br />

Iwork<br />

Iuncommon<br />

Iwork<br />

Iwork<br />

uncommon for for an an in in di di vid vid u u al al to<br />

to<br />

work for for the the same same em em ploy ploy er er for for 25+<br />

25+<br />

years, the defined benefit plan (the<br />

traditional “pen sion plan”) was the<br />

ultimate reward for a committed<br />

employee from an appreciative employ<br />

er. Then along came the 401(k),<br />

and the face of employer-sponsored<br />

retirement plans changed forever.<br />

The old DB plan, however, is not yet<br />

totally extinct.<br />

DB v. DC<br />

For purposes of this article it may first be<br />

beneficial to highlight the differences between<br />

defined benefit (DB) and de fined<br />

contribution (DC) plans. While components<br />

such as the degree of design flexi<br />

bil i ty and the ap proach used in re gard to<br />

in vest ment advice differ between the two<br />

types of retirement plans, this ar ti cle will<br />

fo cus on three ma jor dif fer enc es be tween<br />

DB and DC plans.<br />

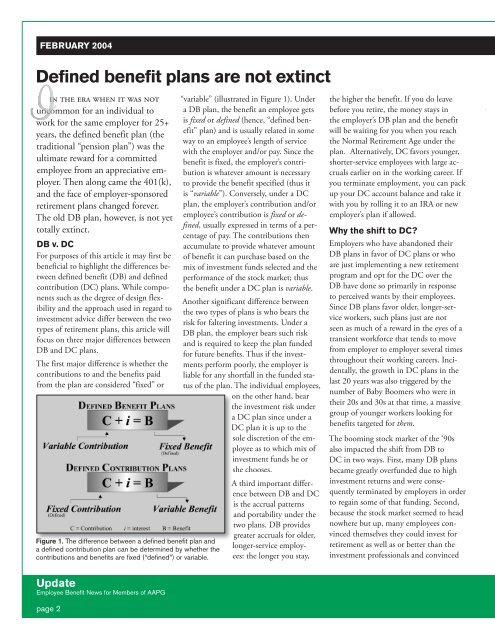

The first major dif fer ence is whether the<br />

con tri bu tions to and the benefits paid<br />

from the plan are con sid ered “fixed” or<br />

Figure 1. The difference between a defi ned benefi t plan and<br />

a defi ned contribution plan can be determined by whether the<br />

contributions and benefi ts are fi xed (“defi ned”) or variable.<br />

Update<br />

Employee Benefi t News for Members of AAPG<br />

page 2<br />

“vari able” (il lus trat ed in Fig ure 1). Un der<br />

a DB plan, the ben e fit an em ploy ee gets<br />

is fixed or de fined (hence, “de fined benefit”<br />

plan) and is usu al ly re lat ed in some<br />

way to an em ploy ee’s length of service<br />

<strong>with</strong> the em ploy er and/or pay. Since the<br />

ben e fit is fixed, the employer’s con tri -<br />

bu tion is what ev er amount is nec es sary<br />

to pro vide the ben e fit spec i fied (thus it<br />

is “vari able”). Conversely, under a DC<br />

plan, the em ploy er’s con tri bu tion and/or<br />

em ploy ee’s con tri bu tion is fixed or defined,<br />

usu al ly ex pressed in terms of a percent<br />

age of pay. The con tri bu tions then<br />

ac cu mu late to pro vide what ev er amount<br />

of benefit it can pur chase based on the<br />

mix of in vest ment funds se lect ed and the<br />

per for mance of the stock mar ket; thus<br />

the ben e fit un der a DC plan is vari able.<br />

Another significant difference between<br />

the two types of plans is who bears the<br />

risk for faltering in vest ments. Under a<br />

DB plan, the em ploy er bears such risk<br />

and is required to keep the plan fund ed<br />

for fu ture ben e fits. Thus if the in vest -<br />

ments per form poor ly, the em ploy er is<br />

liable for any short fall in the fund ed status<br />

of the plan. The in di vid u al em ploy ees,<br />

on the other hand, bear<br />

the investment risk un der<br />

a DC plan since under a<br />

DC plan it is up to the<br />

sole dis cre tion of the employ<br />

ee as to which mix of<br />

investment funds he or<br />

she chooses.<br />

A third important difference<br />

between DB and DC<br />

is the accrual patterns<br />

and port a bil i ty under the<br />

two plans. DB pro vides<br />

great er ac cru als for older,<br />

long er-service employees:<br />

the longer you stay,<br />

the higher the benefit. If you do leave<br />

before you re tire, the money stays in<br />

the employer’s DB plan and the ben e fit<br />

will be wait ing for you when you reach<br />

the Normal Re tire ment Age un der the<br />

plan. Al ter na tive ly, DC fa vors young er,<br />

short er-service em ploy ees <strong>with</strong> large accru<br />

als ear li er on in the work ing career. If<br />

you terminate em ploy ment, you can pack<br />

up your DC ac count balance and take it<br />

<strong>with</strong> you by rolling it to an IRA or new<br />

em ploy er’s plan if al lowed.<br />

Why the shift to DC?<br />

Employers who have abandoned their<br />

DB plans in favor of DC plans or who<br />

are just implementing a new retirement<br />

pro gram and opt for the DC over the<br />

DB have done so primarily in response<br />

to perceived wants by their employees.<br />

Since DB plans favor older, longer-service<br />

workers, such plans just are not<br />

seen as much of a reward in the eyes of a<br />

tran sient workforce that t<strong>end</strong>s to move<br />

from em ploy er to em ploy er several times<br />

through out their working careers. Incidentally,<br />

the growth in DC plans in the<br />

last 20 years was also trig gered by the<br />

num ber of Baby Boomers who were in<br />

their 20s and 30s at that time, a mas sive<br />

group of young er work ers look ing for<br />

benefits targeted for them.<br />

The boom ing stock mar ket of the ‘90s<br />

also impacted the shift from DB to<br />

DC in two ways. First, many DB plans<br />

be came great ly overfunded due to high<br />

in vest ment re turns and were con se -<br />

quent ly ter mi nat ed by em ploy ers in or der<br />

to re gain some of that funding. Sec ond,<br />

be cause the stock market seemed to head<br />

no where but up, many em ploy ees convinced<br />

them selves they could invest for<br />

re tire ment as well as or bet ter than the<br />

in vest ment pro fes sion als and con vinced