S All asset categories end 2003 with positive returns - American ...

S All asset categories end 2003 with positive returns - American ...

S All asset categories end 2003 with positive returns - American ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FEBRUARY<br />

2004<br />

• Defi ned benefi t<br />

plans not yet<br />

extinct<br />

page 2<br />

Up date<br />

Employee Benefi t News for Members of AAPG<br />

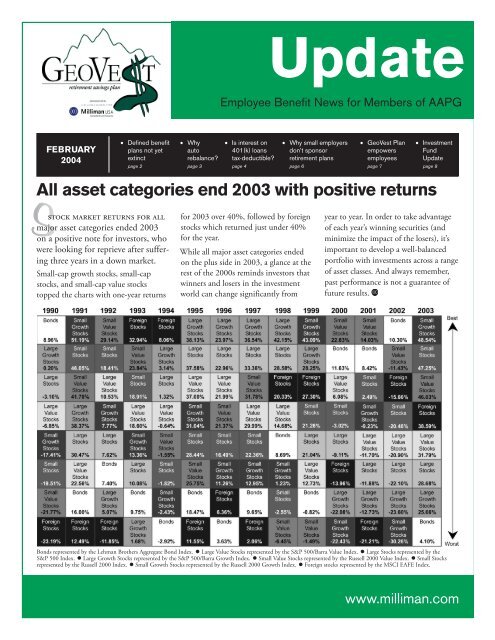

<strong>All</strong> <strong>asset</strong> <strong>categories</strong> <strong>end</strong> <strong>2003</strong> <strong>with</strong> <strong>positive</strong> <strong>returns</strong><br />

S<br />

stock market <strong>returns</strong> for all<br />

major <strong>asset</strong> <strong>categories</strong> <strong>end</strong>ed <strong>2003</strong><br />

on a <strong>positive</strong> note for investors, who<br />

were looking for reprieve after suffering<br />

three years in a down market.<br />

Small-cap growth stocks, small-cap<br />

stocks, and small-cap value stocks<br />

topped the charts <strong>with</strong> one-year <strong>returns</strong><br />

• Why<br />

auto<br />

rebalance?<br />

page 3<br />

• Is interest on<br />

401(k) loans<br />

tax-deductible?<br />

page 4<br />

for <strong>2003</strong> over 40%, followed by foreign<br />

stocks which returned just under 40%<br />

for the year.<br />

While all major <strong>asset</strong> <strong>categories</strong> <strong>end</strong>ed<br />

on the plus side in <strong>2003</strong>, a glance at the<br />

rest of the 2000s reminds investors that<br />

winners and losers in the investment<br />

world can change significantly from<br />

• Why small employers<br />

don’t sponsor<br />

retirement plans<br />

page 6<br />

• GeoVest Plan<br />

empowers<br />

employees<br />

page 7<br />

• Investment<br />

Fund<br />

Update<br />

page 8<br />

year to year. In order to take advantage<br />

of each year’s winning securities (and<br />

minimize the impact of the losers), it’s<br />

important to develop a well-balanced<br />

portfolio <strong>with</strong> investments across a range<br />

of <strong>asset</strong> classes. And always remember,<br />

past performance is not a guarantee of<br />

future results.<br />

FUNDS continued on page 2 u<br />

Bonds represented by the Lehman Brothers Ag gre gate Bond Index. l Large Value Stocks represented by the S&P 500/Barra Value Index. l Large Stocks represented by the<br />

S&P 500 Index. l Large Growth Stocks represented by the S&P 500/Barra Growth Index. l Small Value Stocks represented by the Russell 2000 Value Index. l Small Stocks<br />

represented by the Russell 2000 Index. l Small Growth Stocks rep re sent ed by the Russell 2000 Growth Index. l Foreign stocks represented by the MSCI EAFE Index.<br />

www.milliman.com

FEBRUARY 2004<br />

Defined benefit benefit plans plans are are not not extinct<br />

extinct<br />

I<br />

I Iin in the the era era when when it it was was not<br />

not<br />

Iuncommon<br />

Iwork<br />

Iuncommon<br />

Iwork<br />

Iwork<br />

Iuncommon<br />

Iwork<br />

Iwork<br />

Iuncommon<br />

Iwork<br />

Iuncommon<br />

Iwork<br />

Iwork<br />

uncommon for for an an in in di di vid vid u u al al to<br />

to<br />

work for for the the same same em em ploy ploy er er for for 25+<br />

25+<br />

years, the defined benefit plan (the<br />

traditional “pen sion plan”) was the<br />

ultimate reward for a committed<br />

employee from an appreciative employ<br />

er. Then along came the 401(k),<br />

and the face of employer-sponsored<br />

retirement plans changed forever.<br />

The old DB plan, however, is not yet<br />

totally extinct.<br />

DB v. DC<br />

For purposes of this article it may first be<br />

beneficial to highlight the differences between<br />

defined benefit (DB) and de fined<br />

contribution (DC) plans. While components<br />

such as the degree of design flexi<br />

bil i ty and the ap proach used in re gard to<br />

in vest ment advice differ between the two<br />

types of retirement plans, this ar ti cle will<br />

fo cus on three ma jor dif fer enc es be tween<br />

DB and DC plans.<br />

The first major dif fer ence is whether the<br />

con tri bu tions to and the benefits paid<br />

from the plan are con sid ered “fixed” or<br />

Figure 1. The difference between a defi ned benefi t plan and<br />

a defi ned contribution plan can be determined by whether the<br />

contributions and benefi ts are fi xed (“defi ned”) or variable.<br />

Update<br />

Employee Benefi t News for Members of AAPG<br />

page 2<br />

“vari able” (il lus trat ed in Fig ure 1). Un der<br />

a DB plan, the ben e fit an em ploy ee gets<br />

is fixed or de fined (hence, “de fined benefit”<br />

plan) and is usu al ly re lat ed in some<br />

way to an em ploy ee’s length of service<br />

<strong>with</strong> the em ploy er and/or pay. Since the<br />

ben e fit is fixed, the employer’s con tri -<br />

bu tion is what ev er amount is nec es sary<br />

to pro vide the ben e fit spec i fied (thus it<br />

is “vari able”). Conversely, under a DC<br />

plan, the em ploy er’s con tri bu tion and/or<br />

em ploy ee’s con tri bu tion is fixed or defined,<br />

usu al ly ex pressed in terms of a percent<br />

age of pay. The con tri bu tions then<br />

ac cu mu late to pro vide what ev er amount<br />

of benefit it can pur chase based on the<br />

mix of in vest ment funds se lect ed and the<br />

per for mance of the stock mar ket; thus<br />

the ben e fit un der a DC plan is vari able.<br />

Another significant difference between<br />

the two types of plans is who bears the<br />

risk for faltering in vest ments. Under a<br />

DB plan, the em ploy er bears such risk<br />

and is required to keep the plan fund ed<br />

for fu ture ben e fits. Thus if the in vest -<br />

ments per form poor ly, the em ploy er is<br />

liable for any short fall in the fund ed status<br />

of the plan. The in di vid u al em ploy ees,<br />

on the other hand, bear<br />

the investment risk un der<br />

a DC plan since under a<br />

DC plan it is up to the<br />

sole dis cre tion of the employ<br />

ee as to which mix of<br />

investment funds he or<br />

she chooses.<br />

A third important difference<br />

between DB and DC<br />

is the accrual patterns<br />

and port a bil i ty under the<br />

two plans. DB pro vides<br />

great er ac cru als for older,<br />

long er-service employees:<br />

the longer you stay,<br />

the higher the benefit. If you do leave<br />

before you re tire, the money stays in<br />

the employer’s DB plan and the ben e fit<br />

will be wait ing for you when you reach<br />

the Normal Re tire ment Age un der the<br />

plan. Al ter na tive ly, DC fa vors young er,<br />

short er-service em ploy ees <strong>with</strong> large accru<br />

als ear li er on in the work ing career. If<br />

you terminate em ploy ment, you can pack<br />

up your DC ac count balance and take it<br />

<strong>with</strong> you by rolling it to an IRA or new<br />

em ploy er’s plan if al lowed.<br />

Why the shift to DC?<br />

Employers who have abandoned their<br />

DB plans in favor of DC plans or who<br />

are just implementing a new retirement<br />

pro gram and opt for the DC over the<br />

DB have done so primarily in response<br />

to perceived wants by their employees.<br />

Since DB plans favor older, longer-service<br />

workers, such plans just are not<br />

seen as much of a reward in the eyes of a<br />

tran sient workforce that t<strong>end</strong>s to move<br />

from em ploy er to em ploy er several times<br />

through out their working careers. Incidentally,<br />

the growth in DC plans in the<br />

last 20 years was also trig gered by the<br />

num ber of Baby Boomers who were in<br />

their 20s and 30s at that time, a mas sive<br />

group of young er work ers look ing for<br />

benefits targeted for them.<br />

The boom ing stock mar ket of the ‘90s<br />

also impacted the shift from DB to<br />

DC in two ways. First, many DB plans<br />

be came great ly overfunded due to high<br />

in vest ment re turns and were con se -<br />

quent ly ter mi nat ed by em ploy ers in or der<br />

to re gain some of that funding. Sec ond,<br />

be cause the stock market seemed to head<br />

no where but up, many em ploy ees convinced<br />

them selves they could invest for<br />

re tire ment as well as or bet ter than the<br />

in vest ment pro fes sion als and con vinced

em ploy ers to give them that op por tu ni ty<br />

through the DC plan.<br />

Where are we headed now?<br />

Both the number of DC plans im ple -<br />

ment ed and the number of DB plans<br />

terminated has slowed in re cent years.<br />

Despite the investment flexibility DC<br />

plans have, the tough stock market of<br />

the early 2000s has dampened em ploy ees’<br />

thirst for being their own in vest ment<br />

manager. There is renewed in ter est in and<br />

desire for a benefit that is de ter min able<br />

Call Center CHAT<br />

Each month, Update<br />

features ques tions re ceived by<br />

Mil li man’s Customer Ser vice<br />

De part ment. � is month’s<br />

ques tion is an swered by<br />

Client Services Supervisor<br />

David Huizel.<br />

QUESTION: Why should I<br />

consider having my account<br />

automatically rebalanced?<br />

ANSWER: Electing to have your GeoVest<br />

Plan account automatically rebalanced is<br />

an excellent way to keep yourself on track<br />

<strong>with</strong> your retirement planning. Rebalancing<br />

means making sure your current mix<br />

of investment funds is aligned <strong>with</strong> your<br />

investment objectives and target <strong>asset</strong><br />

allocation strategy. If your holdings rise<br />

above your original allocation, your portfolio<br />

becomes more aggressive, and your<br />

risk exposure to possible losses increases.<br />

If your holdings fall below your target<br />

allocation, your portfolio moves to the<br />

more conservative side, and your chances<br />

of getting the rates of return you are hoping<br />

for decrease.<br />

Many experts agree if the percentage of<br />

money you have in a particular fund is<br />

<strong>with</strong>in 5% of your original <strong>asset</strong> allocation,<br />

your portfolio is probably okay for<br />

(or fixed) and which can be planned for<br />

upon retirement, caus ing some em ploy ers<br />

(and some em ploy ees) to think, “Hey,<br />

those tra di tion al pen sion plans weren’t so<br />

bad after all.” Thus, em ploy ers have been<br />

hang ing on to their DB plans al ready in<br />

place, and a crop of em ploy ers have even<br />

been look ing into es tab lish ing a new DB<br />

plan. Some have im ple ment ed hybrid<br />

plan de signs that have the best features of<br />

both DB and DC.<br />

Many experts believe, however, that a<br />

significant revival of DB plans is unlikely<br />

the time being; if over 5%, you might<br />

want to consider rebalancing. For example,<br />

say your investment strategy is to<br />

have 40% of your holdings in the Bond<br />

Fund, 40% in the Large-Cap Value Stock<br />

Fund, and 20% in the International<br />

Fund. When looking at your account to<br />

determine if you should rebalance (ideally,<br />

at least once a year), you notice 41%<br />

of your existing holdings are in the Bond<br />

Fund, 32% are in the Large-Cap Value<br />

Stock Fund, and 27% are in the International<br />

Fund. Since your original strategy<br />

is to have only 20% of your holdings in<br />

international stocks and you now have<br />

27%, your portfolio may be weighted on<br />

the more aggressive side, increasing your<br />

risk exposure and also your possibility for<br />

loss.<br />

Now, you can manually correct your allocation<br />

(i.e., rebalance) by moving some<br />

of the money out of the International<br />

Fund into the Large-Cap Value Stock<br />

Fund. Or you might change the percentages<br />

of your future contributions to, say,<br />

40% to the Bond Fund, 46% to the<br />

Large-Cap Value Stock Fund, and 14%<br />

to the International Fund.<br />

But what if you are someone who doesn’t<br />

monitor their account regularly or who<br />

FEBRUARY 2004<br />

in the short-term due to administrative<br />

com plex i ties (and associated expense)<br />

and a sense that em ploy ees still do value<br />

their 401(k)s de spite the beating they<br />

took during the last bear market. Longterm<br />

how ev er, a recognition of how inadequately<br />

many employees are pre par ing<br />

for re tire ment may cause a shift back to<br />

DB plans. If this is the case, it is pos si ble<br />

DB plans will rule again and DC plans<br />

will be rel e gat ed to the role of a sup ple -<br />

men tal rath er than a pri ma ry source of<br />

re tire ment in come for many.<br />

just can’t seem to “get around to it” when<br />

it comes to some of those investing and<br />

retirement planning “chores” such as<br />

rebalancing? In that case, the automatic<br />

rebalancing feature of the GeoVest Plan<br />

might make sense for you.<br />

By selecting the auto rebalance option,<br />

there will be an automatic redistribution<br />

of the <strong>asset</strong>s in your account either quarterly,<br />

semi-annually, or annually. While<br />

the auto rebalance feature is elected,<br />

the ability to make investment election<br />

changes will be disabled; however, you<br />

may discontinue auto rebalancing at<br />

any time. Auto rebalance can be elected<br />

through Milliman’s Web Service Center<br />

at www.millimanonline.com or through<br />

a Customer Service Representative.<br />

Periodic maintenance of your 401(k) account<br />

is crucial to achieving your desired<br />

nest egg. Auto rebalance is an easy and<br />

convenient way for GeoVest Plan participants<br />

to perform this maintenance.<br />

If you have further questions on this<br />

is sue, please contact Customer Service at<br />

800 652.6675.<br />

Update<br />

Employee Benefi t News for Members of AAPG<br />

page 3

FEBRUARY 2004<br />

PlanBITS<br />

1099Rs sent automatically<br />

<strong>with</strong> distribution checks<br />

Employees who take an in-service<br />

<strong>with</strong>drawal or distribution from their<br />

401(k) account should note the 1099R<br />

form is attached to their check. They<br />

will need the 1099R when preparing<br />

their tax <strong>returns</strong> for the year in<br />

which they took the distribution.<br />

Replacement 1099R forms are available<br />

through the Charles Schwab Trust<br />

Company for $5. Contact Customer<br />

Service for more information.<br />

Milliman USA welcomes<br />

Justin Ingraham<br />

Please join Milliman USA in welcoming<br />

Justin Ingraham to the GeoVest<br />

Plan service team. Justin joined<br />

Milliman February 9 as a Customer<br />

Service Representative.<br />

Look for Milliman at AAPG<br />

Annual Meeting<br />

Milliman USA representatives will be<br />

att<strong>end</strong>ing the AAPG Annual Meeting<br />

in Dallas, Texas, on April 18-21,<br />

2004. You are welcome to stop by the<br />

booth to visit about the GeoVest Plan,<br />

or att<strong>end</strong> the interactive presentation<br />

and discussion regarding this valuable<br />

AAPG member benefit.<br />

Update<br />

Employee Benefi t News for Members of AAPG<br />

page 4<br />

Interest on 401(k) loans not<br />

tax-deductible<br />

A<br />

as employees prepare their<br />

<strong>2003</strong> tax <strong>returns</strong>, some may question<br />

whether or not they can deduct<br />

the interest they pay back to their<br />

accounts on a 401(k) loan. Here’s<br />

what you should tell them.<br />

A loan taken from your 401(k) account is<br />

not tax-deductible. This is the case even<br />

if the purpose of the 401(k) loan is for<br />

the purchase of a home. Interest paid on<br />

a mortgage or home equity line of credit<br />

may be tax-deductible because your<br />

home is being used to secure the loan.<br />

In the case of a 401(k) loan, your 401(k)<br />

account is used to secure the loan. Remember,<br />

you are already getting a tax<br />

advantage when you put money into<br />

your 401(k) plan, since these contributions<br />

are taken out of your paycheck pretax<br />

(i.e., before regular income taxes are<br />

taken out).<br />

When you are considering taking a loan<br />

from your 401(k) plan versus ob tain ing a<br />

loan from other sources, wheth er or not<br />

the interest is tax-de duct ible is just one of<br />

the factors that will affect your decision.<br />

Also con sid er:<br />

l Interest paid back on your 401(k)<br />

loan is paid back to your own account<br />

rath er than to a bank or other<br />

in sti tu tion.<br />

l However, unlike your 401(k) sala<br />

ry de fer rals, you repay your loan<br />

<strong>with</strong> after-tax dol lars. When you<br />

<strong>with</strong> draw this mon ey at re tire ment,<br />

it will be taxed again, and you will<br />

es sen tial ly be pay ing tax es twice on<br />

the same mon ey.<br />

l The interest you pay back to your<br />

ac count may be less than what you<br />

could otherwise have earned through<br />

your 401(k) investments. You also<br />

lose out on the com pound ing earnings<br />

you would oth er wise have received<br />

on the money you borrowed.<br />

l If you leave your employer, the entire<br />

outstanding balance on the loan<br />

is due <strong>with</strong>in 60 days. If you don’t<br />

pay it all back, you will have to pay<br />

taxes on the balance plus a 10% penal<br />

ty if you are not 55 at the time of<br />

termination.<br />

Answer to puzzle on page 6:<br />

Good business leaders create a vision, articulate the<br />

vision, passionately own the vision, and relentlessly<br />

drive it to completion.

Ve VVe VVe VVe VVe VVe VVe VVe VVe VVe VVe VVe VVe VVe VVe VVe VVe VVe VVe VVe VVe VVe VVe VVe VVe VVe VVe VVe VVe VVe VVe<br />

o eeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeee<br />

UNLOCK NLOCK THE THE TREAS TREAS AS A URES WITHIN<br />

PPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPlllaaaaaaaaaannnnnnnnnnnnnnnnnn<br />

GGGGGGGGGGGGGGeeeeeeeeeeooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVV ssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssssstttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttt oV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV ooV V<br />

1. Cut out or make a<br />

copy of this form.<br />

2. Complete form<br />

entirely.<br />

3. Mail or fax today!<br />

Milliman USA<br />

8500 Normandale Lake Blvd<br />

Suite 1850<br />

Minneapolis, MN 55437<br />

phone: 800 652.6675<br />

fax: 952 820.3100<br />

Yes, I would like more information about GeoVest.<br />

Name Title<br />

Company<br />

Address<br />

nMERGERS AND<br />

City State Zip Code<br />

Telephone Number Fax Number<br />

Current Number of Employees<br />

ACQUISITIONS<br />

CONSULTING<br />

FEBRUARY 2004<br />

When two or more companies are merging, sometimes it’s easy to lose<br />

sight of all the issues involved <strong>with</strong> such a merger. For example, if the<br />

merging entities offer different retirement packages, which package will<br />

the merged company retain? Or will the merged company retain features<br />

of both packages? Perhaps the new company will opt to design an<br />

entirely new plan altogether.<br />

Milliman USA can help <strong>with</strong> evaluating retirement benefi ts for companies<br />

involved in a merger, and GeoVest Plan sponsors can obtain this service<br />

at no additional cost. Our experienced professionals are available to<br />

help you objectively compare plan features, services, and costs. There<br />

are a lot of complex decisions to make in a merger. What to do <strong>with</strong><br />

the retirement benefi ts doesn’t have to be one of them.<br />

Update<br />

Employee Benefi t News for Members of AAPG<br />

page 5

FEBRUARY 2004<br />

Small employers cite revenue uncertainty and costs<br />

as impediments to sponsoring a retirement plan<br />

R<br />

revenue uncertainty is the<br />

top reason small employers (those<br />

<strong>with</strong> five to 100 full-time employees)<br />

do not sponsor a retirement<br />

plan, according to the <strong>2003</strong> Small<br />

Employer Retirement Survey<br />

(SERS) sponsored by the Employee<br />

Benefit Research Institute (EBRI),<br />

the <strong>American</strong> Savings Education<br />

Council (ASEC), and Mathew Greenwald<br />

& Associates.<br />

Perhaps there is a link in uncertain revenue<br />

and the offering of other benefits<br />

as well. Of small employers who do not<br />

offer a retirement plan, those who also<br />

did not offer health insurance were more<br />

likely to say uncertain revenue keeps<br />

them from sponsoring a retirement plan<br />

(37.8% compared to 22.1% of small employers<br />

who did offer health insurance).<br />

Just for FUN<br />

Update<br />

Employee Benefi t News for Members of AAPG<br />

page 6<br />

Other demographics also came into play<br />

whether or not employers blamed unstable<br />

revenues for not offering a retirement<br />

plan. Citing revenue uncertainty<br />

decreased as gross revenue of the business<br />

increased (18% for employers <strong>with</strong> over<br />

$2 million in revenue versus 40.4% for<br />

employers <strong>with</strong> $500,000-$750,000 in<br />

revenue) and as average salary of most<br />

full-time employees increased (19.9%<br />

for employers where most full-time employees<br />

made over $40,000 compared<br />

to $27.3% for employers where most<br />

full-timers made between $20,000 and<br />

$30,000).<br />

It is no surprise, then, that 58% of those<br />

who were very or somewhat likely to start<br />

a retirement plan in the next two years<br />

said it would be much more likely they<br />

would start a plan if they experienced<br />

an increase in business profits. Over twothirds<br />

of those employers who originally<br />

said they were not too likely or not at<br />

Each number in the phrase below represents a different letter of the alphabet. Not all letters of the alphabet<br />

are used. To get you started, the number “10” represents the letter “V.” The solution is on page 4.<br />

~ John Welch<br />

all likely to start a plan in the next two<br />

years also said an increase in business<br />

profits would make them much more<br />

likely (22.8%) or somewhat more likely<br />

(44.3%) they would install a retirement<br />

plan.<br />

The second most cited reason for not<br />

offering a plan was the administrative<br />

and set-up costs for a plan. Interestingly,<br />

those who were not aware of the<br />

tax credits established by the Economic<br />

Growth Tax Relief and Reconciliation<br />

Act (EGTRRA) of 2001 were more likely<br />

to say costs were an impediment to their<br />

sponsoring a plan than those who were<br />

aware of the EGTRRA tax credits. Small<br />

employers who do not currently sponsor<br />

a retirement plan should note they<br />

are allowed a tax credit for 50% of the<br />

first $1,000 of administrative expenses<br />

incurred <strong>with</strong>in each of the first three<br />

plan years after implementing a qualified<br />

retirement plan. Therefore, there is<br />

a maximum credit of<br />

$500 a year for three<br />

years. To be eligible, an<br />

employer must not have<br />

had, in the preceding<br />

year, more than 100 employees.<br />

The plan must<br />

be established after 2001<br />

and must cover at least<br />

one non-highly compensated<br />

employee. In addition,<br />

the employer must<br />

not have sponsored a<br />

qualified retirement plan<br />

during the three years<br />

immediately prior to the<br />

credit being available.<br />

Source: <strong>2003</strong> Small Employer<br />

Retirement Survey, EBRI Notes,<br />

September <strong>2003</strong>.

Ssince since the introduction of<br />

of<br />

Sthe the 401(k) plan in the 1980s, many<br />

have applauded the 401(k) for giving<br />

employees the opportunity to<br />

be in charge of their own retirement.<br />

However, some employees may be<br />

slightly hesitant about being in charge,<br />

and their 401(k) plan can <strong>end</strong> up being<br />

more an obstacle than a road map to a<br />

comfortable retirement. Fortunately, the<br />

GeoVest Plan works well for both kinds<br />

of investors: those who enjoy having control<br />

of their investments and those who<br />

say they could frankly use a little help.<br />

When employees are uncertain about the<br />

stock market and investing or hesitant<br />

about participating in their 401(k) because<br />

they don’t completely understand<br />

how 401(k)s work, inertia sets in. Instead<br />

of proactively trying to learn sound<br />

investment principles or to determine<br />

how much they might need to fund their<br />

retirement goals, they simply put it off.<br />

And put it off…and put it off, seriously<br />

jeopardizing their prospects for a comfortable<br />

retirement.<br />

As such, Milliman USA has designed a<br />

variety of plan features which empower<br />

employees to reap the benefits of the<br />

401(k) <strong>with</strong>out having to become savvy<br />

investors.<br />

The Plan offers seven model portfolios<br />

ranging from very conservative to very<br />

aggressive. These portfolios are predetermined<br />

mixes utilizing several of the funds<br />

offered under the GeoVest Plan. Participants<br />

can use the Retirement Toolbox at<br />

www.millimanonline.com or the Your<br />

Investor Profile worksheet in their Participant<br />

PlanFolder to identify which model<br />

is best suited for their situation. The<br />

Retirement Toolbox also has a powerful<br />

Retirement Income Analyzer that can<br />

help determine retirement savings needs<br />

and identify any surplus or shortfall that<br />

may result from the participant’s current<br />

savings level.<br />

The GeoVest Plan also offers four lifestyle<br />

funds in addition to the 10 other investment<br />

options covering the full range of<br />

the risk/return spectrum. GeoVest plan<br />

participants can either (1) diversify their<br />

<strong>asset</strong>s among the 10 non-lifestyle funds,<br />

FEBRUARY 2004<br />

GeoVest Plan empowers employees to admit they<br />

need <strong>asset</strong> allocation help<br />

Remember there are three ways to access<br />

your GeoVest ac count information:<br />

Online through Milliman USA’s Web Service Center<br />

(millimanonline.com)<br />

Through the GeoVest Plan Telephone Hotline<br />

(toll-free at 800 974.2371)<br />

Through Milliman USA’s Customer Service Department<br />

(toll-free at 800 652.6675)<br />

(2) choose one lifestyle fund based on<br />

their investing personality, or (3) choose<br />

a model portfolio as described above.<br />

The Plan’s lifestyle funds, managed by<br />

The Vanguard Group, have built in <strong>asset</strong><br />

allocations based on the investment objectives<br />

of the funds. Rather than investing<br />

in individual securities, the lifestyle<br />

funds invest in combinations of several<br />

underlying Vanguard funds.<br />

The Lifestyle Income Fund seeks current<br />

income and capital growth. The fund allocates<br />

<strong>asset</strong>s <strong>with</strong>in the following parameters:<br />

80% in bonds and 20% in stocks.<br />

The Lifestyle Conservative Growth Fund<br />

is slightly more risky than the Lifestyle<br />

Income Fund, typically investing 60% of<br />

<strong>asset</strong>s in bonds and 40% in stocks. The<br />

fund seeks current income and low-tomoderate<br />

capital growth. The Lifestyle<br />

Moderate Growth Fund also typically<br />

invests 60% of <strong>asset</strong>s in stocks and 40%<br />

in bonds and seeks capital growth and a<br />

reasonable level of current income. The<br />

Lifestyle Growth Fund is the riskiest<br />

of the lifestyle funds, typically investing<br />

80% of <strong>asset</strong>s in stocks and 20% in<br />

bonds.<br />

More details on the funds can be found<br />

following the links in the Investment<br />

Fund Performance section of Milliman’s<br />

Web Service Center.<br />

Finally, the Plan offers an automatic<br />

rebalancing option, which is discussed<br />

in more detail in the Call Center Chat<br />

feature on page 3.<br />

By taking advantage of several of the<br />

features of the GeoVest Plan, participants<br />

will find investing and retirement planning<br />

does not have to be that difficult<br />

after all.<br />

Update<br />

Employee Benefi t News for Members of AAPG<br />

page 7

Asset Category<br />

ALBANY<br />

ATLANTA<br />

BERMUDA<br />

BOISE<br />

BOSTON<br />

CHICAGO<br />

COLUMBUS<br />

DALLAS<br />

DENVER<br />

GREENSBORO, NC<br />

HARTFORD<br />

HONG KONG<br />

HOUSTON<br />

Investment Fund<br />

Update<br />

Employee Benefit News for Members of AAPG<br />

page 8<br />

INVESTMENT FUND UPDATE AS OF JANUARY 31, 2004<br />

Update is a monthly publication for members of the <strong>American</strong> Association of Petroleum<br />

Geologists exploring retirement plan and employee benefit issues. �is publication is for<br />

informational purposes only and is not int<strong>end</strong>ed to r<strong>end</strong>er legal advice on the topics discussed.<br />

NAV 3-Month 1-Year<br />

5-Year<br />

Annualized<br />

10-Year<br />

Annualized<br />

Stable Value Morley Stable Value Fund $17.43 0.99% 4.38% 5.80% N/A N/A<br />

The GeoVest Plan is a comprehensive, customized retirement savings plan tailored specifically for<br />

members of the <strong>American</strong> Association of Petroleum Geologists and other affiliated geological<br />

professional associations. GeoVest is set up for small employers and sole proprietorships but<br />

has many of the same characteristics found in Fortune 500 retirement plans. Some of the<br />

key benefits GeoVest sponsors and participants enjoy include outsourced administration,<br />

a 24-hour automated voice response unit, a customer service call center, a dynamic interactive<br />

Web Service Center including automatic rebalance and online investment advice<br />

features, and an additional Plan Sponsor Web site for companies that desire a “macro” level<br />

look at their retirement plan.<br />

Milliman Offices Internationally MILLIMAN GLOBAL<br />

INDIANAPOLIS<br />

IRVINE<br />

KANSAS CITY<br />

LONDON<br />

LOS ANGELES<br />

MADRID<br />

MILAN<br />

MILWAUKEE<br />

MINNEAPOLIS<br />

NEW YORK<br />

NORWALK, CT<br />

OMAHA<br />

PHILADELPHIA<br />

PHOENIX<br />

PORTLAND, ME<br />

PORTLAND, OR<br />

PRINCETON, NJ<br />

ST. LOUIS<br />

SALT LAKE CITY<br />

SAN DIEGO<br />

SAN FRANCISCO<br />

SÃO PAULO<br />

SEATTLE<br />

SEOUL<br />

TAMPA<br />

TOKYO<br />

WASHINGTON, D.C.<br />

ARGENTINA<br />

AUSTRIA<br />

BARBADOS<br />

BELGIUM<br />

BERMUDA<br />

BRAZIL<br />

CANADA<br />

CHANNEL ISLANDS<br />

CHINA<br />

COLOMBIA<br />

DENMARK<br />

FRANCE<br />

GERMANY<br />

INDIA<br />

IRELAND<br />

ISLE OF MAN<br />

ITALY<br />

JAMAICA<br />

JAPAN<br />

KOREA<br />

MEXICO<br />

NETHERLANDS<br />

NIGERIA<br />

NORWAY<br />

Inquiries may be directed to: Milliman USA, Benefits Service Center<br />

8500 Normandale Lake Boulevard, Suite 1850<br />

Minneapolis, MN 55437-3830<br />

800 652.6675<br />

e-mail: gerald.erickson@milliman.com<br />

Ticker<br />

Symbol<br />

Bond PIMCO Total Return Institutional $10.76 2.10% 5.80% 7.33% 7.55% PTTRX<br />

Large-Cap Value Stock Hotchkis & Wiley Large-Cap Value $18.97 9.74% 48.90% 9.47% 11.82% HWLIX<br />

Index Vanguard Index 500 $104.54 8.06% 34.37% -1.08% 10.82% VFINX<br />

Large-Cap Bl<strong>end</strong> Stock Dreyfus Appreciation $37.53 7.63% 25.93% -0.43% 11.40% DGAGX<br />

Mid-Cap Value Stock Dreyfus Mid-Cap Value $28.95 15.38% 67.34% 15.85% N/A DMCVX<br />

Mid-Cap Stock Artisan Mid-Cap $26.97 8.93% 41.87% 14.97% N/A ARTMX<br />

Small-Cap Value Stock Quaker Small-Cap Value $18.07 9.44% 57.68% 12.31% N/A QUSVX<br />

Small-Cap Growth Stock RS Diversified Growth $22.92 8.01% 80.05% 10.84% N/A RSDGX<br />

International Nations International Value $19.84 14.43% 53.95% 11.70% N/A NIVLX<br />

Lifestyle Income Vanguard Lifestrategy Income $13.34 3.39% 12.68% 5.02% N/A VASIX<br />

Lifestyle Conservative Growth Vanguard Lifestrategy Conservative Growth $14.72 4.82% 19.51% 4.05% N/A VSCGX<br />

Lifestyle Moderate Growth Vanguard Lifestrategy Moderate Growth $16.89 6.44% 26.84% 2.99% N/A VSMGX<br />

Lifestyle Growth Vanguard Lifestrategy Growth $18.50 7.88% 34.20% 1.68% N/A VASGX<br />

Fund performance figures were provided by Gartmore Morley and Morningstar. Past performance is not a guarantee of future results.<br />

PHILIPPINES<br />

SPAIN<br />

SWEDEN<br />

TRINIDAD & TOBAGO<br />

UNITED KINGDOM<br />

UNITED STATES<br />

© Milliman USA, Inc.<br />

<strong>All</strong> Rights Reserved